Federal Form 8995

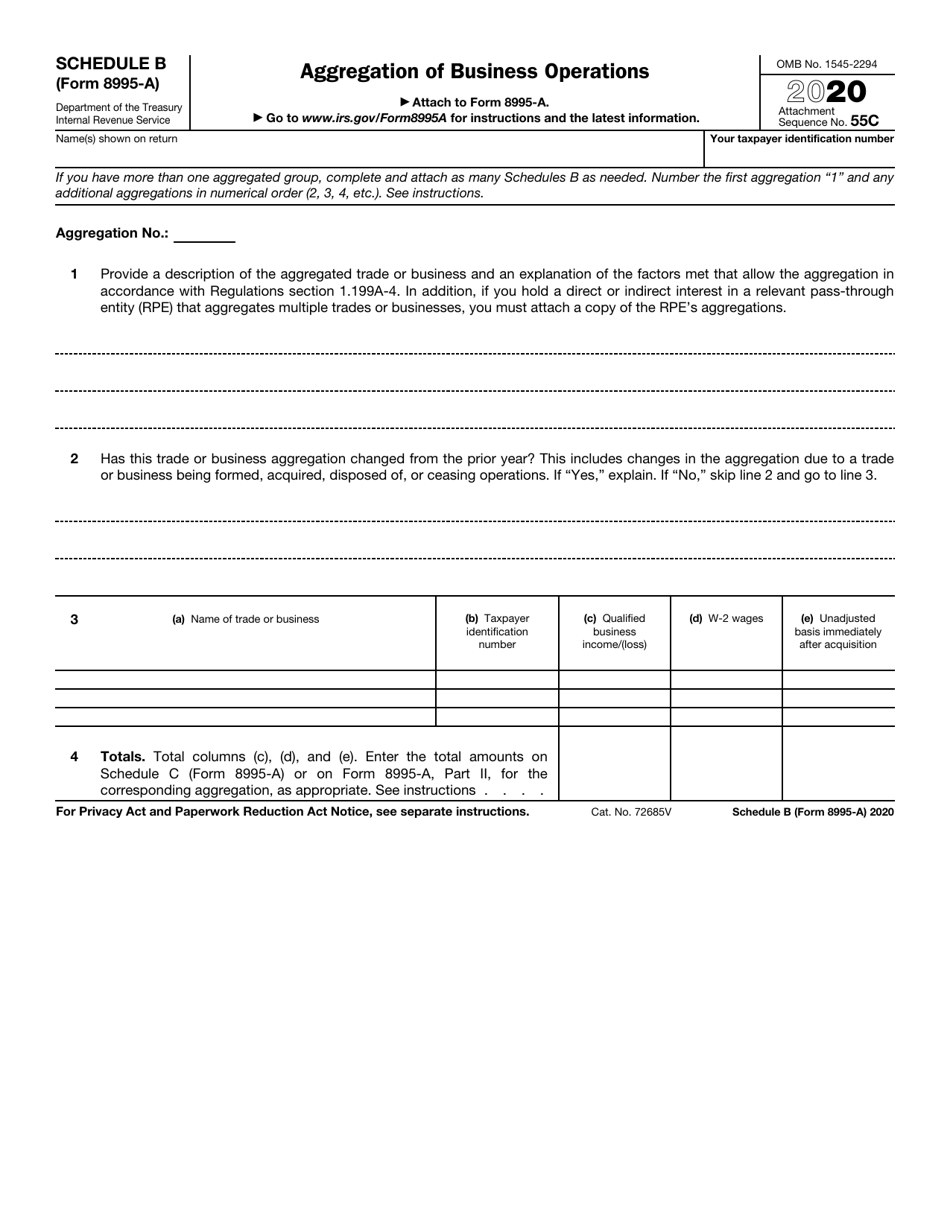

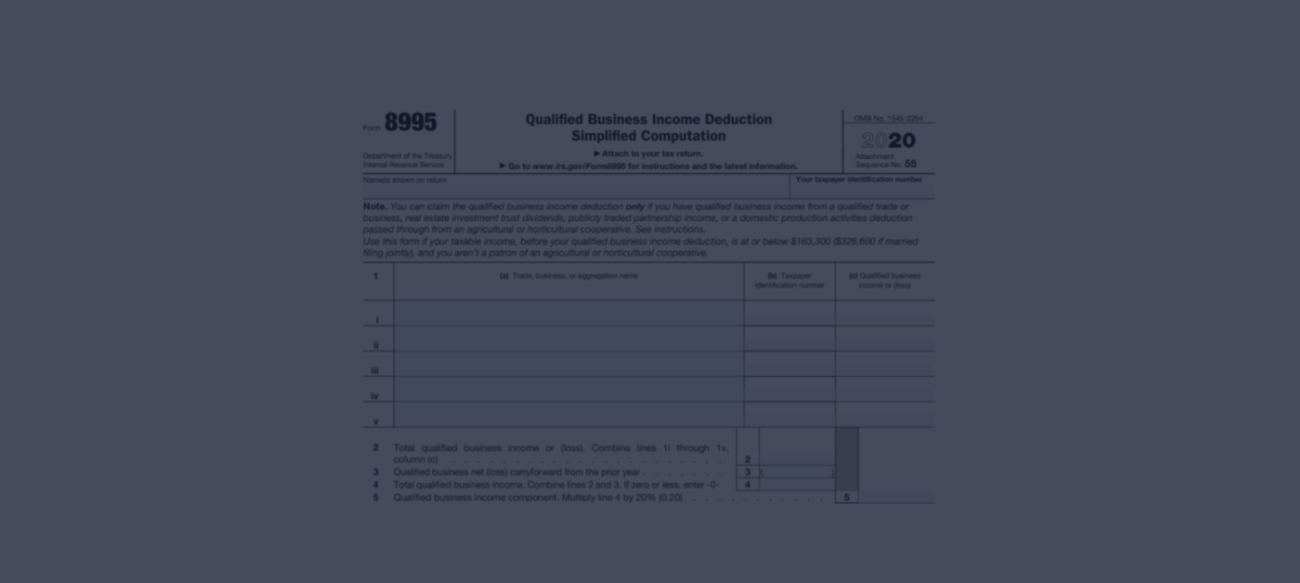

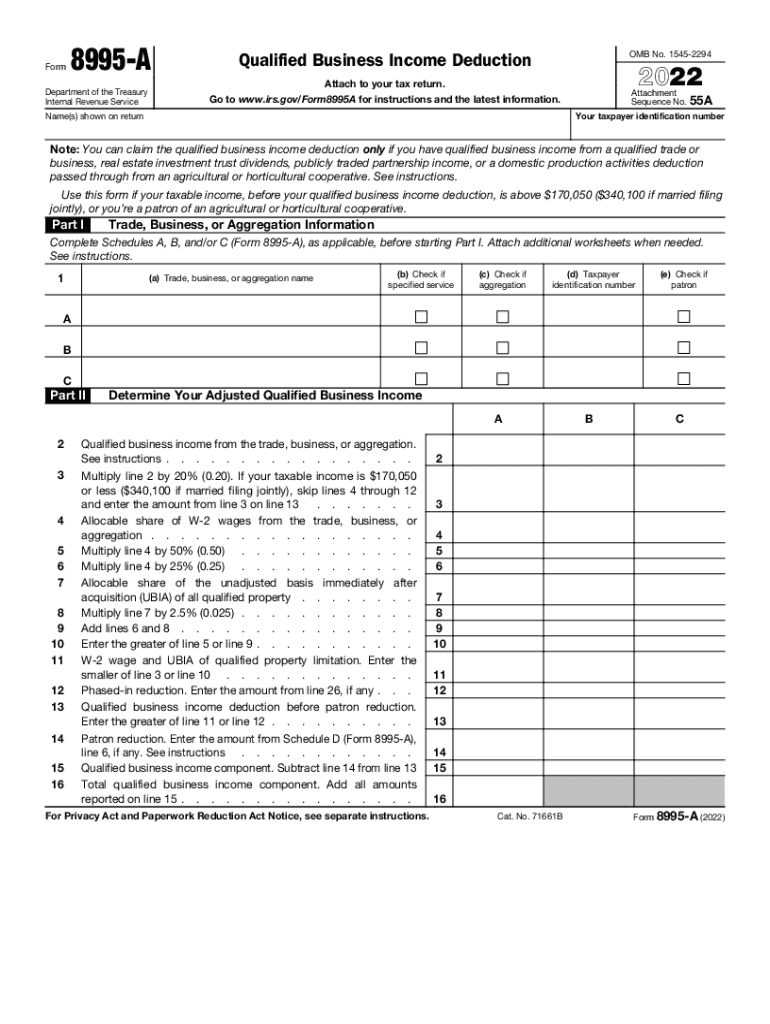

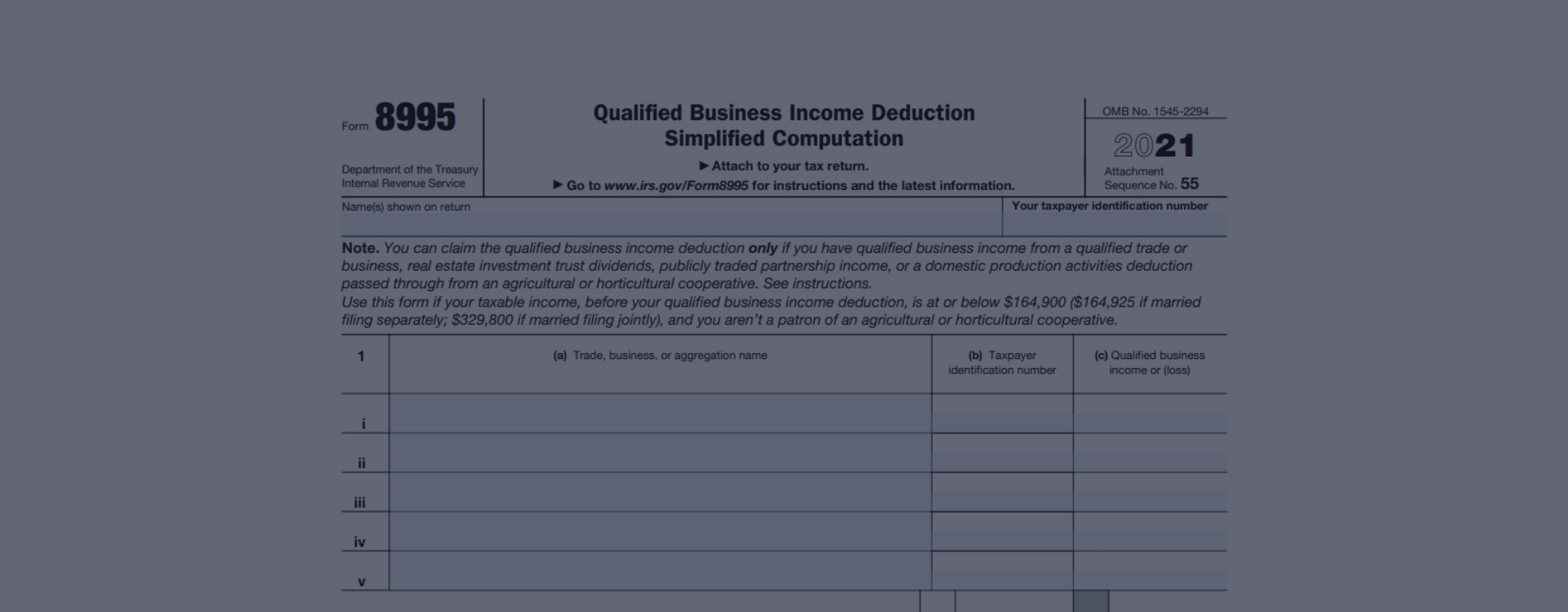

Federal Form 8995 - Web in accordance with section 1104 (b) of title xi of the financial institutions reform, recovery, and enforcement act of 1989, as amended, notice is hereby given. So, when do people need or can use income tax form 8995? Upload, modify or create forms. Web this printable form 8995 allows eligible taxpayers to claim a deduction for up to 20% of their qualified business income, which is determined by specific criteria outlined by the. Qualified business income deduction simplified computation. Web if form 8995 is being filed with the return, the aggregation information will be on a separate attachment to form 8995. It appears you don't have a pdf plugin for this browser. Attach to your tax return. Web 8995 is a federal individual income tax form. Web the federal form 8995, also known as the qualified business income deduction simplified computation, must be filed by us taxpayers eligible for the qbid. Web use form 8995 if: The due date for submitting the irs form 8995 for 2022 is april 15th, which is the standard deadline for filing individual income tax. Upload, modify or create forms. Web the irs form 8995 purpose. The primary purpose of this form is to calculate the qbi deduction for individuals,. Written by a turbotax expert • reviewed by a turbotax cpa. Upload, modify or create forms. Web the irs form 8995 purpose. You have qualified business income, qualified reit dividends, or qualified ptp income (loss), your 2020 taxable income before the qualified business. Upload, modify or create forms. Web what is form 8995? Try it for free now! So, when do people need or can use income tax form 8995? Web irs form 8995 for 2022 must be filed by individuals, partnerships, s corporations, and trusts or estates that have qualified business income (qbi) from a qualified trade or. Web 8995 is a federal individual income tax form. Ad register and subscribe now to work on your irs qualified business income deduction form. Updated for tax year 2022 • february 2, 2023 4:34 pm. Web 8995 is a federal individual income tax form. The draft form 8995 is comprised of one section (17 lines) with a fairly straightforward computation of the qualified business income (taking. Upload, modify or. Web what is form 8995? The primary purpose of this form is to calculate the qbi deduction for individuals,. Web this printable form 8995 allows eligible taxpayers to claim a deduction for up to 20% of their qualified business income, which is determined by specific criteria outlined by the. Ad register and subscribe now to work on your irs qualified. Web if form 8995 is being filed with the return, the aggregation information will be on a separate attachment to form 8995. Attach additional worksheets when needed. Complete, edit or print tax forms instantly. So, when do people need or can use income tax form 8995? Web the federal form 8995, also known as the qualified business income deduction simplified. Department of the treasury internal revenue service. Use this form if your taxable income, before your qualified business income deduction, is at or below $164,900 ($164,925 if married filing separately;. Web in accordance with section 1104 (b) of title xi of the financial institutions reform, recovery, and enforcement act of 1989, as amended, notice is hereby given. Web what is. It appears you don't have a pdf plugin for this browser. Web use form 8995 if: Web if form 8995 is being filed with the return, the aggregation information will be on a separate attachment to form 8995. Web this printable form 8995 allows eligible taxpayers to claim a deduction for up to 20% of their qualified business income, which. Can i use form 8995 for my business? Ad register and subscribe now to work on your irs qualified business income deduction form. Web what is form 8995? Web in accordance with section 1104 (b) of title xi of the financial institutions reform, recovery, and enforcement act of 1989, as amended, notice is hereby given. Web the federal form 8995,. Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. Web what is form 8995? Try it for free now! The draft form 8995 is comprised of one section (17 lines) with a fairly straightforward computation of the qualified business income (taking. Use form 8995 to figure your. It appears you don't have a pdf plugin for this browser. Attach to your tax return. Ad register and subscribe now to work on your irs qualified business income deduction form. Web what is form 8995? Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. 1 (a) trade, business, or. Use form 8995 to figure your qualified business income (qbi) deduction. Web the irs form 8995 purpose. Try it for free now! The draft form 8995 is comprised of one section (17 lines) with a fairly straightforward computation of the qualified business income (taking. Web use form 8995 if: The primary purpose of this form is to calculate the qbi deduction for individuals,. Use this form if your taxable income, before your qualified business income deduction, is at or below $164,900 ($164,925 if married filing separately;. Web irs form 8995 for 2022 must be filed by individuals, partnerships, s corporations, and trusts or estates that have qualified business income (qbi) from a qualified trade or. So, when do people need or can use income tax form 8995? Web in accordance with section 1104 (b) of title xi of the financial institutions reform, recovery, and enforcement act of 1989, as amended, notice is hereby given. Attach additional worksheets when needed. Web federal — qualified business income deduction simplified computation. Can i use form 8995 for my business? Updated for tax year 2022 • february 2, 2023 4:34 pm.Irs Form 8995a Schedule B Download Fillable Pdf Or Fill Online

8995 Fill Out and Sign Printable PDF Template signNow

IRS Form 8995 Instructions Your Simplified QBI Deduction

Form 8995 Basics & Beyond

8995 Form 📝 IRS Form 8995 for Instructions Printable Sample With PDF

Irs 8995 A Form Fill Out and Sign Printable PDF Template signNow

Form 8995A Draft WFFA CPAs

IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

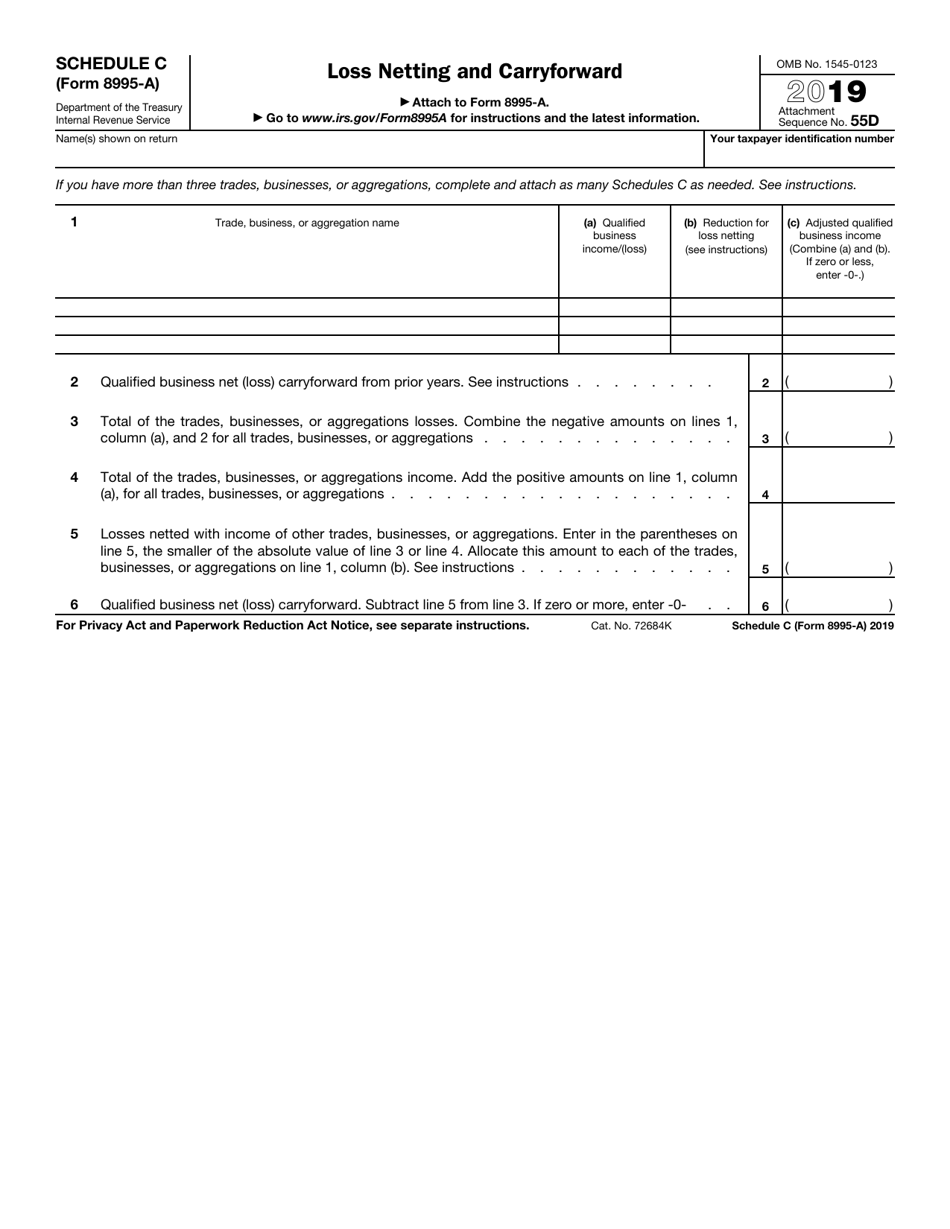

IRS Form 8995A Schedule C Download Fillable PDF or Fill Online Loss

8995 Form 📝 IRS Form 8995 for Instructions Printable Sample With PDF

Related Post: