Turbotax Form 3921

Turbotax Form 3921 - Ad access irs tax forms. Web instructions for employee you have received this form because your employer (or transfer agent) transferred your employer’s stock to you pursuant to your exercise of an incentive. Web form 3921, exercise of an incentive stock option under section 422 (b), is a form provided to a taxpayer when they exercise an incentive stock option (iso). The form has to be. Web do personal taxes with expert help do business taxes with expert help. Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). Web for that calendar year, file form 3921 for each transfer made during that year. Web form 3921 is a tax form that helps the irs keep track of when and how employees exercise their incentive stock options (isos). Web do i need to file form 3921 even if i didn't sell? Web find out about form 3921 and how employee granted iso is taxed by william perez updated on december 24, 2022 reviewed by lea d. Set up an irs payment plan. Form 3921 is a form that companies have to file with the irs when a shareholder exercises their incentive stock option (iso). You don't enter it on your income tax return in the sense that the irs will. A startup is required to file one form 3921. Ad tax preparation services ordered online in. One form needs to be filed for each transfer of stock that. Although this information is not taxable unless. A startup is required to file one form 3921. Web who must file. A form 3921 is not required for the exercise of an incentive stock option by an employee. Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). Web who must file. Form 3921 is an irs form that must be filed by a company when an employee has exercised an incentive stock option (iso) in the last tax. Web find. Web 1 best answer tomyoung level 13 actually you do need to report the exercise of iso stock if you did not sell all of the stock before year end, and you do that. Complete, edit or print tax forms instantly. Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant. Complete, edit or print tax forms instantly. Web who must file. A form 3921 is not required for the exercise of an incentive stock option by an employee. Ad access irs tax forms. Web form 3921 is a form that companies have to file with the irs when an existing or former employee exercises an iso. Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). A form 3921 is not required for the exercise of an incentive stock option by an employee. Web form 3921 is a tax form that helps the irs keep track of when. Form 3921 is an irs form that must be filed by a company when an employee has exercised an incentive stock option (iso) in the last tax. Web what is irs form 3921? Web for regular tax purposes, form 3921 is generally informational and the document should be retained for record keeping purposes. Although this information is not taxable unless.. If stock acquired through an iso is sold or. According to irs publication 525 you must report it for amt purposes once it becomes transferable by you without. Set up an irs payment plan. Web form 3921 is a form that companies have to file with the irs when an existing or former employee exercises an iso. Web you have. Web entering amounts from form 3921 in the individual module of lacerte solved • by intuit • 289 • updated 1 year ago this article will help you enter amounts. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option. Web instructions for employee you. Web entering amounts from form 3921 in the individual module of lacerte solved • by intuit • 289 • updated 1 year ago this article will help you enter amounts. Web form 3921 is a form that companies have to file with the irs when an existing or former employee exercises an iso. Ad tax preparation services ordered online in. Web find out about form 3921 and how employee granted iso is taxed by william perez updated on december 24, 2022 reviewed by lea d. Web 3 min read june 14, 2017 if you sell stock by exercising incentive stock options (isos), the type of tax you’ll pay depends on your holding period. Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). Web the form 3921 helps determine the basis of the stock when you actually sell the stock. A form 3921 is not required for the exercise of an incentive stock option by an employee. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option. You don't enter it on your income tax return in the sense that the irs will. Get ready for tax season deadlines by completing any required tax forms today. Web who must file. Complete, edit or print tax forms instantly. If stock acquired through an iso is sold or. Web for that calendar year, file form 3921 for each transfer made during that year. One form needs to be filed for each transfer of stock that. We offer a variety of software related to various fields at great prices. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. Form 3921 is a form that companies have to file with the irs when a shareholder exercises their incentive stock option (iso). Web form 3921 is a tax form that helps the irs keep track of when and how employees exercise their incentive stock options (isos). Form 3921 is an irs form that is filed when an employee has exercised shares including incentive stock options (isos) in the last tax year, and informs the irs. Ad tax preparation services ordered online in less than 10 minutes. Although this information is not taxable unless.Form 3921 Download Printable PDF Template

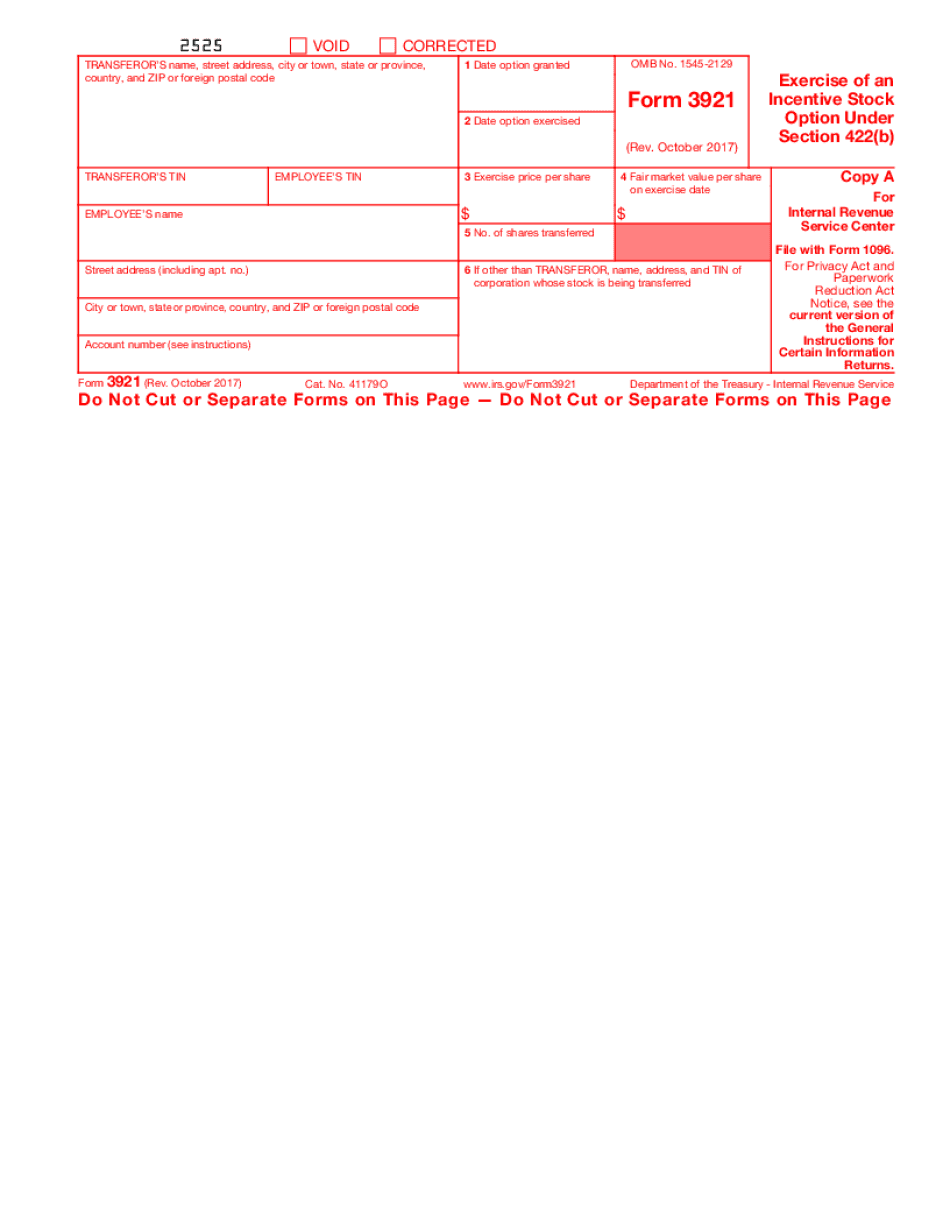

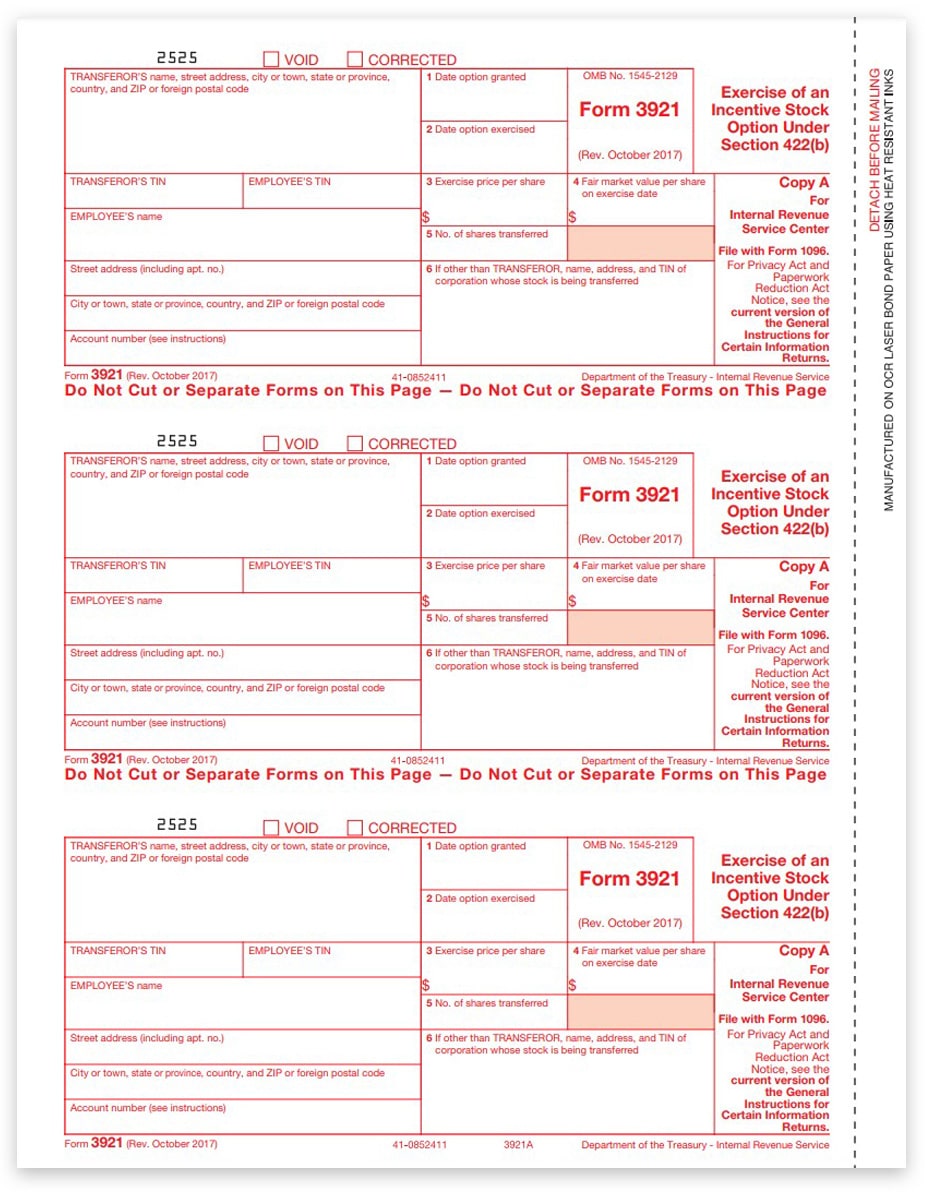

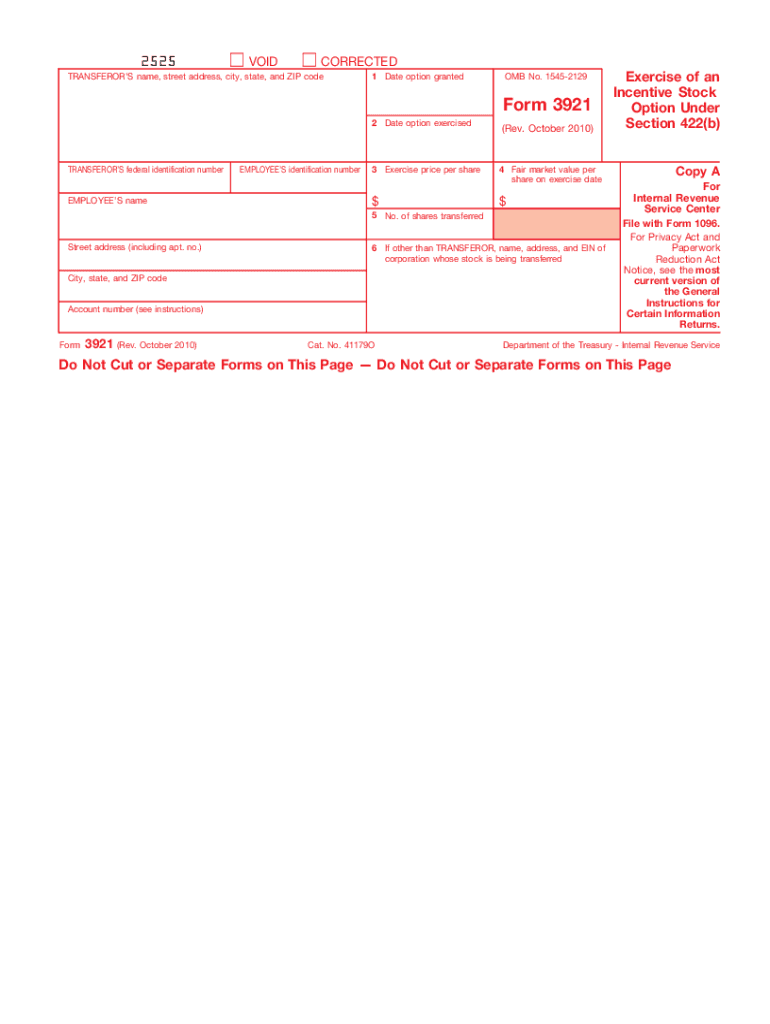

3921 Tax Forms for Incentive Stock Option, IRS Copy A DiscountTaxForms

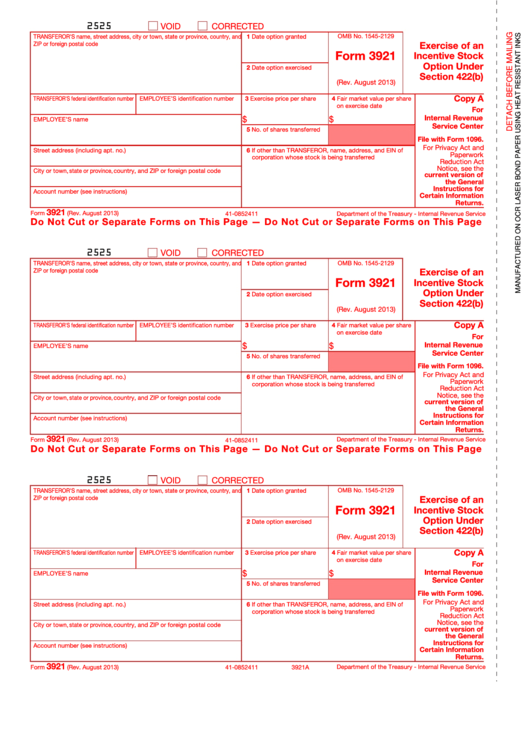

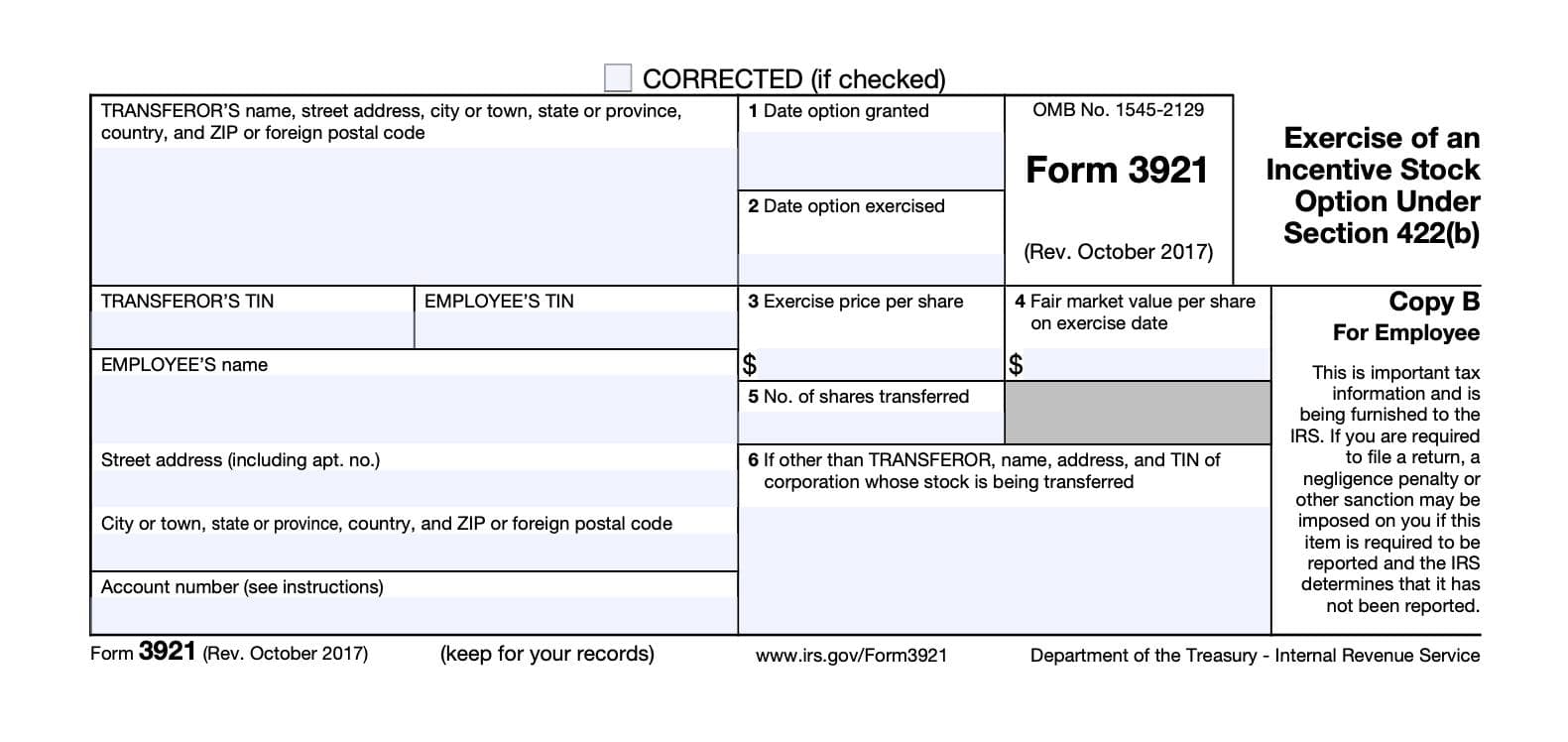

Form 3921 Exercise Of An Incentive Stock Option Under Section 422b

Form 3921 Exercise of an Incentive Stock Option under Section 422(b

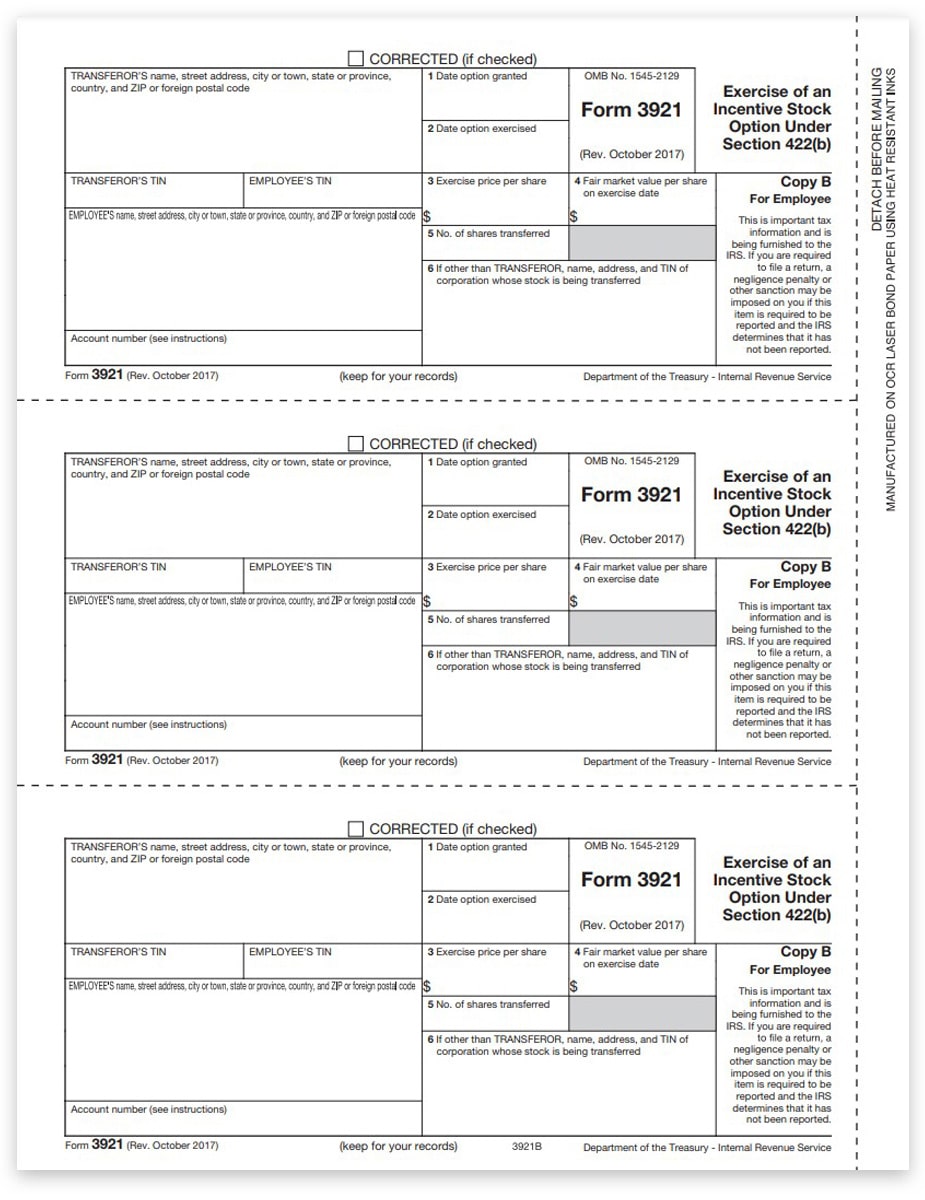

3921 Forms for Incentive Stock Option, Employee Copy B DiscountTaxForms

Where do i enter form 3921 information? (Turbotax 2019)

3921 IRS Tax Form Copy A Free Shipping

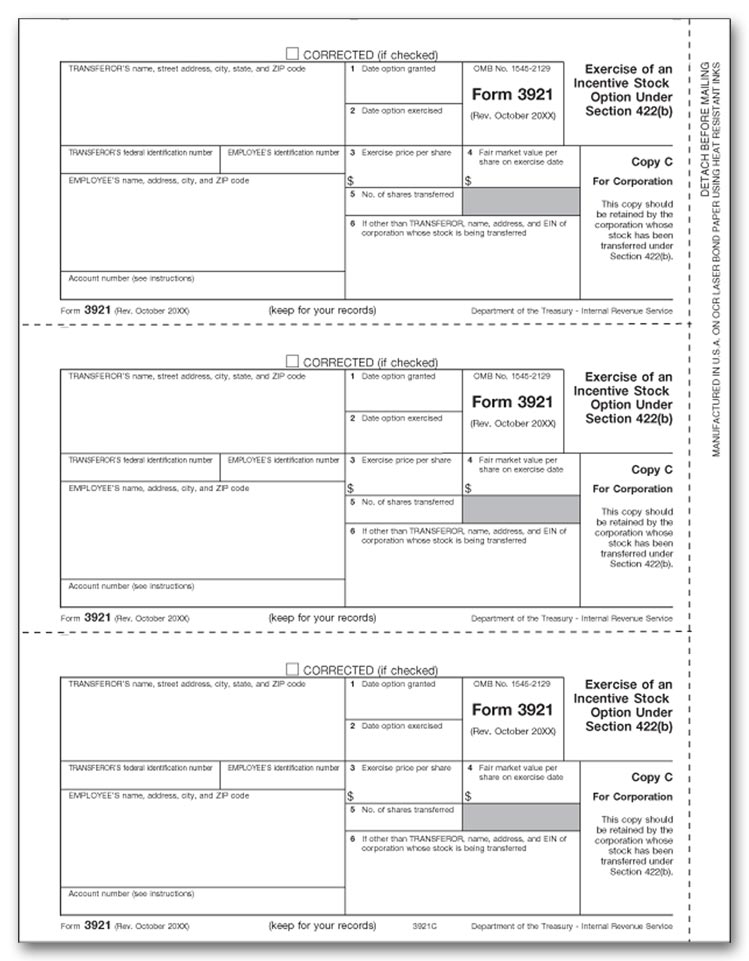

3921 Laser Tax Forms, Copy C

Form 3921 Fill Out and Sign Printable PDF Template signNow

Form 3921 Everything you need to know

Related Post: