Tc 40 Form

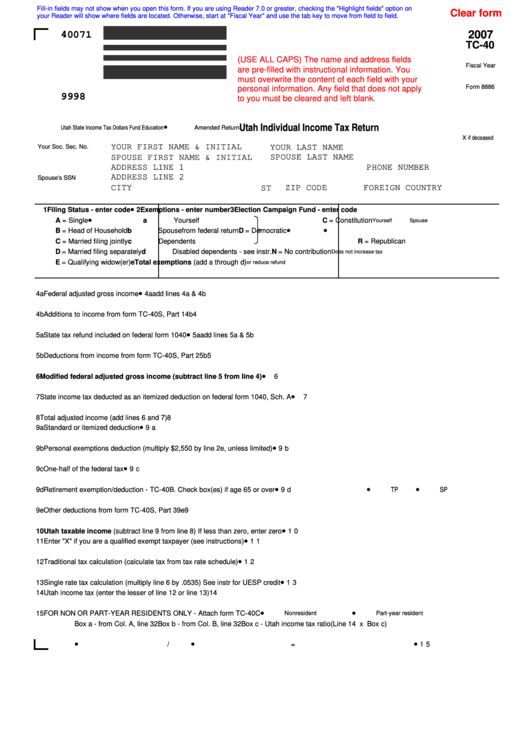

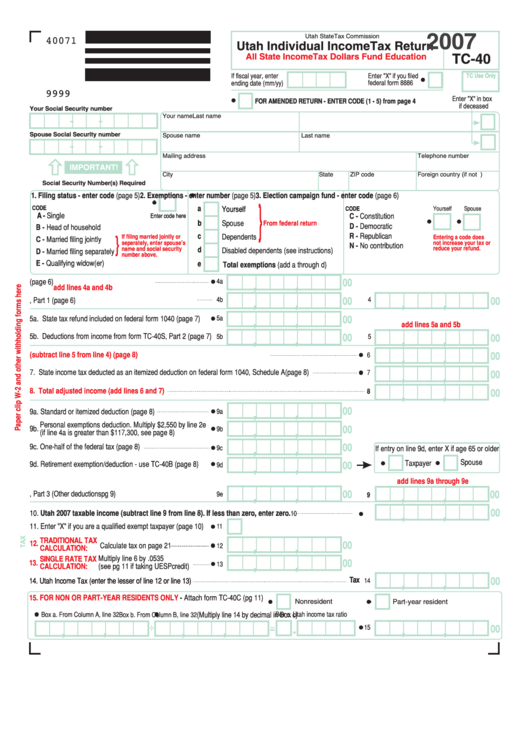

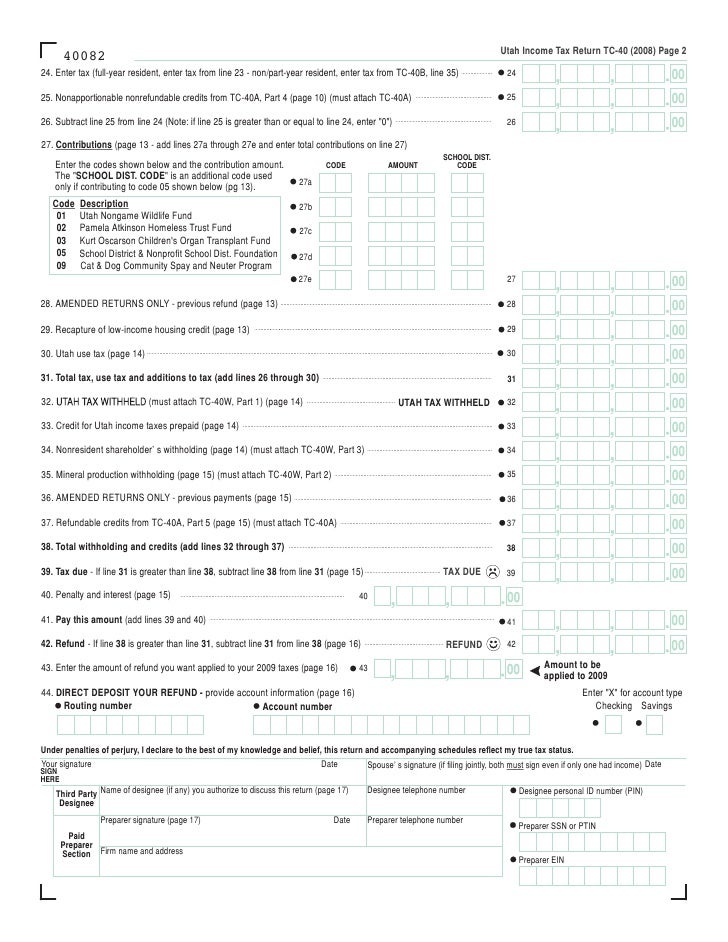

Tc 40 Form - You can download or print. This form is for income earned in tax year 2022, with tax returns due in april 2023. Name, address, ssn, & residency. How to obtain income tax and related forms. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. Web follow these steps to calculate your utah tax: Web prepayment requirements for filing extension. Attach completed schedule to your utah income. State refund on federal return. Do not enter a number greater than 1.0000. Web prepayment requirements for filing extension. Do not enter a number greater than 1.0000. Attach completed schedule to your utah income. Name, address, ssn, & residency. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. Attach completed schedule to your utah income. Name, address, ssn, & residency. Web follow these steps to calculate your utah tax: Web prepayment requirements for filing extension. You can download or print. Web prepayment requirements for filing extension. Do not enter a number greater than 1.0000. Name, address, ssn, & residency. Round to 4 decimal places. How to obtain income tax and related forms. Web follow these steps to calculate your utah tax: Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. State refund on federal return. Name, address, ssn, & residency. Round to 4 decimal places. Attach completed schedule to your utah income. State refund on federal return. This form is for income earned in tax year 2022, with tax returns due in april 2023. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. Web prepayment requirements for filing extension. Name, address, ssn, & residency. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. This form is for income earned in tax year 2022, with tax returns due in april 2023. How to obtain income tax and. Attach completed schedule to your utah income. You can download or print. Web prepayment requirements for filing extension. Round to 4 decimal places. How to obtain income tax and related forms. Web prepayment requirements for filing extension. State refund on federal return. Do not enter a number greater than 1.0000. Attach completed schedule to your utah income. Name, address, ssn, & residency. This form is for income earned in tax year 2022, with tax returns due in april 2023. You can download or print. Attach completed schedule to your utah income. How to obtain income tax and related forms. Do not enter a number greater than 1.0000. This form is for income earned in tax year 2022, with tax returns due in april 2023. How to obtain income tax and related forms. You can download or print. Round to 4 decimal places. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a. State refund on federal return. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. How to obtain income tax and related forms. Do not enter a number greater than 1.0000. Web prepayment requirements for filing extension. Round to 4 decimal places. This form is for income earned in tax year 2022, with tax returns due in april 2023. You can download or print. Name, address, ssn, & residency. Web follow these steps to calculate your utah tax: Attach completed schedule to your utah income.Fillable Form Tc40 Utah Individual Tax Return 2007

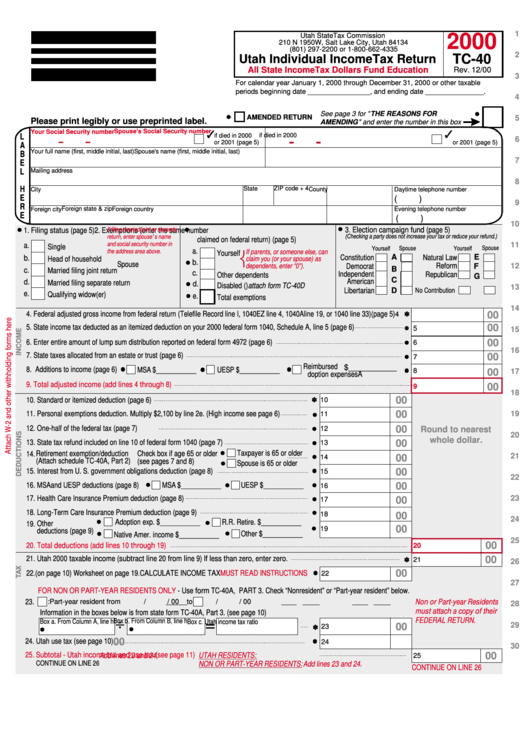

Form Tc40 Utah Individual Tax Return 2000 printable pdf

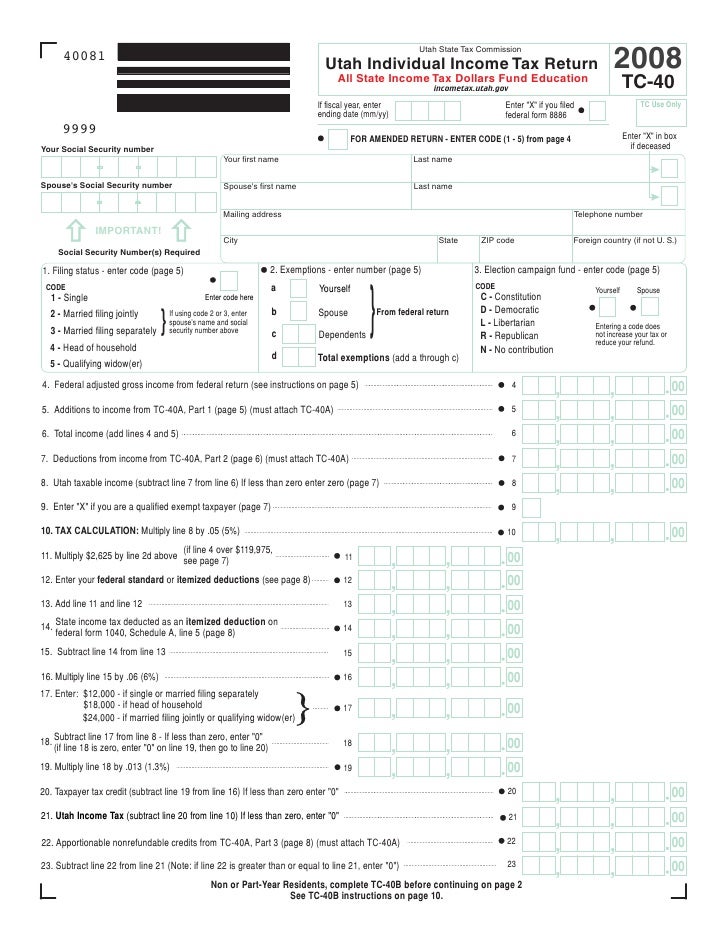

tax.utah.gov forms current tc tc40plain

Form Tc40 Utah Individual Tax Return 2007 printable pdf

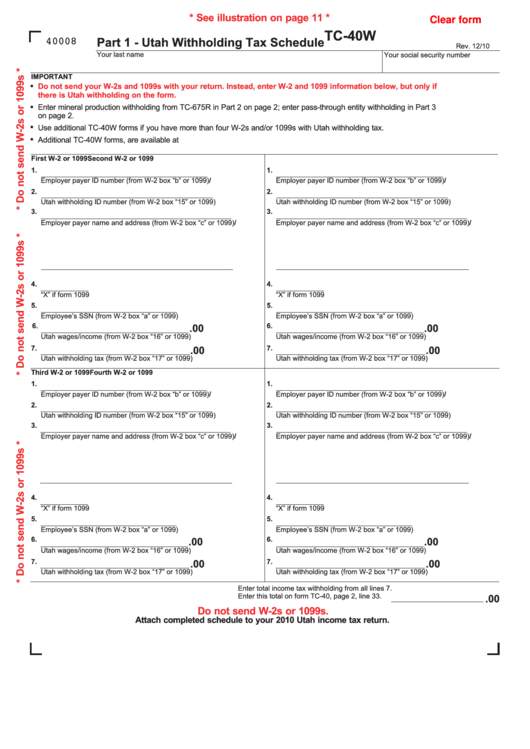

Fillable Form Tc40w Utah Withholding Tax Schedule printable pdf download

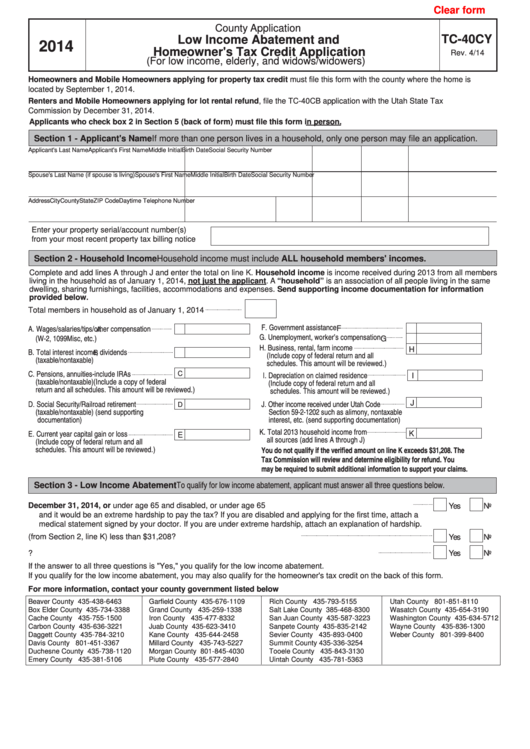

Fillable Form Tc40cy Low Abatement And Homeowner'S Tax Credit

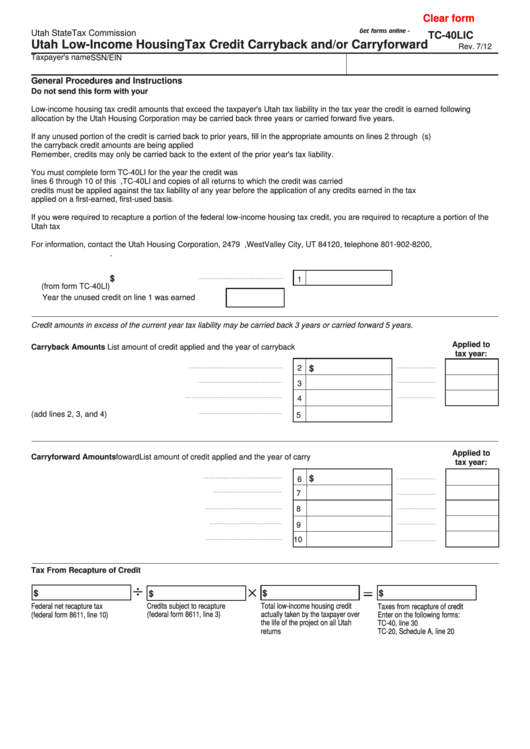

Fillable Form Tc40lic Utah Housing Tax Credit Carryback

2020 UT TC40 Forms & Instructions Fill Online, Printable, Fillable

tax.utah.gov forms current tc tc40plain

tax.utah.gov forms current tc tc40v2009

Related Post: