Form 1099-Patr Instructions

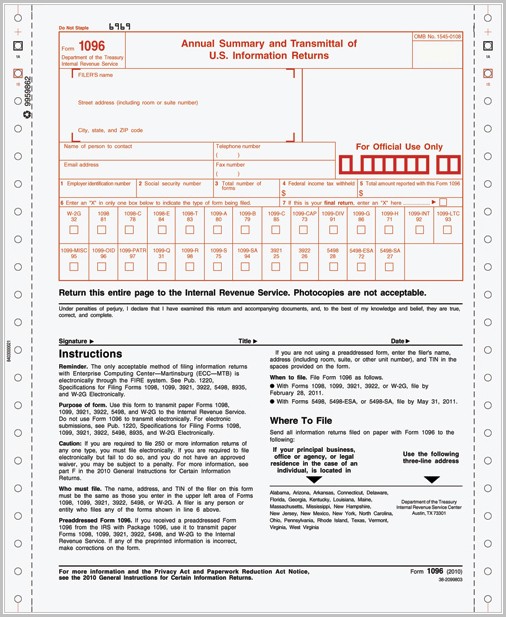

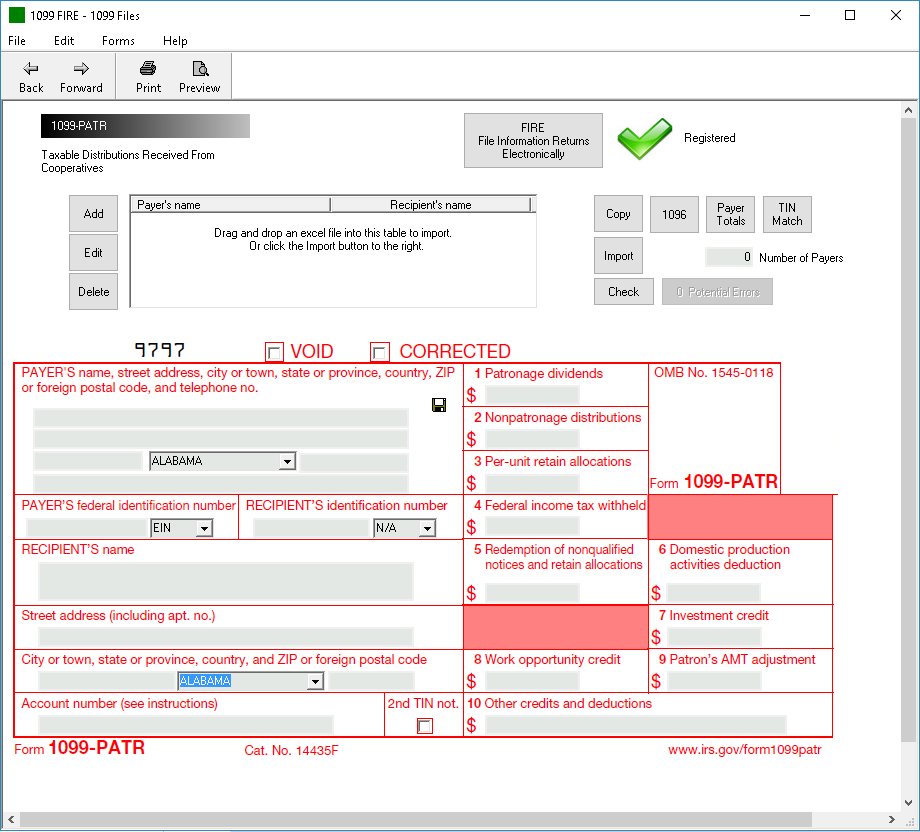

Form 1099-Patr Instructions - Report any amounts shown in boxes 1, 2, 3, and 5 as income,. See form 3491, consumer cooperative exemption application, for information about how to apply for this exemption. Web to fill in form 1096 using this data, select form 1096 from the module library list. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web specific instructions statements to recipients. If you have questions about reporting on form. Get ready for tax season deadlines by completing any required tax forms today. Web updated october 13, 2023. Report dividends paid on a. [email protected] form 5329 form 5329 line 55, stylesheet should read. Instructions for recipient distributions you received from a cooperative may be includible in your income. Generally, if you are an individual, report any amounts shown in boxes 1, 2,. Get ready for tax season deadlines by completing any required tax forms today. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Open (continue). You may have received one if were paid distributions or. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Distributions you received from a cooperative may be included in your income. Select the desired forms to import from the import 1099/1098 menu on the. Ad ap leaders rely on iofm’s expertise to keep. Web updated october 13, 2023. [email protected] form 5329 form 5329 line 55, stylesheet should read. See form 3491, consumer cooperative exemption application, for information about how to apply for this exemption. You may have received one if were paid distributions or. Web specific instructions statements to recipients. Web instructions for recipient distributions you received from a cooperative may be includible in your income. A cooperative is required to file form 1099. Starting in tax year 2018, the domestic production activities deduction has been. See form 3491, consumer cooperative exemption application, for information about how to apply for this exemption. Sum up all wages, tips, and other payments. Instructions for recipient distributions you received from a cooperative may be includible in your. Web updated october 13, 2023. Calculate the total federal income tax withheld from employees’ paychecks. Report any amounts shown in boxes 1, 2, 3, and 5 as income,. Generally, if you are an individual, report any amounts shown in boxes 1, 2,. Web to fill in form 1096 using this data, select form 1096 from the module library list. Generally, if you are an. Calculate the total federal income tax withheld from employees’ paychecks. See form 3491, consumer cooperative exemption application, for information about how to apply for this exemption. Web instructions for recipient distributions you received from a cooperative may be. Generally, if you are an. Instructions for recipient distributions you received from a cooperative may be includible in your. Get ready for tax season deadlines by completing any required tax forms today. [email protected] form 5329 form 5329 line 55, stylesheet should read. Calculate the total federal income tax withheld from employees’ paychecks. Web instructions for recipient distributions you received from a cooperative may be includible in your income. Report dividends paid on a. Web to fill in form 1096 using this data, select form 1096 from the module library list. You may enter an “x” in this box if you were notified by the irs twice within 3 calendar years that. Sum. Generally, if you are an. Sum up all wages, tips, and other payments made to employees. Distributions you received from a cooperative may be included in your income. Report dividends paid on a. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Instructions for recipient distributions you received from a cooperative may be includible in your income. [email protected] form 5329 form 5329 line 55, stylesheet should read. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. See form 3491, consumer cooperative exemption application, for information about how to apply for this exemption. Generally, if you. Instructions for recipient distributions you received from a cooperative may be includible in your income. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Report any amounts shown in boxes 1, 2, 3, and 5 as income,. Report dividends paid on a. [email protected] form 5329 form 5329 line 55, stylesheet should read. Get ready for tax season deadlines by completing any required tax forms today. Select the desired forms to import from the import 1099/1098 menu on the. Web instructions for recipient distributions you received from a cooperative may be includible in your income. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web updated october 13, 2023. Calculate the total federal income tax withheld from employees’ paychecks. Open (continue) your return in turbotax. Generally, if you are an. Web specific instructions statements to recipients. A cooperative is required to file form 1099. Distributions you received from a cooperative may be included in your income. Generally, if you are an individual, report any amounts shown in boxes 1, 2,. Web instructions for recipient distributions you received from a cooperative may be includible in your income. See form 3491, consumer cooperative exemption application, for information about how to apply for this exemption. You may enter an “x” in this box if you were notified by the irs twice within 3 calendar years that.Irs Form 1099 Patr Instructions Form Resume Examples

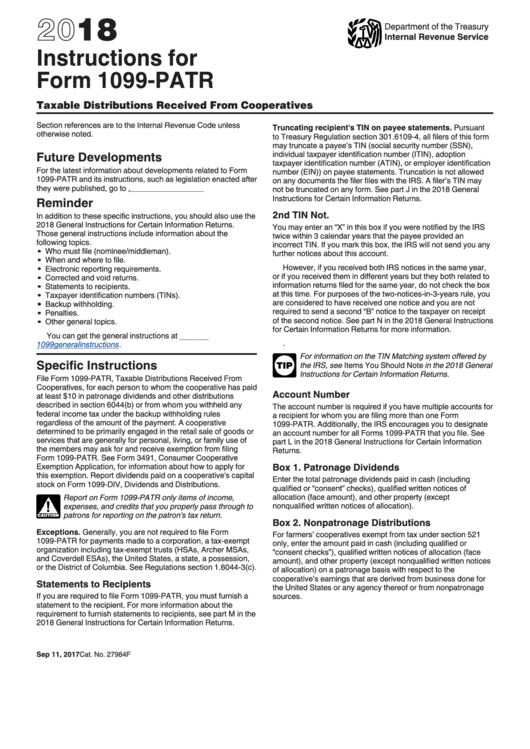

Instructions For Form 1099Patr 2018 printable pdf download

IRS Form 1099PATR 2018 2019 Fillable and Editable PDF Template

Download Instructions for IRS Form 1099PATR Taxable Distributions

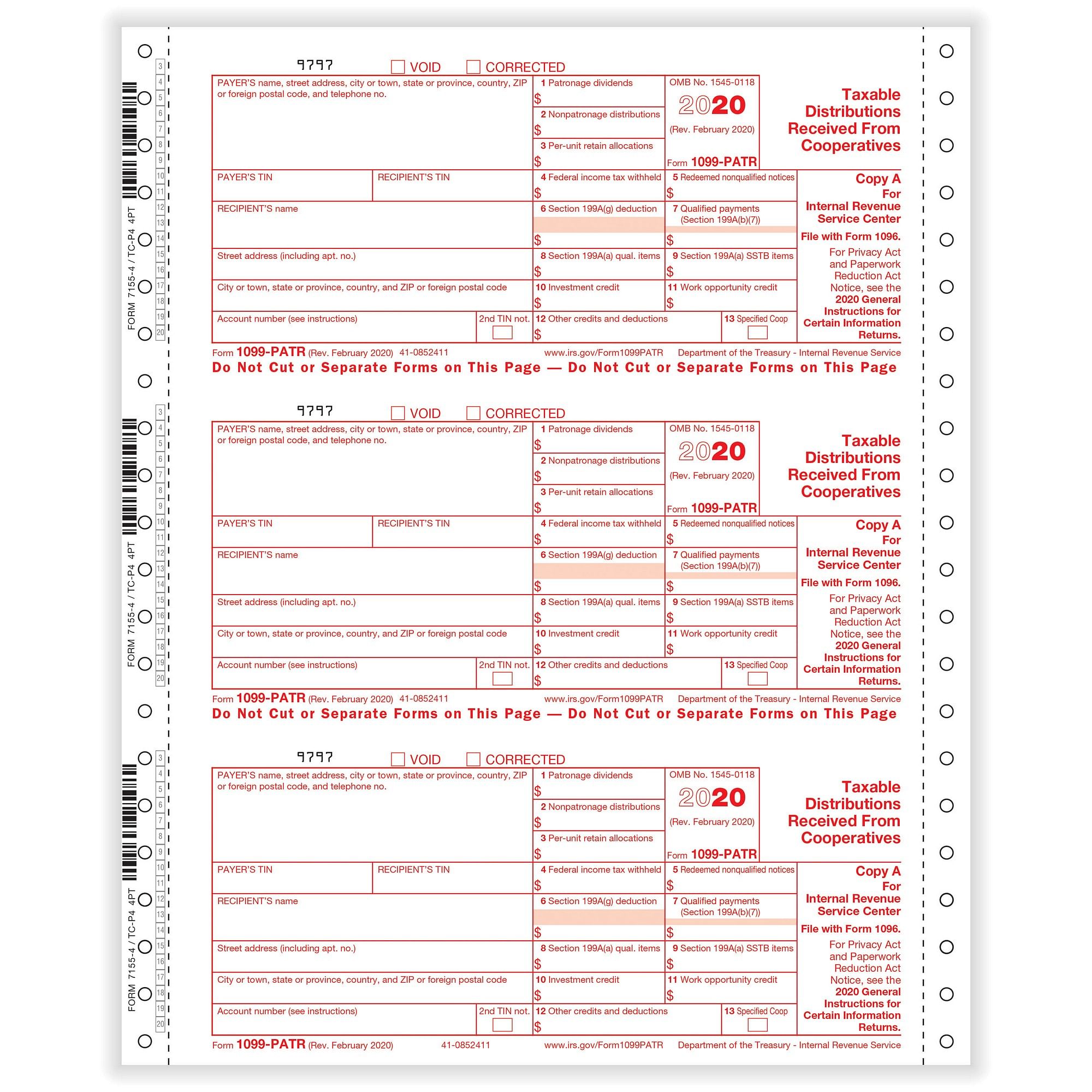

Form 1099PATR Taxable Distributions Received From Cooperatives, IRS Copy A

tax act 1099 patr Fill Online, Printable, Fillable Blank form1099

Form 1099PATR Software 79 print, 289 eFile 1099PATR Software

Formulário 1099PATR Distribuições tributáveis recebidas de

1099PATR Patronage 4part 1wide Carbonless (200 Forms/Pack)

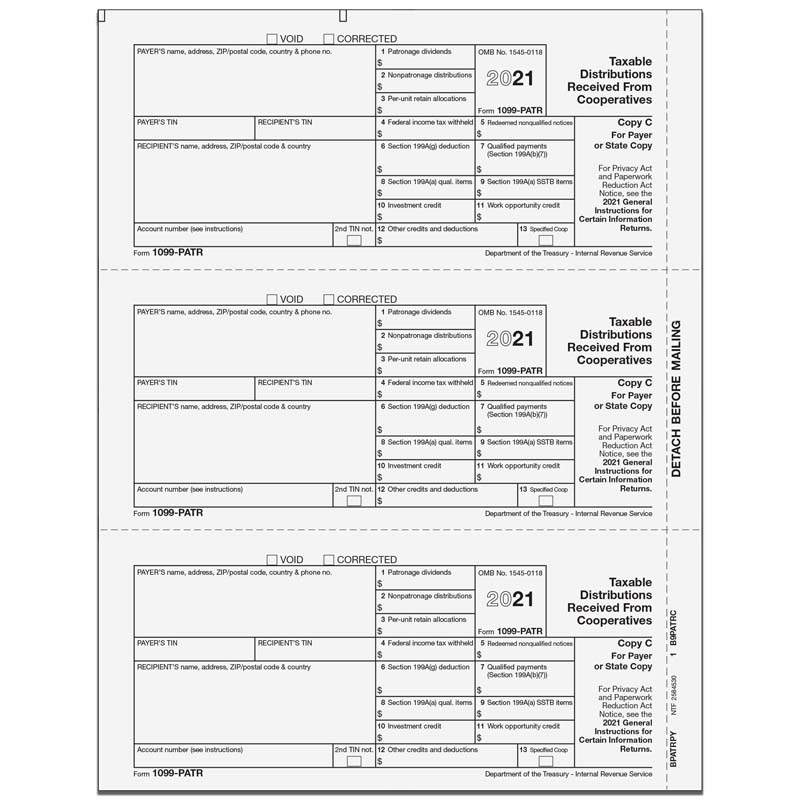

1099PATR Taxable Distributions Received From Cooperatives Payer or

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png)