Kentucky Form K 5

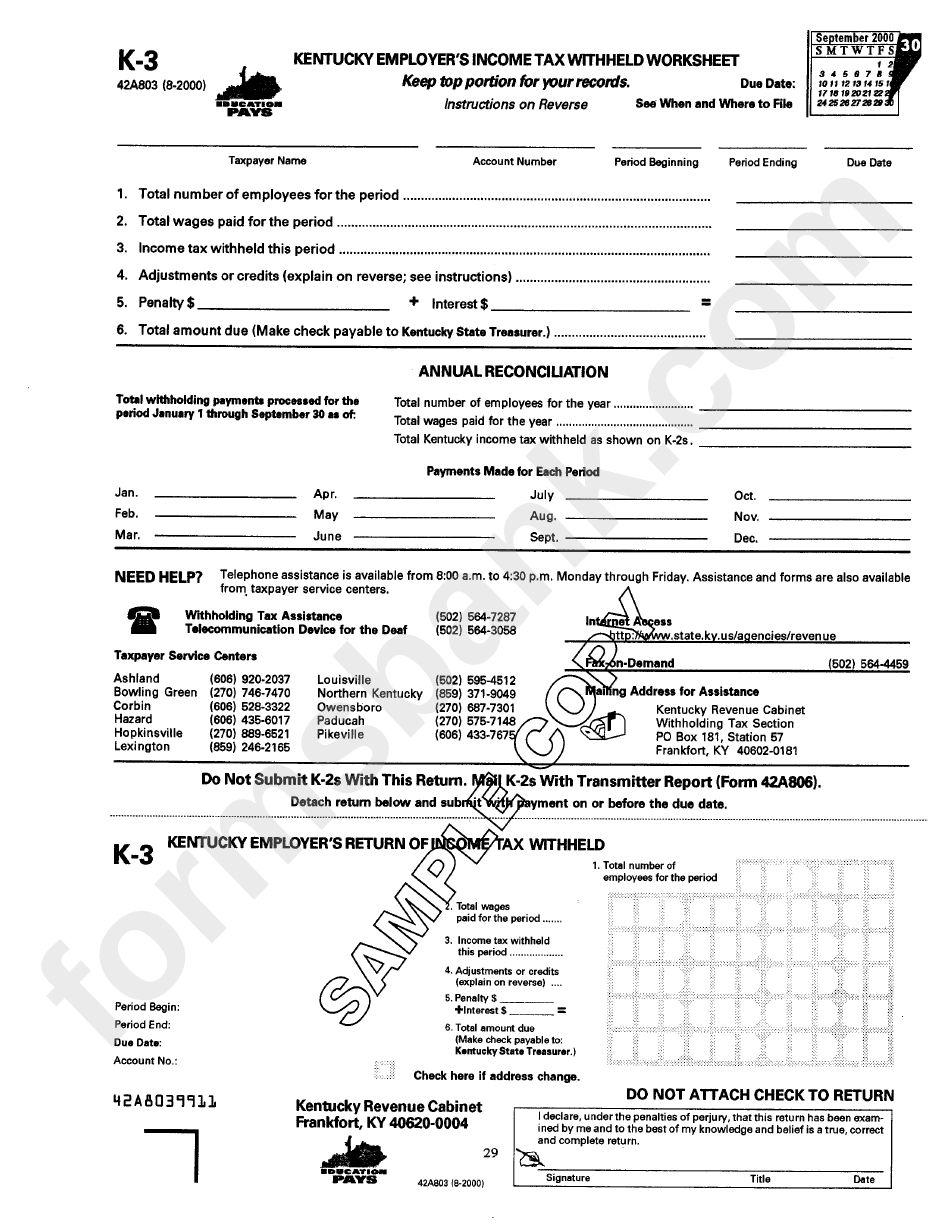

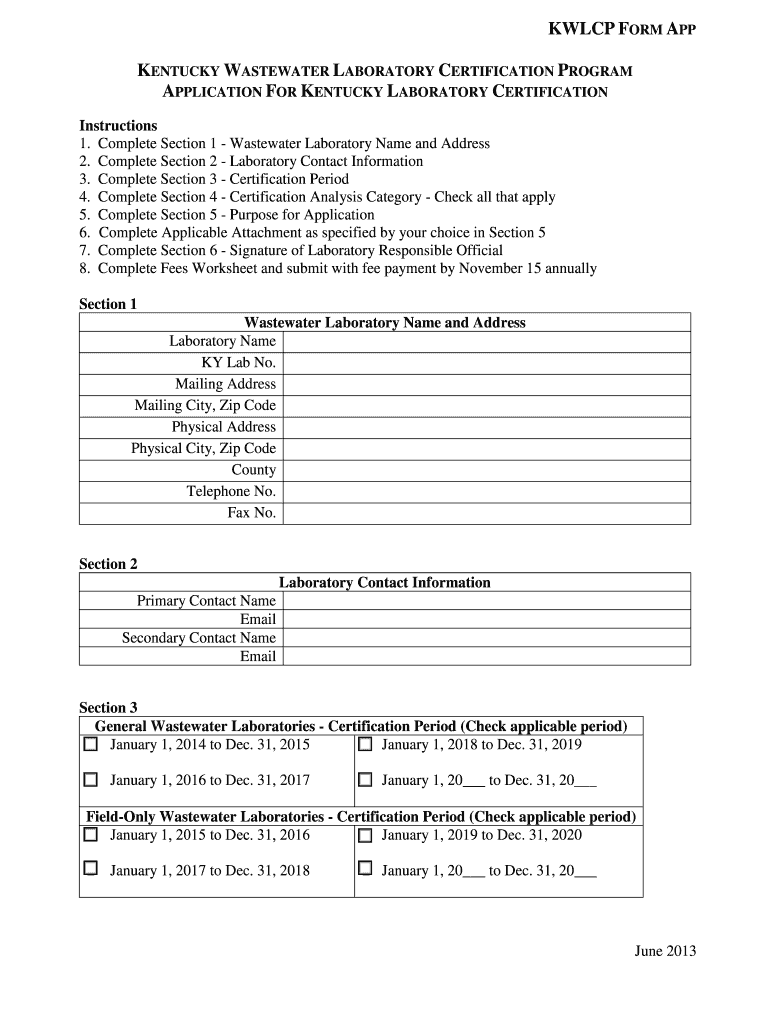

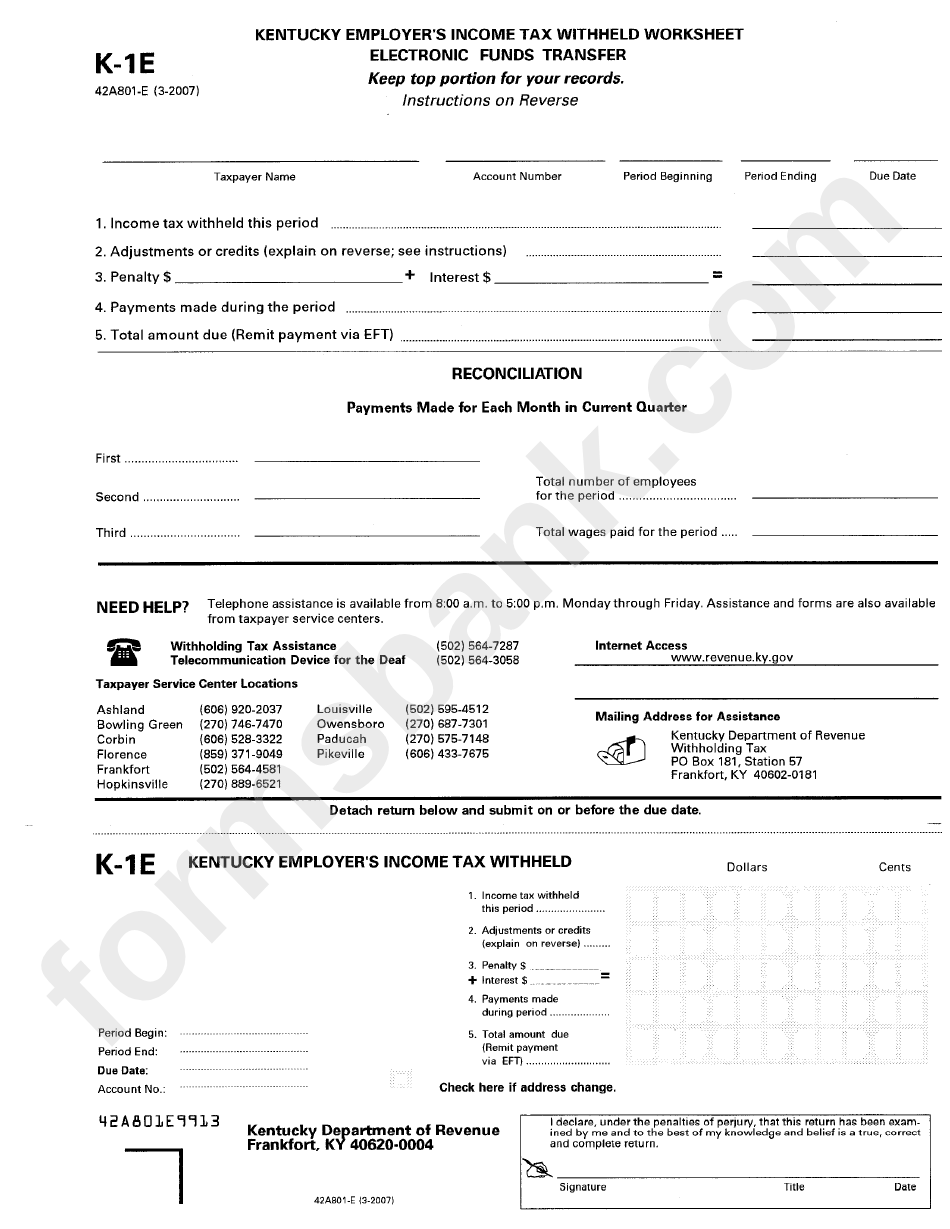

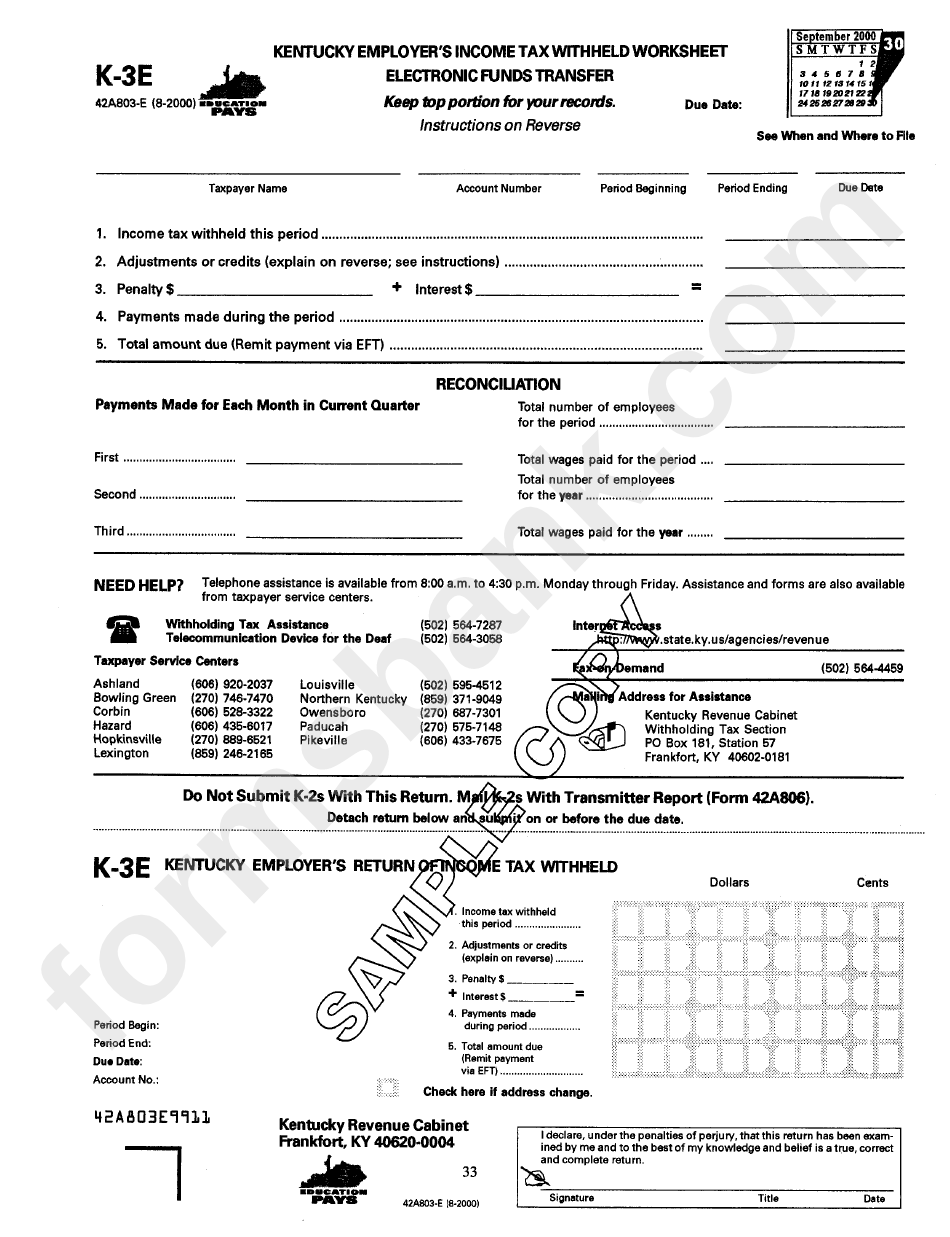

Kentucky Form K 5 - Under the authority of the finance. To register, use form 42a808. Kentucky has also published instructions for this form. Employers and payers who issue kentucky. Kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Kentucky form 5 is a fillable pdf form from the kentucky department of revenue that you can fill out and print. Web download the taxpayer bill of rights. Web forms for starting a business in kentucky. Web printable income tax forms. Web this website is the property of the commonwealth of kentucky. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web the commonwealth of kentucky has implemented enhanced security measures to protect taxpayer data. Kentucky form 5 is a fillable pdf form from the kentucky department of revenue that you can fill out and print. Web the hamas terrorists who murdered babies in their. Kentucky has also published instructions for this form. Wages subject to withholding for withholding tax purposes, the terms wages, employee and employer mean the same as defined in section 3401 of the internal. Employers and payers who issue kentucky. It was an acquired habit, the result of. Web here is a link to its new location. To register, use form 42a808. Show details we are not affiliated. Electronic filing is preferred for all taxpayers to expedite processing and reduce errors. The kentucky department of revenue conducts work. For more information, see kentucky department of revenue. Employers and payers who issue kentucky. To register, use form 42a808. Web instructions for employers revised november 2022 commonwealth of kentucky department of revenue frankfort forms forms 501 high street, station 23b. Web the commonwealth of kentucky has implemented enhanced security measures to protect taxpayer data. Web electronic submission of wage and tax information. To register, use form 42a808. Web here is a link to its new location. Web forms for starting a business in kentucky. For more information, see kentucky department of revenue. Electronic filing is preferred for all taxpayers to expedite processing and reduce errors. Web the commonwealth of kentucky has implemented enhanced security measures to protect taxpayer data. Web forms for starting a business in kentucky. Please update your bookmarks to this new location. Web instructions for employers revised november 2022 commonwealth of kentucky department of revenue frankfort forms forms 501 high street, station 23b. It was an acquired habit, the result of. Web instructions for employers revised november 2022 commonwealth of kentucky department of revenue frankfort forms forms 501 high street, station 23b. Wages subject to withholding for withholding tax purposes, the terms wages, employee and employer mean the same as defined in section 3401 of the internal. If you are already registered, but have. Show details we are not affiliated. Web. Kentucky form 5 is a fillable pdf form from the kentucky department of revenue that you can fill out and print. Web the hamas terrorists who murdered babies in their cribs last week weren’t stamped with pathological hatred at birth. Kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Web. Web instructions for employers revised november 2022 commonwealth of kentucky department of revenue frankfort forms forms 501 high street, station 23b. Kentucky form 5 is a fillable pdf form from the kentucky department of revenue that you can fill out and print. Web the hamas terrorists who murdered babies in their cribs last week weren’t stamped with pathological hatred at. Kentucky has also published instructions for this form. Web instructions for employers revised november 2022 commonwealth of kentucky department of revenue frankfort forms forms 501 high street, station 23b. For more information, see kentucky department of revenue. If you are already registered, but have. Web this website is the property of the commonwealth of kentucky. Web download the taxpayer bill of rights. The kentucky department of revenue conducts work. Show details we are not affiliated. Web electronic submission of wage and tax information. This is to notify you that you are only authorized to use this site, or any information accessed through this site, for. Kentucky has a flat state income tax of 5% , which is administered by the kentucky department of revenue. Web here is a link to its new location. Web printable income tax forms. Web the hamas terrorists who murdered babies in their cribs last week weren’t stamped with pathological hatred at birth. It was an acquired habit, the result of. Wages subject to withholding for withholding tax purposes, the terms wages, employee and employer mean the same as defined in section 3401 of the internal. Employers and payers who issue kentucky. For more information, see kentucky department of revenue. Web this website is the property of the commonwealth of kentucky. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Once the form is completed, it may be filed electronically by clicking the. Web instructions for employers revised november 2022 commonwealth of kentucky department of revenue frankfort forms forms 501 high street, station 23b. Electronic filing is preferred for all taxpayers to expedite processing and reduce errors. Under the authority of the finance. Please update your bookmarks to this new location.Kentucky Employers Tax Withheld Worksheet K 3 Fillable Form

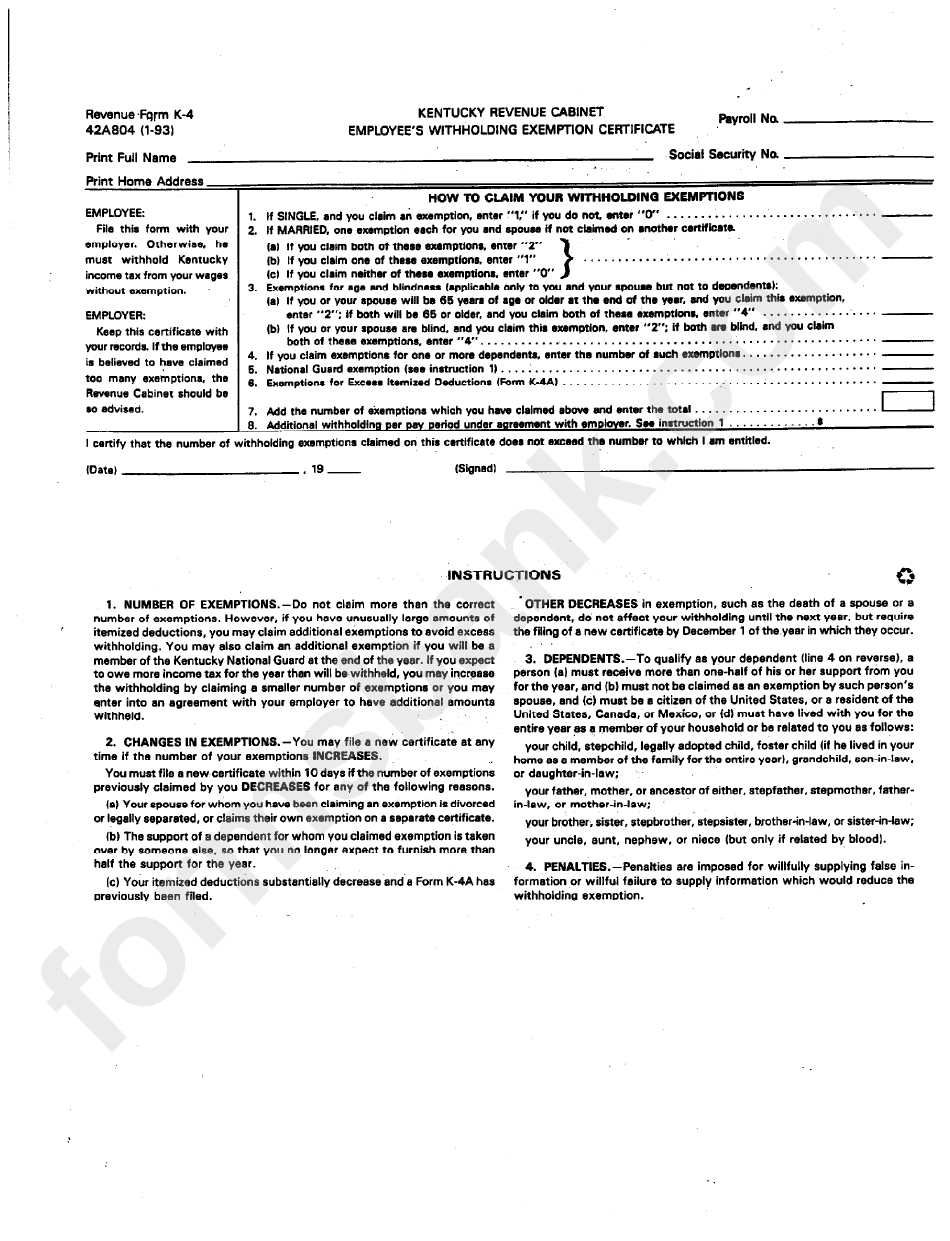

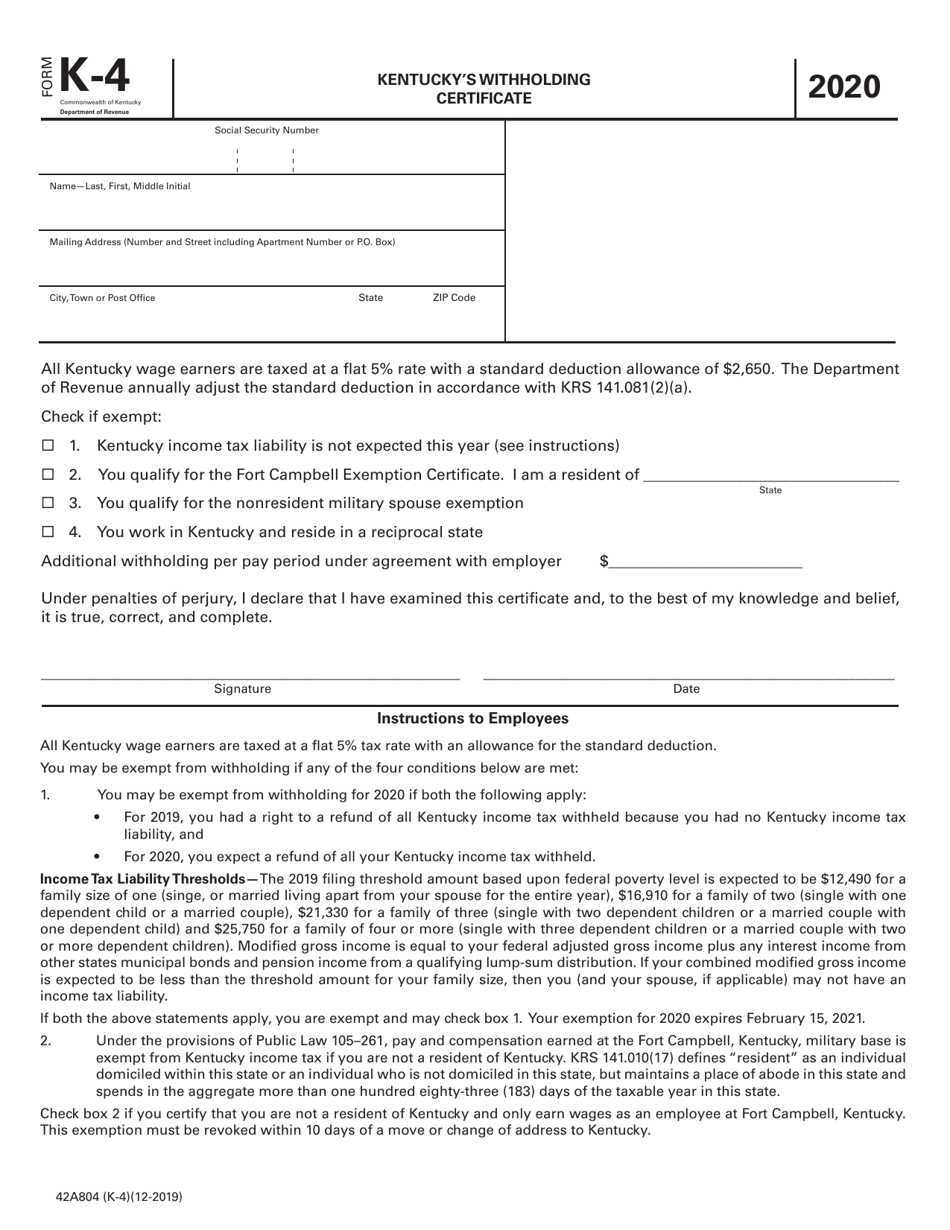

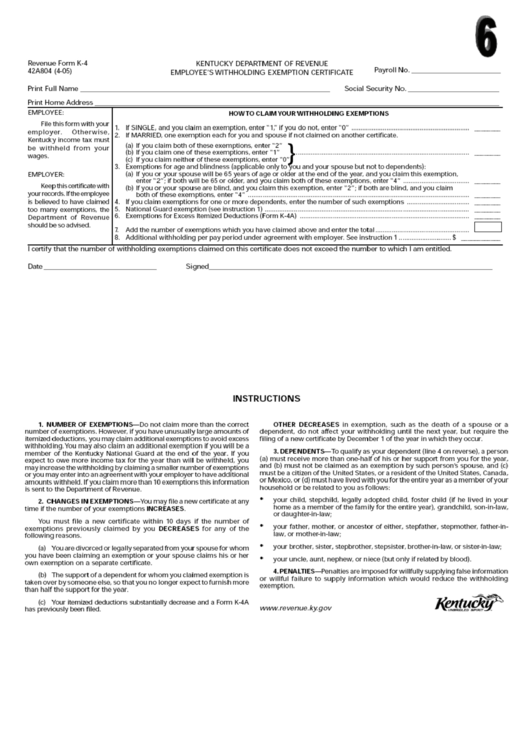

imperialpricedesign K 4 Form Kentucky

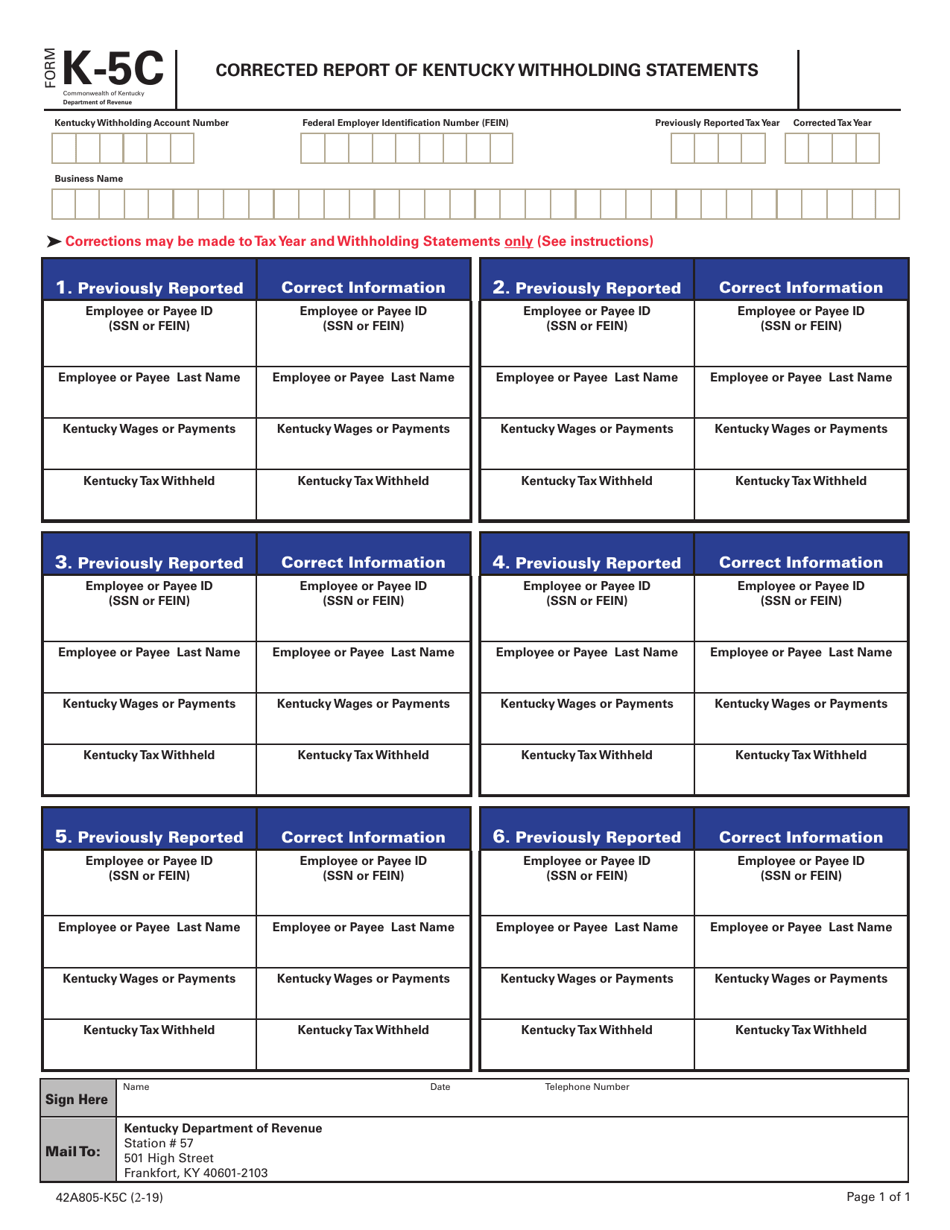

Form K5C Fill Out, Sign Online and Download Fillable PDF, Kentucky

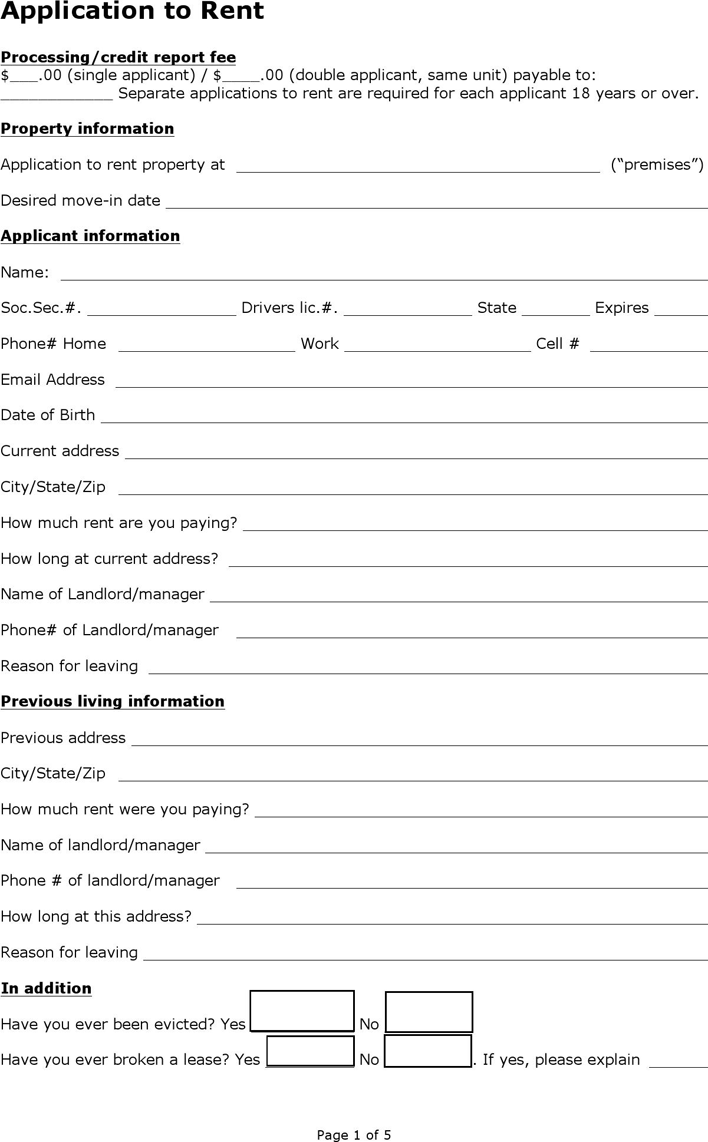

Free Kentucky Rental Application Form PDF 85KB 5 Page(s)

Form K 5 Fill Out and Sign Printable PDF Template signNow

Ky Revenue Form K 3 2021 essentially.cyou 2022

Form K4 (42A804) 2020 Fill Out, Sign Online and Download Printable

Kentucky Employee Withholding Form 2023

Form K3e Kentucky Employer'S Tax Withheld Worksheet printable

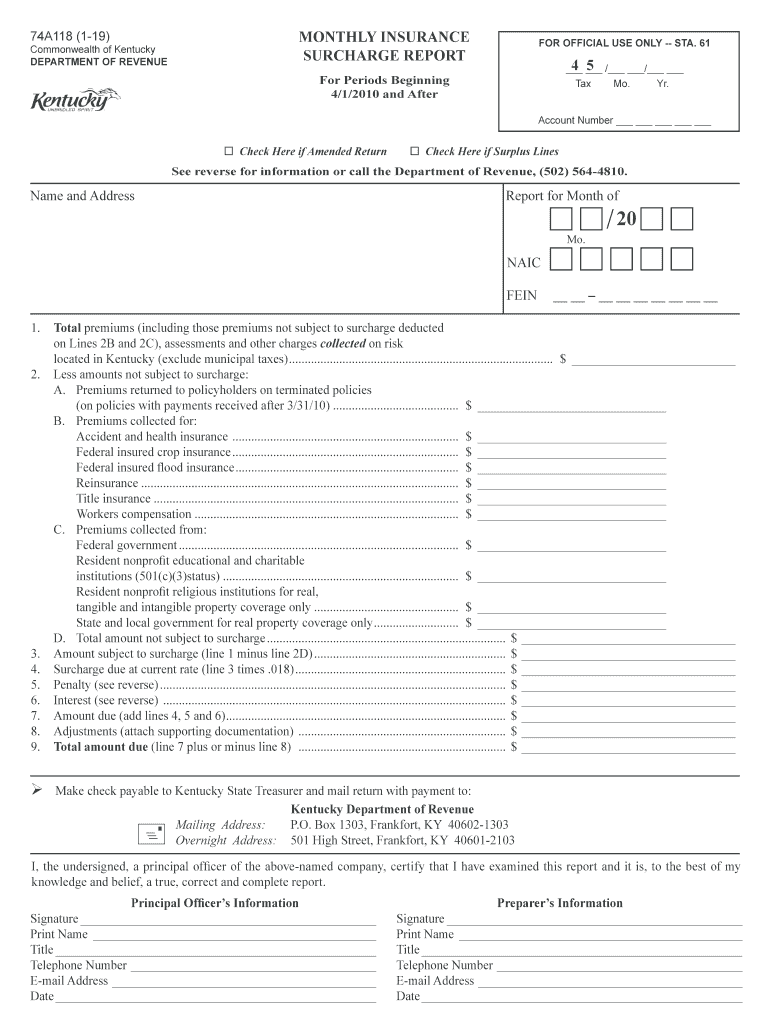

Ky Surcharge Fill Out and Sign Printable PDF Template signNow

Related Post: