Form 1065 Other Deductions

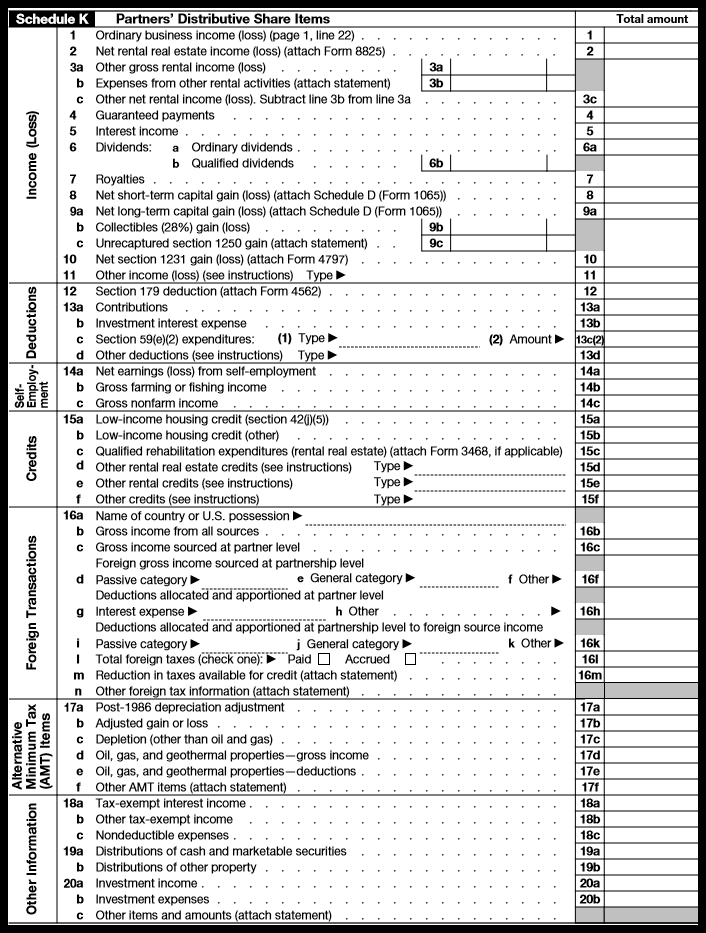

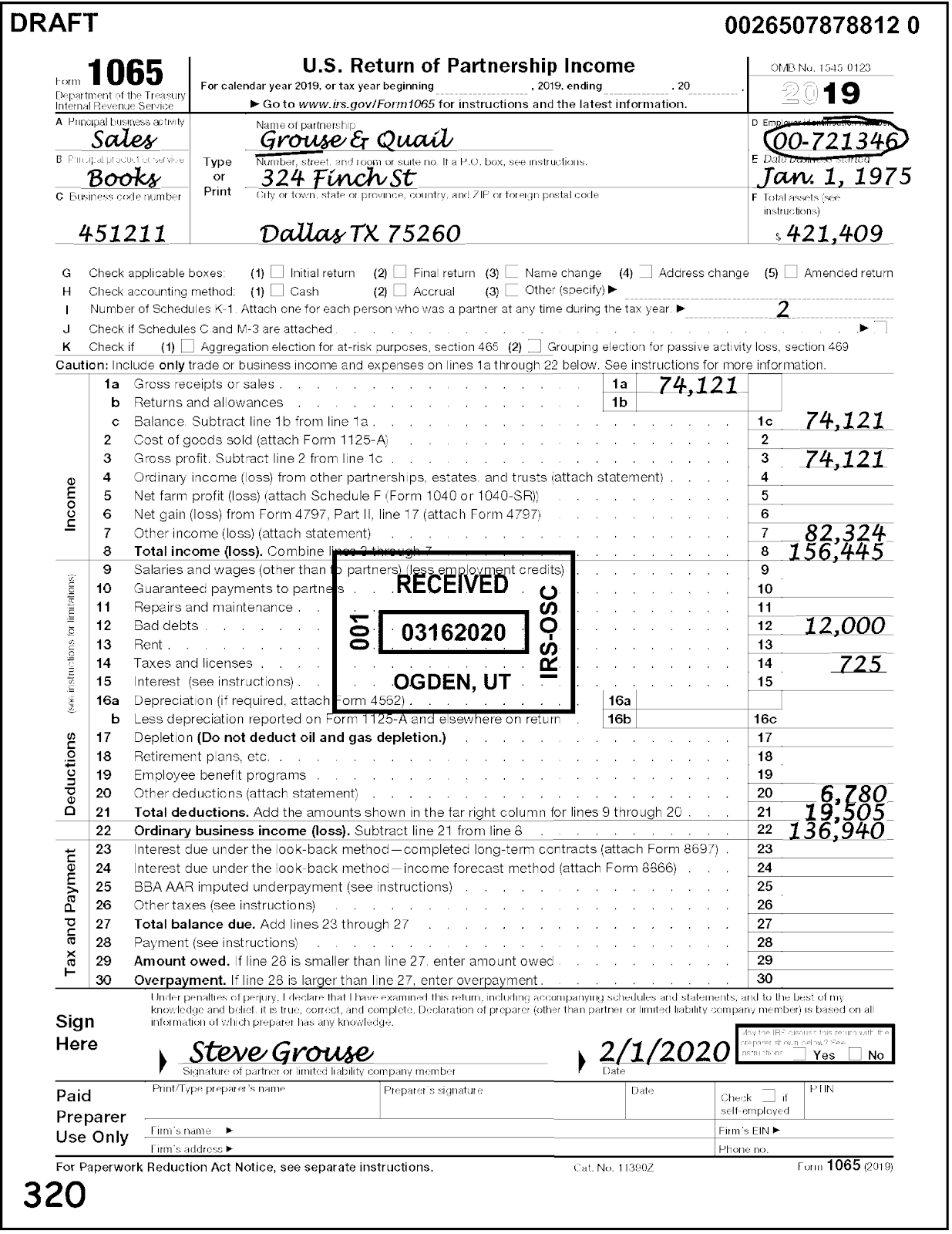

Form 1065 Other Deductions - Return of partnership income are reported on line 20. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. To enter this information in. Web other deductions (list below or attach schedule) a. This form is for partnerships to file their. Attach a statement listing by type. Partner's share of current year income, deductions, credits, and other items. Enter total of lines 14b. Has an amount in box 13. There's no input code available for code w due to the variety of information that can be reported here. This form is for partnerships to file their. Form 1065 is the tax form partnerships need to file in order to report their annual financial information. Return of partnership income are reported on line 20. Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no. There's no input code available for code w due to the variety of information that can be reported here. Has an amount in box 13. Tax credit consulting, syndication legal & financial structuring. To enter this information in. Enter total of lines 14b. Generally, a partnership doesn't pay tax on its income but passes through any profits or losses to its partners. Return of partnership income are reported on line 20. Web other deductions (list below or attach schedule) a. Web you can deduct unreimbursed partnership expenses (upe) if you were required to pay partnership expenses personally under the partnership agreement. Other deductions,. Easy, fast, secure & free to try! Generally, a partnership doesn't pay tax on its income but passes through any profits or losses to its partners. Web you can deduct unreimbursed partnership expenses (upe) if you were required to pay partnership expenses personally under the partnership agreement. Enter the total allowable trade or business deductions that aren't deductible elsewhere on. Enter the total allowable trade or business deductions that aren't deductible elsewhere on page 1 of form 1065. Web form 1065 is the internal revenue service (irs) federal tax return for all types of business partnerships, including general partnerships, limited partnerships, and. Easy, fast, secure & free to try! Web you can deduct unreimbursed partnership expenses (upe) if you were. Web go to www.irs.gov/form1065 for instructions and the latest information. Enter total of lines 14b. Call us for a free consultation. Web you can deduct unreimbursed partnership expenses (upe) if you were required to pay partnership expenses personally under the partnership agreement. Web irs form 1065 is officially known as the us return of partnership income. Enter the total allowable trade or business deductions that aren't deductible elsewhere on page 1 of form 1065. Call us for a free consultation. Partner's share of current year income, deductions, credits, and other items. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership.. Enter the total allowable trade or business deductions that aren't deductible elsewhere on page 1 of form 1065. Generally, a partnership doesn't pay tax on its income but passes through any profits or losses to its partners. Web the purpose of form 1065 is to report a partnership’s income, losses, gains, deductions, credits, and other information. Web form 1065 is. Web you can deduct unreimbursed partnership expenses (upe) if you were required to pay partnership expenses personally under the partnership agreement. Has an amount in box 13. Easy, fast, secure & free to try! Amounts with this code may include, but. Enter the total allowable trade or business deductions that aren't deductible elsewhere on page 1 of form 1065. There's no input code available for code w due to the variety of information that can be reported here. Generally, a partnership doesn't pay tax on its income but passes through any profits or losses to its partners. To enter this information in. Has an amount in box 13. This form is for partnerships to file their. Easy, fast, secure & free to try! Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or. Enter the total allowable trade or business deductions that aren't deductible elsewhere on page 1 of form 1065. Return of partnership income are reported on line 20. Generally, a partnership doesn't pay tax on its income but passes through any profits or losses to its partners. Ad do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! Ad helping make your project a reality. Web the purpose of form 1065 is to report a partnership’s income, losses, gains, deductions, credits, and other information. Tax credit consulting, syndication legal & financial structuring. Income menu rents, royalties, entities (sch e, k. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. Web you can deduct unreimbursed partnership expenses (upe) if you were required to pay partnership expenses personally under the partnership agreement. This form is for partnerships to file their. Web other deductions or expenses that do not conform to the separate lines for deductions on the form 1065 partnership return are reported on line 20. Web other deductions (list below or attach schedule) a. Attach a statement listing by type. Other deductions, for an individual return in intuit. Web other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s. Web irs form 1065 is officially known as the us return of partnership income. The amounts shown in boxes 1 through 21 reflect your share of income,.Form 1065 Line 20 Other Deductions Worksheet

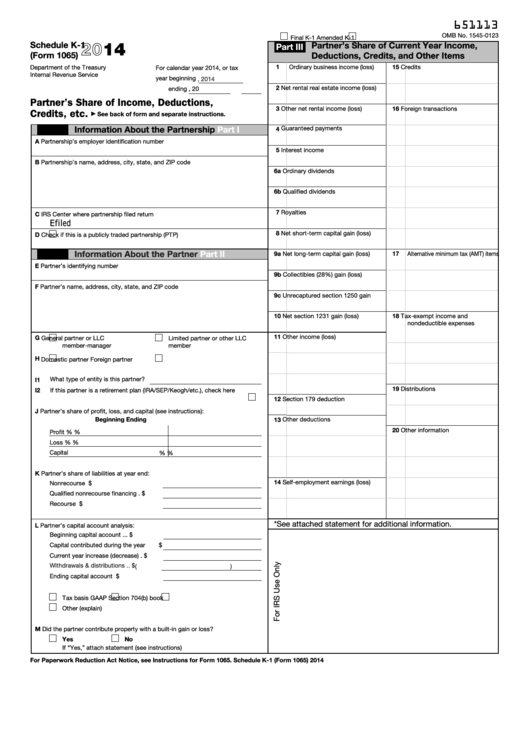

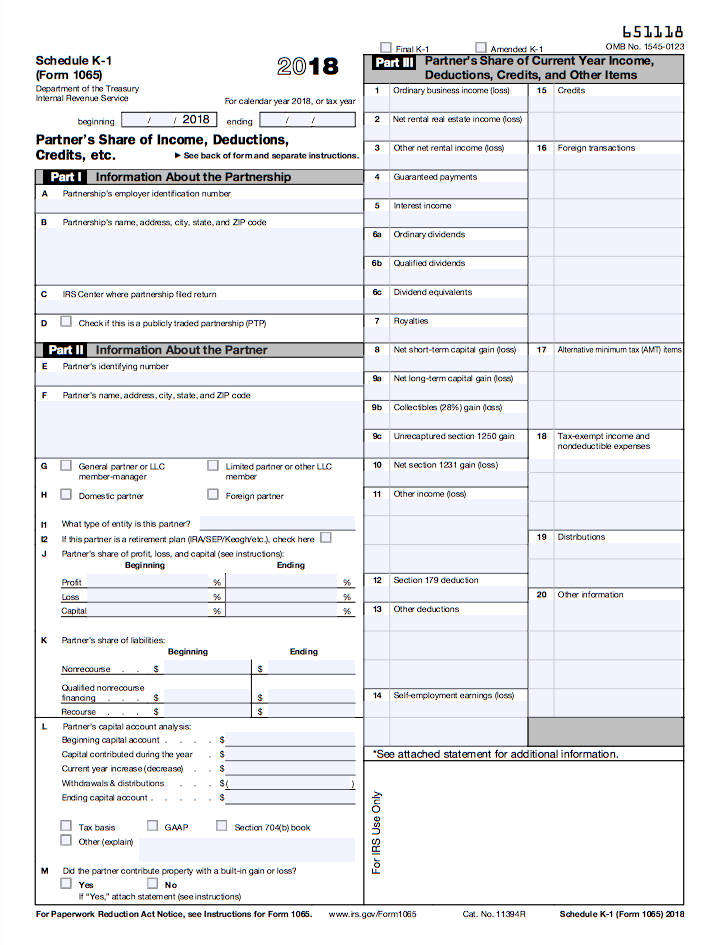

IRS Form 1065 Schedule K1 2018 Fill Out, Sign Online and Download

form 1065 line 20 other deductions worksheet

How To Complete Form 1065 With Instructions

IRS releases drafts of the new Form 1065, Schedule K1 Accounting Today

Get a copy of 1065 tax transcript opmrestaurant

U.S Tax Return for Partnership , Form 1065 Meru Accounting

How to Prepare Form 1065 in 8 Steps [+ Free Checklist]

Form 1065 Line 20 Other Deductions Worksheet

Form 1065 Line 20 Other Deductions Worksheet

Related Post:

![How to Prepare Form 1065 in 8 Steps [+ Free Checklist]](https://fitsmallbusiness.com/wp-content/uploads/2019/02/form-1065-income-and-expenses-section.png)