Form 3514 Turbotax

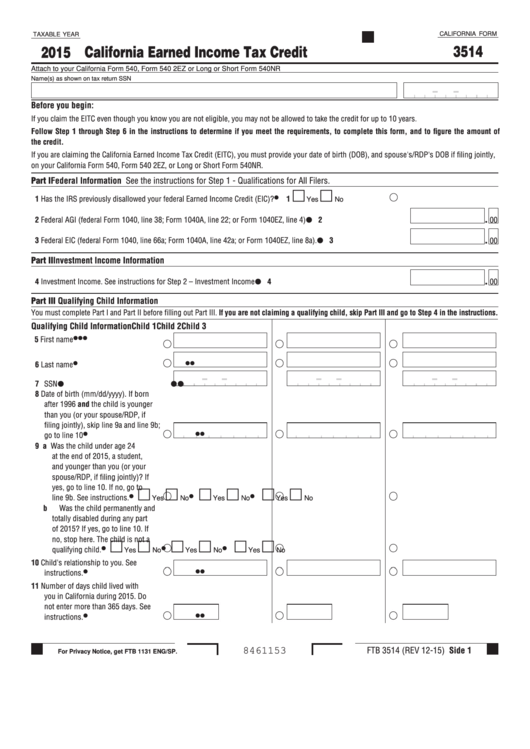

Form 3514 Turbotax - Populated, but we don't have any of that and don't qualify for eic. Form 3514, california earned income tax credit. This turbo tax might help explain why you're receiving it: Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be. Web to claim the california eitc, even if you do not owe california taxes, you must file a california income tax return and complete and attach the california eitc form (ftb. Web california form 3514 want business code, etc. We offer a variety of software related to various fields at great prices. Web the form 3514 requests a business code, business license number and sein. Get ready for tax season deadlines by completing any required tax forms today. Web all features, services, support, prices, offers, terms and conditions are subject to change without notice. If you are separated from your. References in these instructions are to the internal. Web forms and publications search | california franchise tax board. Populated, but we don't have any of that and don't qualify for eic. Return to forms and publications. This form does not apply to me. References in these instructions are to the internal revenue code. 2022 earned income tax credit table. Please use the link below to. Web this business code can be found on any of your business activities not only on a schedule c. Web ca form 3514 is for ca earned income credit. If you don't have a sein or business license number, then you should be able to. References in these instructions are to the internal revenue code. Both your earned income and federal adjusted gross income (agi) must be less than $56,844 to qualify for. Web 2020 california earned income tax. References in these instructions are to the internal revenue code. It appears you don't have a pdf plugin for this browser. Web this business code can be found on any of your business activities not only on a schedule c. It could refer to a small business, farm income, or a partnership schedule. Return to forms and publications. California form 3514, page 2, lines 18a through 18e need to be completed for tax returns with business income or loss. If you claim the california earned income tax credit (eitc) even though you know you are not eligible, you may not be. The following diagnostic is generating: It appears you don't have a pdf plugin for this browser. If. Web form 3514 is a california individual income tax form. It appears you don't have a pdf plugin for this browser. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web ca form 3514 is for ca earned income credit. Web 2020 instructions for form ftb 3514 | ftb.ca.gov states: References in these instructions are to the internal. Ad explore the collection of software at amazon & take your skills to the next level. Web 603 rows on this page. Web california form 3514 want business code, etc. If you claim the california earned income tax credit (eitc) even. Web when claiming the california earned income tax credit, form 3514 line 1a asks if the irs has in a previous year disallowed your federal eic. Attach to your california form 540, form 540 2ez or form 540nr. Get ready for tax season deadlines by completing any required tax. Web form 3514 is a california individual income tax form. Name(s) as shown on tax return. Populated, but we don't have any of that and don't qualify for eic. Web forms and publications search | california franchise tax board. If you claim the california earned income tax credit (eitc) even. Web 2020 instructions for form ftb 3514 | ftb.ca.gov states: Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be. Return to forms and publications. Form 3514, california earned income tax credit. The following diagnostic is generating: The following diagnostic is generating: Complete, edit or print tax forms instantly. How do we get rid of that form? We offer a variety of software related to various fields at great prices. References in these instructions are to the internal revenue code. Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be. Web california form 3514 want business code, etc. Web 2020 instructions for form ftb 3514 | ftb.ca.gov states: To qualify for the california eitc, you must meet all of. Populated, but we don't have any of that and don't qualify for eic. Please use the link below to. It appears you don't have a pdf plugin for this browser. Web 2020 california earned income tax credit. 2022 earned income tax credit table. Web ca form 3514 is for ca earned income credit. Web 603 rows on this page. If you are separated from your. Attach to your california form 540, form 540 2ez or form 540nr. Ad explore the collection of software at amazon & take your skills to the next level. California form 3514, page 2, lines 18a through 18e need to be completed for tax returns with business income or loss.Form 3514 California Earned Tax Credit 2015 printable pdf

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

TurboTax Self Employed Explained How to File Rideshare Taxes Advice

How To Upload Your Form 1099 To Turbotax Turbo Tax

What is a Schedule K1 Tax Form? TurboTax Tax Tips & Videos Fill

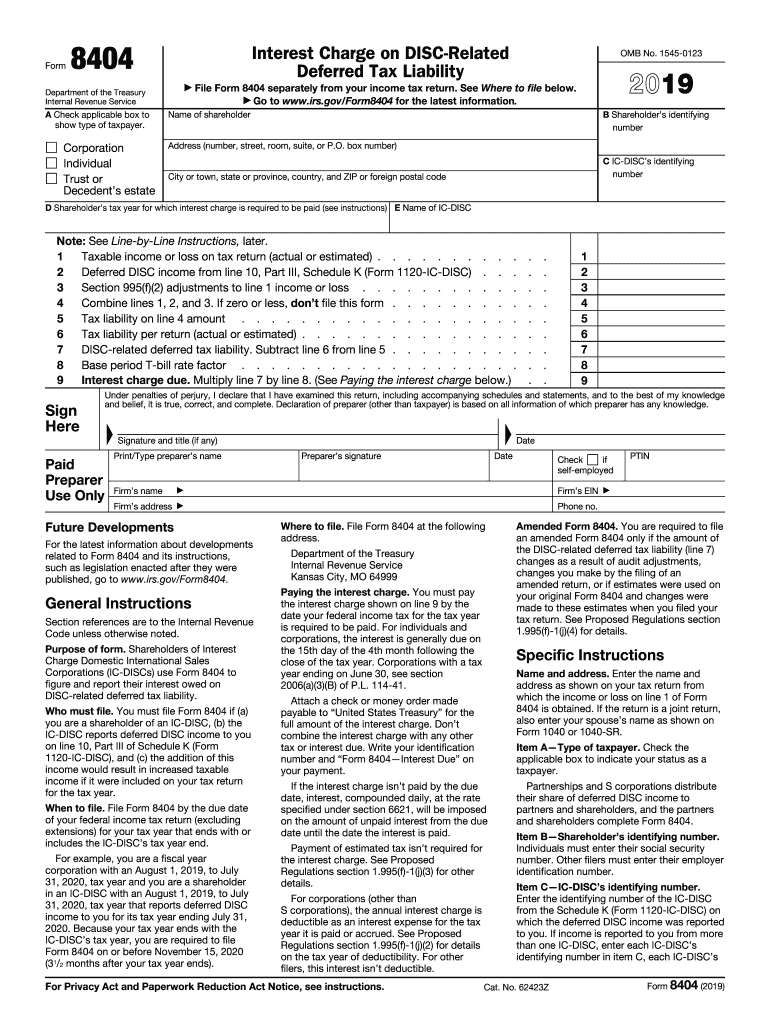

Form 8404 Fill Out and Sign Printable PDF Template signNow

how to remove form 3514 TurboTax Support

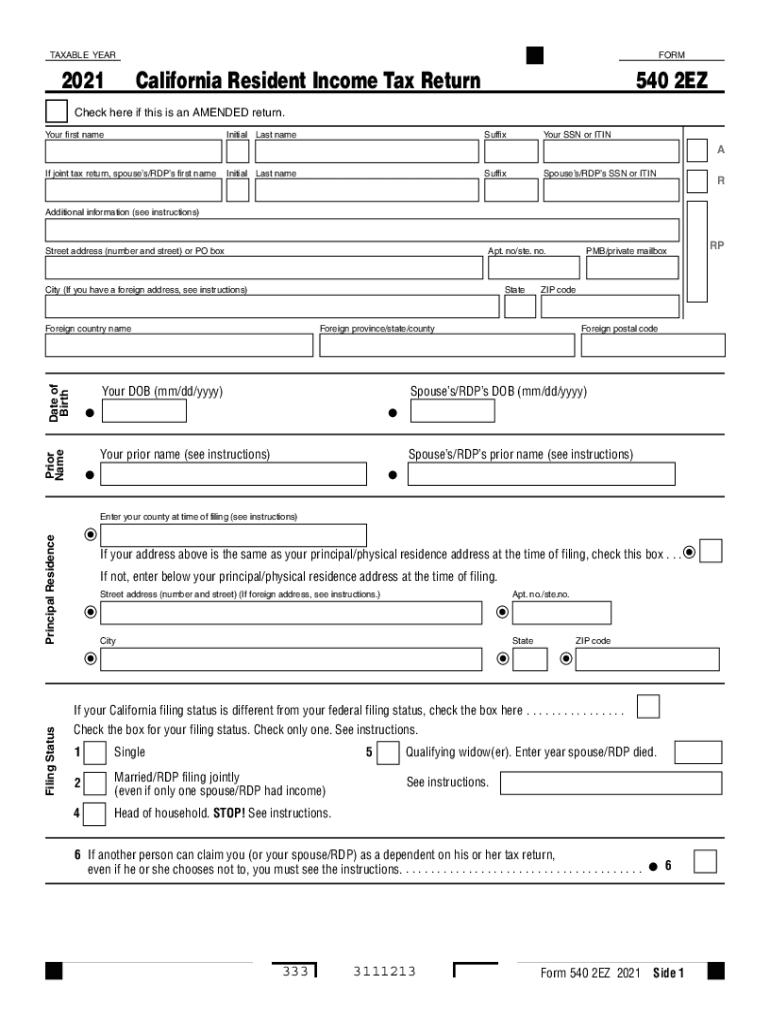

CA FTB 540 2EZ 20212022 Fill and Sign Printable Template Online US

TurboTax Deluxe Federal + eFile + State 2009 Software

Form 3514 Fill and Sign Printable Template Online US Legal Forms

Related Post: