Where To File Form 5329 By Itself

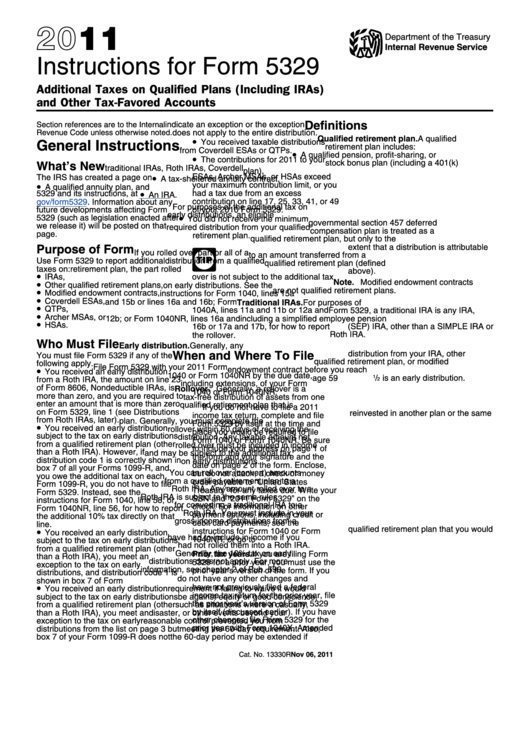

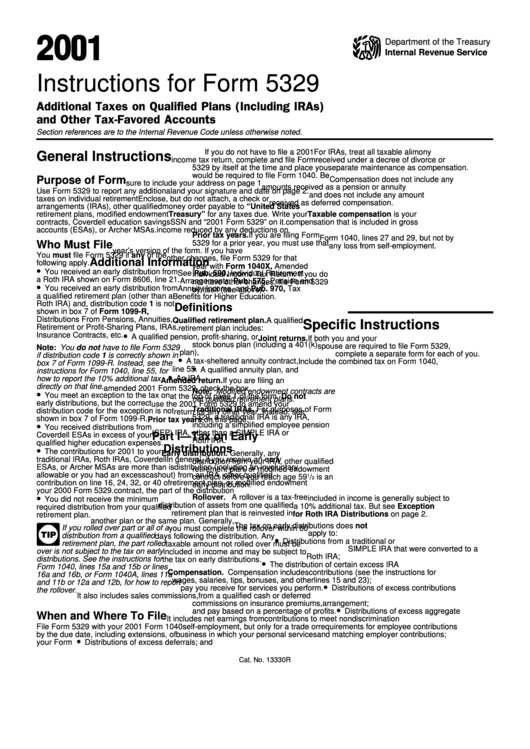

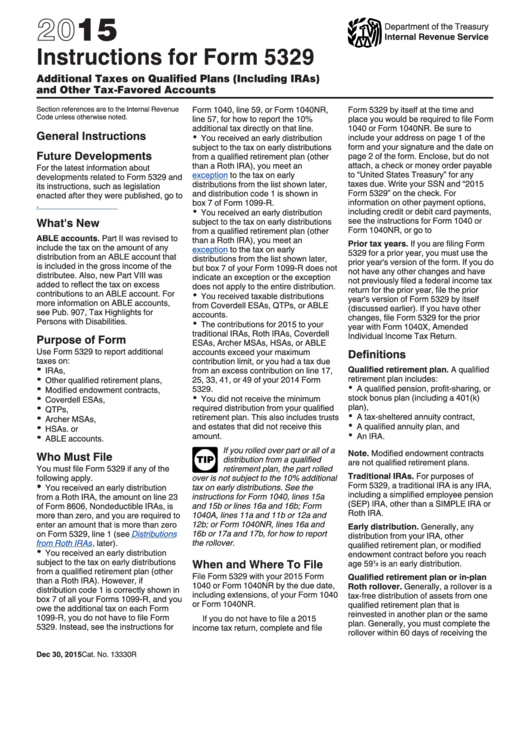

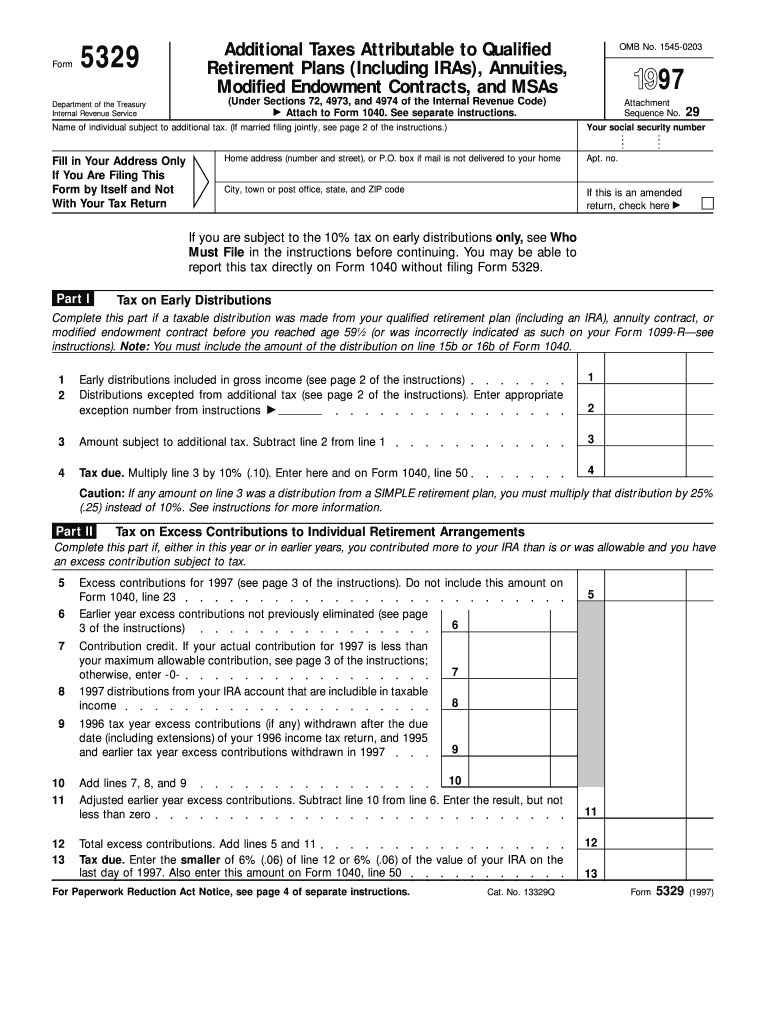

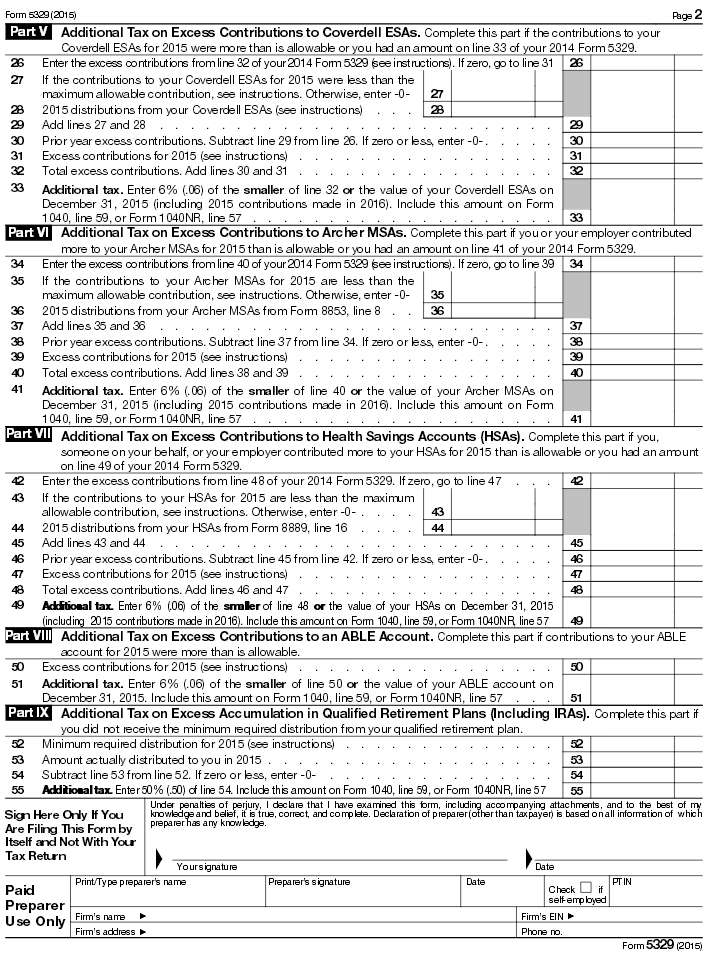

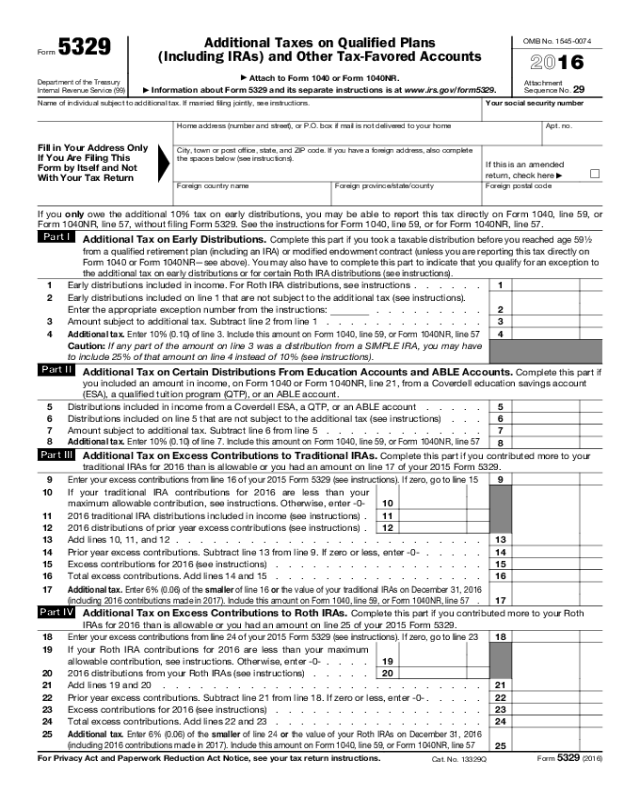

Where To File Form 5329 By Itself - If you don’t have to file a 2022 income tax return, complete and file form 5329 by itself at the time and place you would be required to file form. Web when and where to file. From within your taxact return ( online or desktop), click federal. Web to enter, review, or delete information for form 5329: Web but if you are filing a return only because you owe this tax, you can file form 5329 by itself. Tip if you don’t have to file a. Ad explore the collection of software at amazon & take your skills to the next level. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps,. We offer a variety of software related to various fields at great prices. If you don’t have to file a 2022 income tax return,. Web when and where to file. Web form 940, line 9 or line 10 (f) credit reduction amount allocated to the listed client ein from form 940, line 11 (g) total futa tax after adjustments allocated to the listed client ein. If you don’t have to file a 2022 income tax return, complete and file form 5329 by itself at. If you don’t have to file a 2022 income tax return,. But if you are filing a return only because you owe this. Ad explore the collection of software at amazon & take your skills to the next level. If you don’t have to file a 2022 income tax return, complete and file form 5329 by itself at the time. Web how do i file form 5329 with an amended return? If you do not have to file a 2014. Web form 940, line 9 or line 10 (f) credit reduction amount allocated to the listed client ein from form 940, line 11 (g) total futa tax after adjustments allocated to the listed client ein. Web when and where to. If you don’t have to file a 2022 income tax return, complete and file form 5329 by itself at the time and place you would be required to file form. No, you cannot file only form 5329. If you don’t have to file a 2022 income tax return,. Ad explore the collection of software at amazon & take your skills. Tip if you don’t have to file a. Ad our friendly tax attorneys are here to help. For 2023, the roth ira contribution limit is reduced (phased out) in the. Web but if you are filing a return only because you owe this tax, you can file form 5329 by itself. If you haven't filed your 2020 tax return then. Web those not required to file a tax return should complete and file form 5329 by itself. Web when and where to file. Remember to make the necessary. If you don’t have to file a 2022 income tax return,. Our experienced tax attorneys will handle it all. Ad our friendly tax attorneys are here to help. We offer a variety of software related to various fields at great prices. Web file form 5329 with your 2014 form 1040 or form 1040nr by the due date, including extensions, of your form 1040 or form 1040nr. If you haven't filed your 2020 tax return then you can use turbotax. Remember to make the necessary. But if you are filing a return only because you owe this. If you don’t have to file a 2020. Web how do i file form 5329 with an amended return? Web those not required to file a tax return should complete and file form 5329 by itself. Ad our friendly tax attorneys are here to help. Web those not required to file a tax return should complete and file form 5329 by itself. Tip if you don’t have to file a. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps,. We offer a variety of software related to various fields at great prices. Ad explore the collection of software at amazon & take your skills to the next level. For 2023, the roth ira contribution limit is reduced (phased out) in the. No, you cannot file only form 5329. Web those not required to file a tax return should complete and file form 5329 by itself. Use form 5329 to report additional taxes. Web to enter, review, or delete information for form 5329: Ad our friendly tax attorneys are here to help. We offer a variety of software related to various fields at great prices. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps,. If you do not have to file a 2014. Web while you can still file a 5329 for prior years because there are no statute of limitations for excess contributions, you would not file a blank form. Web 1 best answer. Remember to make the necessary. Our experienced tax attorneys will handle it all. Web file form 5329 with your 2014 form 1040 or form 1040nr by the due date, including extensions, of your form 1040 or form 1040nr. Web the information on form 5329 must be reported on and it must accompany form 1040: First complete the steps detailed in completing amended returns in ultratax cs. Use form 5329 to report additional taxes on: If you haven't filed your 2020 tax return then you can use turbotax to file your tax. For 2023, the roth ira contribution limit is reduced (phased out) in the. Web how do i file form 5329 with an amended return? Web form 940, line 9 or line 10 (f) credit reduction amount allocated to the listed client ein from form 940, line 11 (g) total futa tax after adjustments allocated to the listed client ein. Ad iluvenglish.com has been visited by 10k+ users in the past month Web those not required to file a tax return should complete and file form 5329 by itself. If you don’t have to file a 2022 income tax return,.Instructions For Form 5329 Additional Taxes On Qualified Plans And

Form 5329 Additional Taxes on Qualified Plans and Other TaxFavored

Instructions For Form 5329 Additional Taxes On Qualified Plans And

Instructions for How to Fill in IRS Form 5329

Instructions For Form 5329 (2015) printable pdf download

1099R Coding Change

Form 5329 Instructions & Exception Information for IRS Form 5329

5329 Fill Out and Sign Printable PDF Template signNow

Who must file the 2015 Form 5329?

Form 5329 Edit, Fill, Sign Online Handypdf

Related Post: