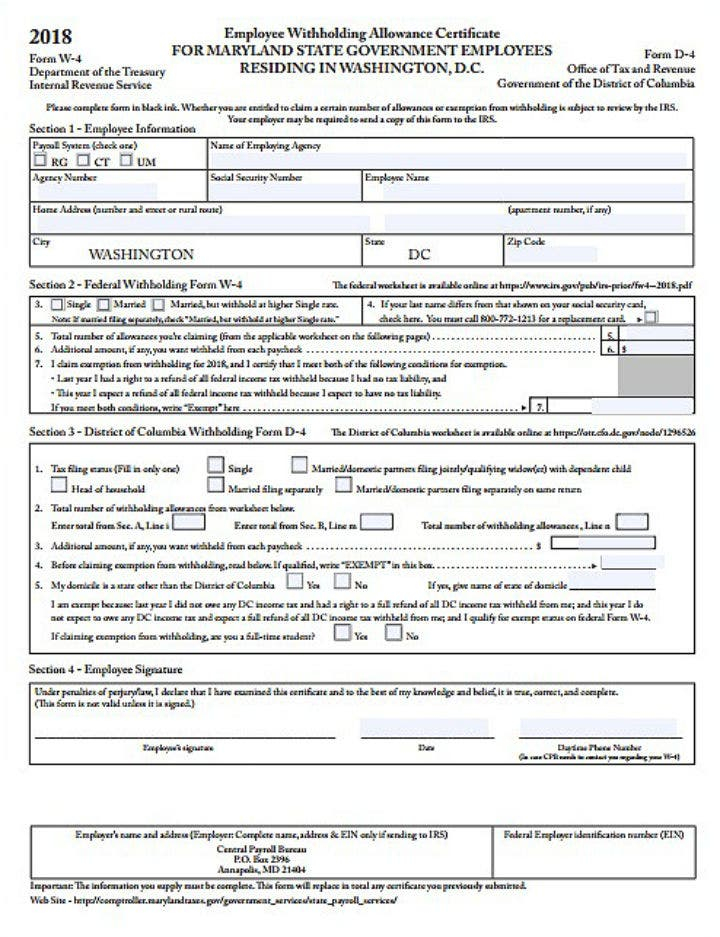

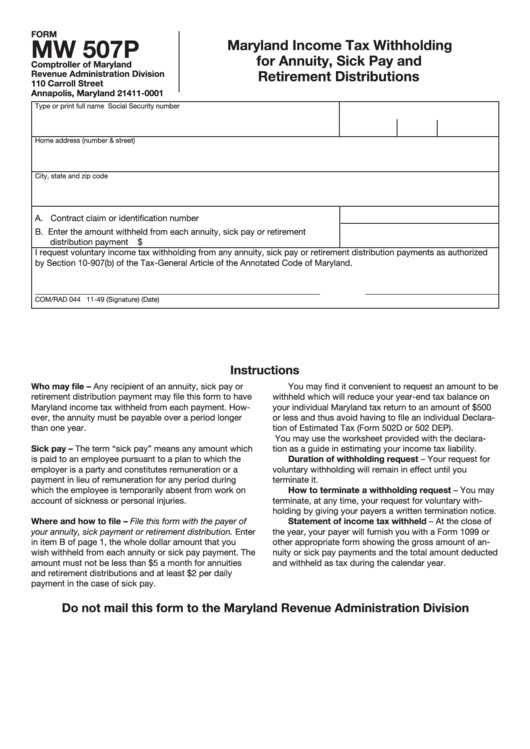

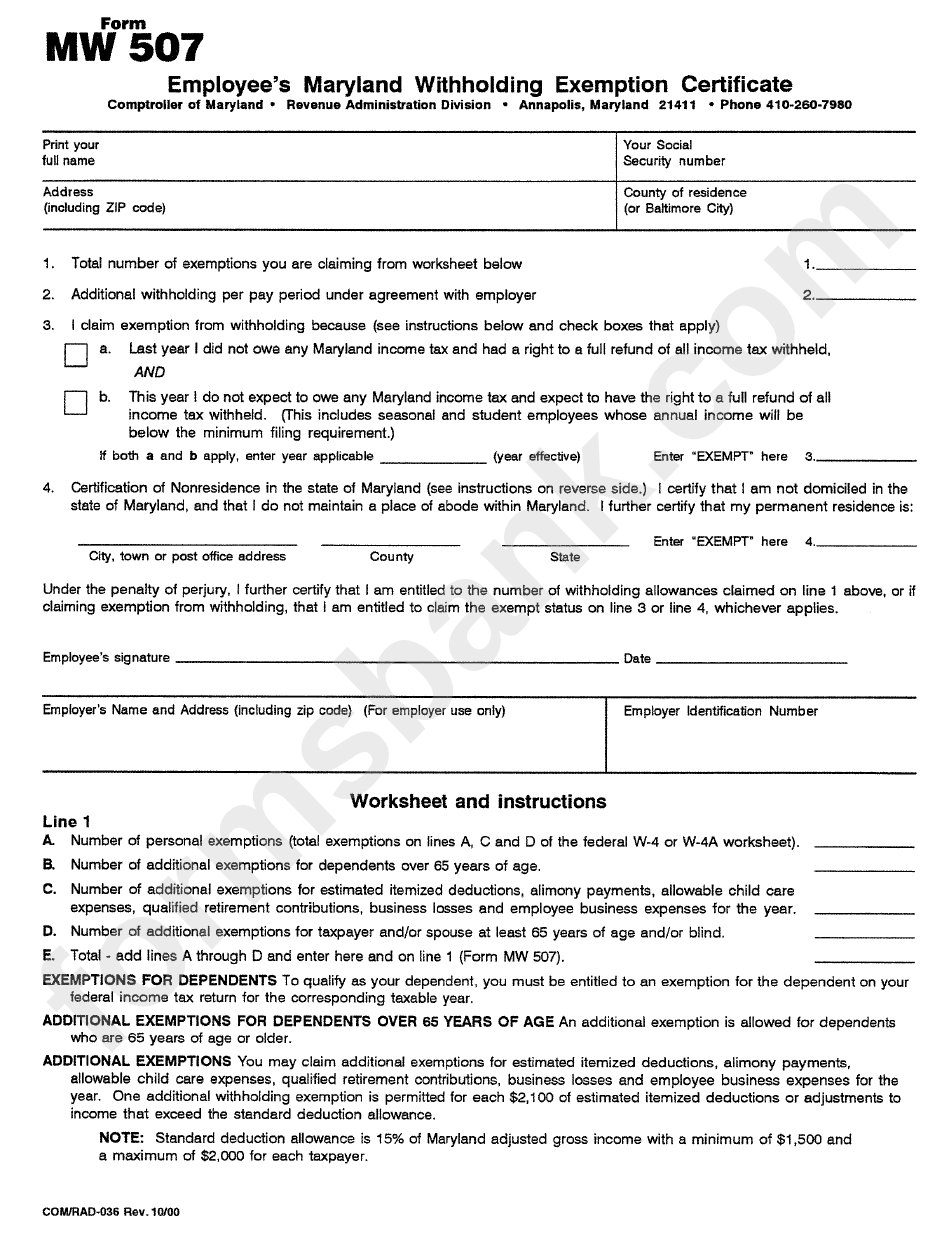

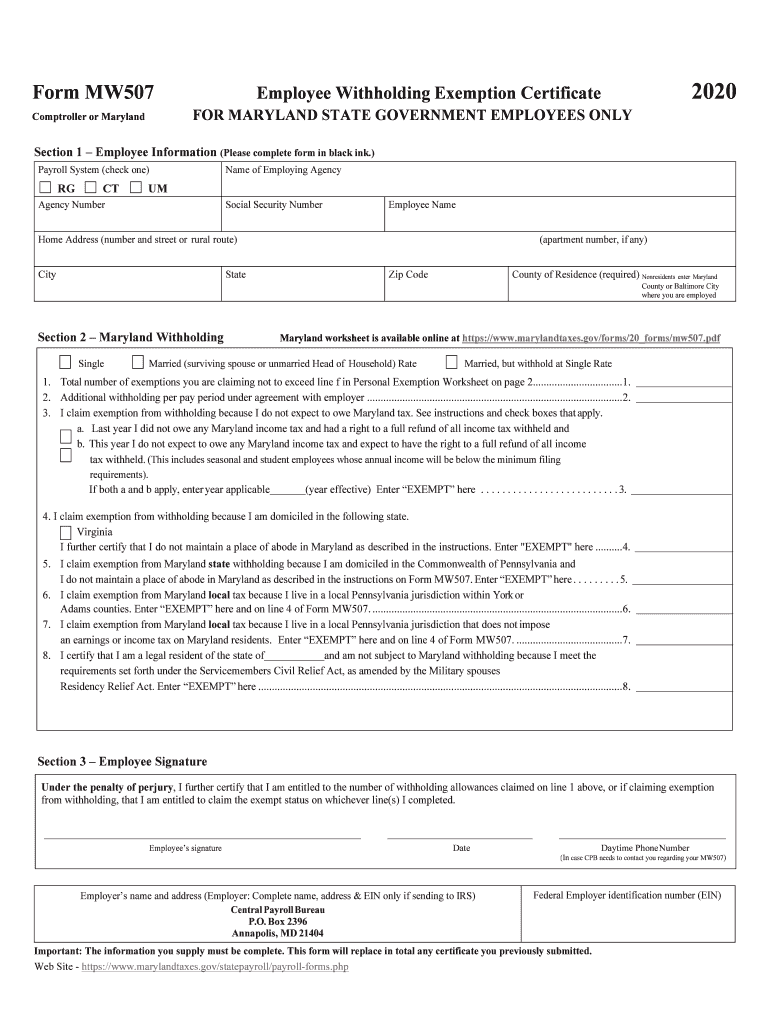

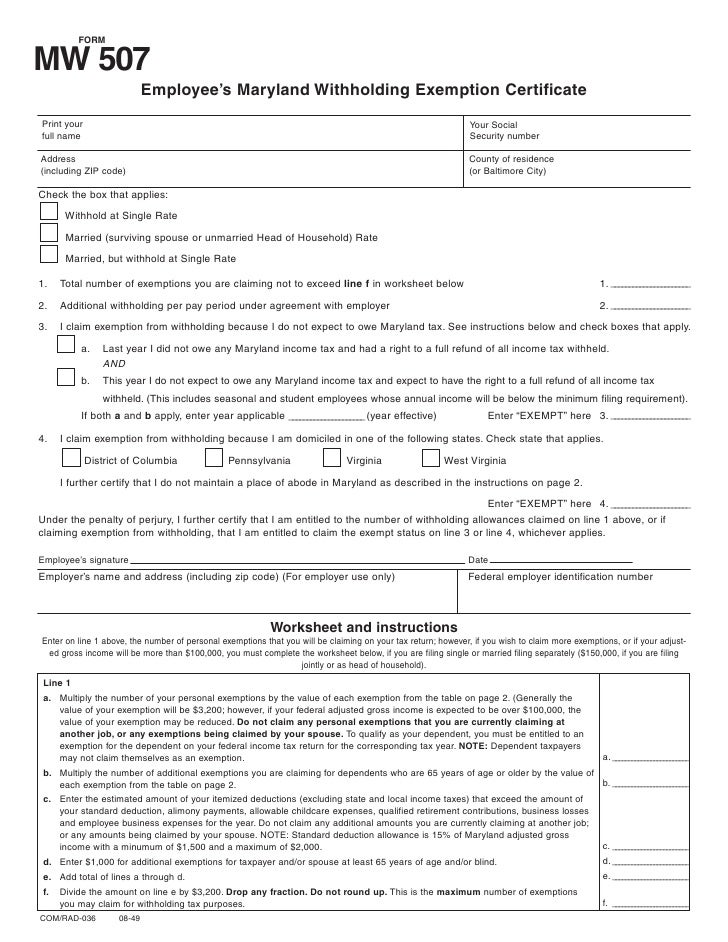

Maryland Employee Withholding Form

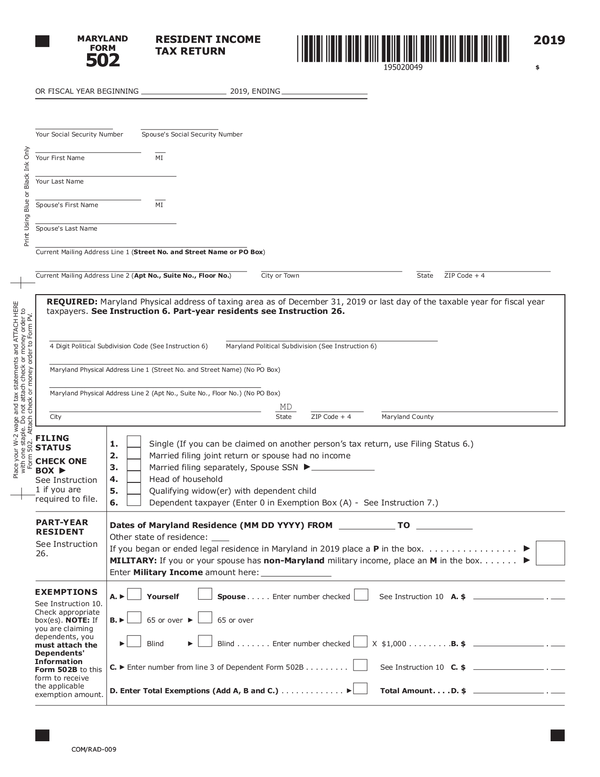

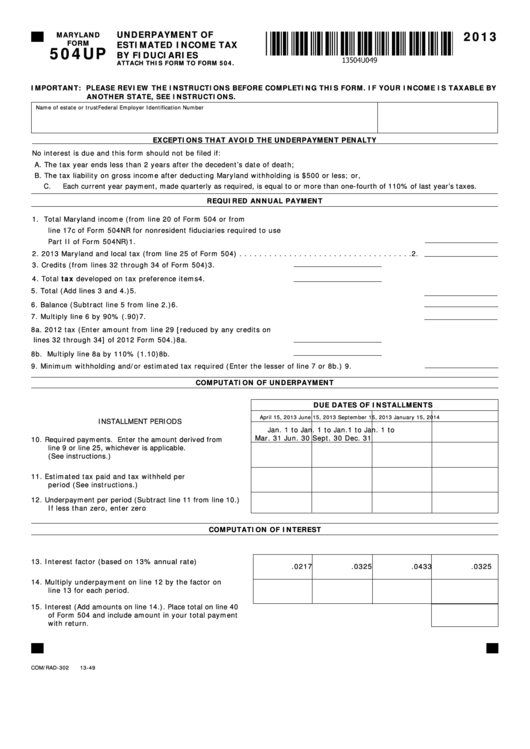

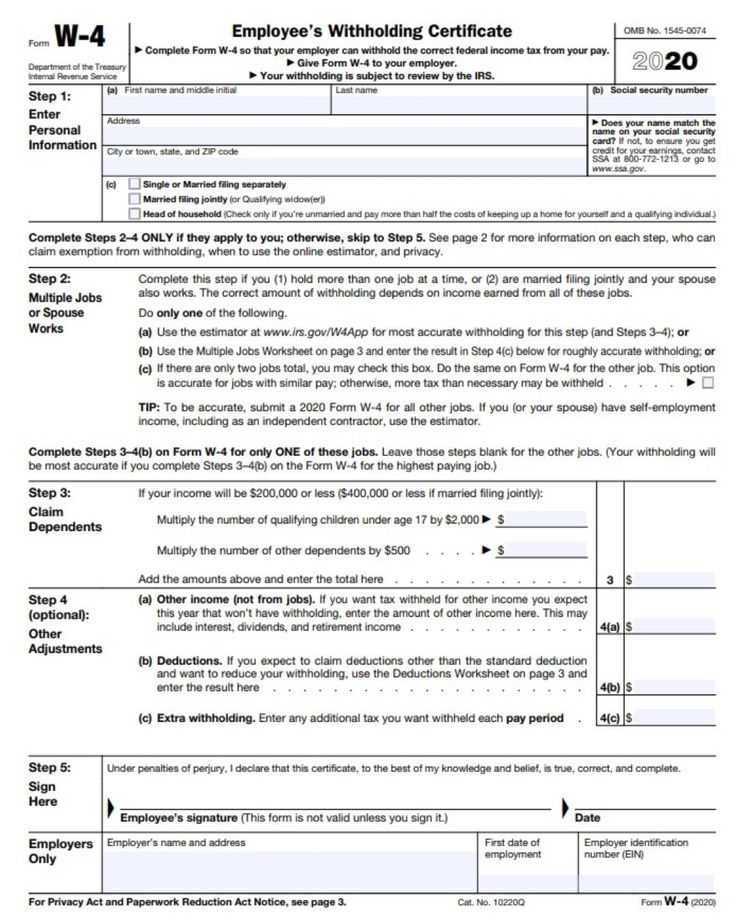

Maryland Employee Withholding Form - Maryland’s income tax rate ranges from 2% to 5.75%, based on the employee’s income and filing status with some exceptions for retirees. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. This guide is effective january 2021 and includes local income. Ad pdffiller.com has been visited by 1m+ users in the past month Web form mw507 employee's maryland withholding exemption certificate print full name social security number street address,city,state,zip county of residence. Web online withholding calculator for tax year 2022. The law requires that you complete an employee’s withholding allowance certificate so that. Web other taxes and regulations resources. Division of state documents (sos) filing maryland withholding reports. For maryland state government employees only. For more information, see nonresidents who work in maryland. Web employee's maryland withholding exemption certificate: Web form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the. Ad pdffiller.com has been visited by 1m+ users in the past month Failure to. Web form mw507 employee's maryland withholding exemption certificate print full name social security number street address,city,state,zip county of residence. The law requires that you complete an employee’s withholding allowance certificate so that. Enter the county in which the employee works. Web form mw507 is the state of maryland’s withholding exemption certificate that allows employees to select how much is withheld. Form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their. The paper version of form 500cr has been discontinued. Form name latest revision date; Web employees residing in state form no. Web employee withholding exemption certificate. Get ready for the season deadline by completing any required tax forms today. Web withheld from wage payments to each employee. Web employee's maryland withholding exemption certificate: Division of state documents (sos) filing maryland withholding reports. Form name latest revision date; Web form mw507 is the state of maryland’s withholding exemption certificate that allows employees to select how much is withheld from their paycheck. For maryland state government employees only. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Web maryland income tax withholding. Web a maryland form mw507 is a document used. Web employee withholding exemption certificate. Form mw508cr has been created to allow. Failure to fill out the. Web 7 rows employee's maryland withholding exemption certificate: Get ready for the season deadline by completing any required tax forms today. Web form mw507 is the state of maryland’s withholding exemption certificate that allows employees to select how much is withheld from their paycheck. For maryland state government employees only. Web employee's maryland withholding exemption certificate: This guide is effective january 2021 and includes local income. Complete form mw507 so that your employer can withhold the correct maryland income tax from. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Web form mw507 employee's maryland withholding exemption certificate print full name social security number street address,city,state,zip county of residence. Web form mw507 is the state of maryland’s withholding exemption certificate that allows employees to select how much is withheld from their paycheck. For. Web maryland employer withholding guide. Form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their. Web form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the. The law requires that you. Web online withholding calculator for tax year 2022. Web maryland income tax withholding. Form mw508cr has been created to allow. Web maryland employer withholding guide. Web employees residing in state form no. Web maryland income tax withholding. Ad pdffiller.com has been visited by 1m+ users in the past month Form mw508cr has been created to allow. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Web form mw507 is the state of maryland’s withholding exemption certificate that allows employees to select how much is withheld from their paycheck. Maryland’s income tax rate ranges from 2% to 5.75%, based on the employee’s income and filing status with some exceptions for retirees. Web 7 rows employee's maryland withholding exemption certificate: For maryland state government employees only. Web completing withholding forms for maryland state employees. Failure to fill out the. Web maryland employer withholding guide. Web employees residing in state form no. Ad download or email md bcps w4 rating & more fillable forms, register and subscribe now! The law requires that you complete an employee’s withholding allowance certificate so that. Web withheld from wage payments to each employee. For maryland state government employees only. Web employee withholding exemption certificate. For maryland state government employees only. This guide is effective january 2021 and includes local income. Web online withholding calculator for tax year 2022.Maryland Withholding Employee Form 2023

Maryland Withholding Tax Form

Form Mw 507 Employee'S Maryland Withholding Exemption Certificate

Maryland Employee Withholding Form 2023 Printable Forms Free Online

Md Employee Tax Withholding Form

Maryland Employee Tax Withholding Form 2022

Maryland State Withholding Form

Maryland Withholding Employee Form

Employee's Maryland Withholding Exemption Certificate

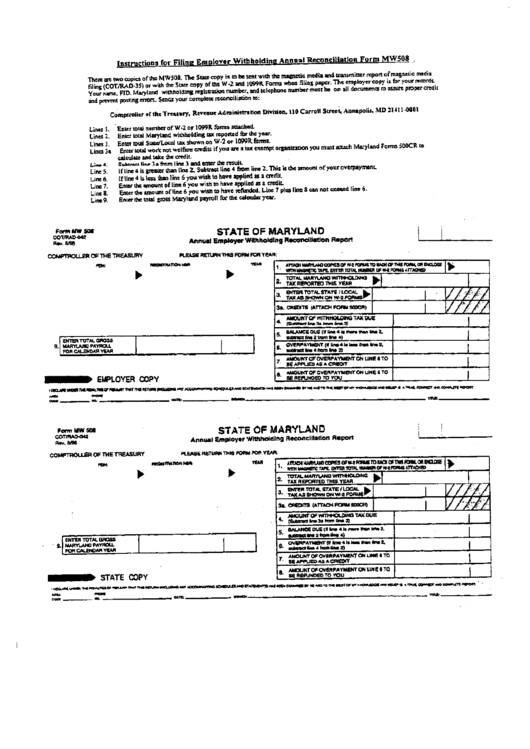

Form Mv500 State Of Maryland Annual Employer Withholding

Related Post: