Sc Sales Tax Form

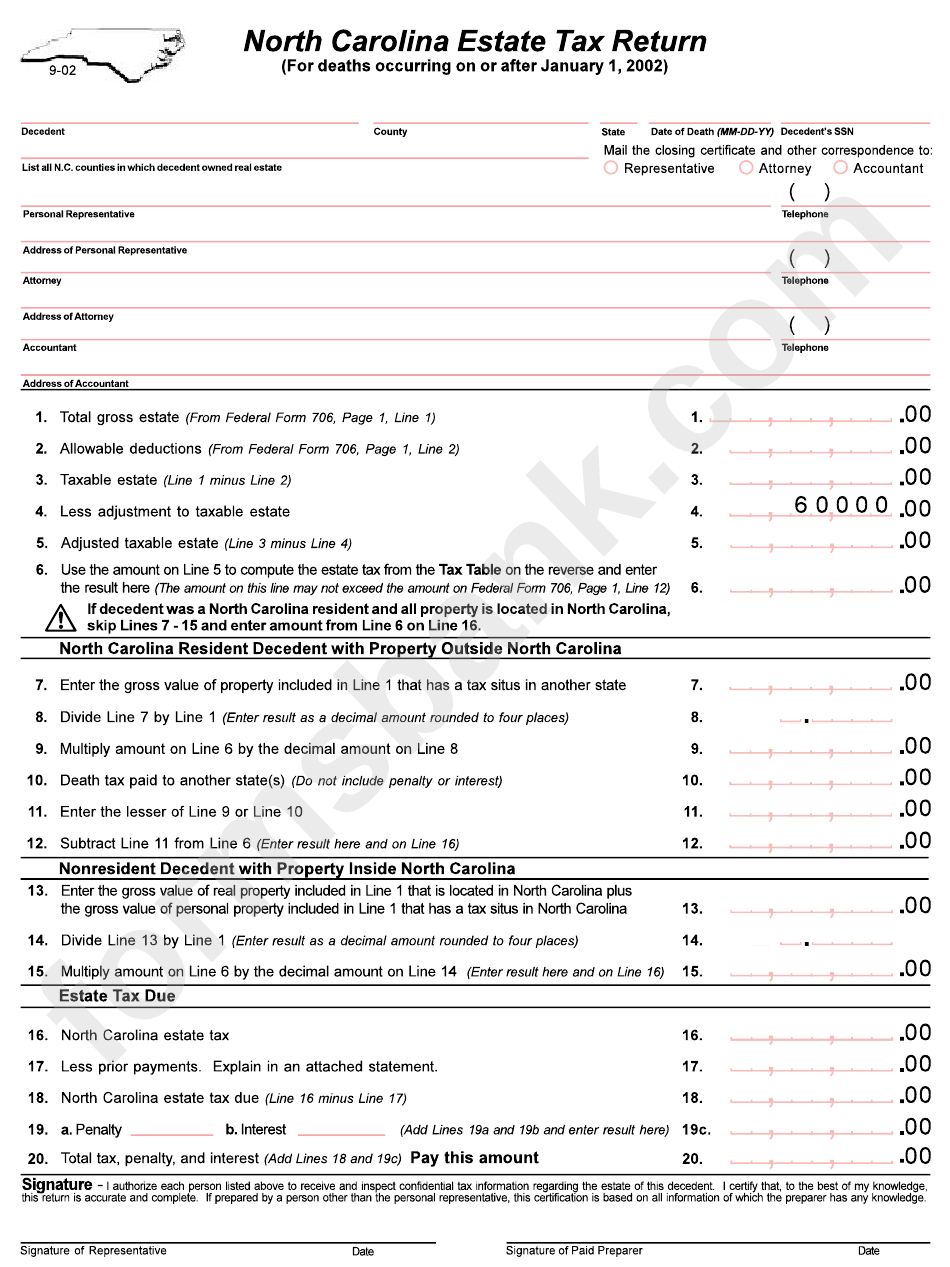

Sc Sales Tax Form - December 11, 2019 by melody rogers. Monday is a federal reserve bank holiday. If included in the sale price, shipping charges are. Separately stated shipping and handling charges are not subject to kansas sales tax as of july 1, 2023. The statewide sales and use tax rate is six percent (6%). Municipalities and counties may also add a local sales and use tax. Web applying for a sales & use tax exemption. Web anyone who files south carolina sales tax returns for two or more locations is eligible to apply for the consolidated sales tax return option. An individual 85 years old or older is entitled to claim a 1% exemption from state sales & use tax on. You will need to provide your file number when. Web tax and legal forms. File online using mydorway > account closing. Web sales tax is imposed on the sale of goods and certain services in south carolina. Web sales & use taxpayer s whose south carolina tax liability is $15,000 or more per filing period must file and pay electronically. 2020 rates included for use while preparing your income. Web how to file and pay sales tax in south carolina. Web sales & use taxes click on a sales & use tax listed below to learn more about filing and licensing requirements. Multistate tax commission uniform sales and use tax certificate. December 11, 2019 by melody rogers. Web sale and use tax license. Web manage your south carolina tax accounts online. Ohio accepts the uniform sales and use tax certificate created by the multistate tax. Web south carolina’s sales tax is 6 percent, as is the use tax. We recommend filing and paying your taxes on our free and. This blog provides instructions on how to file and pay. Municipalities and counties may also add a local sales and use tax. To apply, complete the consolidated sales tax return participation. This blog provides instructions on how to file and pay. 2020 rates included for use while preparing your income tax deduction. An individual 85 years old or older is entitled to claim a 1% exemption from state sales &. Web south carolina’s sales tax is 6 percent, as is the use tax. Web sales tax is imposed on the sale of goods and certain services in south carolina. Web sale and use tax license. File online using mydorway > account closing. Counties may impose an additional. Municipalities and counties may also add a local sales and use tax. Sales tax is imposed on all retailers within south carolina and applies to all retail sales. The statewide sales and use tax rate is six percent (6%). Ad access irs tax forms. This blog provides instructions on how to file and pay. Web sales tax return option after submitting an application to the scdor and receiving approval. We recommend filing and paying your taxes on our free and. Web sales & use taxpayer s whose south carolina tax liability is $15,000 or more per filing period must file and pay electronically. You will need to provide your file number when. Web file. Notary public application [pdf] motor vehicle forms. Separately stated shipping and handling charges are not subject to kansas sales tax as of july 1, 2023. We recommend filing and paying your taxes on our free and. The statewide sales & use tax rate is six percent (6%). South carolina's sales and use tax rate is 6 percent. Get ready for tax season deadlines by completing any required tax forms today. Web anyone who files south carolina sales tax returns for two or more locations is eligible to apply for the consolidated sales tax return option. Web applying for a sales & use tax exemption. The statewide sales and use tax rate is six percent (6%). Web how. Monday is a federal reserve bank holiday. Web anyone who files south carolina sales tax returns for two or more locations is eligible to apply for the consolidated sales tax return option. Web sales tax is imposed on the sale of goods and certain services in south carolina. Web file & pay apply for a business tax account upload w2s. Ohio accepts the uniform sales and use tax certificate created by the multistate tax. Monday is a federal reserve bank holiday. Web sales tax is imposed on the sale of goods and certain services in south carolina. Multistate tax commission uniform sales and use tax certificate. Out of the major us. If included in the sale price, shipping charges are. Get ready for tax season deadlines by completing any required tax forms today. An individual 85 years old or older is entitled to claim a 1% exemption from state sales & use tax on. To apply, complete the consolidated sales tax return participation. Web tax and legal forms. Gross proceeds of sales/rentals and withdrawals of inventory for. Municipalities and counties may also add a local sales and use tax. Web sales & use taxpayer s whose south carolina tax liability is $15,000 or more per filing period must file and pay electronically. Web anyone who files south carolina sales tax returns for two or more locations is eligible to apply for the consolidated sales tax return option. File online using mydorway > account closing. The statewide sales & use tax rate is six percent (6%). Ad browse our selection of environmentally friendly forms & other custom printed products! Ad access irs tax forms. Tpt filers are reminded of the following september tpt filing deadlines: Web manage your south carolina tax accounts online.North Carolina Estate Tax Return Form printable pdf download

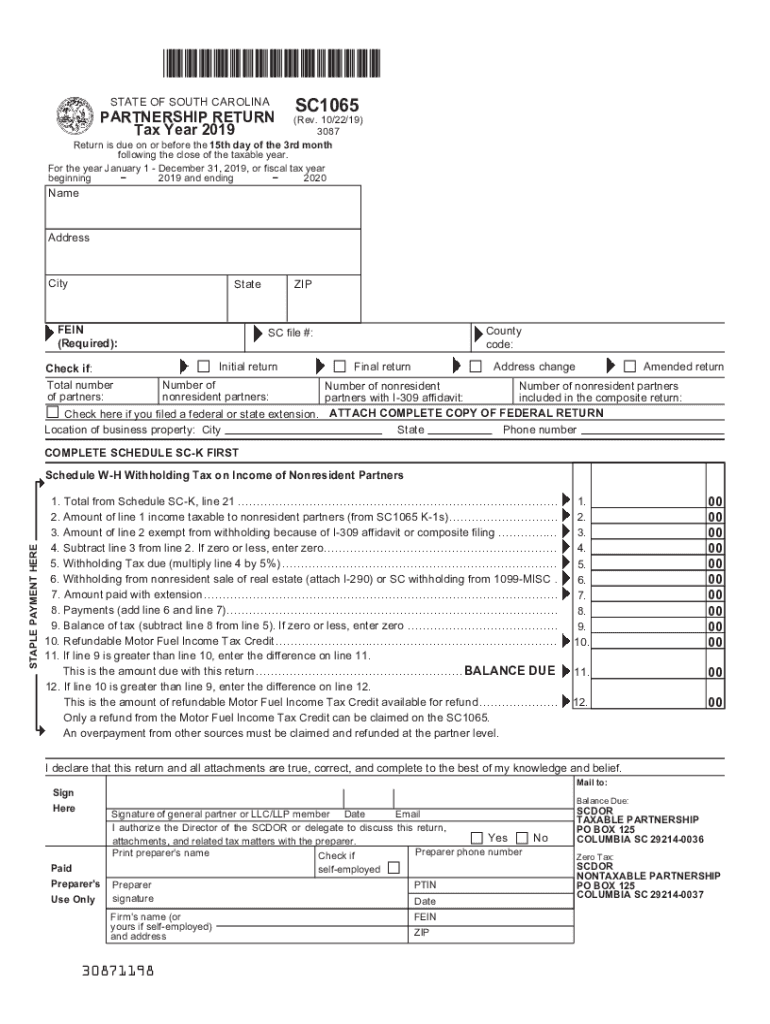

Sc 1065 Fill Out and Sign Printable PDF Template signNow

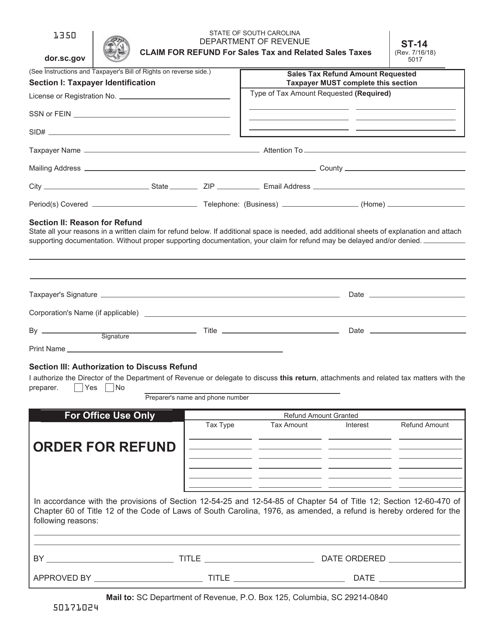

Form ST14 Fill Out, Sign Online and Download Printable PDF, South

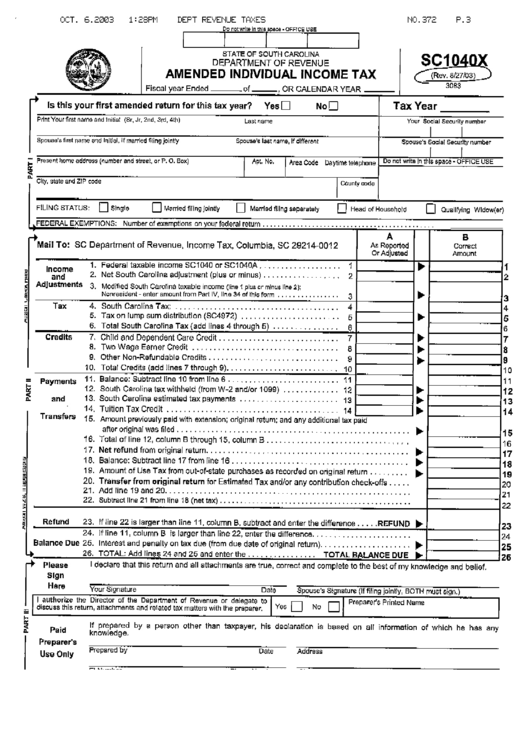

Form Sc1040x Amended Individual Tax South Carolina

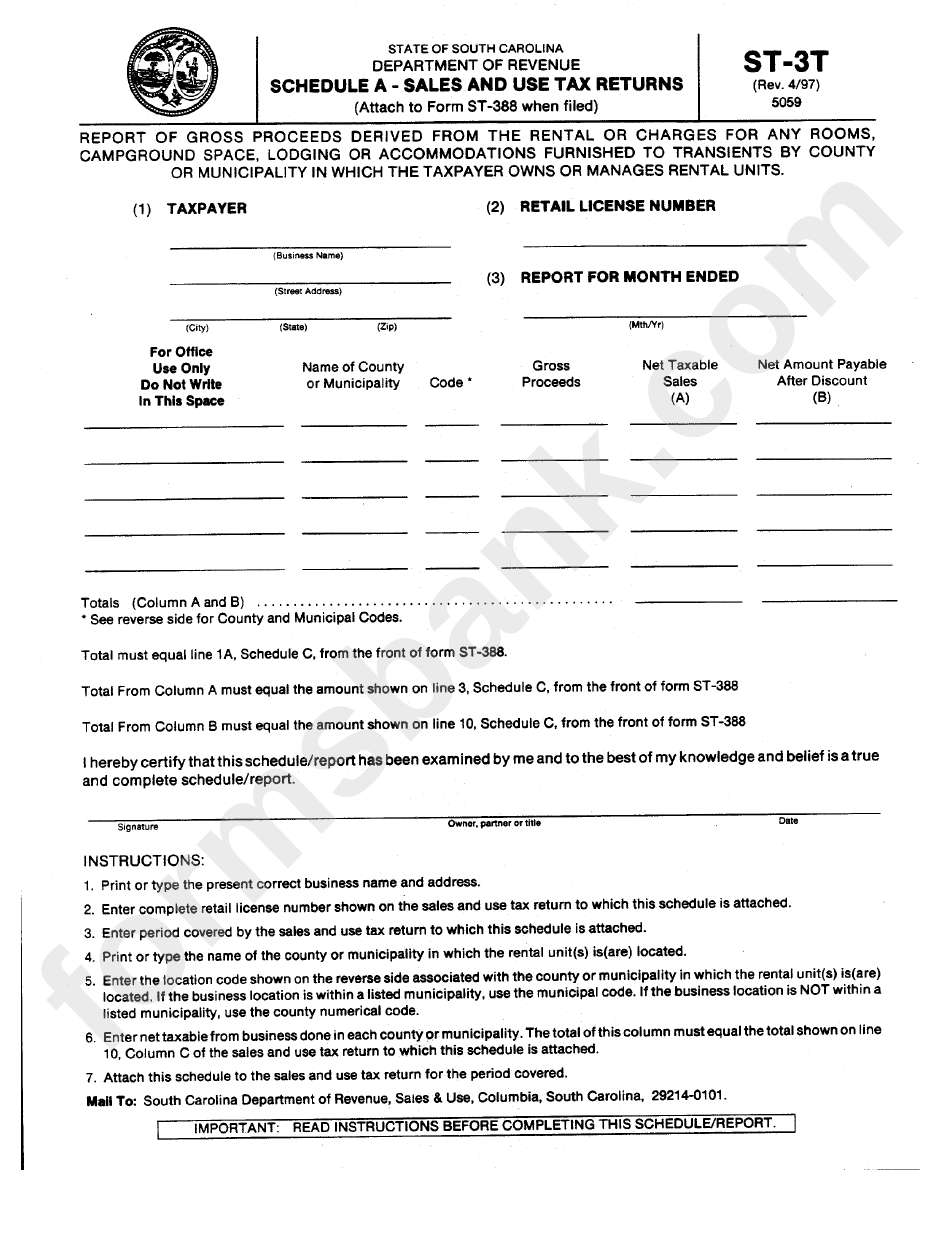

Form St3t Schedule A Sales And Use Tax Returns South Carolina

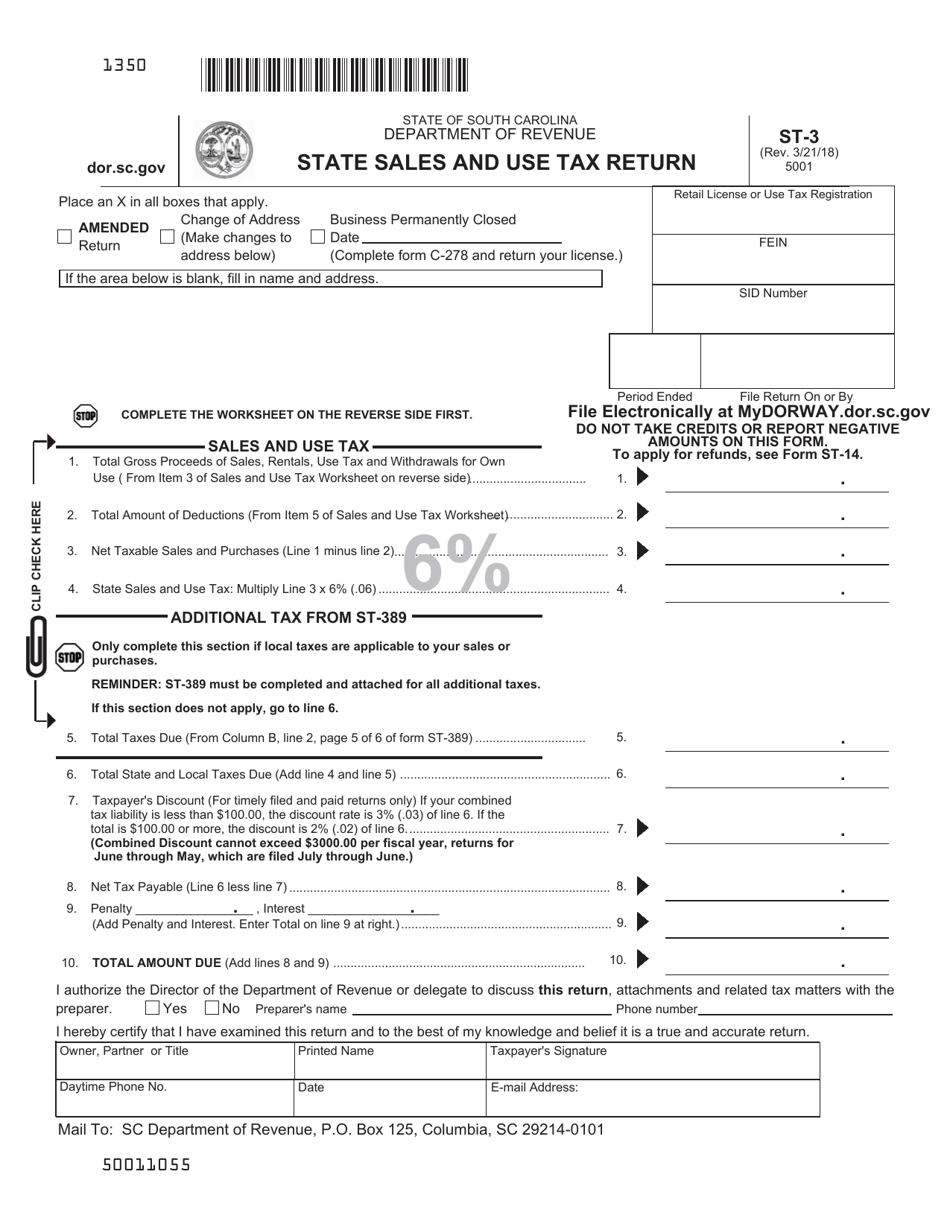

Form ST3 Fill Out, Sign Online and Download Printable PDF, South

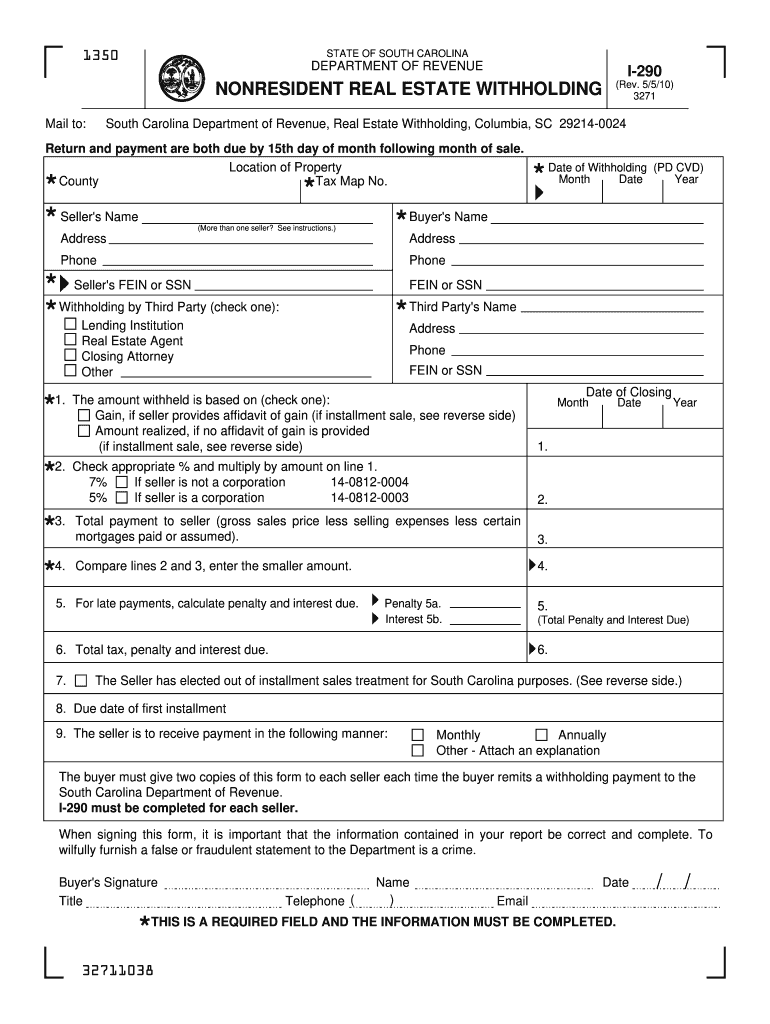

South Carolina Tax Form 290 Fill Out and Sign Printable PDF Template

Sc Fillable Tax Forms Printable Forms Free Online

South Carolina Resale Certificate Fill Out and Sign Printable PDF

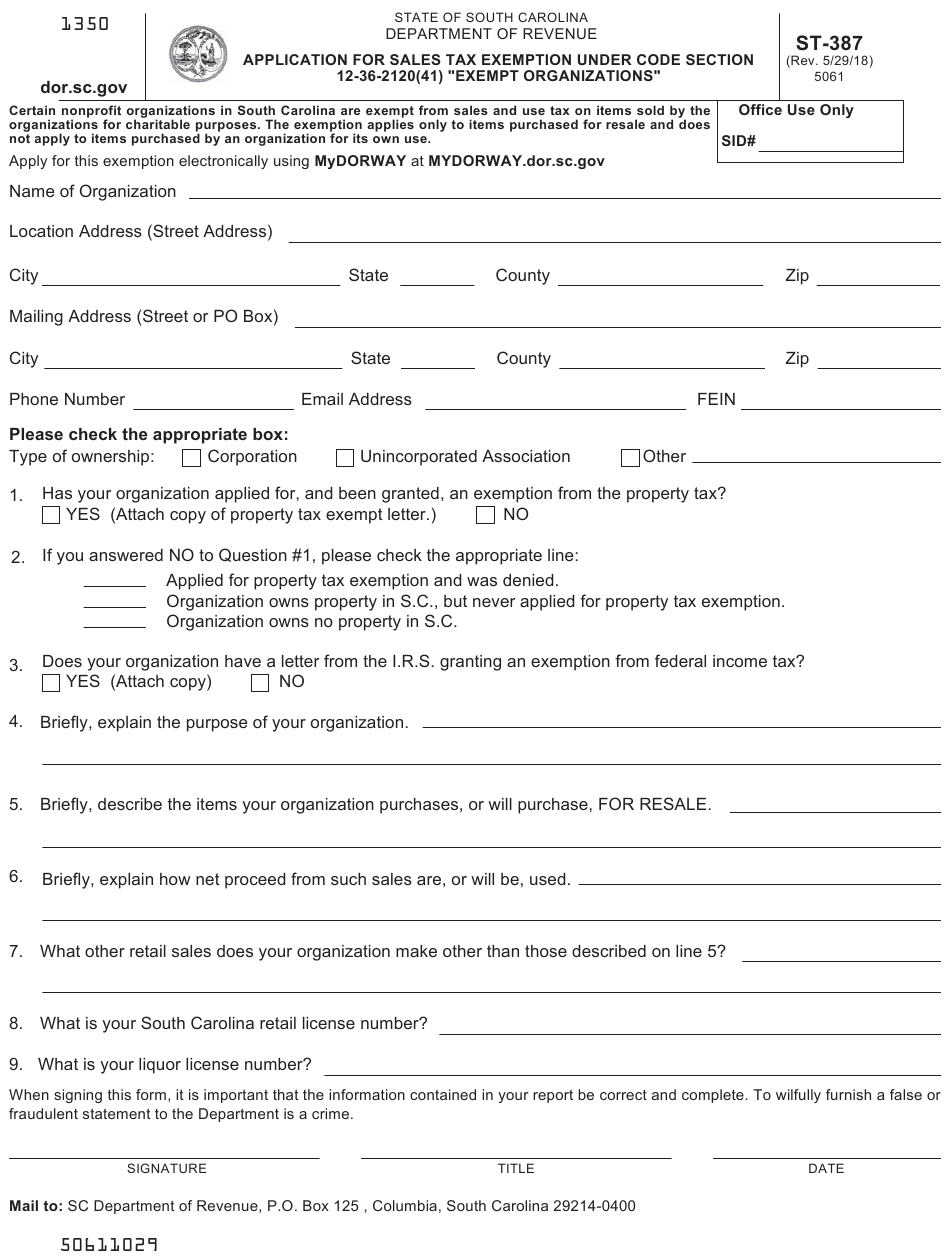

South Carolina State Sales Tax Exemption Form

Related Post: