Form 8582 Unallowed Loss

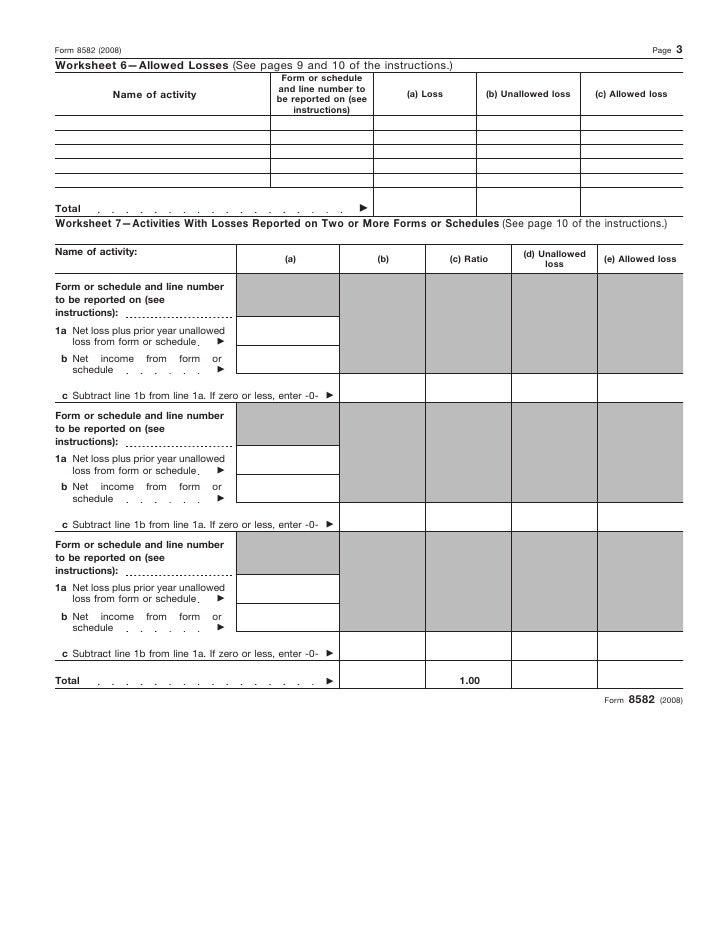

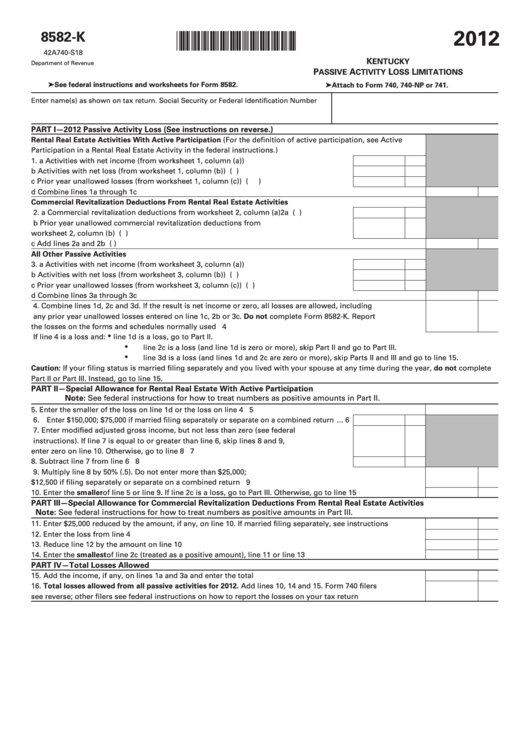

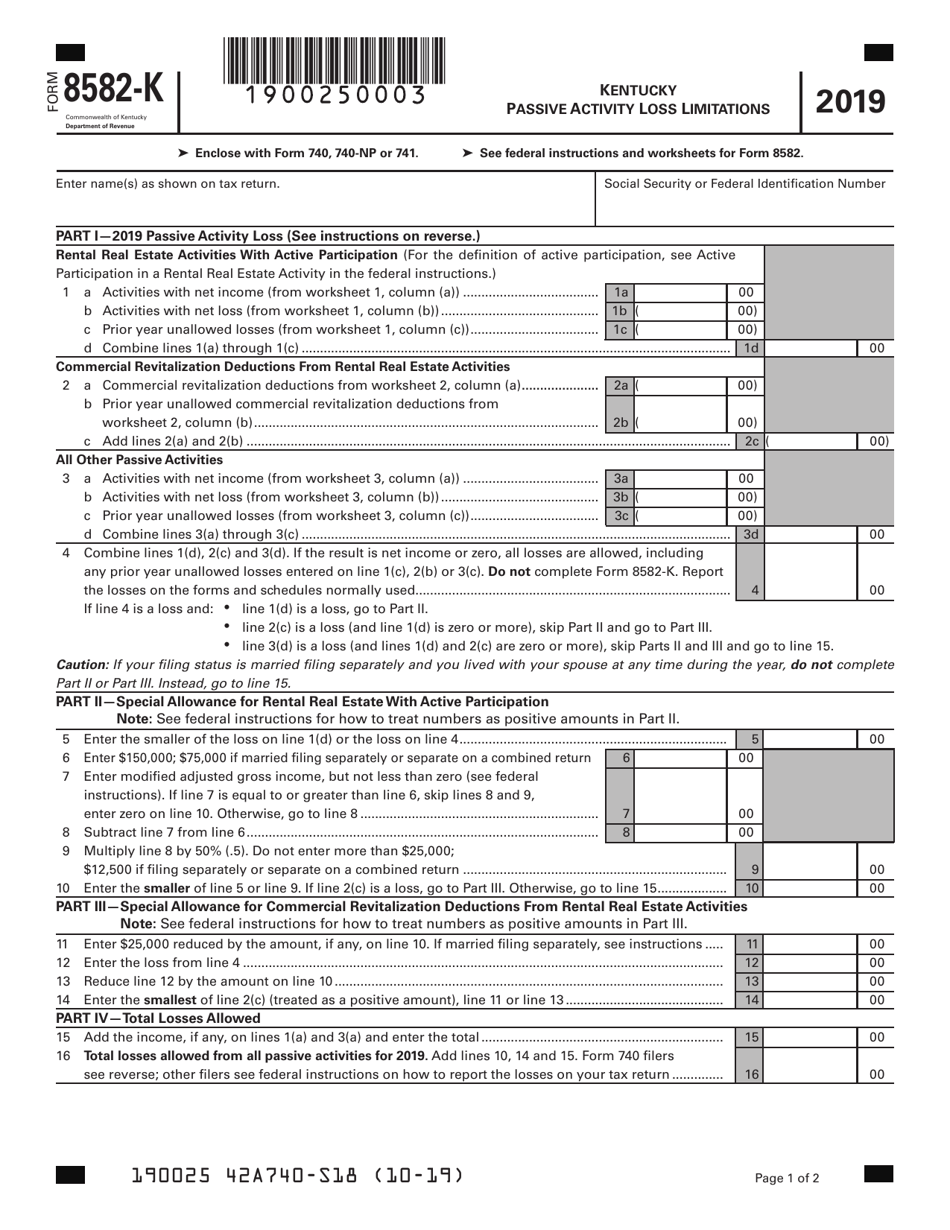

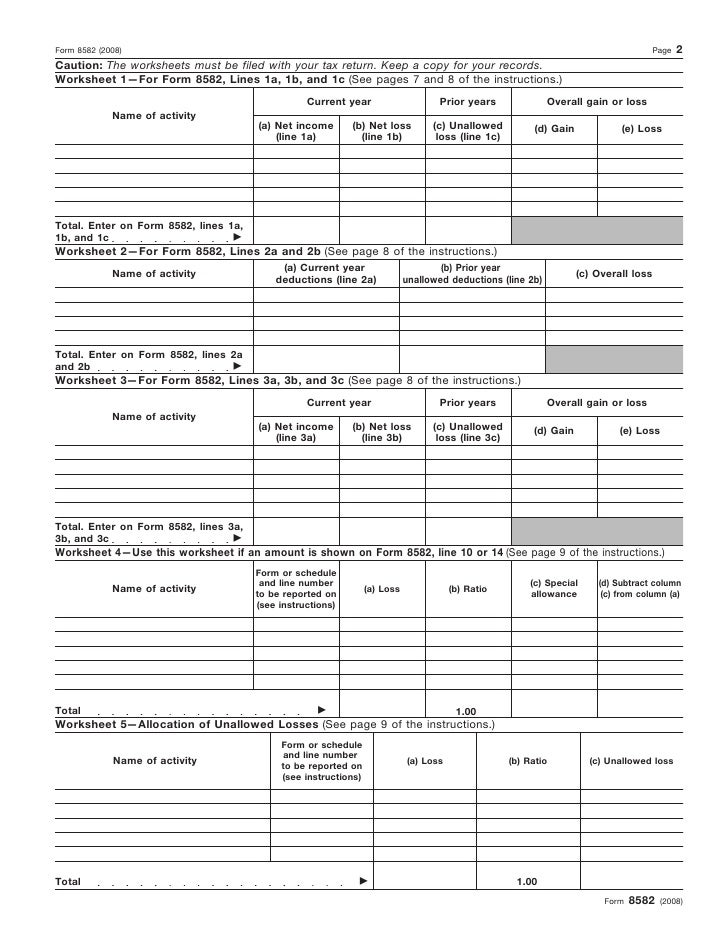

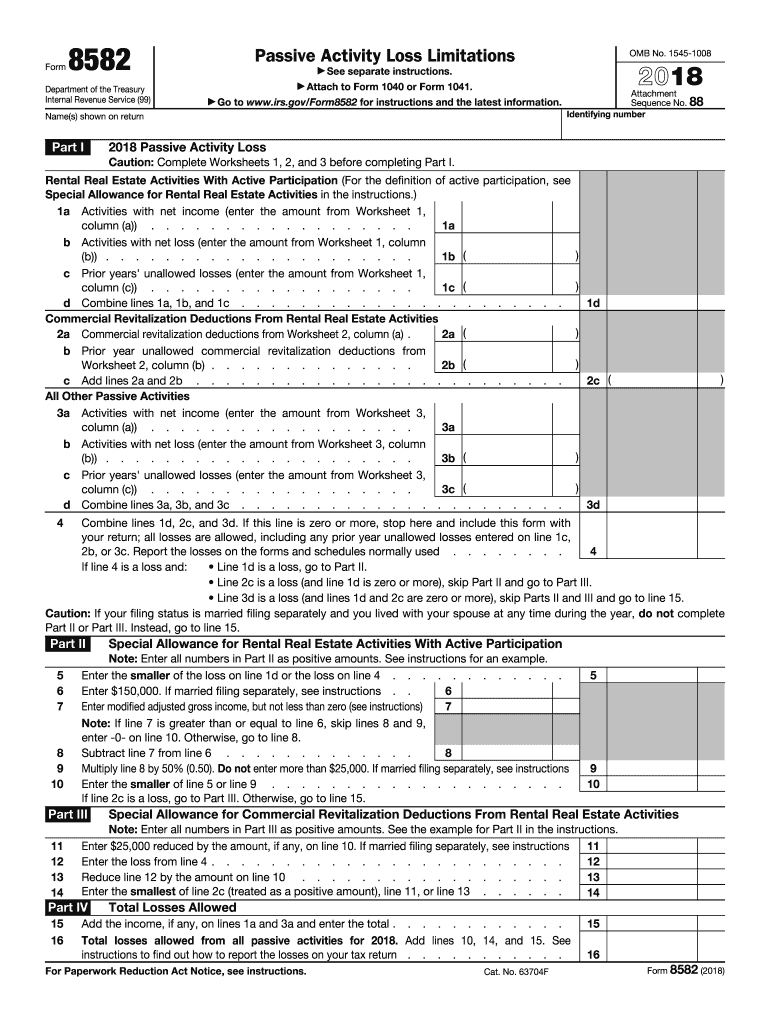

Form 8582 Unallowed Loss - To force form 8582 to print, open the prnt screen and select the option produce form. Web department of the treasury internal revenue service passive activity loss limitations see separate instructions. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: Web for the program to populate the prior year unallowed losses on form 8582, do the following: Web form 8582 (2008) worksheet 1—for form 8582, lines 1a, 1b, and 1c (see pages 7 and 8 of the instructions.) current year prior years overall gain or loss (c) unallowed loss. If you actively participated in a passive rental real estate activity, you may. Ad access irs tax forms. Entering prior year unallowed losses for a rental. Web department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. Form 8582 is used by noncorporate taxpayers to figure the amount of. Complete, edit or print tax forms instantly. If you actively participated in a passive rental real estate activity, you may. Web for the program to populate the prior year unallowed losses on form 8582, do the following: Web up to 10% cash back the passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting. Web department of the treasury internal revenue service passive activity loss limitations see separate instructions. It is not always beneficial for. Web department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. Go to the sch e pg 1. Basically, the net loss is still passive, the income is just shown separately on the 8582. Web the income and the carryovers go to form 8582. Web form 8582 (2008) worksheet 1—for form 8582, lines 1a, 1b, and 1c (see pages 7 and 8 of the instructions.) current year prior years overall gain or loss (c) unallowed loss. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: Web form 8582 must. Web department of the treasury internal revenue service passive activity loss limitations see separate instructions. Entering prior year unallowed losses for a rental. Web the income and the carryovers go to form 8582. Complete, edit or print tax forms instantly. Web a loss is not limited and form 8582 is not required when an activity was fully disposed of. Ad access irs tax forms. At the bottom of the page, click the loss limitation. To force form 8582 to print, open the prnt screen and select the option produce form. Web when creating the current year return, taxslayer pro will inform you if unallowed losses are found in the prior year return: Form 8582 is used by noncorporate taxpayers. Web a loss is not limited and form 8582 is not required when an activity was fully disposed of. Web when creating the current year return, taxslayer pro will inform you if unallowed losses are found in the prior year return: Web 4 rows form 8582 department of the treasury internal revenue service (99) passive activity loss. Web the income. Web when creating the current year return, taxslayer pro will inform you if unallowed losses are found in the prior year return: Web from 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive activity deductions (including prior year unallowed losses). Web per irs instructions for form 8582 passive activity loss limitations, starting page 3:. Entering prior year unallowed losses for a rental. Web yes, unallowed losses on form 8582 will continue to carry forward until you sell the property. Get ready for tax season deadlines by completing any required tax forms today. At the bottom of the page, click the loss limitation. Web 4 rows form 8582 department of the treasury internal revenue service. Ad access irs tax forms. Web form 8582 (2008) worksheet 1—for form 8582, lines 1a, 1b, and 1c (see pages 7 and 8 of the instructions.) current year prior years overall gain or loss (c) unallowed loss. Web department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. Basically, the net loss is still passive,. Web form 8582 (2008) worksheet 1—for form 8582, lines 1a, 1b, and 1c (see pages 7 and 8 of the instructions.) current year prior years overall gain or loss (c) unallowed loss. Complete, edit or print tax forms instantly. Part ix is used to figure the portion of the unallowed loss attributable to the 28% rate loss and the portion.. Go to the sch e pg 1. Ad access irs tax forms. Web for the program to populate the prior year unallowed losses on form 8582, do the following: Web yes, unallowed losses on form 8582 will continue to carry forward until you sell the property. If you actively participated in a passive rental real estate activity, you may. Basically, the net loss is still passive, the income is just shown separately on the 8582. Get ready for tax season deadlines by completing any required tax forms today. I can go into form mode and then find form 8582, but it already has my last year's unallowed losses entered and can't change it there. Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. To force form 8582 to print, open the prnt screen and select the option produce form. It is not always beneficial for. Web the income and the carryovers go to form 8582. Form 8582 is used by noncorporate taxpayers to figure the amount of. Web up to 10% cash back the passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting some or all losses from real estate. Web a loss is not limited and form 8582 is not required when an activity was fully disposed of. Complete, edit or print tax forms instantly. Web form 8582 (2008) worksheet 1—for form 8582, lines 1a, 1b, and 1c (see pages 7 and 8 of the instructions.) current year prior years overall gain or loss (c) unallowed loss. Web department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. Web 4 rows form 8582 department of the treasury internal revenue service (99) passive activity loss. Web department of the treasury internal revenue service passive activity loss limitations see separate instructions.Form 8582 Passive Activity Loss Limitations (2014) Free Download

Instructions for Form 8582CR (12/2019) Internal Revenue Service

How do I get form 8582 in Turbotax

TT Business How to enter Form 8582 passive activity loss from prior years

Form 8582Passive Activity Loss Limitations

Fillable Form 8582K Kentucky Passive Activity Loss Limitations

Fill Free fillable form 8582 passive activity loss limitations pdf

Form 8582K Download Fillable PDF or Fill Online Kentucky Passive

Form 8582Passive Activity Loss Limitations

8582 Tax Fill Out and Sign Printable PDF Template signNow

Related Post: