Form 2210 Line D

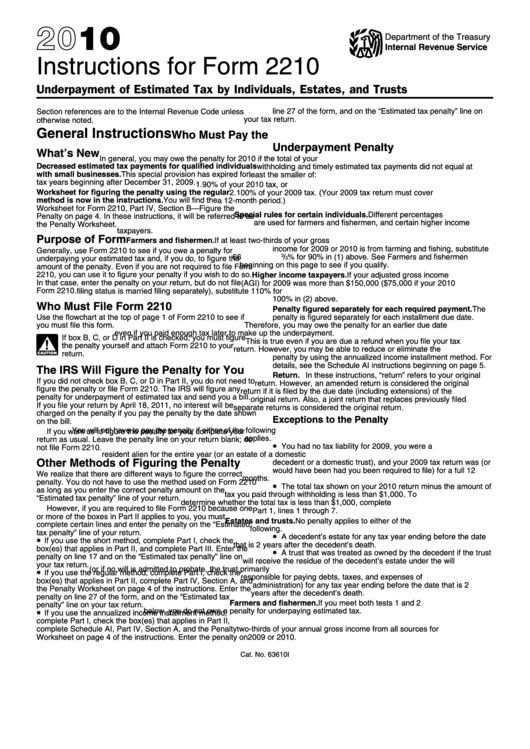

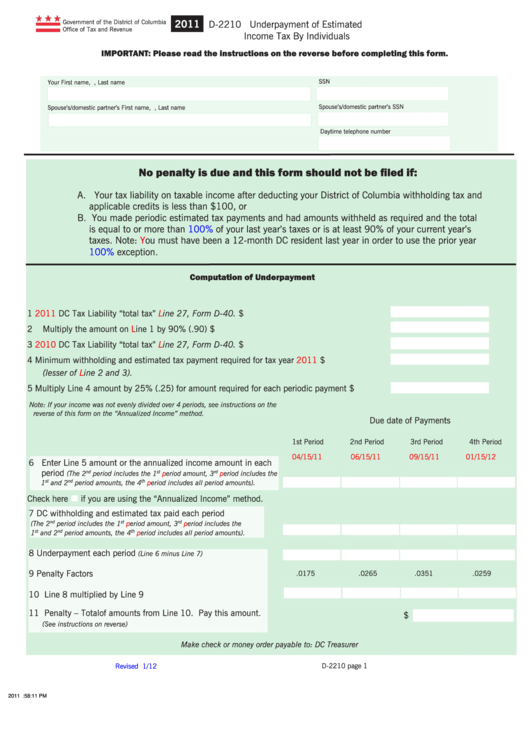

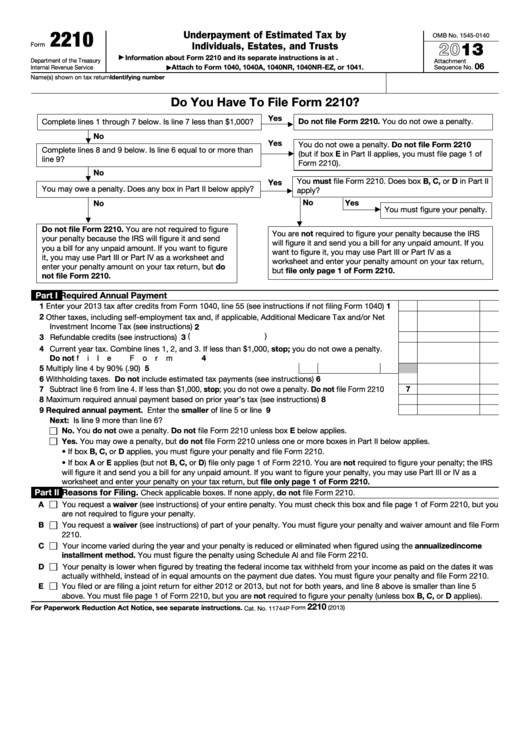

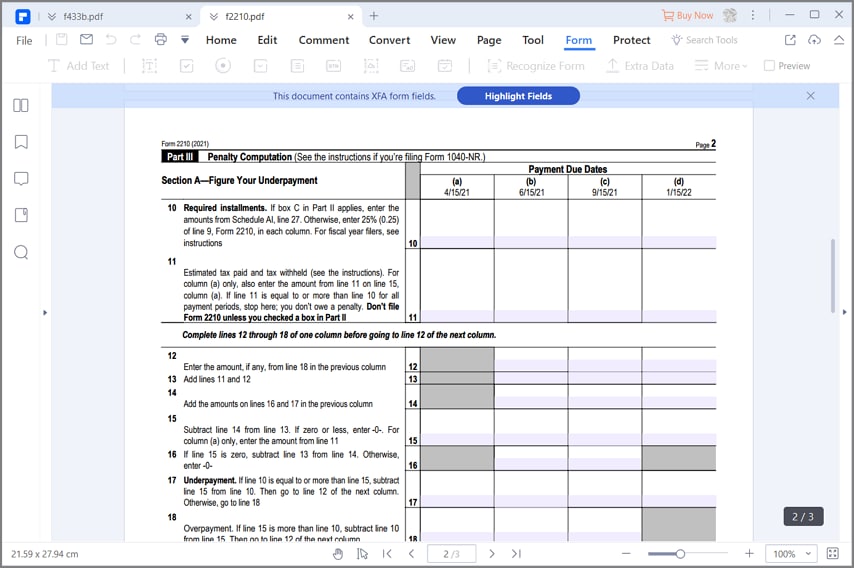

Form 2210 Line D - Get ready for tax season deadlines by completing any required tax forms today. Monday to friday, 9 am to 4 pm, except district holidays. Section references are to the internal revenue code unless otherwise noted. Complete, edit or print tax forms instantly. How do i complete form 2210? Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. File form 2210 unless one or more boxes in part ii below applies. Web get more help. Underpayment of estimated tax by individuals, estates, and trusts. Department of the treasury internal revenue service. Underpayment of estimated tax by individuals, estates, and trusts. Is line 4 or line 7 less than $1,000? Yes adon’t file form 2210. Underpayment of estimated tax by individuals, estates, and trusts. Web office of tax and revenue. Web there are some situations in which you must file form 2210, such as to request a waiver. Form 2210 underpayment of estimated tax, is used to calculate any penalties incurred due to underpayment of taxes over the. Monday to friday, 9 am to 4 pm, except district holidays. Web •you may also complete this form if you believe the. Web there are some situations in which you must file form 2210, such as to request a waiver. Get ready for tax season deadlines by completing any required tax forms today. Get access to the largest online library of legal forms for any state. Department of the treasury internal revenue service. Ad access irs tax forms. Monday to friday, 9 am to 4 pm, except district holidays. Web there are some situations in which you must file form 2210, such as to request a waiver. 1101 4th street, sw, suite 270 west,. Use the flowchart at the top of form 2210, page 1, to see if. Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Web do you have to file form 2210? 1101 4th street, sw, suite 270 west,. Underpayment of estimated tax by individuals, estates, and trusts. Web so line d is asking for the actual amounts withheld in those quarters, not your total withholding divided by 4. Web so line d is asking for the actual amounts withheld in those quarters, not your total withholding divided by 4. This is your 2021 tax, after credits from your tax return. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. You don’t owe. Section references are to the internal revenue code unless otherwise noted. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. Use the flowchart at the top of form 2210, page 1, to see if. Your income varies during. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. Is line 4 or line 7 less than $1,000? Web do you have to file form 2210? Web form 2210 is used to determine how much you owe in. Complete, edit or print tax forms instantly. Ask questions and learn more about your taxes and finances. If you want to start over, you might do this: Web file form 2210 unless box. Department of the treasury internal revenue service. Web file form 2210 unless box. How do i complete form 2210? Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. Yes adon’t file form 2210. Web there are some situations in which you must file form 2210,. Ask questions and learn more about your taxes and finances. Section references are to the internal revenue code unless otherwise noted. This form is for income earned in tax year 2022,. Use the flowchart at the top of form 2210, page 1, to see if. Web so line d is asking for the actual amounts withheld in those quarters, not your total withholding divided by 4. Web •you may also complete this form if you believe the underpayment interest assessed by otr for an underpayment of estimated income tax is incorrect. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Department of the treasury internal revenue service. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year. How do i complete form 2210? Department of the treasury internal revenue service. You don’t owe a penalty. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Get ready for tax season deadlines by completing any required tax forms today. Underpayment of estimated tax by individuals, estates, and trusts. If you want to start over, you might do this: Form 2210 underpayment of estimated tax, is used to calculate any penalties incurred due to underpayment of taxes over the. Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Web file form 2210 unless box.Instructions for Form 2210 (2022)Internal Revenue Service Fill out

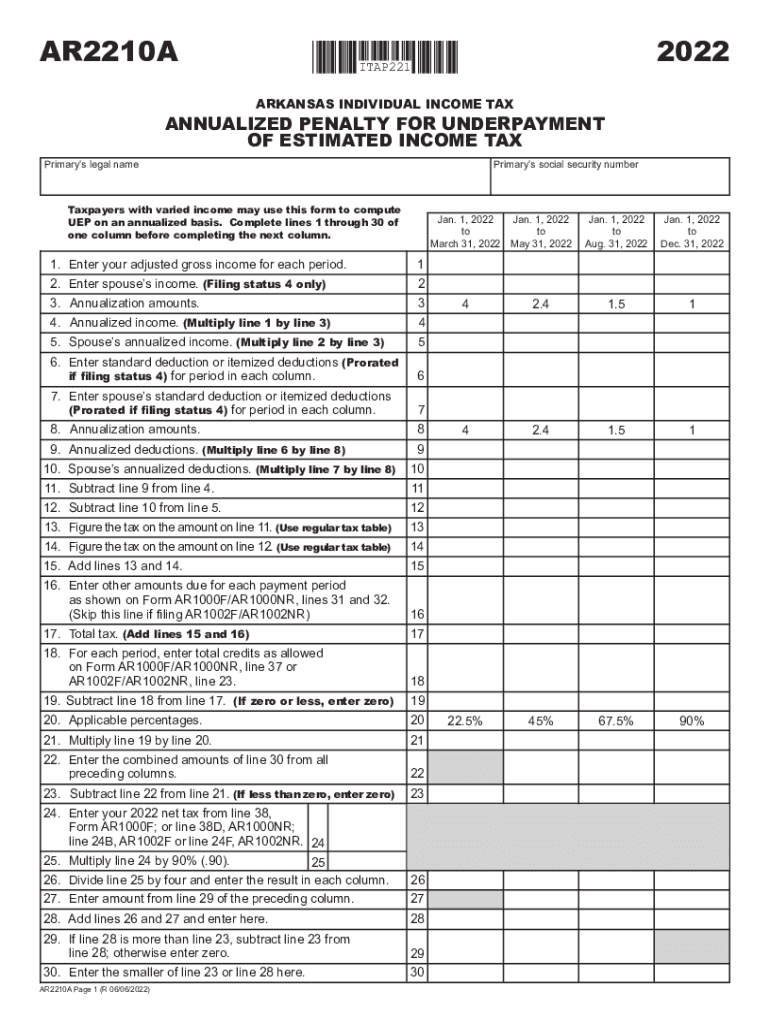

Instructions For Form 2210 Underpayment Of Estimated Tax By

Instructions For Form 2210 Underpayment Of Estimated Tax By

Form 2210 Fill out & sign online DocHub

Form D2210 Underpayment Of Estimated Tax By Individuals

Fillable Form 2210 Underpayment Of Estimated Tax By Individuals

Remplir le formulaire 2210 de l'IRS avec le meilleur remplisseur

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Form 2210 Edit, Fill, Sign Online Handypdf

IRS Form 2210 A Guide to Underpayment of Tax

Related Post: