Form 8582 Worksheet

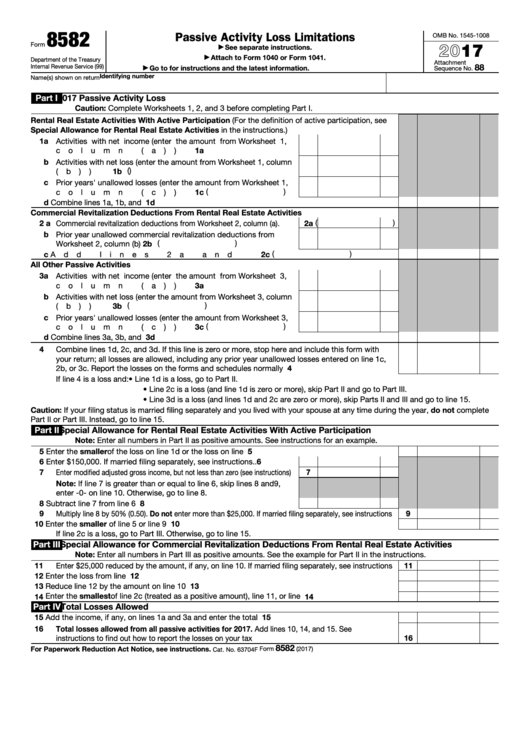

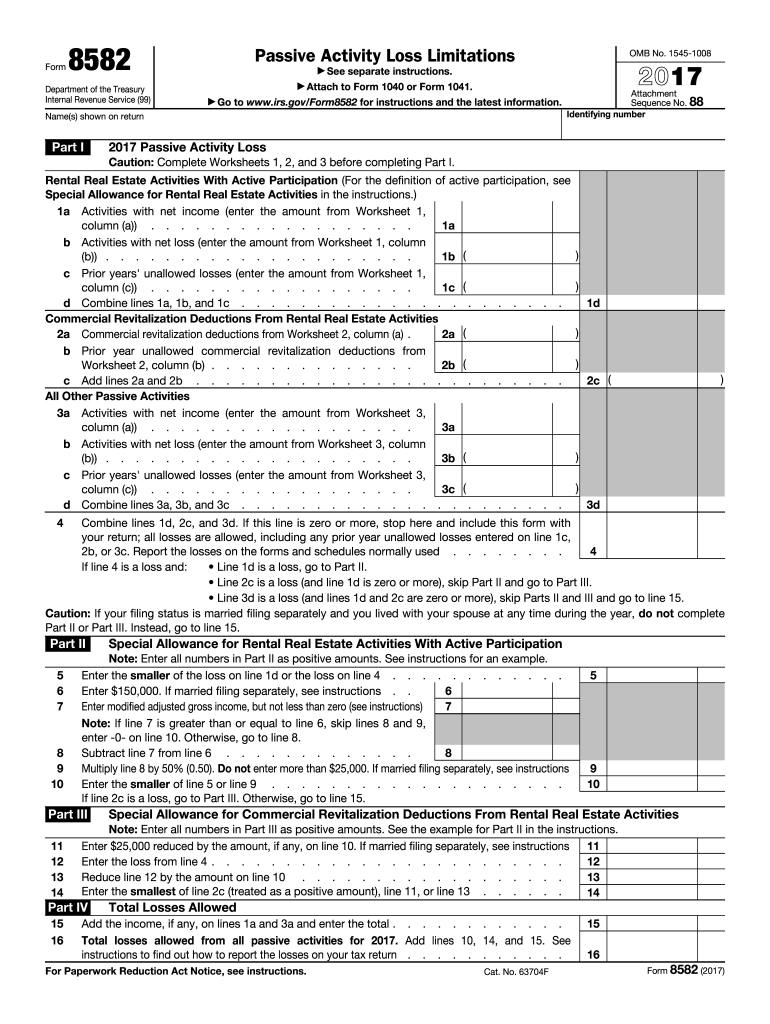

Form 8582 Worksheet - This article will help you: Ad access irs tax forms. Web enter the prior year unallowed losses for each activity. Entering prior year unallowed losses for a rental. Web the only data entry point for form 8582 is the 8582 screen, which allows you to override figures for the wks magi, a worksheet that determines the modified adjusted gross. Web government form cch axcess input worksheet section field; Web solved•by intuit•9•updated 1 year ago. Keep a copy for your records. You find these amounts on worksheet 5, column (c), of your. Form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a. Activity description i keep getting the entry check error: First name and initial > taxpayer. Ad download or email irs 8582 & more fillable forms, register and subscribe now! Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year. Keep a copy for your records. Complete, edit or print tax forms instantly. Web generally, if your modified adjusted gross income is $150,000 or more ($75,000 or more if married filing separately), there is no special allowance. The worksheets must be filed with your tax return. Web up to $40 cash back fill now. First name and initial > taxpayer. Web losses on form 8582, read the (2)(a) and (2)(b), without taking into professional). Name general > basic data: Web up to $40 cash back fill now. Web enter the prior year unallowed losses for each activity. Form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a. Ad download or email irs 8582 & more fillable forms, register and subscribe now! Keep a copy for your records. The passive activity loss should. Web form 8582 department of the treasury internal revenue service passive. In this article, we’ll walk. Keep a copy for your records. A passive activity loss occurs when total. This article will help you: Web form 8582 (2020) caution: A passive activity loss occurs when total. Entering prior year unallowed losses for a rental. The worksheets must be filed with your tax return. Web government form cch axcess input worksheet section field; Get ready for tax season deadlines by completing any required tax forms today. Enter the prior year unallowed losses for each activity. Worksheet 1—for form 8582, lines 1a, 1b, and 1c (see instructions). Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. Web per irs instructions for form 8582, page. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Web enter the prior year unallowed losses for each activity. Ad download or email irs 8582 & more fillable forms, register and subscribe now! Worksheet 1—for form 8582, lines 1a, 1b, and 1c (see instructions). Web up to. Ad download or email irs 8582 & more fillable forms, register and subscribe now! You find these amounts on worksheet 5, column (c), of your. Enter the total of column (c) from. This article will assist you with generating form 8582, passive activity loss limitations, for an individual return in intuit proconnect. First name and initial > spouse. Keep a copy for your records. This article will assist you with generating form 8582, passive activity loss limitations, for an individual return in intuit proconnect. First name and initial > spouse. The worksheets must be filed with your tax return. Web generally, if your modified adjusted gross income is $150,000 or more ($75,000 or more if married filing separately),. Worksheet 1—for form 8582, lines 1a, 1b, and 1c (see instructions). Ad access irs tax forms. All forms individual forms information returns fiduciary reporting entity returns transfer taxes employment (payroll). Keep a copy for your records. You find these amounts on worksheet 5, column (c), of your. The worksheets must be filed with your tax return. Get ready for tax season deadlines by completing any required tax forms today. Web the only data entry point for form 8582 is the 8582 screen, which allows you to override figures for the wks magi, a worksheet that determines the modified adjusted gross. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. This article will help you: Web form 8582 (2018) page. You find these amounts on worksheet 5, column (c), of your 2019 form 8582. Activity description i keep getting the entry check error: Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Web generally, if your modified adjusted gross income is $150,000 or more ($75,000 or more if married filing separately), there is no special allowance. Web losses on form 8582, read the (2)(a) and (2)(b), without taking into professional). Name general > basic data: Enter the prior year unallowed losses for each activity. Complete, edit or print tax forms instantly. Form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a.IRS Form 8582 Instructions A Guide to Passive Activity Losses

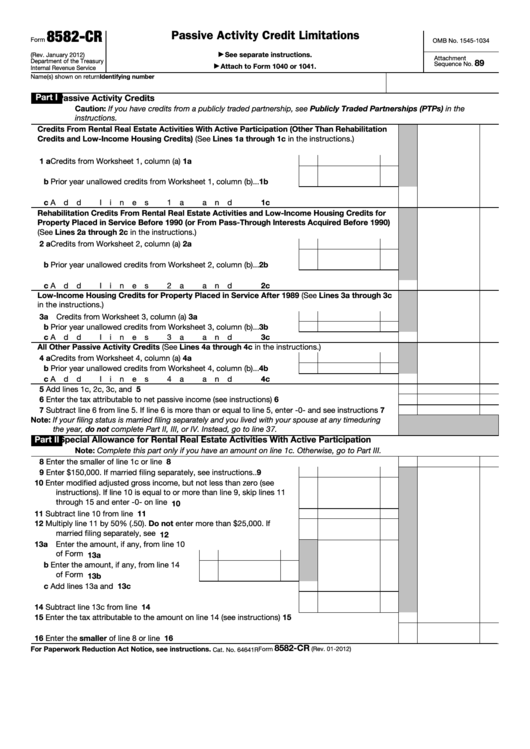

Form 8582CR Passive Activity Credit Limitations (2012) Free Download

Form 8582CR Passive Activity Credit Limitations

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Fillable Form 8582 Passive Activity Loss Limitations 2017 printable

Fillable Form 8582Cr Passive Activity Credit Limitations printable

Form 8582Passive Activity Loss Limitations

8582 Form Fill Out and Sign Printable PDF Template signNow

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Related Post: