How To Report Wash Sales On Form 8949

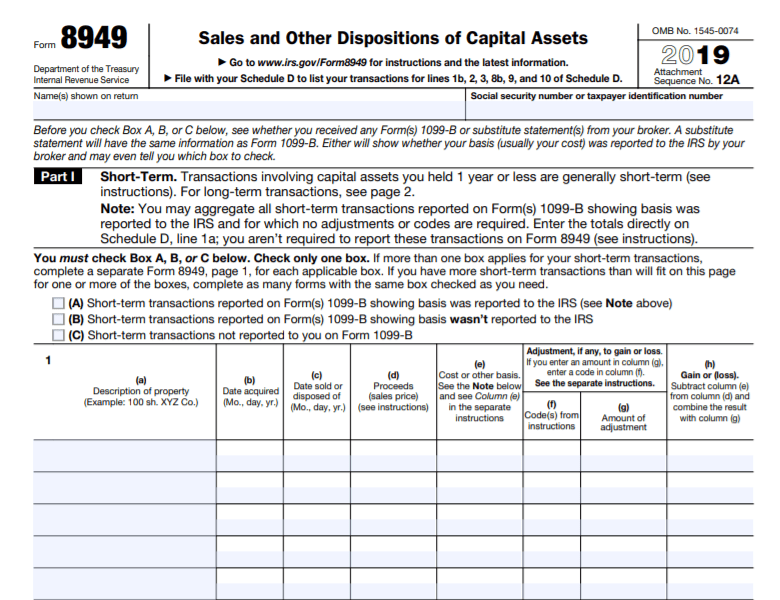

How To Report Wash Sales On Form 8949 - See the schedule d instructions for more information about wash sales generally. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs on forms 1099. Web taxslayer support how do i report a wash sale? If the wash sale was reported in box 1g, enter it there and the 8949 will be adjusted for. Report the appropriate adjustment amount. Web by william perez updated on may 31, 2022 reviewed by lea d. Web to enter a wash sale on form 8949 in taxslayer pro, from the main menu of the tax return (form 1040), select: Web however, this exception will rarely apply to traders and investors because typically they have nondeductible wash sale adjustments. Web how to report a wash sale in proconnect tax down below we will go over how to report a wash sale for all return types. For more details on wash sales, see pub. Web use schedule d to report the following. The overall capital gains and losses from transactions reported on form 8949, sales and other dispositions of capital assets. Web report the sale or exchange on form 8949 and enter the amount of the nondeductible loss as a positive number in column (g). If the wash sale was reported in box 1g,. See the schedule d instructions for more information about wash sales generally. Web how to report a wash sale in proconnect tax down below we will go over how to report a wash sale for all return types. Web if a portion of the sale is disallowed due to being a wash sale, enter the disallowed portion of the loss. To enter your wash sale into the program please follow this pathway: Web taxslayer support how do i report a wash sale? Web report the sale or exchange on form 8949 and enter the amount of the nondeductible loss as a positive number in column (g). Web report the sale or exchange and enter the amount of the nondeductible loss. Web you can log a wash sale on internal revenue service form 8949 by specifically noting that it's a wash sale with the letter w. If the wash sale was reported in box 1g, enter it there and the 8949 will be adjusted for. See the schedule d instructions for more information about wash sales generally. Web how to report. See the schedule d instructions for more information. If the wash sale was reported in box 1g, enter it there and the 8949 will be adjusted for. Web use form 8949 to report sales and exchanges of capital assets. Uradu fact checked by kiran aditham in this article view all the wash sale rule defined example. Enter all information as. Uradu fact checked by kiran aditham in this article view all the wash sale rule defined example. Web to report wash sales per form 8949 instructions in ultratax/1120, access screen d, located in the schedule d folder, and open the detail schedule statement dialog and. Web if a portion of the sale is disallowed due to being a wash sale,. Web to enter a wash sale on form 8949 in taxslayer proweb, from the federal section of the tax return (form 1040) select: Web how to report a wash sale in lacerte follow these steps:go to the dispositions screen:individual module: Report the appropriate adjustment amount. Web you can log a wash sale on internal revenue service form 8949 by specifically. Web use form 8949 to report sales and exchanges of capital assets. Web report the sale or exchange on form 8949 and enter the amount of the nondeductible loss as a positive number in column (g). Web how to report a wash sale in proconnect tax down below we will go over how to report a wash sale for all. Web report the sale or exchange on form 8949 and enter the amount of the nondeductible loss as a positive number in column (g). Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs on forms 1099. Web to report wash sales per form 8949 instructions in ultratax/1120, access screen d, located. Web to report wash sales per form 8949 instructions in ultratax/1120, access screen d, located in the schedule d folder, and open the detail schedule statement dialog and. Web use form 8949 to report sales and exchanges of capital assets. Web how to report a wash sale in proconnect tax down below we will go over how to report a. Web you can log a wash sale on internal revenue service form 8949 by specifically noting that it's a wash sale with the letter w. Web use schedule d to report the following. Web how to report a wash sale in lacerte follow these steps:go to the dispositions screen:individual module: Web to enter a wash sale on form 8949 in taxslayer pro, from the main menu of the tax return (form 1040), select: Web 1 best answer maxtax00 level 4 looks like turbotax might only be reporting wash sales and non covered securities transactions on form 8949 this. Web by william perez updated on may 31, 2022 reviewed by lea d. For more details on wash sales, see pub. See the schedule d instructions for more information about wash sales generally. Your brokerage should tell you. Enter all information as needed regarding the sale. Web you have a nondeductible loss from a wash sale: Income capital gains and losses capital gains and loss. Web open the 8949 screen (the income tab). Federal income (select my forms). Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs on forms 1099. If the wash sale was reported in box 1g, enter it there and the 8949 will be adjusted for. The overall capital gains and losses from transactions reported on form 8949, sales and other dispositions of capital assets. Web report the sale or exchange on form 8949 and enter the amount of the nondeductible loss as a positive number in column (g). Web how to report a wash sale in proconnect tax down below we will go over how to report a wash sale for all return types. Web if a portion of the sale is disallowed due to being a wash sale, enter the disallowed portion of the loss in the field labeled wash sale ls dslwd field.8949 form 2016 Fill out & sign online DocHub

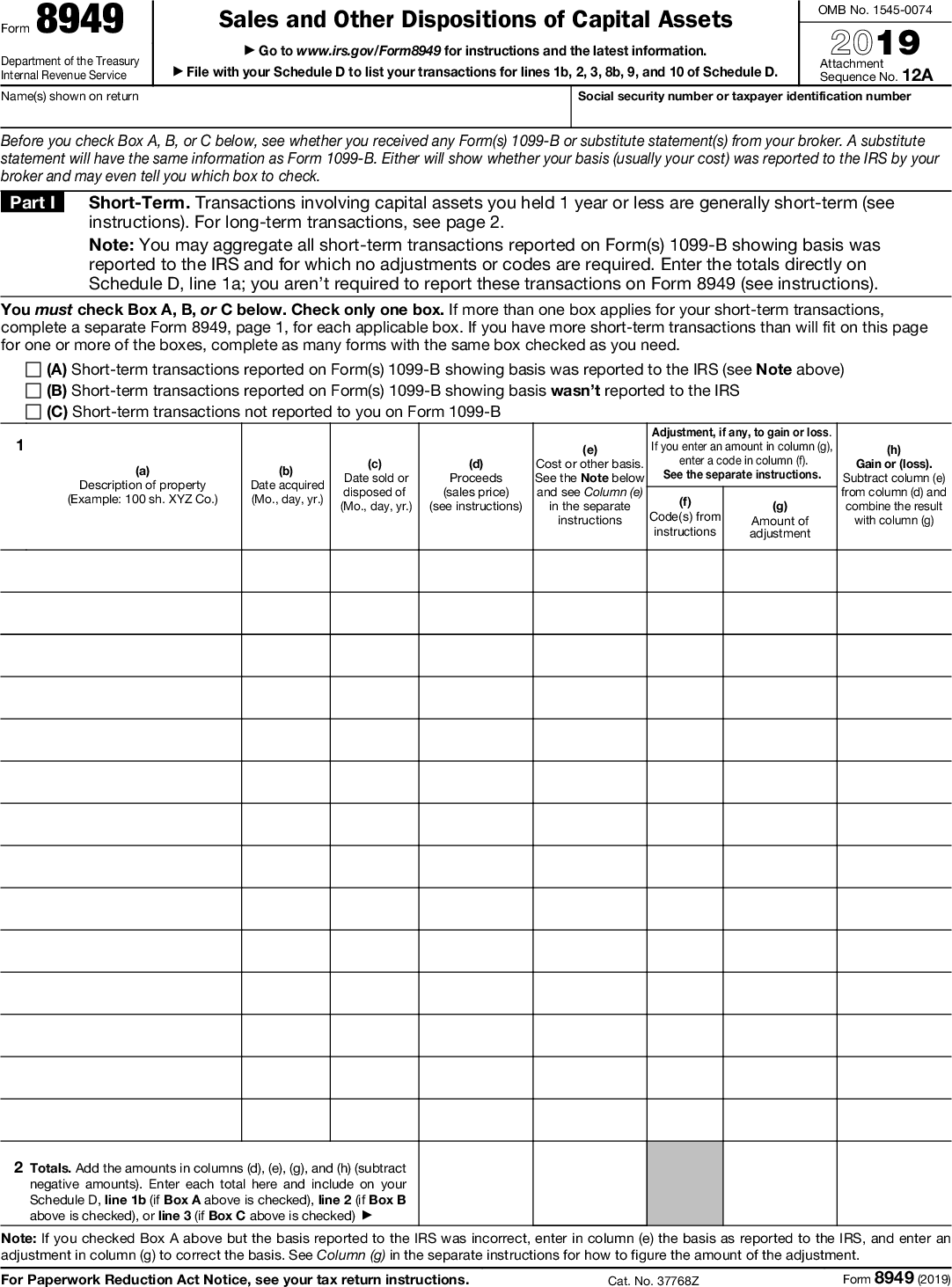

In the following Form 8949 example,the highlighted section below shows

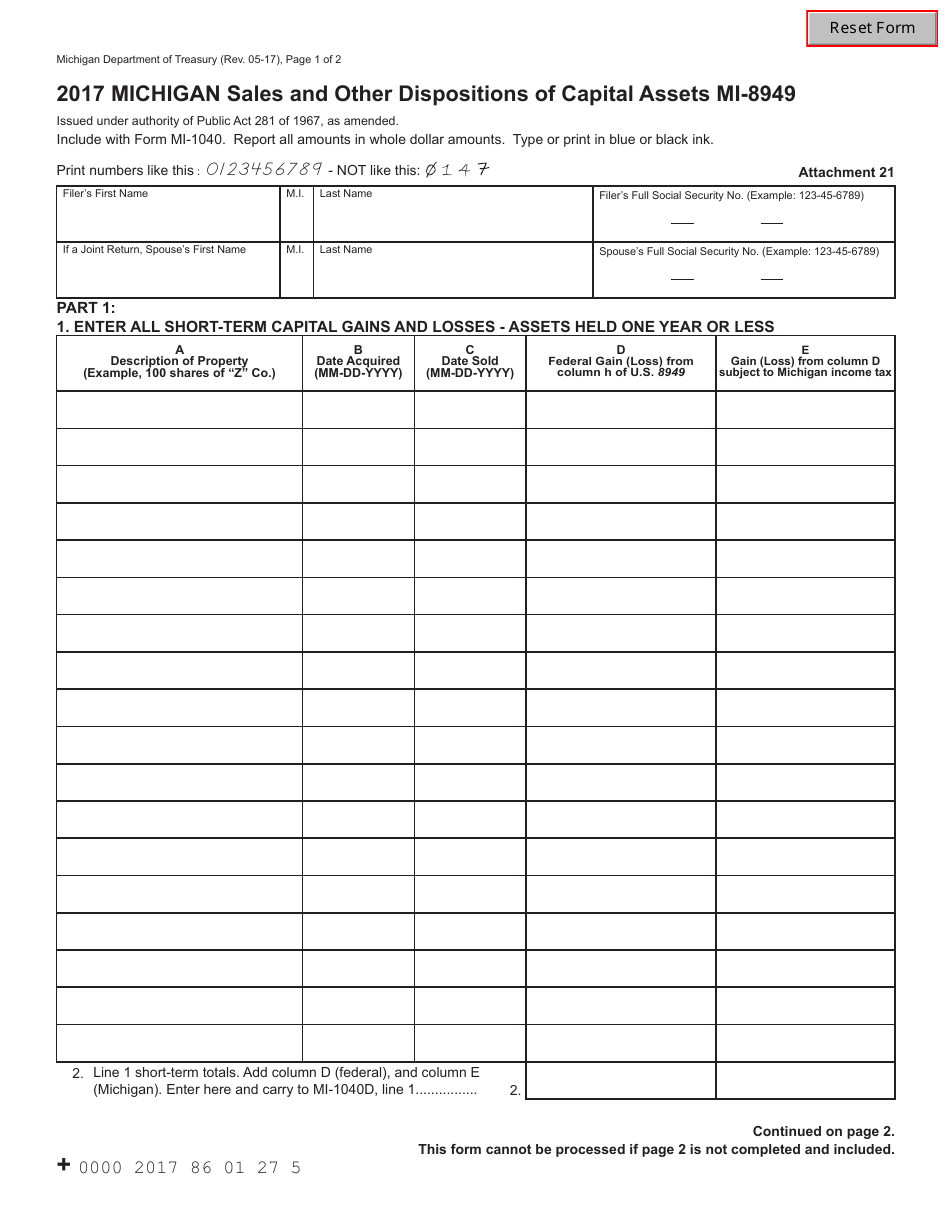

Form MI8949 2017 Fill Out, Sign Online and Download Fillable PDF

Form 8949 Fillable and Editable Digital Blanks in PDF

IRS FORM 8949 YouTube

IRS FORM 8949 & SCHEDULE D TradeLog

What is the IRS Form 8949 and Do You Need It? The Handy Tax Guy

Generating Form 8949 for Tax Preparation TradeLog Software

IRS Form 8949.

To review Tess's completed Form 8949 and Schedule D IRS.gov

Related Post: