Form 1041 Software

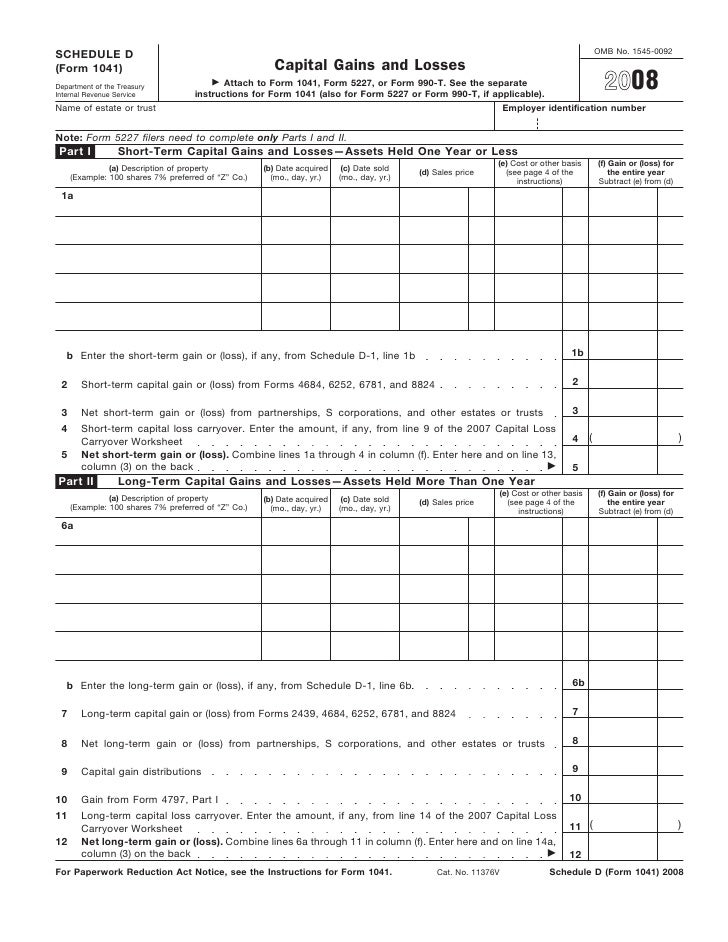

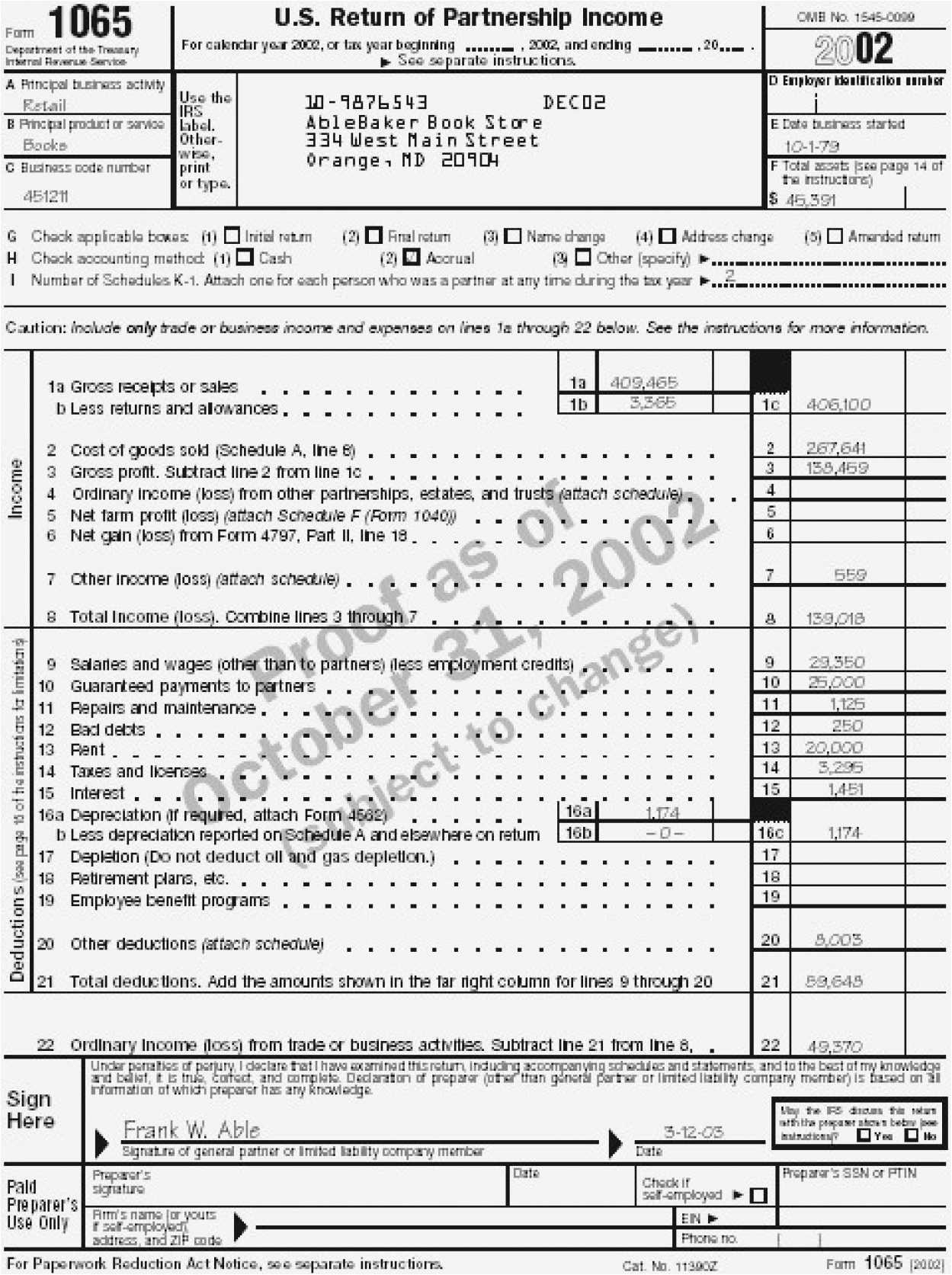

Form 1041 Software - Ad analyze variances across periods, years, or scenarios. Web get started online for free and only pay when you're ready to file your business taxes. Web go to www.irs.gov/form1041 for instructions and the latest information. Web solved • by turbotax • 585 • updated january 13, 2023. Income received from the trust or. Owned by you, the tax team. See form 2441, line 8, for the 2022. Income tax return for estates and trusts. And estates with nonresident alien beneficiaries must file a form 1041. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Form 1041 is used by a. Web an estate or trust that generates income of $600 or more; Web information about form 1041, u.s. Owned by you, the tax team. Online returns online bundles download bundles partnerships form 1065 easy guidance for. Web an estate or trust that generates income of $600 or more; The following links provide information on the companies that have passed the internal revenue service (irs). Providers listed on this webpage are approved irs. Part i persons or organizations. Automate your vendor bills with ai, and sync your banks. If you or your spouse was a student or disabled, check this box. Web go to www.irs.gov/form1041 for instructions and the latest information. Ad analyze variances across periods, years, or scenarios. Web the following companies have passed the irs assurance testing system (ats) requirements for software developers of electronic form 1041 estate and trusts. Income tax return for estates and. Ad analyze variances across periods, years, or scenarios. Web all other trusts need to file form 1041 (u.s. If you or your spouse was a student or disabled, check this box. Web an estate or trust that generates income of $600 or more; The following links provide information on the companies that have passed the internal revenue service (irs). Web an estate or trust that generates income of $600 or more; 79 rows web up to 10% cash back 124 state additional benefits forms requirements 100% accuracy guarantee rest assured, taxact guarantees the calculations on your return are. Bundle & save 54 each all. Online returns online bundles download bundles partnerships form 1065 easy guidance for. Web information about. Web get started online for free and only pay when you're ready to file your business taxes. Income tax return for estates and trusts. Web information about form 1041, u.s. 79 rows web up to 10% cash back 124 state additional benefits forms requirements 100% accuracy guarantee rest assured, taxact guarantees the calculations on your return are. Web turbotax help. Web solved • by turbotax • 585 • updated january 13, 2023. 79 rows web up to 10% cash back 124 state additional benefits forms requirements 100% accuracy guarantee rest assured, taxact guarantees the calculations on your return are. See form 2441, line 8, for the 2022. Web an estate or trust that generates income of $600 or more; Automate. Part i persons or organizations. Online returns online bundles download bundles partnerships form 1065 easy guidance for. Income received from the trust or. Web an estate or trust that generates income of $600 or more; Web solved • by turbotax • 585 • updated january 13, 2023. Income tax return for estates and trusts. Web get started online for free and only pay when you're ready to file your business taxes. Income received from the trust or. Web go to www.irs.gov/form1041 for instructions and the latest information. Online returns online bundles download bundles partnerships form 1065 easy guidance for. Providers listed on this webpage are approved irs. Income tax return for estates and trusts. Income tax return for estates and trusts is generally used to report the income, gains,. Produce critical tax reporting requirements faster and more accurately. Web all other trusts need to file form 1041 (u.s. Produce critical tax reporting requirements faster and more accurately. If you or your spouse was a student or disabled, check this box. 79 rows web up to 10% cash back 124 state additional benefits forms requirements 100% accuracy guarantee rest assured, taxact guarantees the calculations on your return are. Automate your vendor bills with ai, and sync your banks. Web an estate or trust that generates income of $600 or more; Income received from the trust or. Web all other trusts need to file form 1041 (u.s. The following links provide information on the companies that have passed the internal revenue service (irs). Web the following companies have passed the irs assurance testing system (ats) requirements for software developers of electronic form 1041 estate and trusts. See form 2441, line 8, for the 2022. Bundle & save 54 each all. Form 1041 is used by a. Part i persons or organizations. Web go to www.irs.gov/form1041 for instructions and the latest information. And estates with nonresident alien beneficiaries must file a form 1041. Web go to www.irs.gov/form1041 for instructions and the latest information. Income tax return for estates and trusts. Online returns online bundles download bundles partnerships form 1065 easy guidance for. Providers listed on this webpage are approved irs. Web information about form 1041, u.s.Form 1041 Schedule D

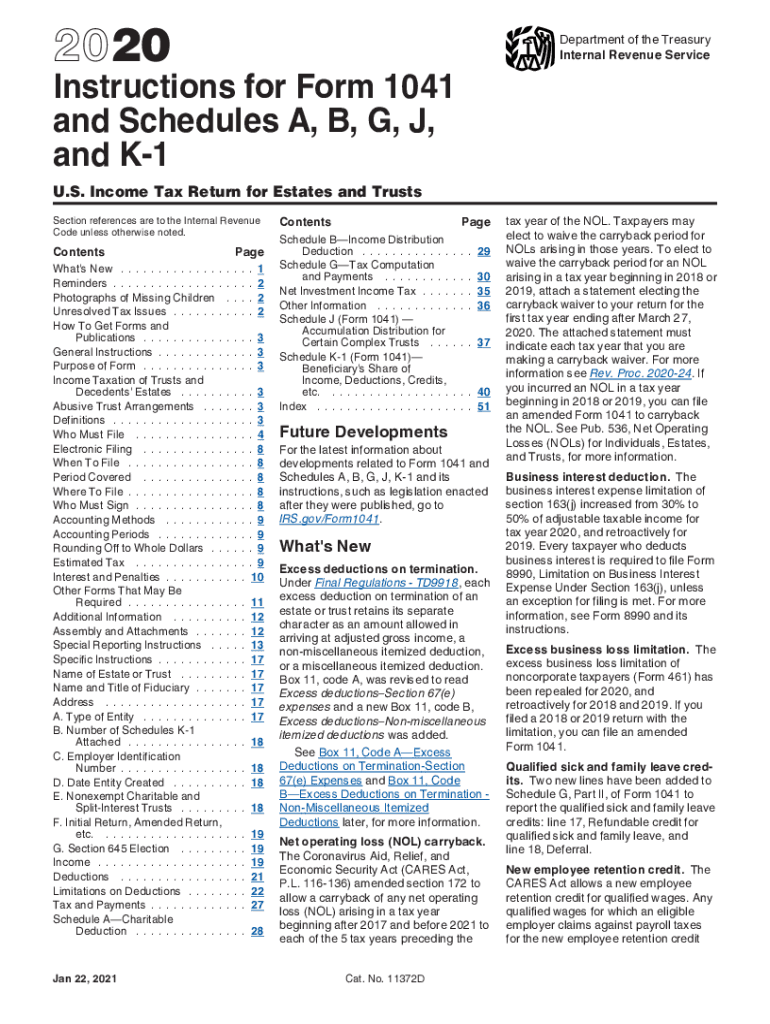

Instructions for Form 1041 and Schedules A, B, G, J, and K 1

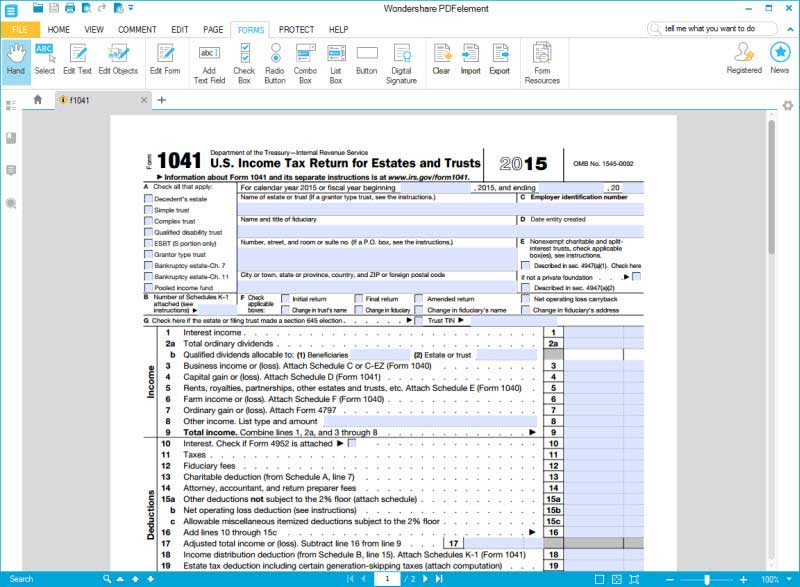

Irs Form 1041 Instructions 2015 Form Resume Examples 2A1W2kO8ze

Best Tax Software For Form 1041 Freeware Base

Guide for How to Fill in IRS Form 1041

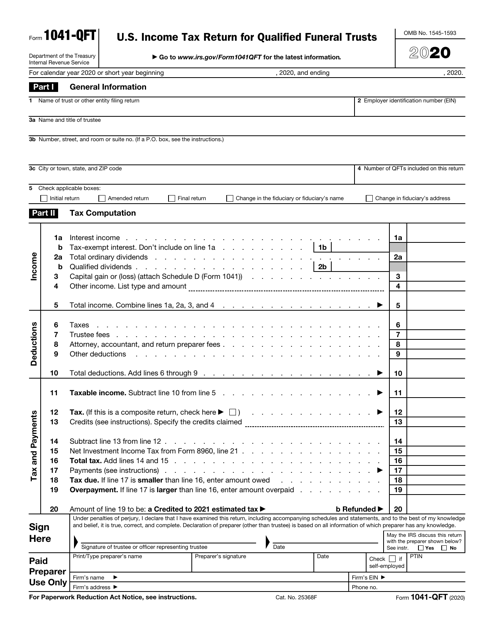

IRS Form 1041QFT Download Fillable PDF or Fill Online U.S. Tax

Form 1041 Tax Software For Mac

How To Fill Out 1041 K1 Leah Beachum's Template

How To Fill Out 1041 K1 Leah Beachum's Template

Best Tax Software For Form 1041 Form Resume Examples mL52wRnOXo

Related Post: