Oklahoma Form 512

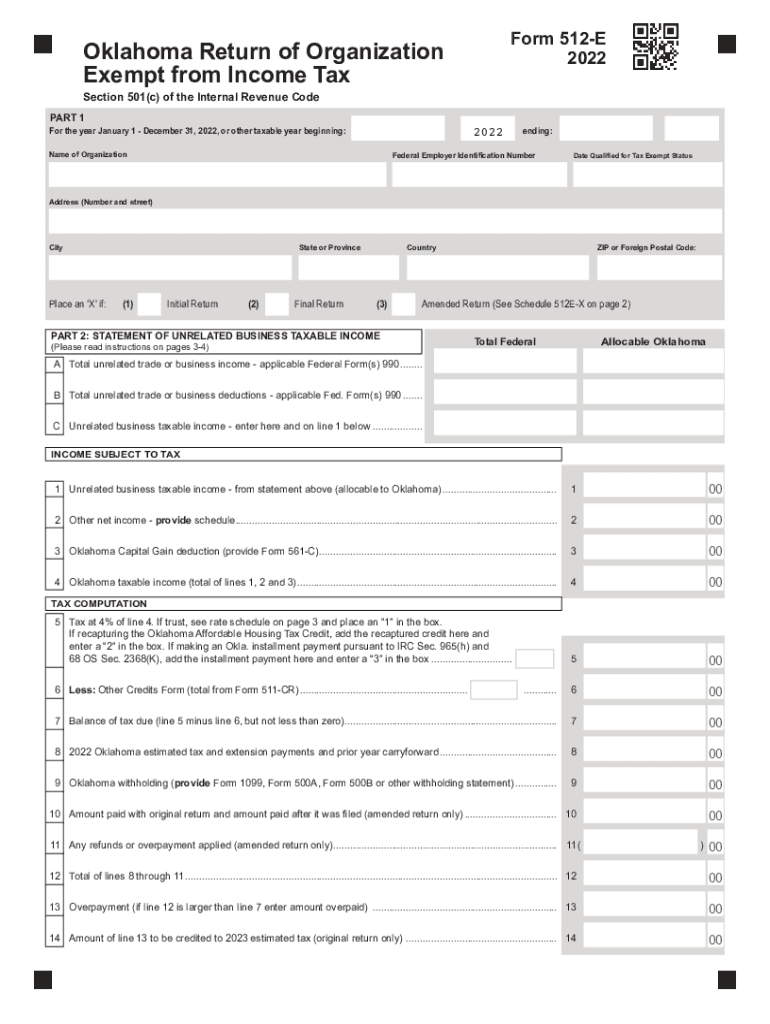

Oklahoma Form 512 - Corporation income and franchise tax return. Web if your federal return is not extended, or an oklahoma liability is owed, an extension of time to file your oklahoma return may be granted on form 504. For s corporations paying the tax on behalf of nonresident shareholders, the nonresident. Investment income of exempt organizations subject to federal excise tax is not subject to. Mail your return to the. Web federal employer identification number. • instructions for completing form 512 • 512 corporation income and. Web 2021 oklahoma corporation income and franchise tax forms and instructions. If this is a final return, place an ‘x’ here: Corporation income and franchise tax return. Oklahoma to allow filing of a combined franchise and corporate income tax return, once appropriate elections are made. Register and subscribe now to work on ok electronic filing form & more fillable forms. Mail your return to the. • instructions for completing the form 512 • 512. Web 2021 oklahoma corporation income and franchise tax forms and instructions. Current oklahoma registration is required, unless vehicle record owner is no longer an oklahoma resident and replacement title is to be mailed to another state. • instructions for completing the form 512 • 512. Mail your return to the. Ad uslegalforms.com has been visited by 100k+ users in the past month If this is a final return, place an ‘x’. Oklahoma to allow filing of a combined franchise and corporate income tax return, once appropriate elections are made. Complete, edit or print tax forms instantly. Web federal employer identification number. Web form 512e is an oklahoma corporate income tax form. Investment income of exempt organizations subject to federal excise tax is not subject to. Current oklahoma registration is required, unless vehicle record owner is no longer an oklahoma resident and replacement title is to be mailed to another state. If this is a final return, place an ‘x’ here: • instructions for completing form 512 • 512 corporation income and. Oklahoma to allow filing of a combined franchise and corporate income tax return, once. Web if your federal return is not extended, or an oklahoma liability is owed, an extension of time to file your oklahoma return may be granted on form 504. Web 2021 oklahoma corporation income and franchise tax forms and instructions. • instructions for completing form 512 • 512 corporation income and. Corporation income and franchise tax return. Investment income of. Register and subscribe now to work on ok electronic filing form & more fillable forms. Corporation income and franchise tax return. Web form 512e is an oklahoma corporate income tax form. • instructions for completing the form 512 • 512. Web 2021 oklahoma corporation income and franchise tax forms and instructions. Web 2021 oklahoma corporation income and franchise tax forms and instructions. For s corporations paying the tax on behalf of nonresident shareholders, the nonresident. If this is a final return, place an ‘x’ here: Web federal employer identification number. Investment income of exempt organizations subject to federal excise tax is not subject to. What’s new in the 2013 oklahoma packet? Ad uslegalforms.com has been visited by 100k+ users in the past month Web 2021 oklahoma corporation income and franchise tax forms and instructions. Enter the information for each corporation included in the consolidated return on a separate line. Web form 512e is an oklahoma corporate income tax form. If this is a final return, place an ‘x’ here: Register and subscribe now to work on ok electronic filing form & more fillable forms. Oklahoma to allow filing of a combined franchise and corporate income tax return, once appropriate elections are made. • instructions for completing the form 512 • 512. Web 2021 oklahoma corporation income and franchise tax. If this is a final return, place an ‘x’ here: Register and subscribe now to work on ok electronic filing form & more fillable forms. Web exempt organizations are subject to tax on unrelated business income. Current oklahoma registration is required, unless vehicle record owner is no longer an oklahoma resident and replacement title is to be mailed to another. Web exempt organizations are subject to tax on unrelated business income. Web form 512e is an oklahoma corporate income tax form. Mail your return to the. Enter the information for each corporation included in the consolidated return on a separate line. Oklahoma to allow filing of a combined franchise and corporate income tax return, once appropriate elections are made. • instructions for completing the form 512 • 512. Web 2021 oklahoma corporation income and franchise tax forms and instructions. If this is a final return, place an ‘x’ here: For s corporations paying the tax on behalf of nonresident shareholders, the nonresident. Corporation income and franchise tax return. Current oklahoma registration is required, unless vehicle record owner is no longer an oklahoma resident and replacement title is to be mailed to another state. Complete, edit or print tax forms instantly. Corporation income and franchise tax return. What’s new in the 2013 oklahoma packet? • instructions for completing form 512 • 512 corporation income and. Investment income of exempt organizations subject to federal excise tax is not subject to. Register and subscribe now to work on ok electronic filing form & more fillable forms. Web if your federal return is not extended, or an oklahoma liability is owed, an extension of time to file your oklahoma return may be granted on form 504. Ad uslegalforms.com has been visited by 100k+ users in the past month Web federal employer identification number.Fill Free fillable 2021 Form 512 Oklahoma Corporation And

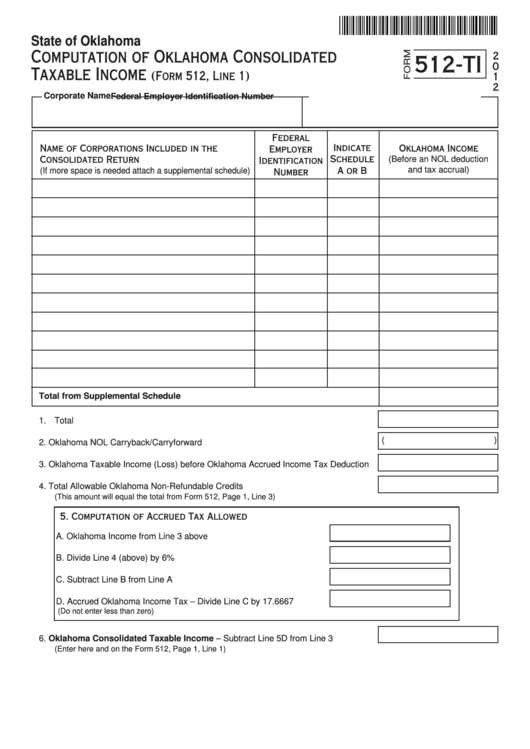

Fillable Form 512Ti Computation Of Oklahoma Consolidated Taxable

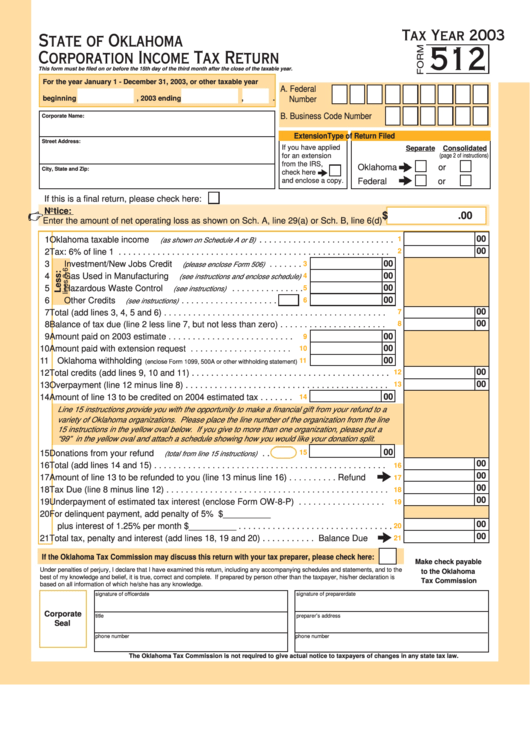

Fillable Form 512 Oklahoma Corporation Tax Return 2003

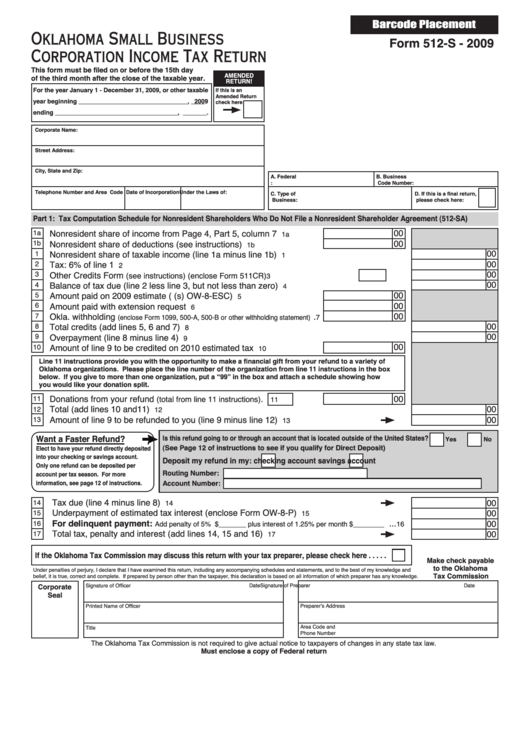

Form 512S Oklahoma Small Business Corporation Tax Return

Fill Free fillable 2021 Form 512 Oklahoma Corporation And

Fill Free fillable 2021 Form 512 Oklahoma Corporation And

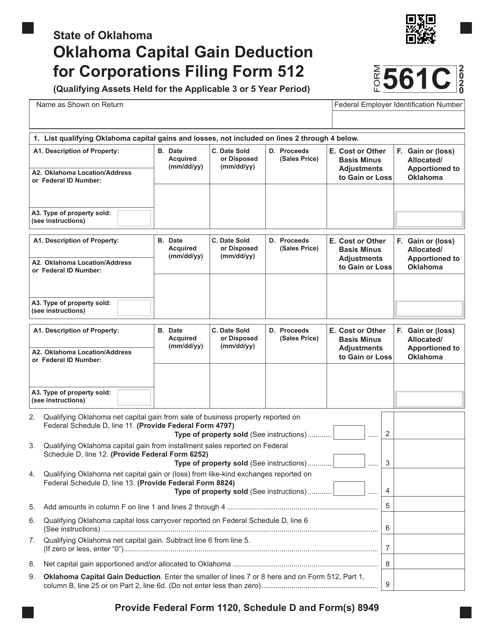

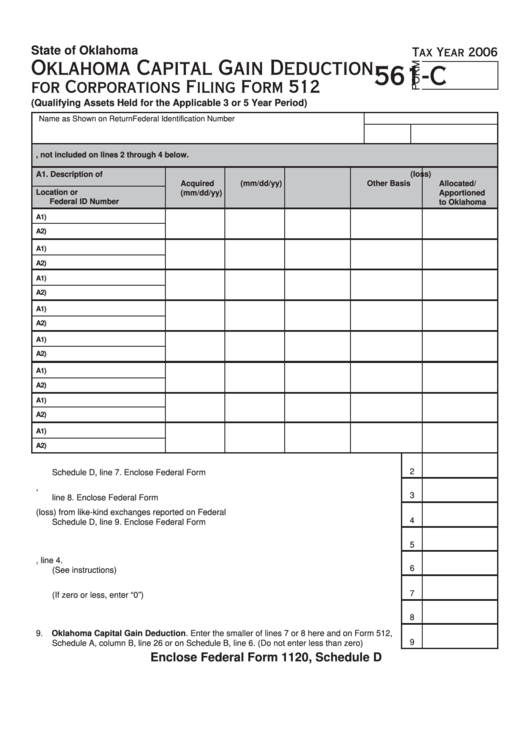

Form 561C Download Fillable PDF or Fill Online Oklahoma Capital Gain

Oklahoma Form 512 Instructions 2021 Fill Out and Sign Printable PDF

Fillable Form 561C Oklahoma Capital Gain Deduction For Corporations

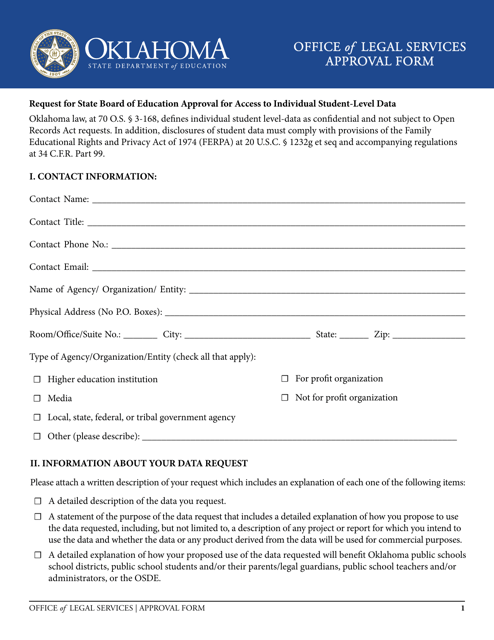

Oklahoma Approval Form Fill Out, Sign Online and Download PDF

Related Post: