What Is Tax Form 8862

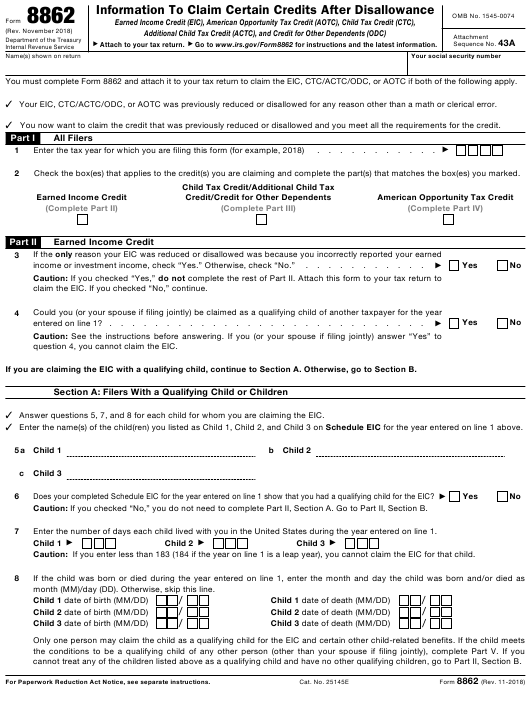

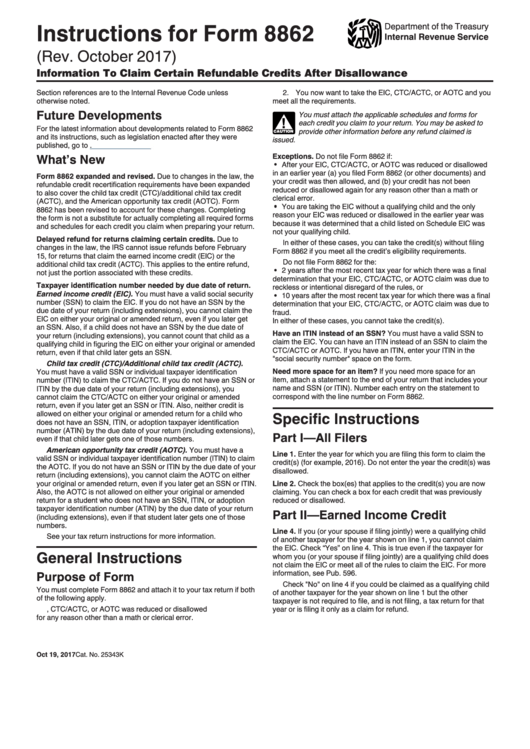

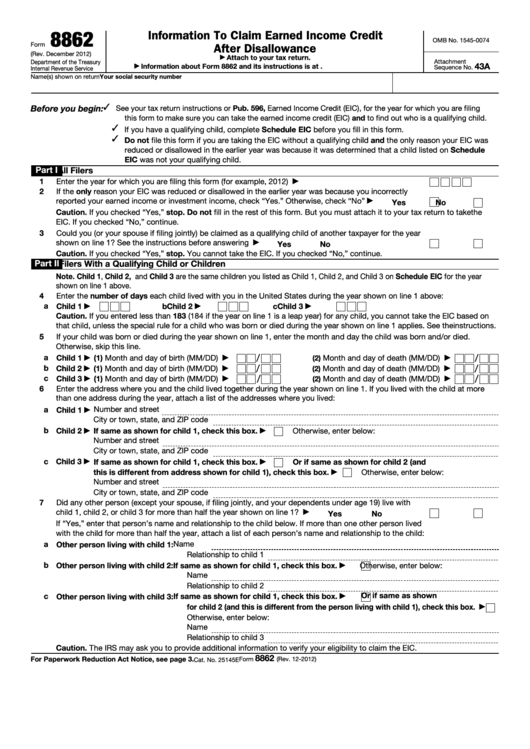

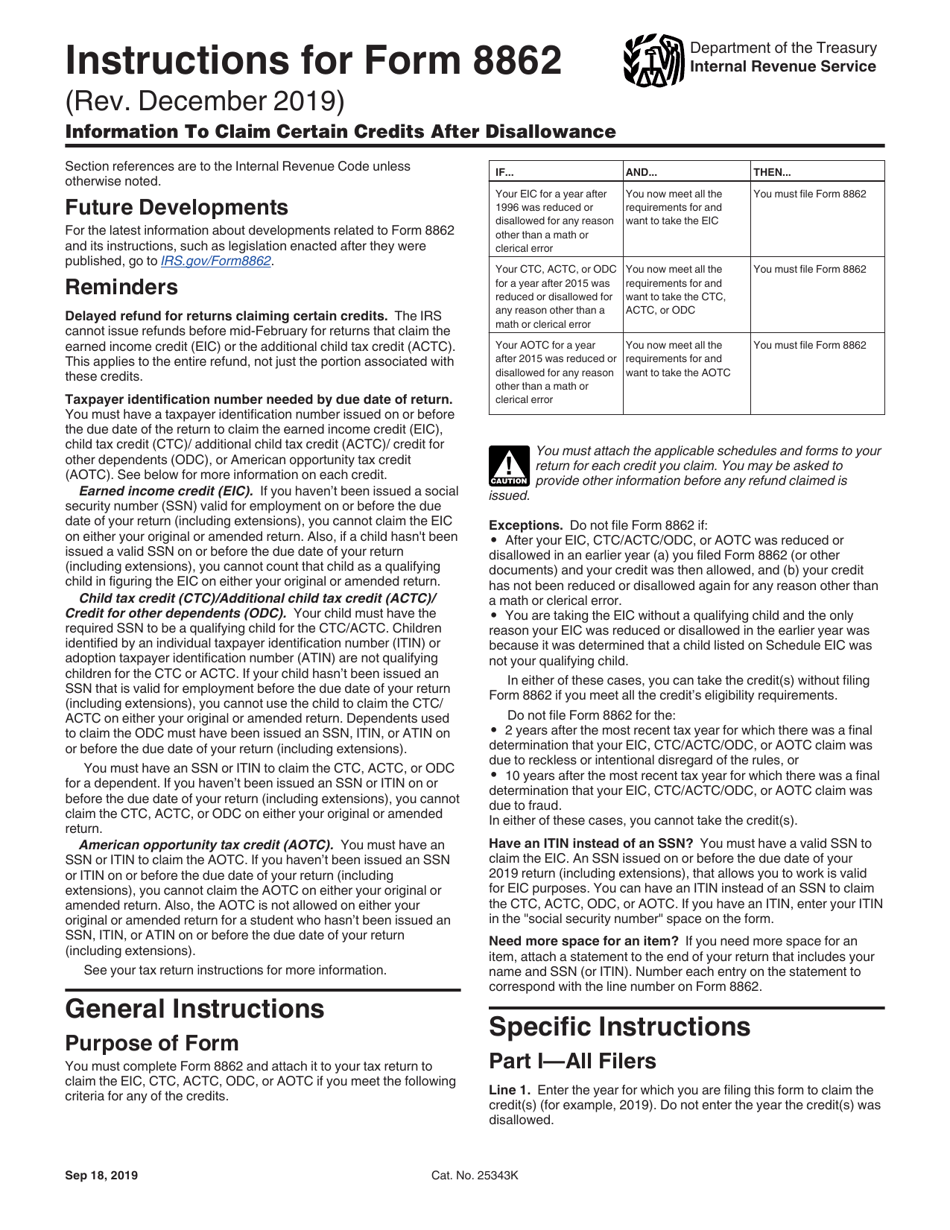

What Is Tax Form 8862 - Information to claim certain credits after disallowance. If your earned income credit (eic) was disallowed or reduced for something other than a math or. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Web if you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Web you can find tax form 8862 on the irs website. Web information to claim certain credits after disallowance. Web form 8862 is a federal individual income tax form. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Web generating individual form 8862 for earned income credit (eic) after disallowance in proconnect. Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after. If you file your taxes online, your online tax software will fill it out for you when you indicate you were previously disallowed to claim. Edit, sign and save irs 8862 form. Web then enter the relationship of each person to the child on the appropriate line. From within your taxact return (desktop), click. You must complete form 8862 and. How do i enter form 8862? From within your taxact return (desktop), click. Web if you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. December 2022) department of the treasury internal revenue service. Web form 8862 is the form the irs requires to be filed when the. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of. Edit, sign and save irs 8862 form. From within your taxact return (desktop), click. Web then enter the relationship of each person to the child on the appropriate line.. Web then enter the relationship of each person to the child on the appropriate line. Taxpayers complete form 8862 and attach it to their tax return if: If your earned income credit (eic) was disallowed or reduced for something other than a math or. Web form 8862 information to claim certain credits after disallowance is used to claim the earned. If your return was rejected because you need. If no one else (other than your spouse and dependents you claim on your income tax. You can generate form 8862, information to claim certain. Who needs to file form 8862?. Click delete, then click ok to confirm. How do i enter form 8862? Turbotax can help you fill out your. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced. Click delete, then click ok to confirm. Web form 8862 is required to be filed with a taxpayer’s tax return if in. If no one else (other than your spouse and dependents you claim on your income tax. Web more about the federal form 8862 tax credit. Who needs to file form 8862?. From within your taxact return (desktop), click. Web if you are filing form 8862 because you received an irs letter, you should send it to the address listed in. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced. Web information to claim certain credits after disallowance. Ad outgrow.us has been visited by 10k+ users in the past month This form is for income. If your return was rejected because you need. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of. Turbotax can help you fill out your. December 2021) department of the treasury internal revenue service. If you file your taxes online, your online tax software will fill it. From within your taxact return (desktop), click. Ad download or email irs 8862 & more fillable forms, register and subscribe now! If your return was rejected because you need. Web you can find tax form 8862 on the irs website. We last updated federal form 8862 in december 2022 from the federal internal revenue service. You must complete form 8862 and attach it to your tax return to claim the eic, ctc/actc/odc, or aotc if both of the. Turbotax can help you fill out your. Taxpayers complete form 8862 and attach it to their tax return if: Web information to claim certain credits after disallowance. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of. How do i enter form 8862? Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced. If your return was rejected because you need. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Click delete, then click ok to confirm. Web table of contents. Web then enter the relationship of each person to the child on the appropriate line. Common reasons why the eitc or the actc may be disallowed and how to avoid them. December 2022) department of the treasury internal revenue service. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Who needs to file form 8862?. Send filled & signed form or save. This form is for income. If you file your taxes online, your online tax software will fill it out for you when you indicate you were previously disallowed to claim. Ad download or email irs 8862 & more fillable forms, register and subscribe now!Printable Irs Form 8862 Printable Form 2021

Form 8867 Fill out & sign online DocHub

Form 8862 For 2019 PERINGKAT

Top 14 Form 8862 Templates free to download in PDF format

Instructions for IRS Form 8862 Information To Claim Certain Credits

Fillable Form 8862 Information To Claim Earned Credit After

8862 Tax Form Fill and Sign Printable Template Online US Legal Forms

Form 8862Information to Claim Earned Credit for Disallowance

Form 8862 Information to Claim Earned Credit After

Download Instructions for IRS Form 8862 Information to Claim Certain

Related Post: