Irs Form 6198 Instructions

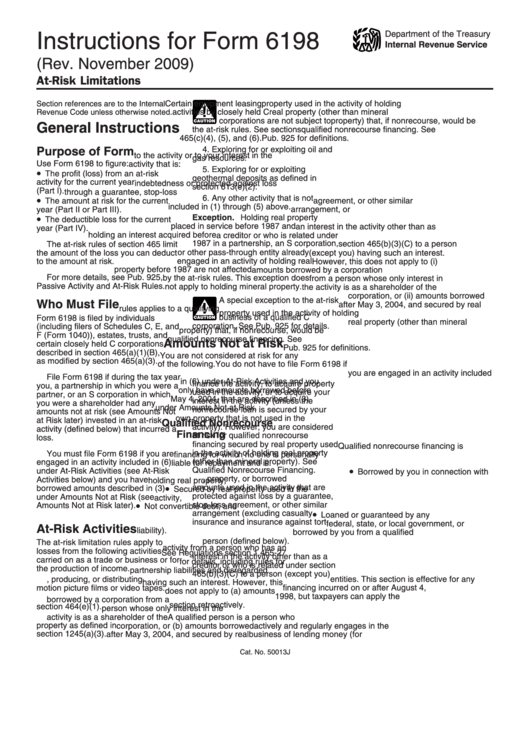

Irs Form 6198 Instructions - Form 6198 isn't currently supported in the fiduciary module, and must be completed. (part i), the amount at risk for the current year (part ii or part iii), and. Generally, any loss from an activity (such as a rental). This year i am using tt (havent filed 2020 yet), and i. Complete, edit or print tax forms instantly. The internal revenue service, tax forms and publications, 1111 constitution ave. Ad find essential office supplies for meticulous recordkeeping at amazon. Attach to your tax return. Estimate your current year's business losses. Form 6198 is used to determine the profit (or loss). Easily fill out pdf blank, edit, and sign them. You can download or print current or past. Get ready for tax season deadlines by completing any required tax forms today. (part i), the amount at risk for the current year (part ii or part iii), and. The deductible loss for the current year (part iv). December 2020) department of the treasury internal revenue service. If line 21 is less than line 5 of form 6198, losses on line 5 (form 6198) must be allocated and carried to next year. Web the internal revenue service (irs) lets taxpayers deduct cash spent on company expenses up to a specified amount. Web page last reviewed or updated: Easily. December 2020) department of the treasury internal revenue service. Ad find essential office supplies for meticulous recordkeeping at amazon. Complete, edit or print tax forms instantly. Easily fill out pdf blank, edit, and sign them. Web use form 6198 to figure: Estimate your current year's business losses. Complete, edit or print tax forms instantly. Form 6198 isn't currently supported in the fiduciary module, and must be completed. Easily fill out pdf blank, edit, and sign them. December 2020) department of the treasury internal revenue service. Web page last reviewed or updated: Get deals and low prices on irs tax forms at amazon Estimate your current year's business losses. Get ready for tax season deadlines by completing any required tax forms today. Web use form 6198 to figure: I had a negative number on line 21. Web use form 6198 to figure: Easily fill out pdf blank, edit, and sign them. (part i), the amount at risk for the current year (part ii or part iii), and. December 2020) department of the treasury internal revenue service. Form 6198 is used to determine the profit (or loss). You can download or print current or past. December 2020) department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Web use form 6198 to figure: Ad find essential office supplies for meticulous recordkeeping at amazon. (part i), the amount at risk for the current year (part ii or part iii), and. This year i am using tt (havent filed 2020 yet), and i. If line 21 is less than line 5 of form 6198, losses on line 5 (form 6198) must be allocated and carried. Form 6198 must be completed if there. Drafting irs form 6198 is a good skill to have so you can determine the maximum deductible amount after a loss in your invested business. December 2020) department of the treasury internal revenue service. Easily fill out pdf blank, edit, and sign them. Web the internal revenue service (irs) lets taxpayers deduct cash. Estimate your current year's business losses. Form 6198 isn't currently supported in the fiduciary module, and must be completed. Get ready for tax season deadlines by completing any required tax forms today. If line 21 is less than line 5 of form 6198, losses on line 5 (form 6198) must be allocated and carried to next year. Web the internal. Web guide on how to write a form 6198. Form 6198 isn't currently supported in the fiduciary module, and must be completed. This year i am using tt (havent filed 2020 yet), and i. Generally, any loss from an activity (such as a rental). Web use form 6198 to figure: Form 6198 is used to determine the profit (or loss). Complete, edit or print tax forms instantly. The internal revenue service, tax forms and publications, 1111 constitution ave. Attach to your tax return. Ad find essential office supplies for meticulous recordkeeping at amazon. (part i), the amount at risk for the current year (part ii or part iii), and. Get ready for tax season deadlines by completing any required tax forms today. Make an assessment of the amount at risk in the business. Get deals and low prices on irs tax forms at amazon Web page last reviewed or updated: Easily fill out pdf blank, edit, and sign them. If line 21 is less than line 5 of form 6198, losses on line 5 (form 6198) must be allocated and carried to next year. I had a negative number on line 21. Web use form 6198 to figure: Form 6198 must be completed if there.Instructions For Form 6198 AtRisk Limitations printable pdf download

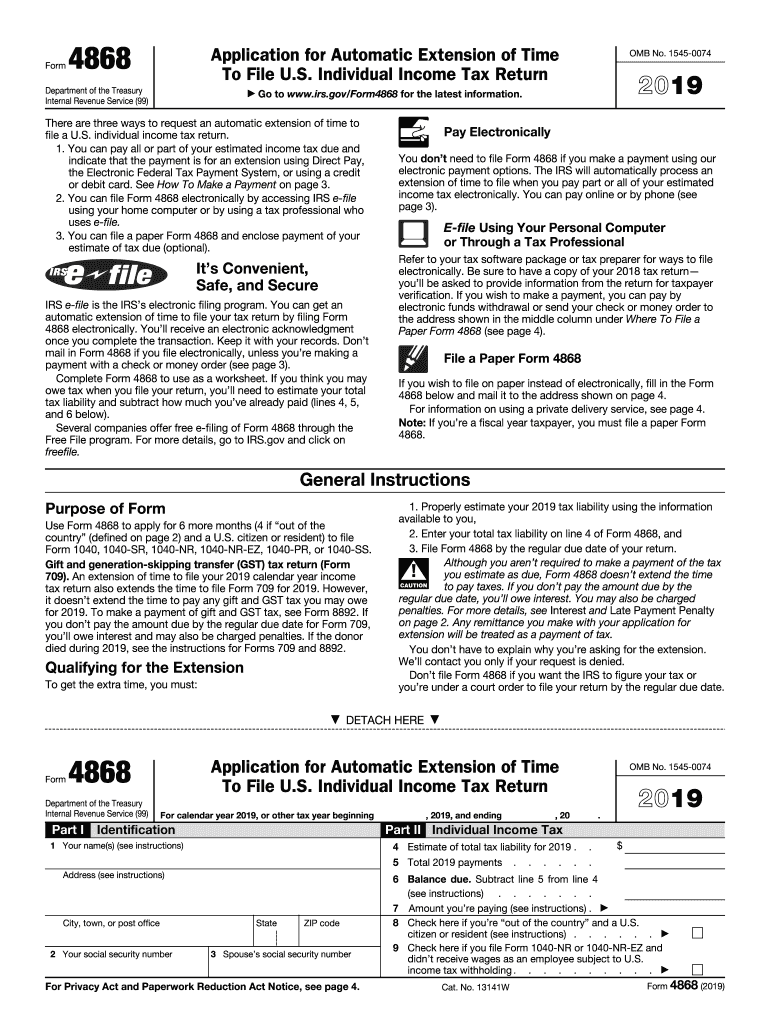

2019 Form IRS 4868 Fill Online, Printable, Fillable, Blank pdfFiller

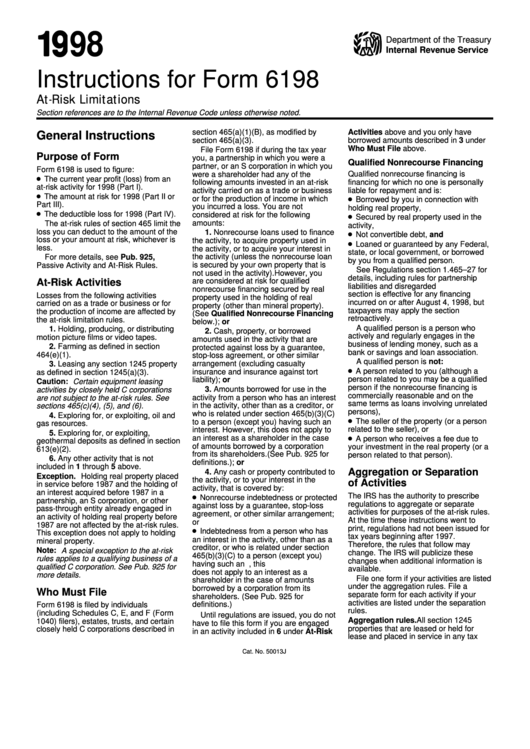

Instructions For Form 6198 AtRisk Limitations 1998 printable pdf

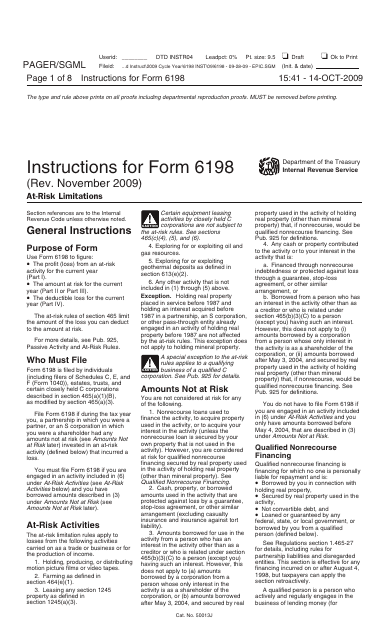

Download Instructions for IRS Form 6198 AtRisk Limitations PDF

Guide to Understanding the AtRisk Basis Rules and Form 6198 (UARB

Form 6198 Edit, Fill, Sign Online Handypdf

Form 6198 Instructions Fill Out and Sign Printable PDF Template signNow

IRS Form 6198 Instructions AtRisk Limitations

Irs Form W4V Printable IRS 656B 2020 Fill and Sign Printable

IRS Form 6198 Instructions AtRisk Limitations

Related Post: