Irs Form 8915-F

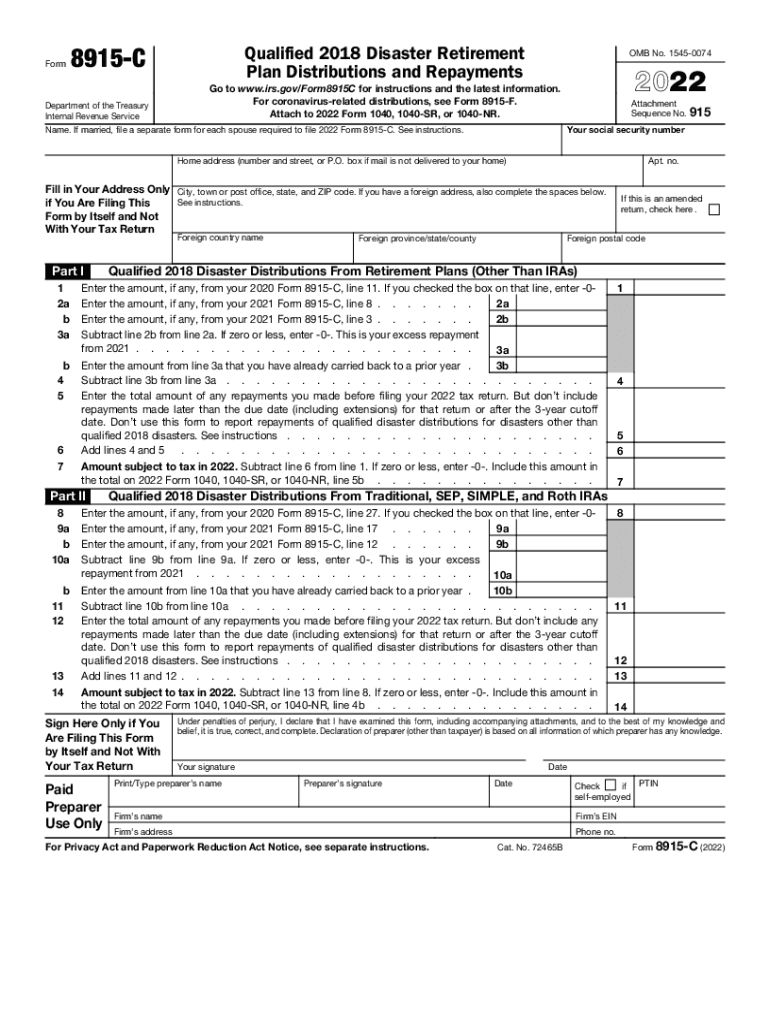

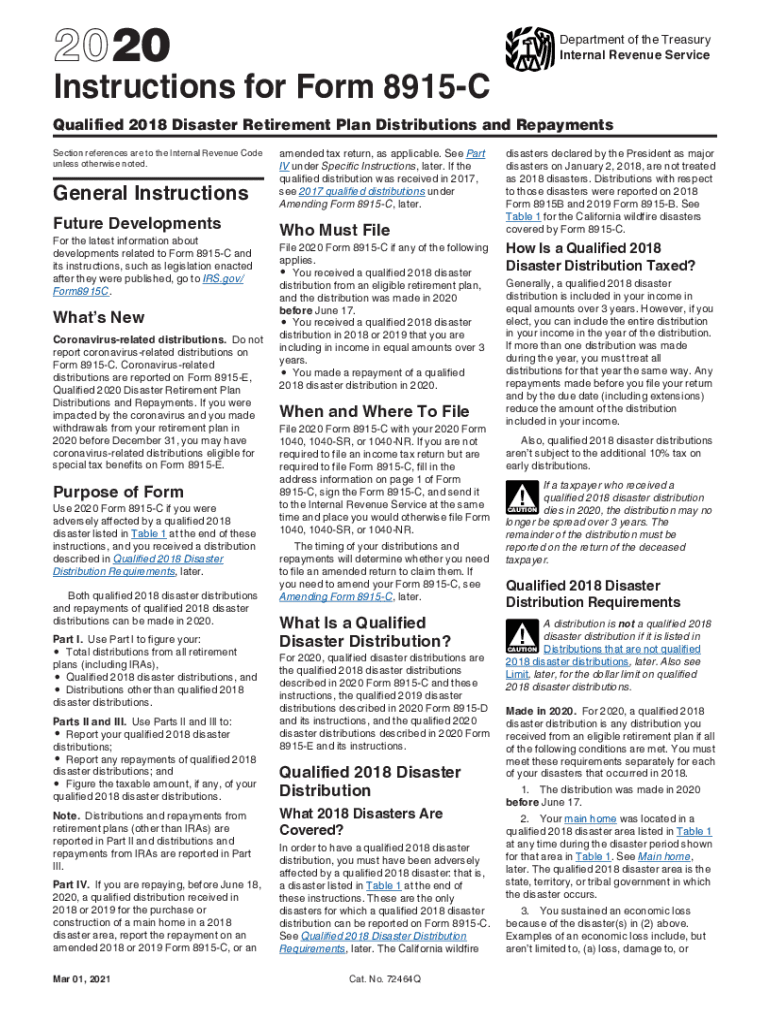

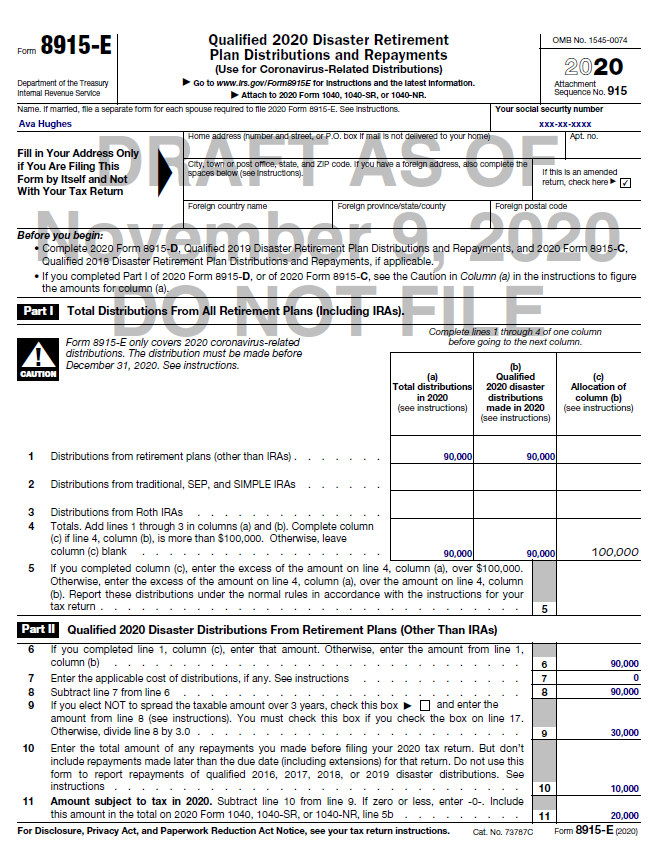

Irs Form 8915-F - Prepare & file prior year taxes fast. And the schedule a (form 1040/sr) page is at irs.gov/schedulea. Web page last reviewed or updated: A team of superannuation experts is ready to help you with your tax questions. See worksheet 1b, later, to determine whether you must use worksheet 1b. See worksheet 1b, later, to determine whether you must use worksheet 1b. I can't even get to the part where i have the last 3rd of my 2020 disaster distribution (covid). You can choose to use worksheet 1b even if you are not required to do so. Turbo tax has some bug that is putting the word coronavirus on line c of the form when box d should be checked. Estimate how much you could potentially save in just a matter of minutes. Starting in tax year 2022,. If typing in a link above instead of. See worksheet 1b, later, to determine whether you must use worksheet 1b. Web 501 page is at irs.gov/pub501; Estimate how much you could potentially save in just a matter of minutes. Starting in tax year 2022,. Ad always free federal, always simple, always right. And the schedule a (form 1040/sr) page is at irs.gov/schedulea. Web 501 page is at irs.gov/pub501; You can choose to use worksheet 1b even if you are not required to do so. Prepare & file prior year taxes fast. A team of superannuation experts is ready to help you with your tax questions. You can choose to use worksheet 1b even if you are not required to do so. Starting in tax year 2022,. See worksheet 1b, later, to determine whether you must use worksheet 1b. You can choose to use worksheet 1b even if you are not required to do so. Estimate how much you could potentially save in just a matter of minutes. Ad we help get taxpayers relief from owed irs back taxes. You can choose to use worksheet 1b even if you are not required to do so. Totally free federal filing,. A team of superannuation experts is ready to help you with your tax questions. Starting in tax year 2022,. See worksheet 1b, later, to determine whether you must use worksheet 1b. Starting in tax year 2022,. Ad if you paid tax on superannuation fund, contact frost’s experienced attorneys now. And the schedule a (form 1040/sr) page is at irs.gov/schedulea. Ad if you paid tax on superannuation fund, contact frost’s experienced attorneys now. Starting in tax year 2022,. A team of superannuation experts is ready to help you with your tax questions. (january 2022) qualified disaster retirement plan distributions and repayments. Totally free federal filing, 4.8 star rating, user friendly. A team of superannuation experts is ready to help you with your tax questions. If typing in a link above instead of. Your return will be rejected. (january 2022) qualified disaster retirement plan distributions and repayments. Ad always free federal, always simple, always right. See worksheet 1b, later, to determine whether you must use worksheet 1b. Totally free federal filing, 4.8 star rating, user friendly. Turbo tax has some bug that is putting the word coronavirus on line c of the form when box d should be checked. Ad if you paid tax on superannuation fund,. See worksheet 1b, later, to determine whether you must use worksheet 1b. Ad if you paid tax on superannuation fund, contact frost’s experienced attorneys now. Web page last reviewed or updated: Web 501 page is at irs.gov/pub501; Turbo tax has some bug that is putting the word coronavirus on line c of the form when box d should be checked. (january 2022) qualified disaster retirement plan distributions and repayments. You can choose to use worksheet 1b even if you are not required to do so. And the schedule a (form 1040/sr) page is at irs.gov/schedulea. Starting in tax year 2022,. Ad if you paid tax on superannuation fund, contact frost’s experienced attorneys now. Web when and where to file. Your return will be rejected. A team of superannuation experts is ready to help you with your tax questions. Prepare & file prior year taxes fast. Estimate how much you could potentially save in just a matter of minutes. And the schedule a (form 1040/sr) page is at irs.gov/schedulea. Web 501 page is at irs.gov/pub501; See worksheet 1b, later, to determine whether you must use worksheet 1b. Ad we help get taxpayers relief from owed irs back taxes. Ad if you paid tax on superannuation fund, contact frost’s experienced attorneys now. Totally free federal filing, 4.8 star rating, user friendly. Ad always free federal, always simple, always right. You can choose to use worksheet 1b even if you are not required to do so. If typing in a link above instead of. I can't even get to the part where i have the last 3rd of my 2020 disaster distribution (covid). (january 2022) qualified disaster retirement plan distributions and repayments. Turbo tax has some bug that is putting the word coronavirus on line c of the form when box d should be checked. Web page last reviewed or updated: A team of superannuation experts is ready to help you with your tax questions. You can choose to use worksheet 1b even if you are not required to do so.About Form 8915F, Qualified Disaster Retirement Plan Distributions and

Form 8915 Qualified Hurricane Retirement Plan Distributions and

Fillable Online Form 8915F (Rev. January 2023). Qualified Disaster

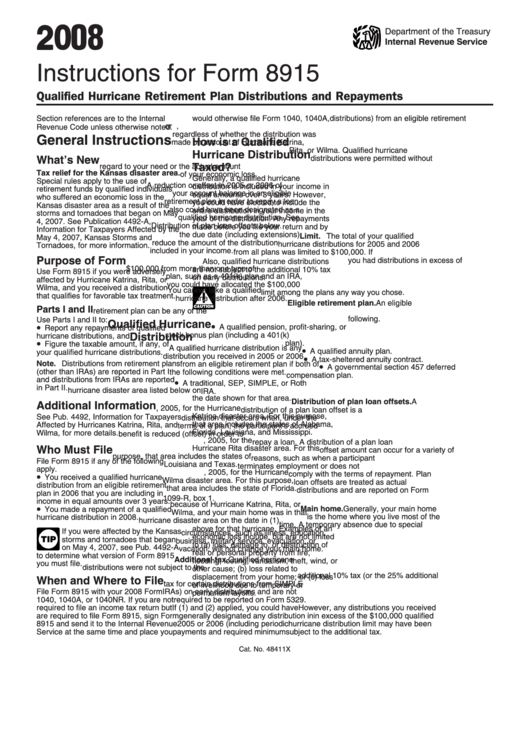

Instructions For Form 8915 2008 printable pdf download

Irs Instructions 8915 Fill Out and Sign Printable PDF Template signNow

IRS 8915D 20192022 Fill and Sign Printable Template Online US

National Association of Tax Professionals Blog

'Forever' form 8915F issued by IRS for retirement distributions Newsday

Publication 4492A (7/2008), Information for Taxpayers Affected by the

Download Instructions for IRS Form 8915F Qualified Disaster Retirement

Related Post: