Umd W2 Form

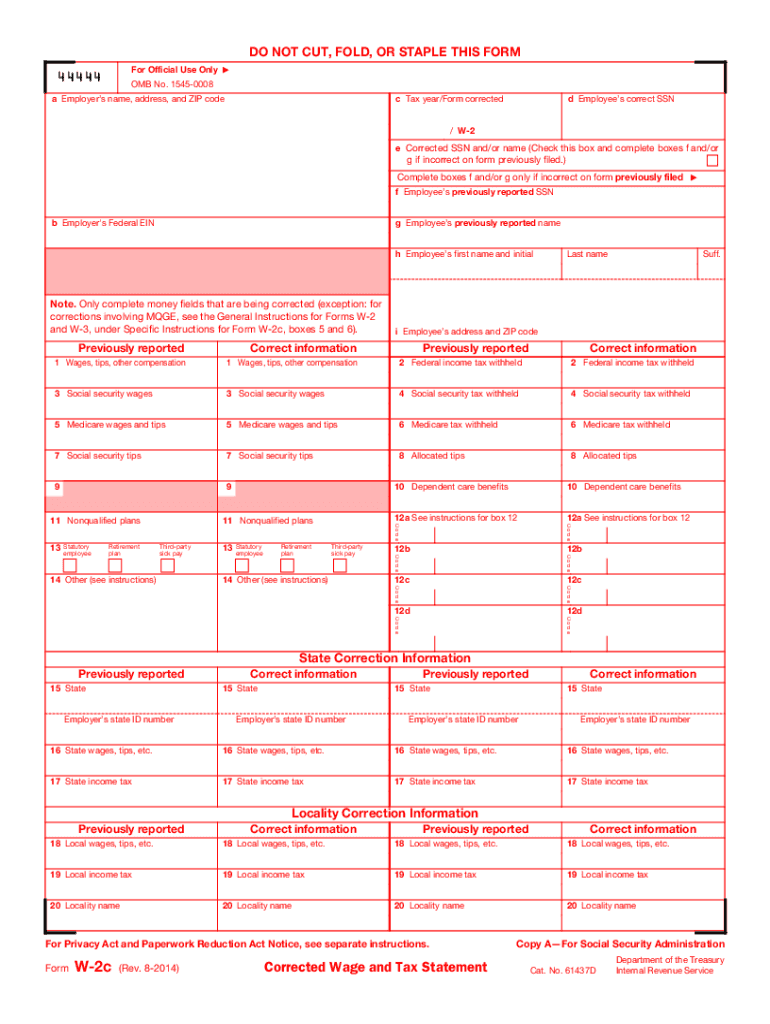

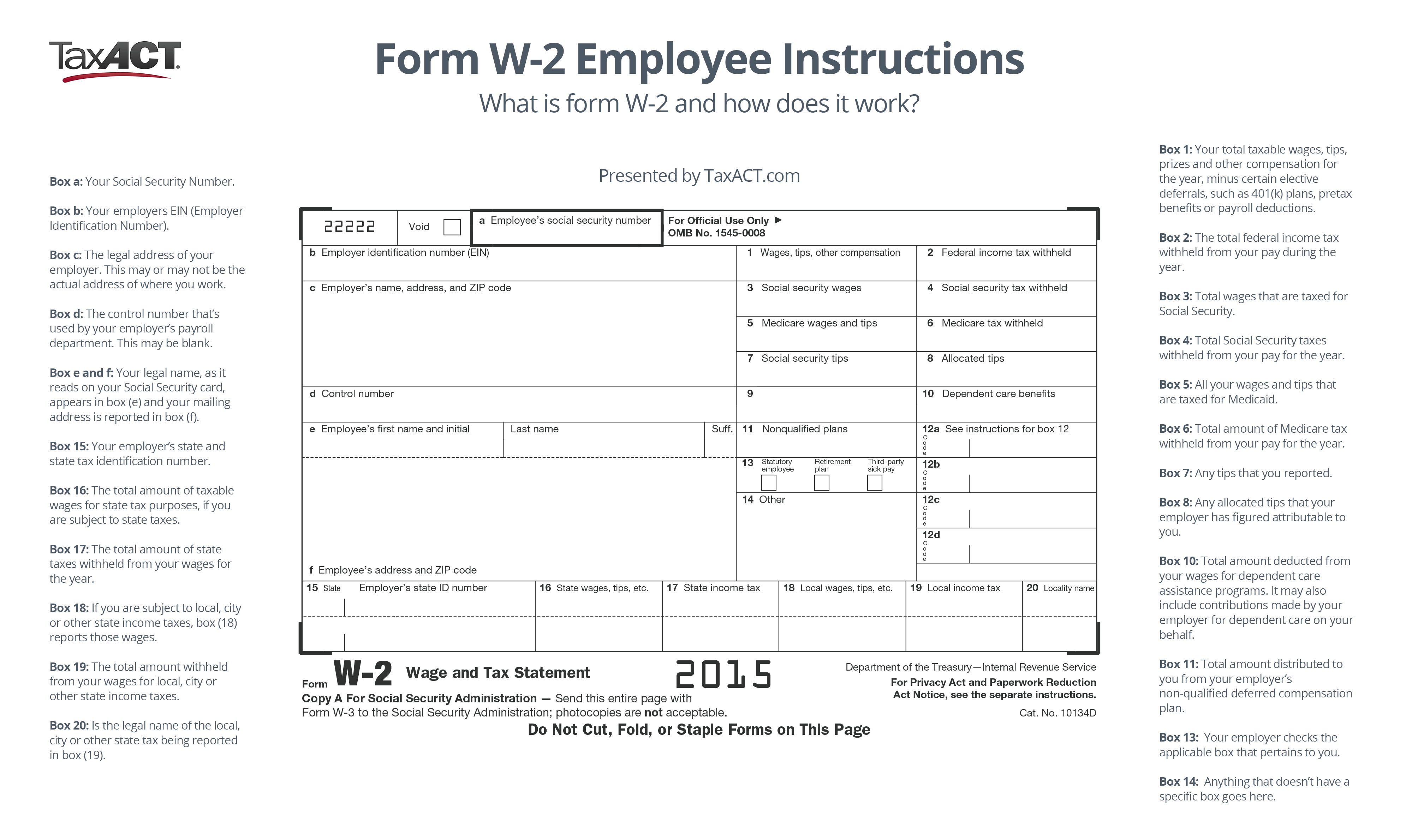

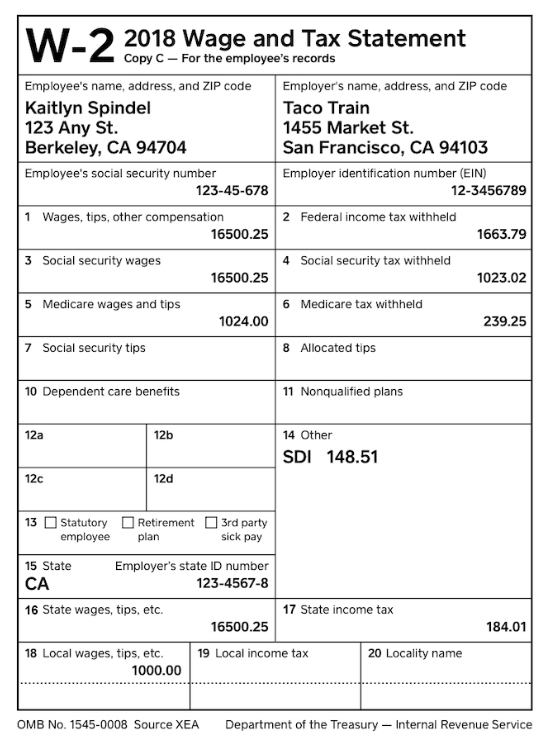

Umd W2 Form - Save or instantly send your ready documents. Web all active state employees and recently retired/terminated employees who are/were paid by the central payroll bureau (cpb) can view/print 12 rolling months of pay stub. Web processing withholding forms view information on the processing of w4 forms and specific requirements for maryland, d.c., and virginia residents. Reinstate for back payment overview and form. The instruction booklets listed here do not. They can also be accessed on the phr website. To reconcile your w‐2 maryland state wages box 16 to your y‐t‐d amount on your final pay stub, use the. Web view a list of forms that are applicable to various payroll transactions. All forms require an original signature. Due to a database outage from september 10, 2023, to september 11, 2023, any transaction. Reinstate for back payment overview and form. Web processing withholding forms view information on the processing of w4 forms and specific requirements for maryland, d.c., and virginia residents. Web accessing your w2’s online: Web maryland law requiresthat employers submit their annual withholding reconciliation using the electronic format (to bulk upload or submit on media) if the total number of w2.. Web view a list of forms that are applicable to various payroll transactions. Web for employees with maryland taxes withheld, you will see two w2 forms for each year. They can also be accessed on the phr website. Your w‐2 wage & tax statement is reported to the internal. How do i create and file the maryland w2 and md. The instruction booklets listed here do not. Reinstate for back payment overview and form. Web caree rs in the legal field panel. Web the state of maryland withholds for maryland, west virginia, and the district of columbia only. The institute for the study of war (isw) is. The instruction booklets listed here do not. Web business income tax employer withholding 2022 withholding forms 2022 employer withholding forms instruction booklets note: Reinstate for back payment overview and form. Your w‐2 wage & tax statement is reported to the internal. Web your w‐2 is the reportable portion of your wages, taxes withheld and value of your health cost [when. Due to a database outage from september 10, 2023, to september 11, 2023, any transaction. Web all active state employees and recently retired/terminated employees who are/were paid by the central payroll bureau (cpb) can view/print 12 rolling months of pay stub. How do i create and file the maryland w2 and md form mw508? Web join dsac for a panel. Easily fill out pdf blank, edit, and sign them. University career center, 3rd floor. Web join dsac for a panel on zoom with professors across the college, the feller center, and alumni to talk about gap years, careers, and working after undergrad. How do i create and file the maryland w2 and md form mw508? Check out isw’s internship virtual. The institute for the study of war (isw) is. The instruction booklets listed here do not. To reconcile your w‐2 maryland state wages box 16 to your y‐t‐d amount on your final pay stub, use the. Web processing withholding forms view information on the processing of w4 forms and specific requirements for maryland, d.c., and virginia residents. Save or instantly. The institute for the study of war (isw) is. Web the state of maryland withholds for maryland, west virginia, and the district of columbia only. Easily fill out pdf blank, edit, and sign them. Web accessing your w2’s online: Web w2 form w2 form w2s are mailed from the state of maryland by january 31st. The instruction booklets listed here do not. Web view a list of forms that are applicable to various payroll transactions. Web complete maryland w 2 form online with us legal forms. Due to a database outage from september 10, 2023, to september 11, 2023, any transaction. Web caree rs in the legal field panel. Due to a database outage from september 10, 2023, to september 11, 2023, any transaction. Web complete maryland w 2 form online with us legal forms. Test and bulk upload your file or view your submission history. The instruction booklets listed here do not. The university of delaware payroll department has announced that starting oct. Check out isw’s internship virtual flyer. Due to a database outage from september 10, 2023, to september 11, 2023, any transaction. Reinstate for back payment overview and form. The institute for the study of war (isw) is. Web all active state employees and recently retired/terminated employees who are/were paid by the central payroll bureau (cpb) can view/print 12 rolling months of pay stub. They can also be accessed on the phr website. Web for employees with maryland taxes withheld, you will see two w2 forms for each year. Web business income tax employer withholding 2022 withholding forms 2022 employer withholding forms instruction booklets note: Save or instantly send your ready documents. Web your w‐2 is the reportable portion of your wages, taxes withheld and value of your health cost [when applicable]. Web maryland form 505 line 19 code “g” (additions to income). Web accessing your w2’s online: How do i create and file the maryland w2 and md form mw508? Web there are several advantages to signing up: University career center, 3rd floor. Web complete maryland w 2 form online with us legal forms. Easily fill out pdf blank, edit, and sign them. Web caree rs in the legal field panel. All forms require an original signature. Web maryland law requiresthat employers submit their annual withholding reconciliation using the electronic format (to bulk upload or submit on media) if the total number of w2.What Is Form W2 and How Does It Work? TaxAct Blog

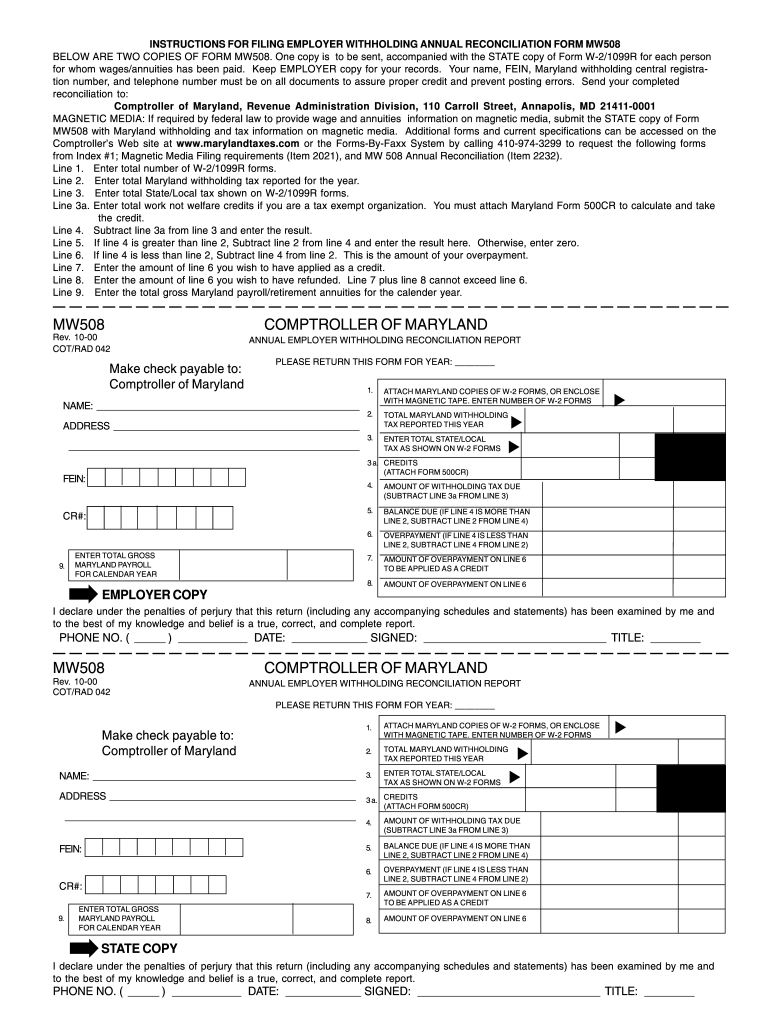

Maryland form mw506r Fill out & sign online DocHub

W2 Form Filing, Deadline, and FAQs Square

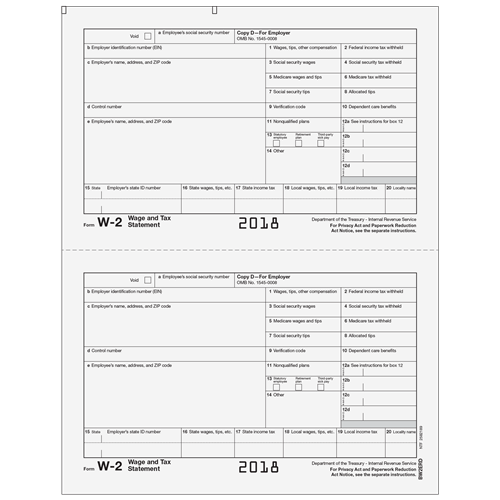

W2 Form Copy 1/D (Employer State/City/Local and File) Condensed 2up

Annual Employer Withholding Reconciliation Return DUE DATE Fill Out

Form W2 Easy to Understand Tax Guidelines 2020

Understanding Your W2 Form [INFOGRAPHIC] Infographic List

W2 Form Fill Out and Sign Printable PDF Template signNow

Virginia Unemployment W2 Forms Universal Network

What Is Form W2? An Employer's Guide to the W2 Tax Form Gusto

Related Post:

![Understanding Your W2 Form [INFOGRAPHIC] Infographic List](https://i0.wp.com/infographiclist.files.wordpress.com/2013/03/the-complete-guide-to-the-w2-form_50ef137271328.jpg)