Irs B Notice Form

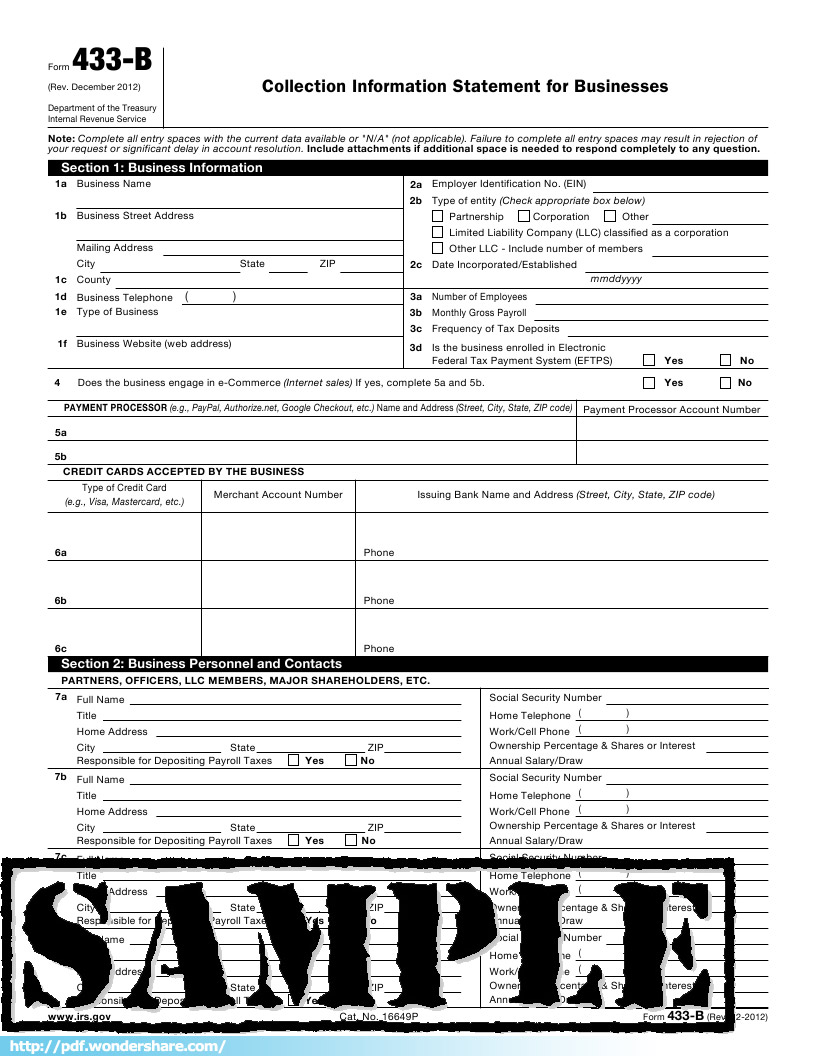

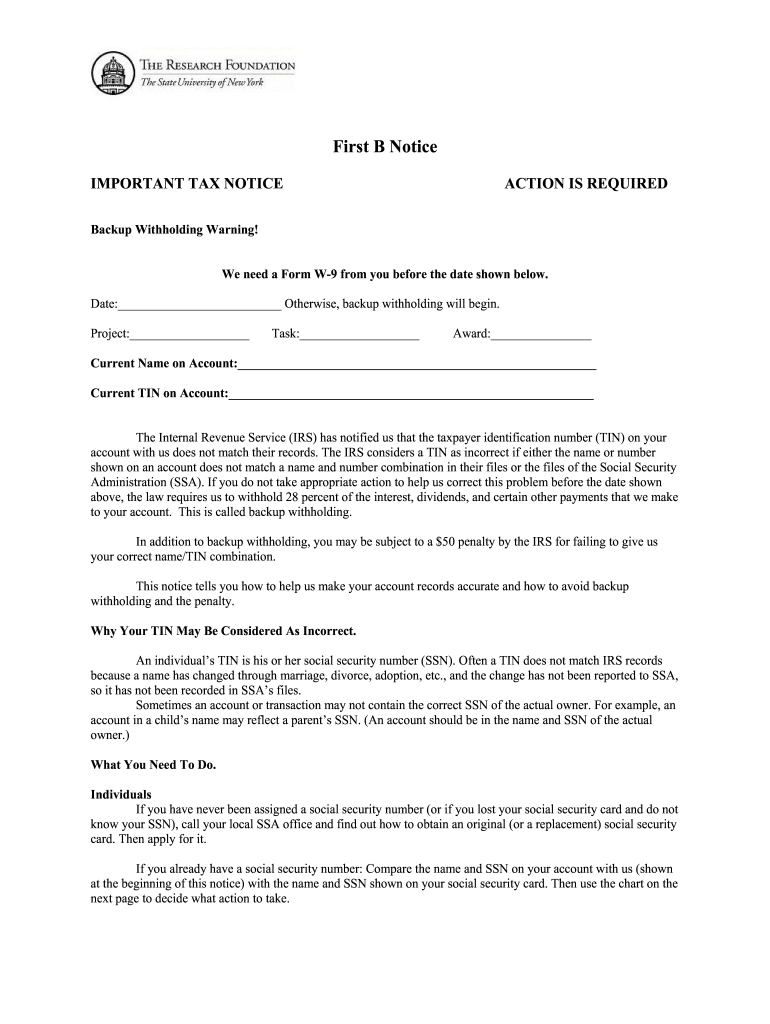

Irs B Notice Form - Web first b notice important tax notice action is required backup withholding warning! When the payer does not act on the immediate citations flagged by the irs or when the number of forms in which an incorrect tin was reported exceeds 50, the federal agency will proceed to issue a tin discrepancy notice. Report all your backup withholding on form 945, annual return of withheld federal income tax. Identify which irs notice you received. Web published october 13, 2012 · updated may 11, 2021. Web a broker or barter exchange must file this form for each person: A taxpayer identification number (tin) can be a: Estimate how much you could potentially save in just a matter of minutes. For whom the broker has sold (including short sales) stocks, commodities, regulated futures contracts, foreign currency contracts (pursuant to a forward contract or. 17, 2023 — as part of larger transformation efforts underway, the internal revenue service announced today key details about the direct file pilot for the 2024 filing season with several states planning to join the innovative effort. Web a “b” notice is a backup withholding notice. The irs will send you a cp2100 notice or a cp2100a notice if your tax documents contain missing tins or incorrect name/tin combinations. Web schedule b (form 1040) 2022 interest and ordinary dividends department of the treasury internal revenue service go to. Web prepare for your appointment. Web the irmaa is. Important ta x notice action is required backup withholding warning! For whom the broker has sold (including short sales) stocks, commodities, regulated futures contracts, foreign currency contracts (pursuant to a forward contract or. We help you understand and meet your federal tax responsibilities. Find irs forms and answers to tax questions. Read the latest irs tweets. Estimate how much you could potentially save in just a matter of minutes. Web a broker or barter exchange must file this form for each person: For paperwork reduction act notice, see your tax return instructions. For whom, they sold stocks, commodities, regulated futures contracts, foreign currency contracts, forward contracts, debt instruments, options, securities futures contracts, etc., for cash, who. Report all your backup withholding on form 945, annual return of withheld federal income tax. Estimate how much you could potentially save in just a matter of minutes. For whom the broker has sold (including short sales) stocks, commodities, regulated futures contracts, foreign currency contracts (pursuant to a forward contract or. Web prepare for your appointment. Failure to comply and. Search for your notice or letter to learn what it means and what you should do Failure to comply and rectify the 1099 filing can result in withholdings, penalties, or audits. Web a “b” notice is a backup withholding notice. Identify which irs notice you received. Report all your backup withholding on form 945, annual return of withheld federal income. Web this revenue procedure also provides rules for the form and content of the notification from the social security administration (ssa) or from the irs which must be received by a payor in order to prevent backup withholding from beginning, or to stop it. If not, the form is available online for you to complete and provide to them. Backup. Bring these items with you: 17, 2023 — as part of larger transformation efforts underway, the internal revenue service announced today key details about the direct file pilot for the 2024 filing season with several states planning to join the innovative effort. Web these notices are commonly referred to as “b” notices and are generally issued to payers who in. Pay the lowest amount of taxes possible with strategic planning and preparation Estimate how much you could potentially save in just a matter of minutes. Follow @irsnews on twitter for the latest news and announcements. Ad save time and money with professional tax planning & preparation services. Web did you receive an irs notice or letter? Web this revenue procedure also provides rules for the form and content of the notification from the social security administration (ssa) or from the irs which must be received by a payor in order to prevent backup withholding from beginning, or to stop it. Web also known as an irs b notice, the irs notifies the 1099 filer that a. Web prepare for your appointment. A cp2100/2100a notice is sent to taxpayers that. We help you understand and meet your federal tax responsibilities. To learn more about form 945, including the deposit requirements, download the. Backup withholding will begin on account number current name on account current tin on. For whom the broker has sold (including short sales) stocks, commodities, regulated futures contracts, foreign currency contracts (pursuant to a forward contract or. We help you understand and meet your federal tax responsibilities. We mail these notices to your address of record. Web prepare for your appointment. These figures change annually with. Web first b notice important tax notice action is required backup withholding warning! For whom, they sold stocks, commodities, regulated futures contracts, foreign currency contracts, forward contracts, debt instruments, options, securities futures contracts, etc., for cash, who received cash,. A taxpayer identification number (tin) can be a: Web did you receive an irs notice or letter? Important ta x notice action is required backup withholding warning! Web access irs forms, instructions and publications in electronic and print media. Read the latest irs tweets. Call to schedule your appointment ahead of time. Web check that your mailing address is correct and up to date with us, so you’ll receive your cp2100 or cp 2100a notice. Pay the lowest amount of taxes possible with strategic planning and preparation Identify which irs notice you received. Find irs forms and answers to tax questions. Web schedule b (form 1040) 2022 interest and ordinary dividends department of the treasury internal revenue service go to. Ad save time and money with professional tax planning & preparation services. Web the irmaa is calculated on a sliding scale with five income brackets topping out at $500,000 and $750,000 for individual and joint filing, respectively.Printable First B Notice Form Template Sample Tacitproject

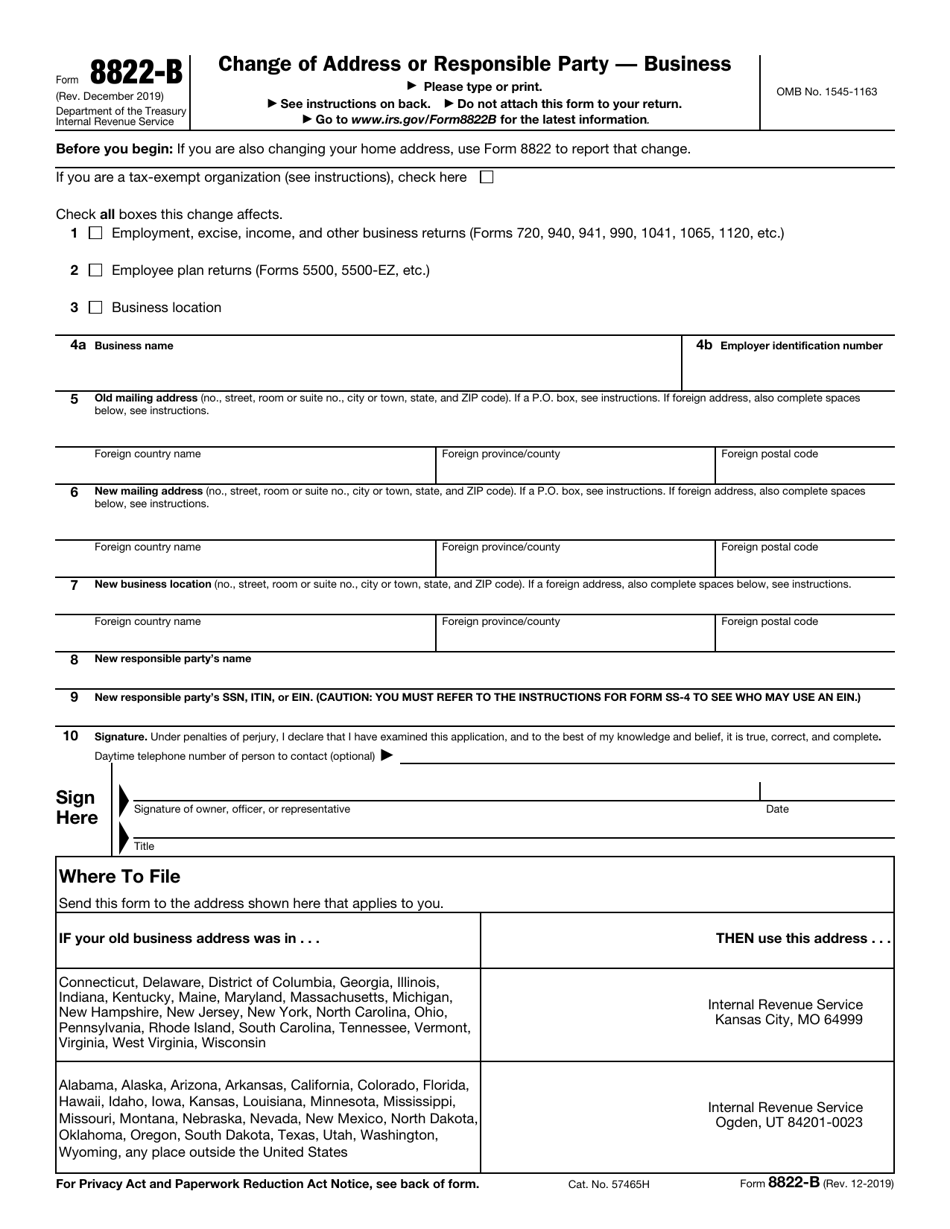

IRS Form 8822B Fill Out, Sign Online and Download Fillable PDF

B Notice Irs Fill Online, Printable, Fillable, Blank pdfFiller

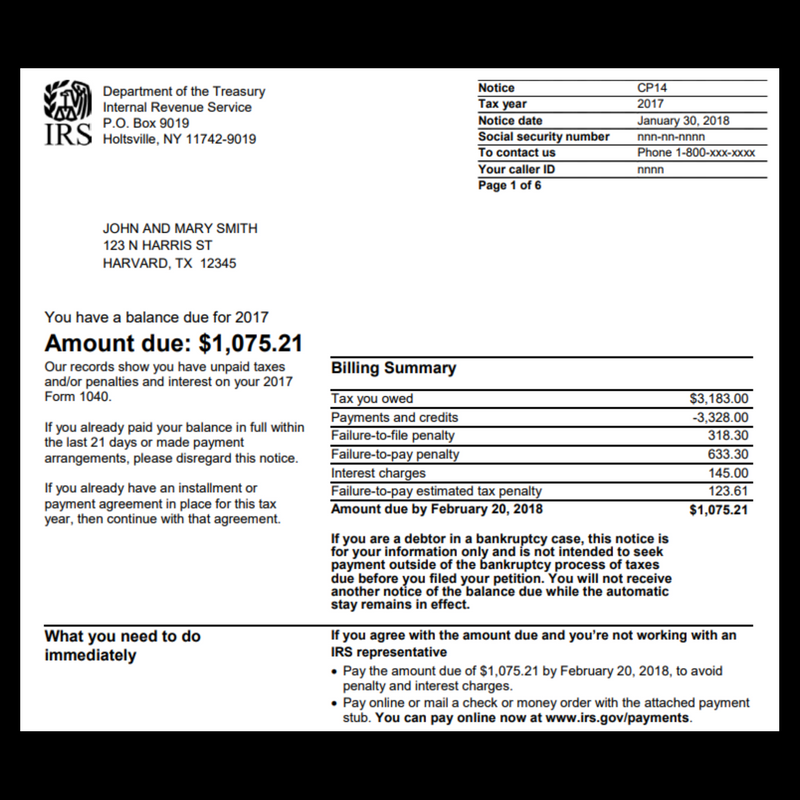

Balance Due Three Steps to Addressing IRS Tax Notice CP14

Who Needs to Fill out IRS Form Schedule B?

Irs B Notice Template

Irs First B Notice Template Tacitproject

Irs B Notice Template

Printable First B Notice Template Printable Templates

B Notice Form Fill Out and Sign Printable PDF Template signNow

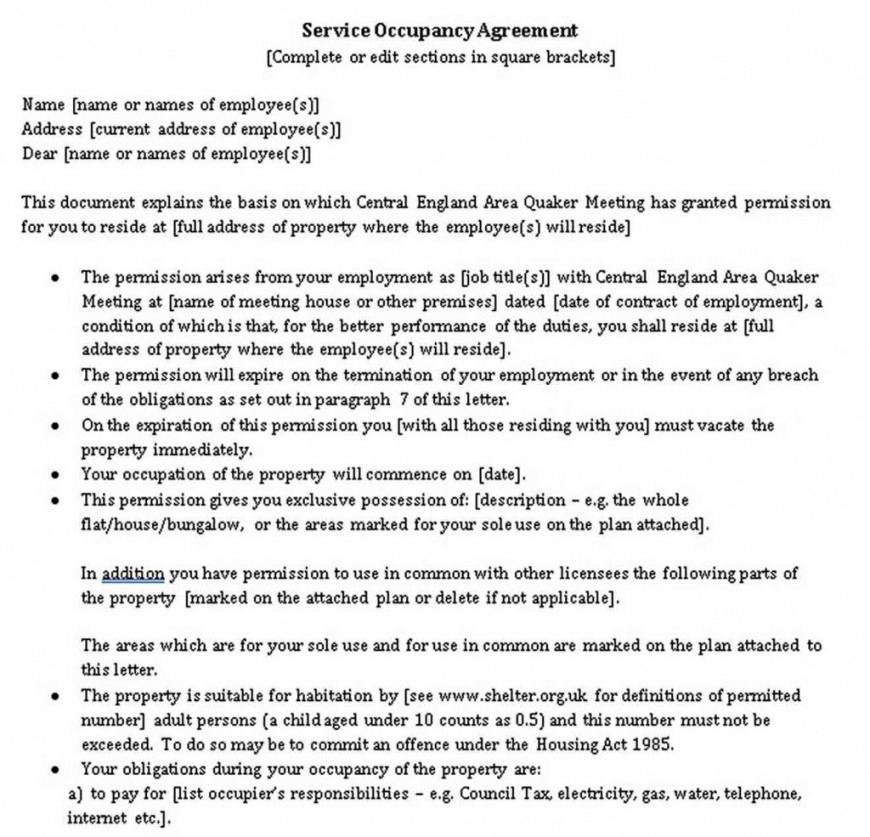

Related Post:

:max_bytes(150000):strip_icc()/ScheduleB-InterestandOrdinaryDividends-c6ff80bf2c1f4de981e0b0625a4e3dc7.png)