Where To Find Form 2210

Where To Find Form 2210 - As you may know, the quarters on the 2210 are not actually three months each. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web 2 best answer julies expert alumni you may not have had to file form 2210 last year. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Department of the treasury internal revenue service. Department of the treasury internal revenue service. Web we last updated federal form 2210 in december 2022 from the federal internal revenue service. To complete form 2210 within the program, please follow the steps listed below. Form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is. The amount on line 4 of your 2210 form last year would be the same as the. Web form 2210 department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts go to www.irs.gov/form2210 for. Solved•by intuit•15•updated july 12, 2023. Underpayment of estimated tax by individuals, estates, and trusts. Future developments for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were. Web. Web instructions for form 2210, underpayment of estimated tax by individuals, estates and trusts. The amount on line 4 of your 2210 form last year would be the same as the. Common questions about form 2210 in lacerte. Web where do i enter form 2210? Underpayment of estimated tax by individuals, estates and trusts what is this form about? Web instructions for form 2210, underpayment of estimated tax by individuals, estates and trusts. Below, you'll find answers to frequently asked. As you may know, the quarters on the 2210 are not actually three months each. Department of the treasury internal revenue service. Department of the treasury internal revenue service. Instructions for form 2210, underpayment of estimated tax. Underpayment of estimated tax by individuals, estates, and trusts. To complete form 2210 within the program, please follow the steps listed below. Department of the treasury internal revenue service. The amount on line 4 of your 2210 form last year would be the same as the. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Below, you'll find answers to frequently asked. Web after you enter your withheld taxes and any estimated tax payments in turbotax, we'll determine if you need to file form 2210 and calculate if any. Web. This form is for income earned in tax year 2022, with tax returns due in april. Common questions about form 2210 in lacerte. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Web 2 best answer julies expert alumni you may not have had. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. You can print other federal tax forms here. Web after you enter your withheld taxes and any estimated tax payments in turbotax, we'll determine if you need to file form 2210 and calculate if any.. Web the internal revenue service (irs) what is the form name? Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. As you may know, the quarters on the 2210 are not actually three months each. Web instructions for form 2210, underpayment of estimated tax by individuals, estates and trusts. Common questions. Solved•by intuit•15•updated july 12, 2023. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Web line 1 this is your 2021 tax, after credits from your tax return. Web 2 best answer julies expert alumni you may not have had to file form 2210. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Instructions for form 2210, underpayment of estimated tax. Underpayment of estimated tax by individuals, estates, and trusts. Form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is.. Underpayment of estimated tax by individuals, estates, and trusts. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. The default method of handling the withholding is to take the total and. Web we last updated federal form 2210 in december 2022 from the federal internal revenue service. Web instructions for form 2210, underpayment of estimated tax by individuals, estates and trusts. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Solved•by intuit•15•updated july 12, 2023. Web line 1 this is your 2021 tax, after credits from your tax return. Web june 18, 2020 2:08 pm. Future developments for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were. Form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is. As you may know, the quarters on the 2210 are not actually three months each. This form is for income earned in tax year 2022, with tax returns due in april. Common questions about form 2210 in lacerte. To complete form 2210 within the program, please follow the steps listed below. Instructions for form 2210, underpayment of estimated tax. The amount on line 4 of your 2210 form last year would be the same as the. Web irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the underpayment penalty if you didn't withhold or pay enough taxes. You can print other federal tax forms here. Department of the treasury internal revenue service.Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

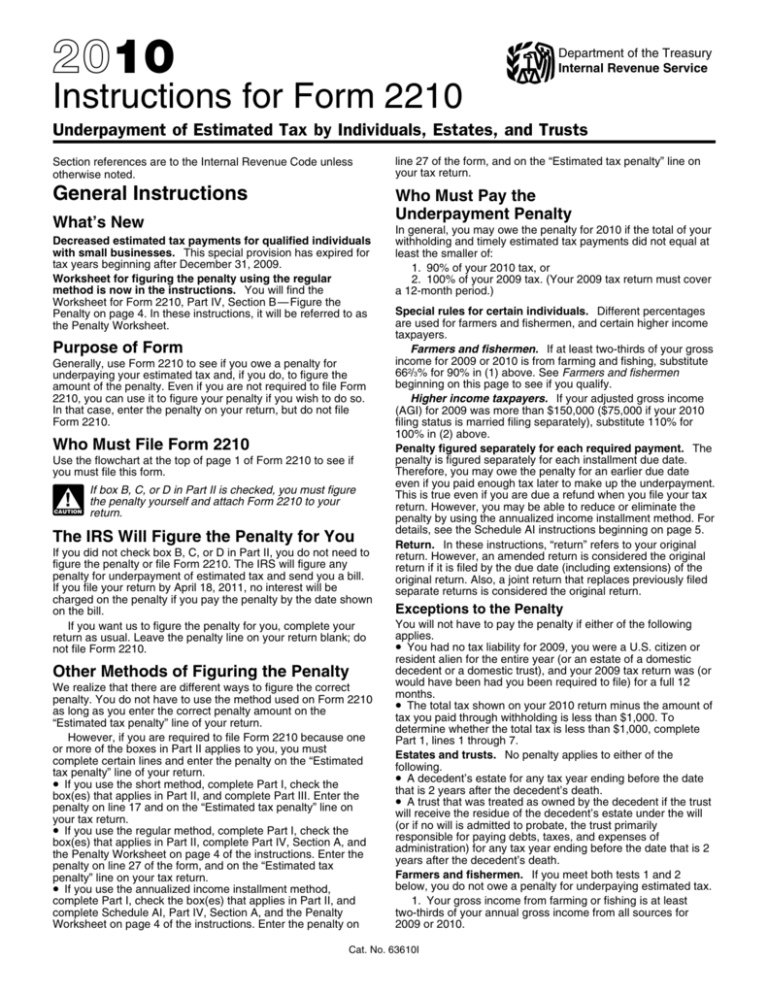

Instructions for Form 2210

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

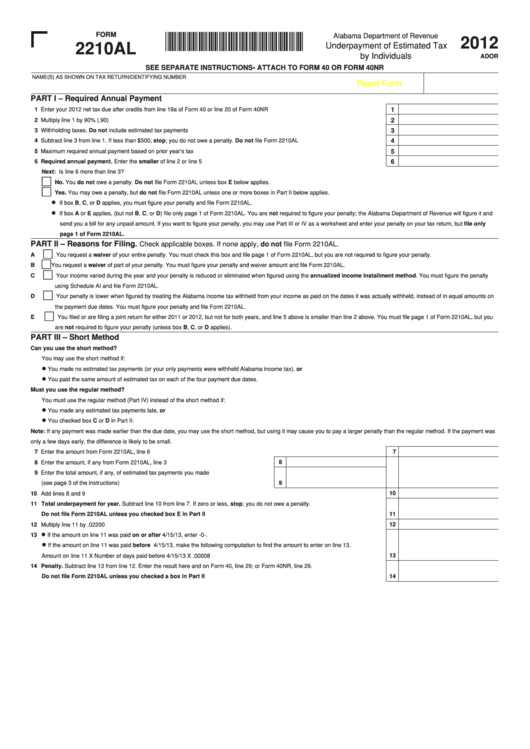

Fillable Form 2210al Underpayment Of Estimated Tax By Individuals

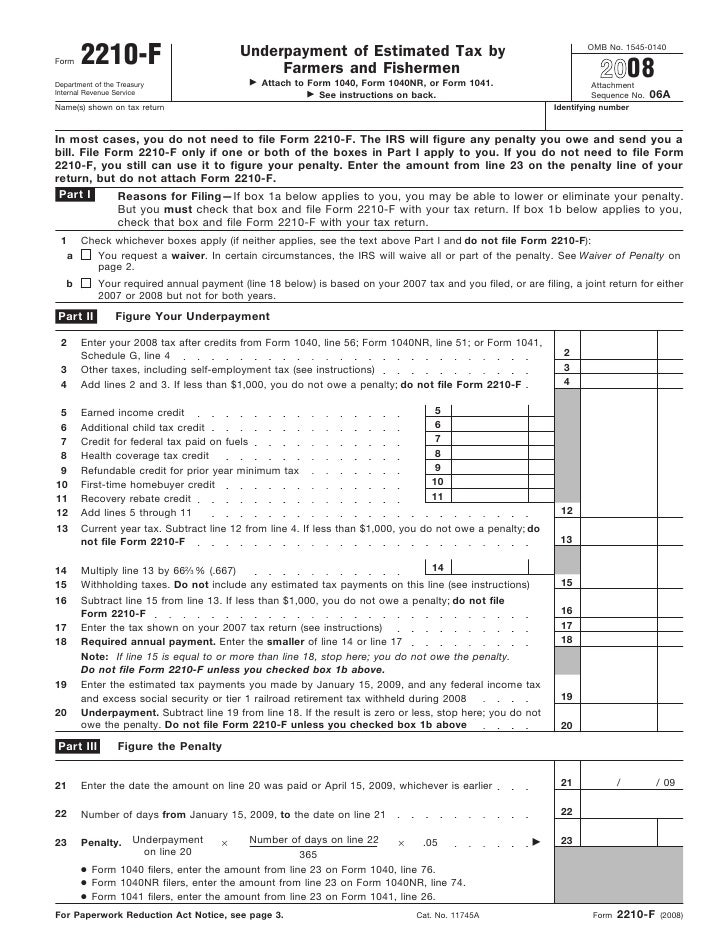

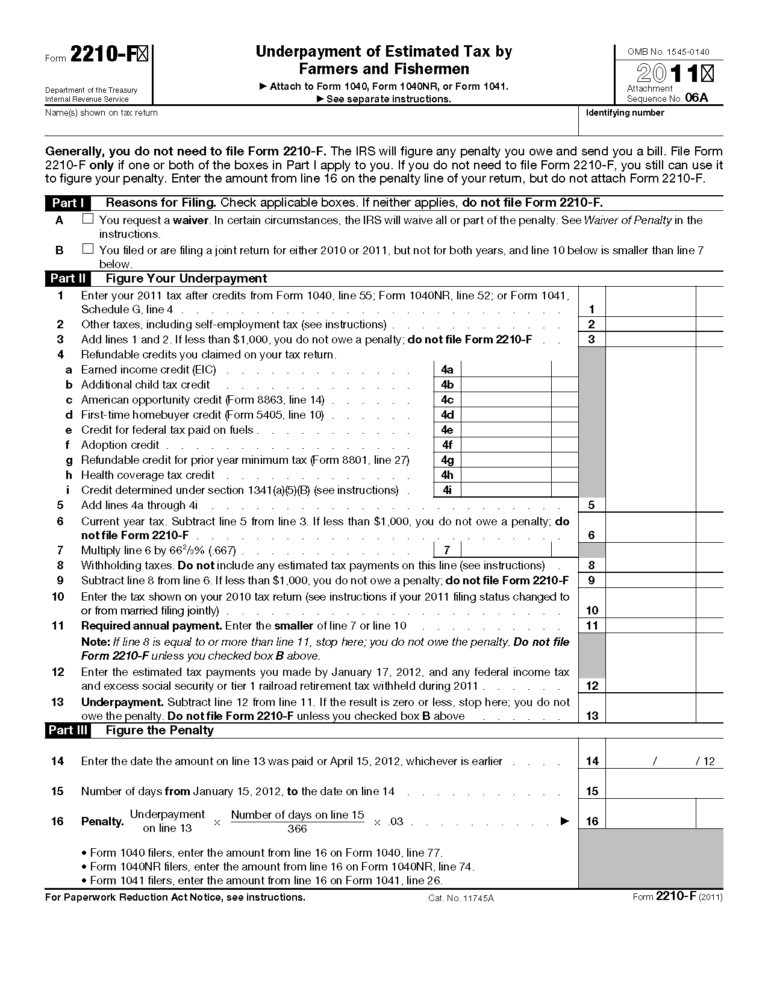

Form 2210FUnderpayment of Estimated Tax Farmers and Fishermen

Form 2210 Fill Online, Printable, Fillable, Blank pdfFiller

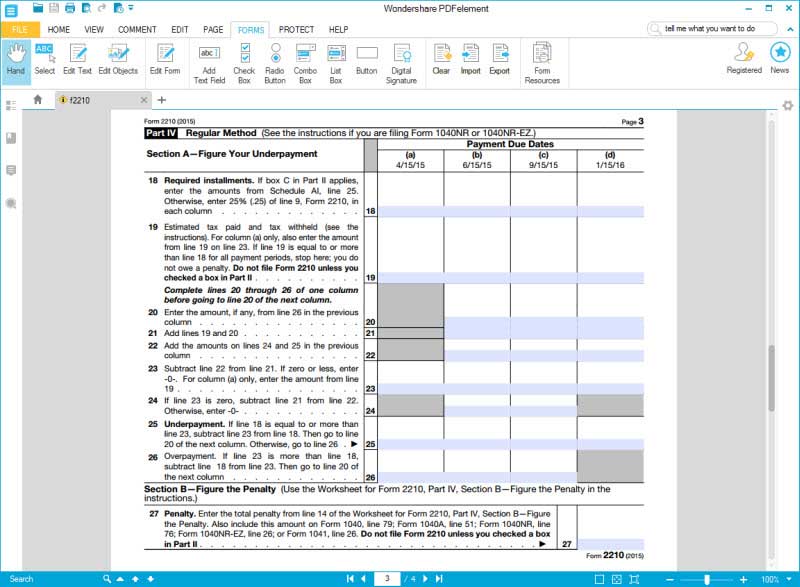

IRS Form 2210 Fill it with the Best Form Filler

IRS Form 2210 walkthrough (Underpayment of Estimated Tax by Individuals

2210 Form 2022 2023

Form 2210 F Underpayment Of Estimated Tax By Farmers And 2021 Tax

Related Post: