Wv Homestead Exemption Application Form

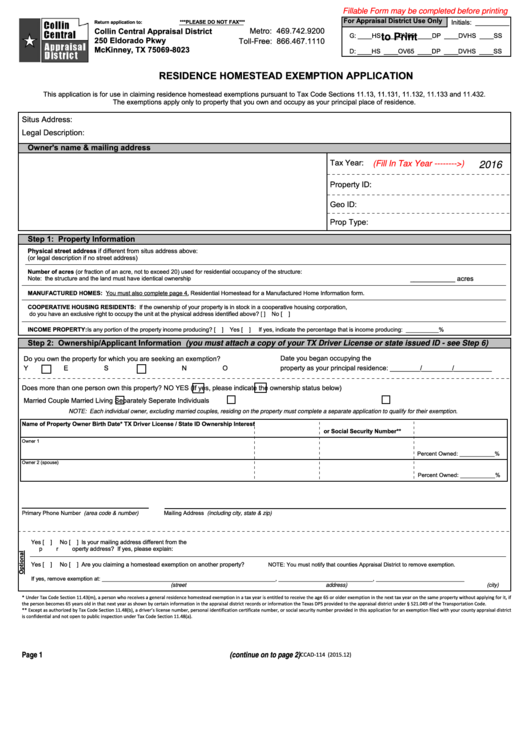

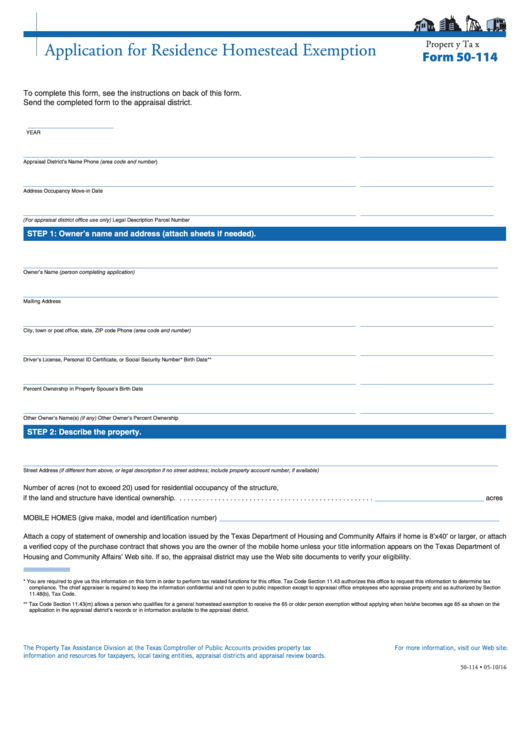

Wv Homestead Exemption Application Form - All new applicants must file between july 1st and. If you have any questions or need. If you have already signed up for the exemption and have not moved, you do not need to. Web the homestead act lops off $20,000 from the assessed value of an eligible taxpayer's property. Web tax information and assistance: Applicant’s eligibility will be approved upon meeting the following requirements: Web application for homestead exemption $20,000 assessed valuation for assessor’s use only: The savings can add up to hundreds of dollars a year in property taxes. Web you must bring either a valid west virginia driver's license or voter's registration card with you in order to sign up for homestead exemption. Web participate in the homestead exemption program (contact your county assessor’s office for more information), have paid their property tax, and have income which is less than. Web the homestead act lops off $20,000 from the assessed value of an eligible taxpayer's property. Web you must have lived at your homestead for at least 6 months and must have been a resident of west virginia for the 2 years prior to your application. If you have already signed up for the exemption and have not moved, you. Ad create legal forms instantly. Web application for homestead exemption for assessor's use only map no. If you have any questions or need. Web the homestead act lops off $20,000 from the assessed value of an eligible taxpayer's property. All new applicants must file between july 1st and. Resident property owners in the county who have attained age 65 are entitled by law to a homestead exemption, which excludes the first $20,000 of. If you have already signed up for the exemption and have not moved, you do not need to. Homestead exemption if you are 65 years of age or older on or before june 30 following. Web application may be made at your county assessors office. Web you must have lived at your homestead for at least 6 months and must have been a resident of west virginia for the 2 years prior to your application. Web article 3, section 3a of the west virginia code. If you have any questions or need. Web application for. Web tax information and assistance: Homestead exemption if you are 65 years of age or older on or before june 30 following the july 1 assessment date, or you. Web you must bring either a valid west virginia driver's license or voter's registration card with you in order to sign up for homestead exemption. Application should be made with the. Web home homestead exemption an exemption from real estate taxes shall be allowed for the first $20,000 of assessed value. Web application for homestead exemption. Applicant’s eligibility will be approved upon meeting the following requirements: Web application for homestead exemption $20,000 assessed valuation for assessor’s use only: Web application for homestead exemption for assessor's use only map no. If you have already signed up for the exemption and have not moved, you do not need to reapply. Web you must have lived at your homestead for at least 6 months and must have been a resident of west virginia for the 2 years prior to your application. Web application for homestead exemption. Edit pdfs, create forms, collect data,. Web the homestead act lops off $20,000 from the assessed value of an eligible taxpayer's property. Web application for homestead exemption for assessor's use only map no. (last) $20,000 assessed valuation tax district: Resident property owners in the county who have attained age 65 are entitled by law to a homestead exemption, which excludes the first $20,000 of. Web application. Web article 3, section 3a of the west virginia code. Web application for homestead exemption. Web how to apply to apply for homestead exemption, you must bring the required documents (listed above) to our office and apply in person. Web participate in the homestead exemption program (contact your county assessor’s office for more information), have paid their property tax, and. Homestead exemption if you are 65 years of age or older on or before june 30 following the july 1 assessment date, or you. Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more. Web how to apply to apply for homestead exemption, you must bring the required documents (listed above) to our office and apply. If you have any questions or need. The applicant must be 65 years of. If you have already signed up for the exemption and have not moved, you do not need to reapply. (last) $20,000 assessed valuation tax district: Web you must bring either a valid west virginia driver's license or voter's registration card with you in order to sign up for homestead exemption. Applicant’s eligibility will be approved upon meeting the following requirements: Ad create legal forms instantly. Web application for homestead exemption $20,000 assessed valuation for assessor’s use only: Web tax information and assistance: To qualify for the homestead. Resident property owners in the county who have attained age 65 are entitled by law to a homestead exemption, which excludes the first $20,000 of. Edit, sign and save wv cert of authority app form. Web participate in the homestead exemption program (contact your county assessor’s office for more information), have paid their property tax, and have income which is less than. Web application for homestead exemption for assessor's use only map no. Web application for homestead exemption. Web application may be made at your county assessors office. Web how to apply to apply for homestead exemption, you must bring the required documents (listed above) to our office and apply in person. Web the homestead act lops off $20,000 from the assessed value of an eligible taxpayer's property. Web homestead excess property tax credit 2022. Application should be made with the assessor by december 1Fillable Residence Homestead Exemption Application Form printable pdf

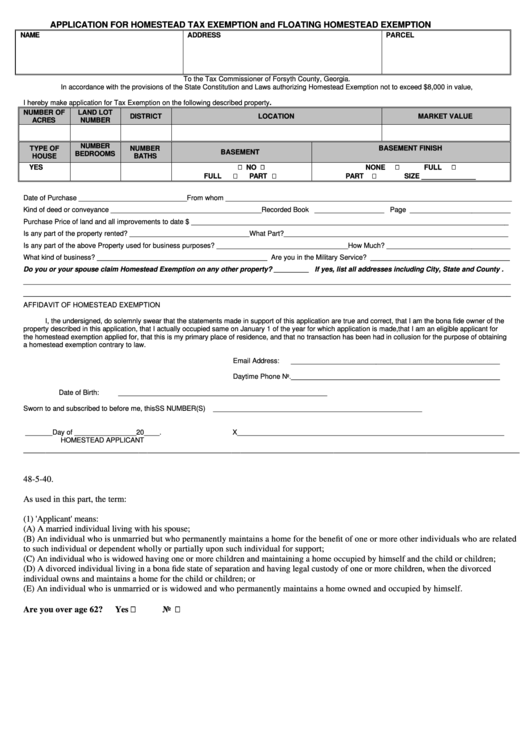

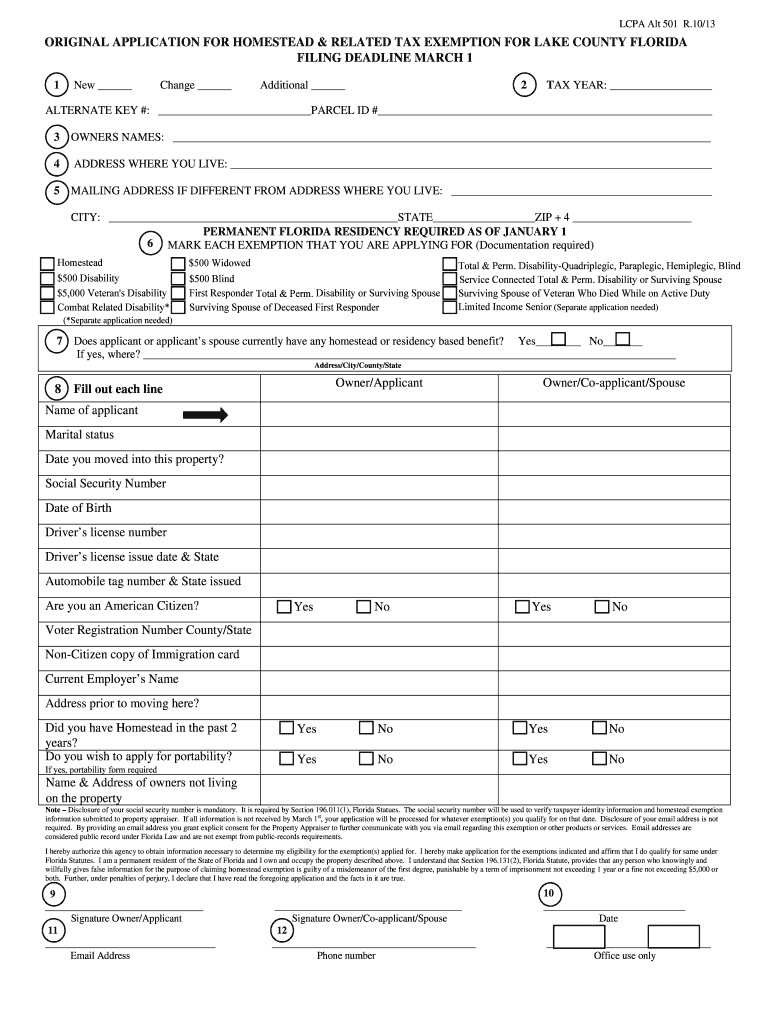

Application For Homestead Tax Exemption And Floating Homestead

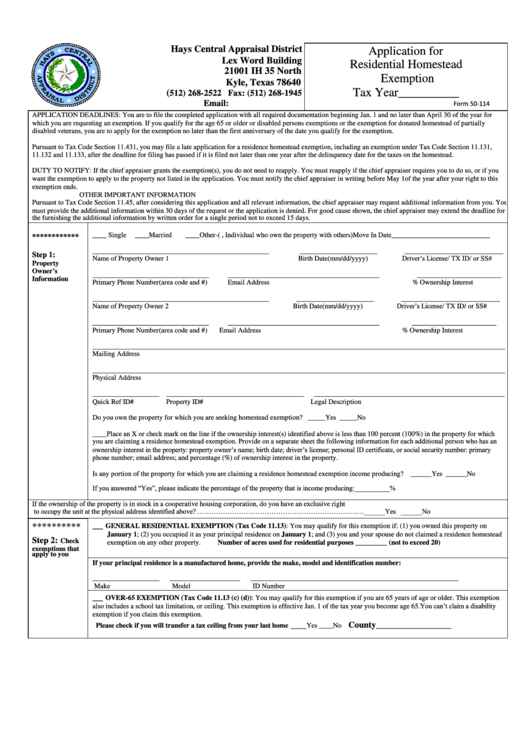

Form 50114 Application For Residential Homestead Exemption printable

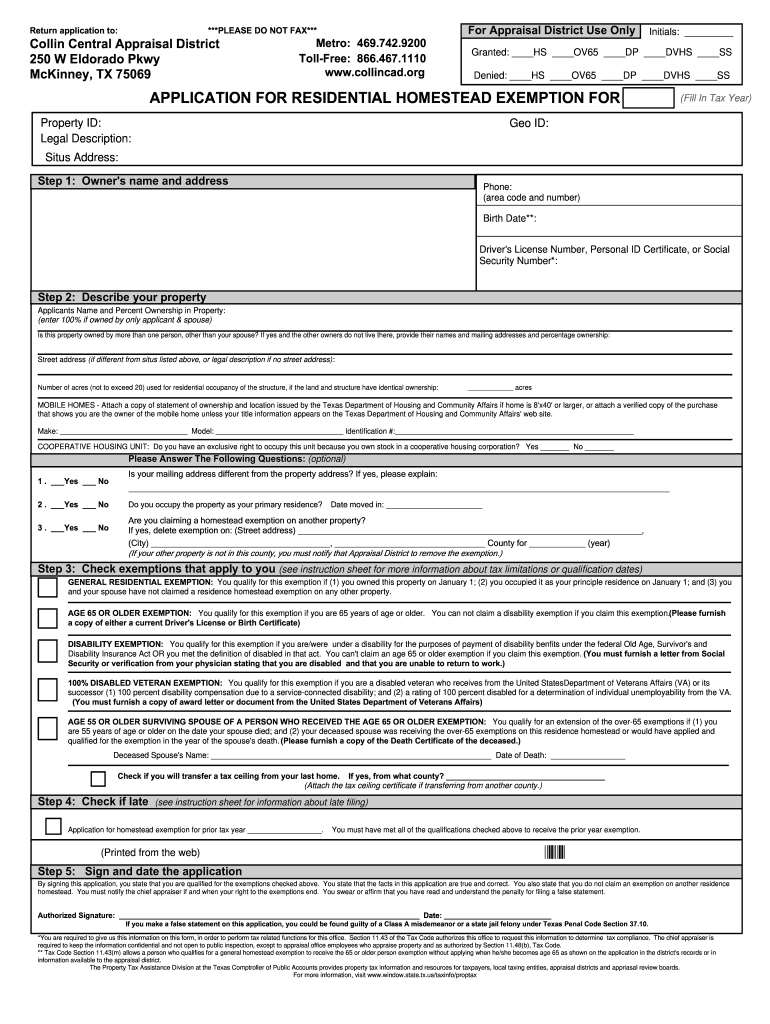

Collin County Homestead Exemption Application Fill Online, Printable

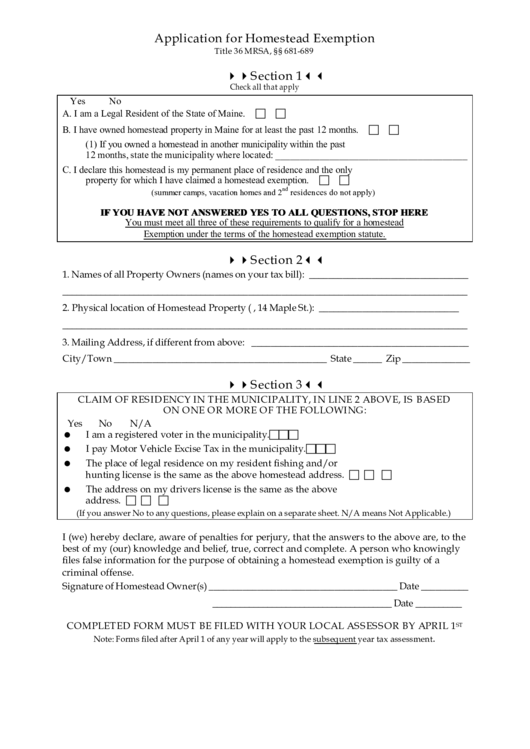

Homestead exemption form

Virginia Homestead Exemption Form Fill and Sign Printable Template

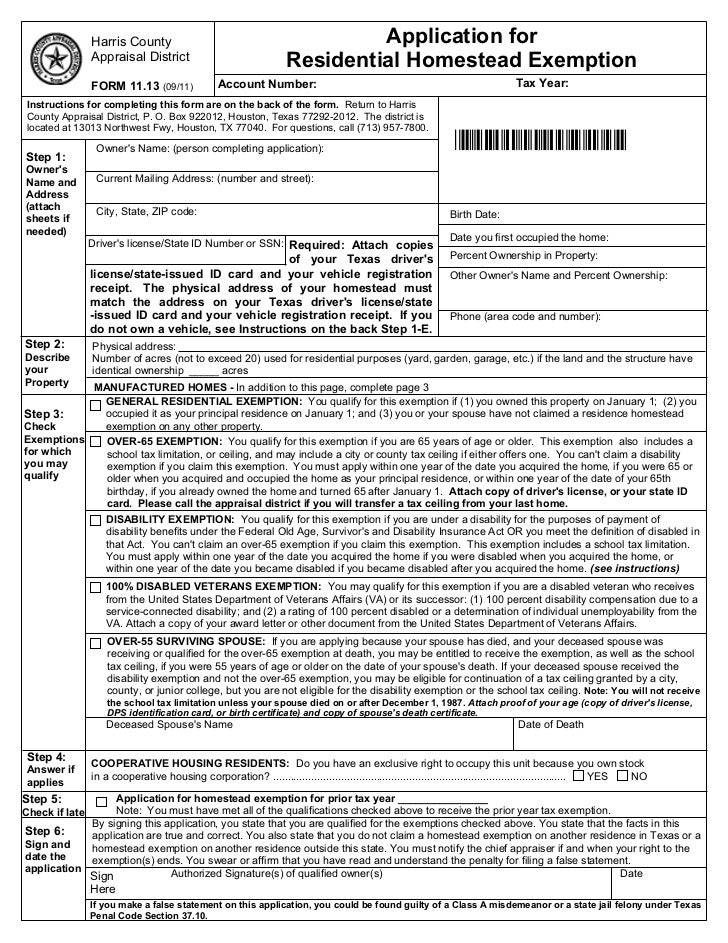

Harris County Homestead Exemption Form

Fillable Application For Homestead Exemption Template printable pdf

Fillable Form 50114 Application For Residence Homestead Exemption

Riverside County Homestead Exemption Form

Related Post: