Nys Form It-204-Ll

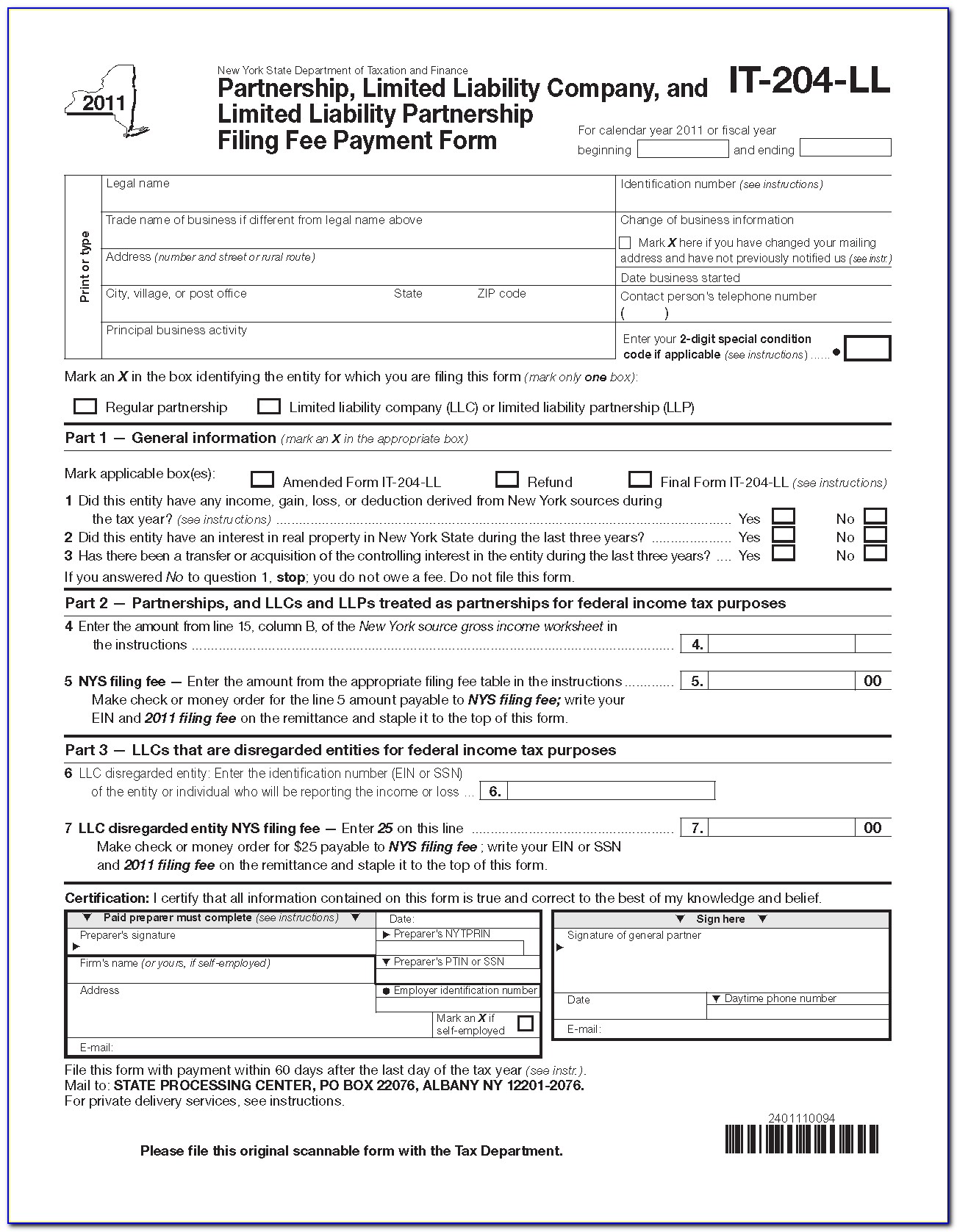

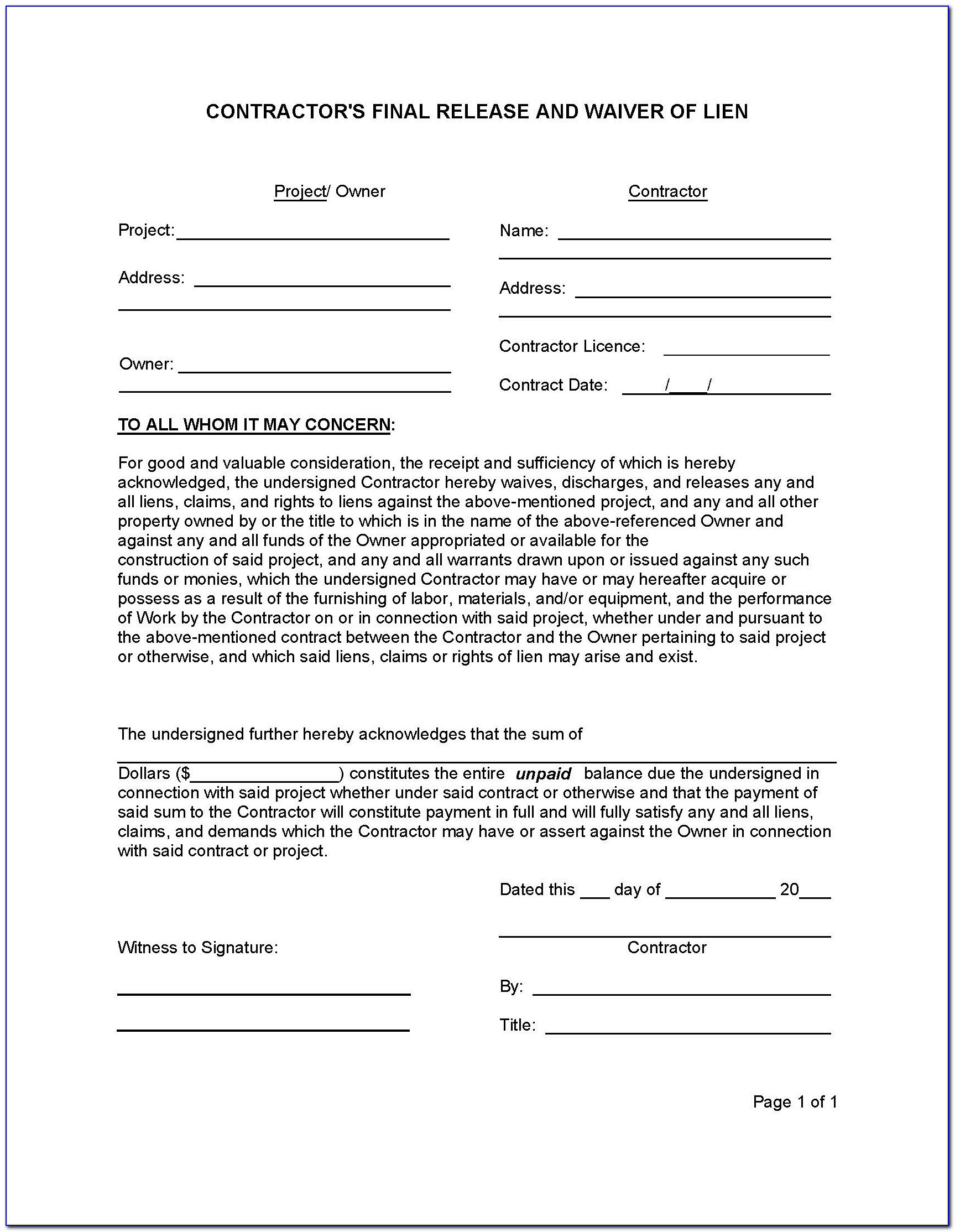

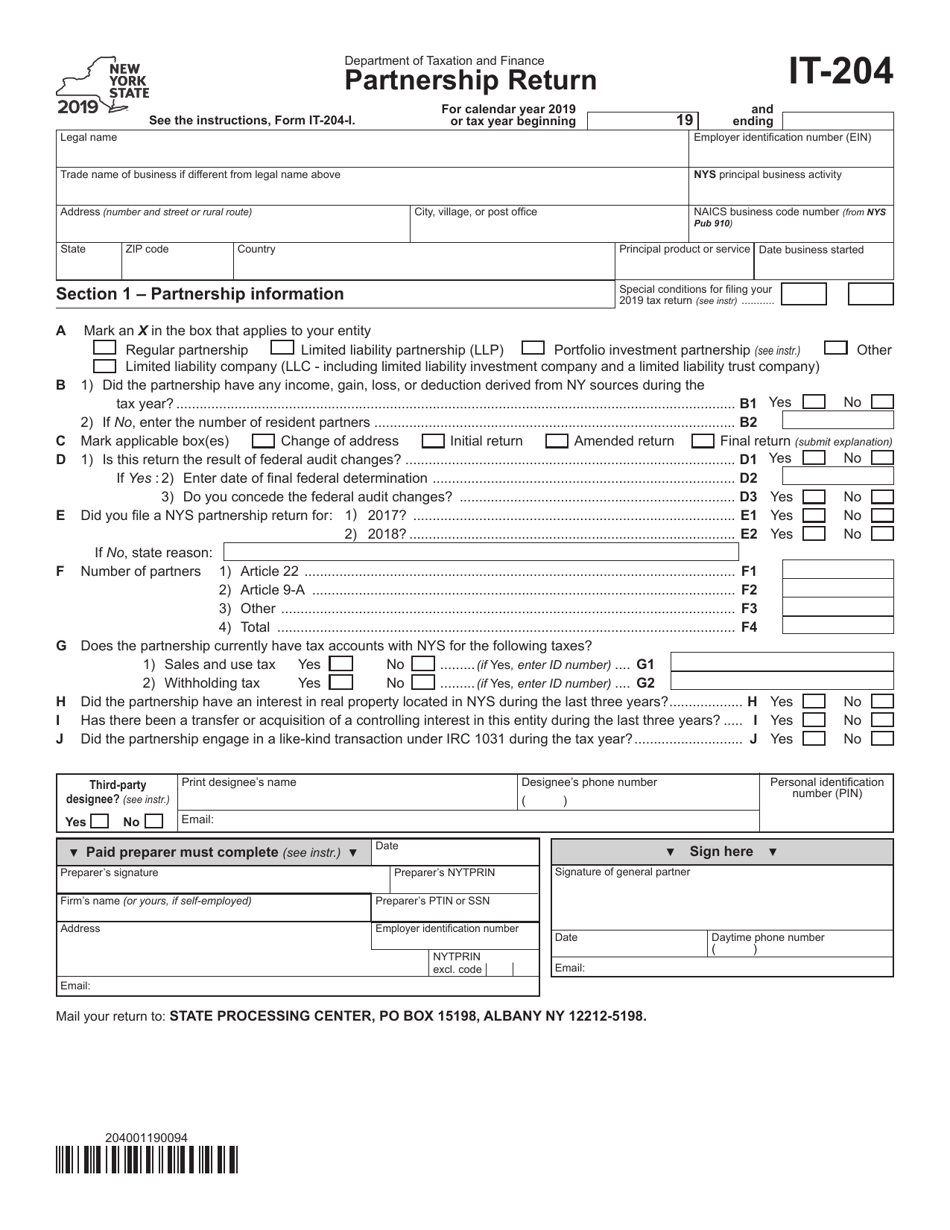

Nys Form It-204-Ll - Easily sign the form with your finger. New york requires every llc to file a biennial statement every two years with the new york department of state (dos). Try it for free now! A penalty of $500 may be imposed for furnishing false information that. Returns for calendar year 2022 are due march 15,. Try it for free now! Go to general > electronic filing. Web • you had new york adjusted gross income between $40,000 and $300,000. A penalty of $500 may be imposed for furnishing false information that. New york — partnership, limited liability company, and limited liability partnership filing fee payment form. From within your taxact return (online or desktop), click state.on. Open form follow the instructions. To fill it out, you need to. Returns for calendar year 2022 are due march 15,. • you had a new york state tax liability after credits of zero or greater (see worksheet). Upload, modify or create forms. Easily sign the form with your finger. Try it for free now! Open form follow the instructions. From within your taxact return ( online or desktop), click state, then. Go to general > electronic filing. Upload, modify or create forms. Try it for free now! Web • you had new york adjusted gross income between $40,000 and $300,000. Upload, modify or create forms. Easily sign the form with your finger. Web gross income and new york additions to income is more than your new york standard deduction. Web gross income and new york additions to income is more than your new york standard deduction. You can file your statement online using the. Upload, modify or create forms. Web gross income and new york additions to income is more than your new york standard deduction. Web • you had new york adjusted gross income between $40,000 and $300,000. A penalty of $500 may be imposed for furnishing false information that. To fill it out, you need to. Upload, modify or create forms. Easily sign the form with your finger. Web • you had new york adjusted gross income between $40,000 and $300,000. New york requires every llc to file a biennial statement every two years with the new york department of state (dos). A penalty of $500 may be imposed for furnishing false information that. New york — partnership, limited liability company,. Try it for free now! From within your taxact return ( online or desktop), click state, then. You can file your statement online using the. Upload, modify or create forms. • you had a new york state tax liability after credits of zero or greater (see worksheet). Web • you had new york adjusted gross income between $40,000 and $300,000. Go to general > electronic filing. To fill it out, you need to. New york — partnership, limited liability company, and limited liability partnership filing fee payment form. From within your taxact return (online or desktop), click state.on. Web 19 rows partnership return; A penalty of $500 may be imposed for furnishing false information that. Web gross income and new york additions to income is more than your new york standard deduction. New york requires every llc to file a biennial statement every two years with the new york department of state (dos). Upload, modify or create forms. Try it for free now! New york — partnership, limited liability company, and limited liability partnership filing fee payment form. Partnership return and related forms. Upload, modify or create forms. Easily sign the form with your finger. Web gross income and new york additions to income is more than your new york standard deduction. Upload, modify or create forms. You can file your statement online using the. Go to general > electronic filing. From within your taxact return ( online or desktop), click state, then. Try it for free now! From within your taxact return (online or desktop), click state.on. A penalty of $500 may be imposed for furnishing false information that. Upload, modify or create forms. Partnership return and related forms. Returns for calendar year 2022 are due march 15,. Web 19 rows partnership return; New york — partnership, limited liability company, and limited liability partnership filing fee payment form. Web gross income and new york additions to income is more than your new york standard deduction. • you had a new york state tax liability after credits of zero or greater (see worksheet). Web • you had new york adjusted gross income between $40,000 and $300,000. Open form follow the instructions. Easily sign the form with your finger. Try it for free now! To fill it out, you need to.NY IT204LL 20152021 Fill and Sign Printable Template Online US

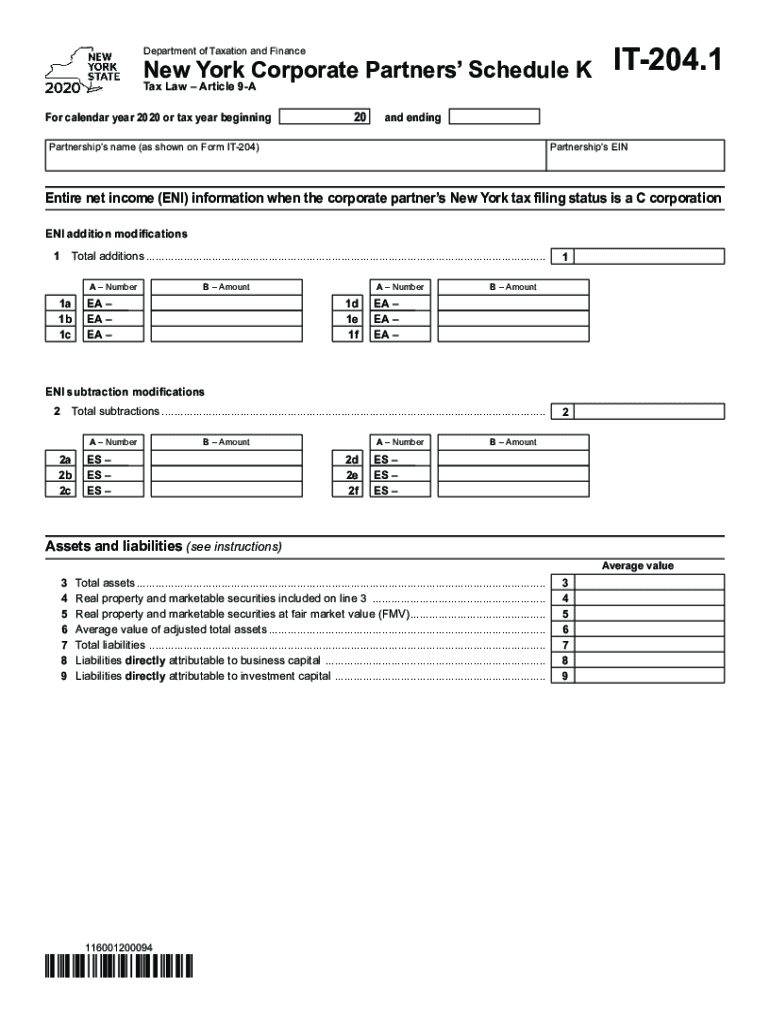

Form it 204 1 New York Corporate Partners Schedule K Tax Year Fill

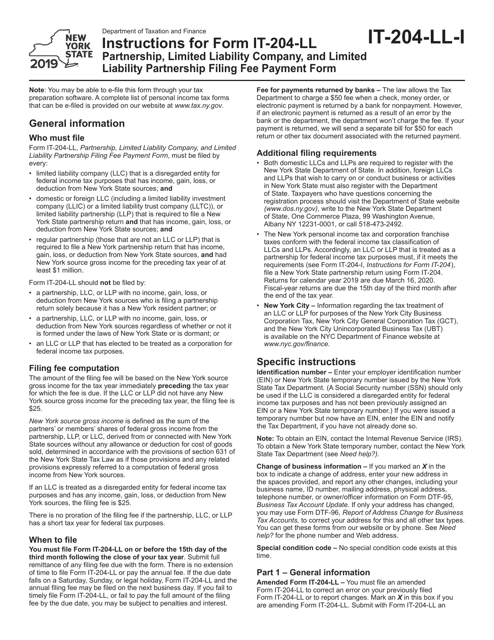

Download Instructions for Form IT204LL Partnership, Limited Liability

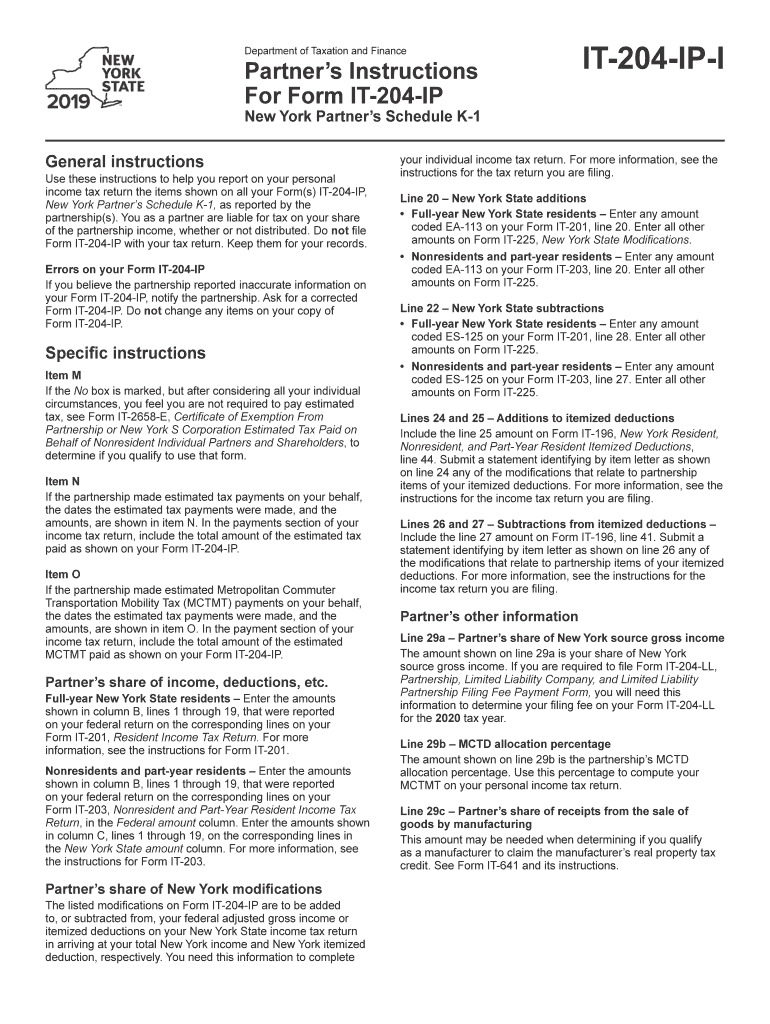

2019 Form NY IT204IPI Fill Online, Printable, Fillable, Blank

2021 Form NY IT204CP Fill Online, Printable, Fillable, Blank pdfFiller

New York Llc Form It 204 Ll Form Resume Examples GwkQZrMDWV

New York Llc Form It 204 Ll Form Resume Examples GwkQZrMDWV

New York Llc Form It 204 Ll Form Resume Examples GwkQZrMDWV

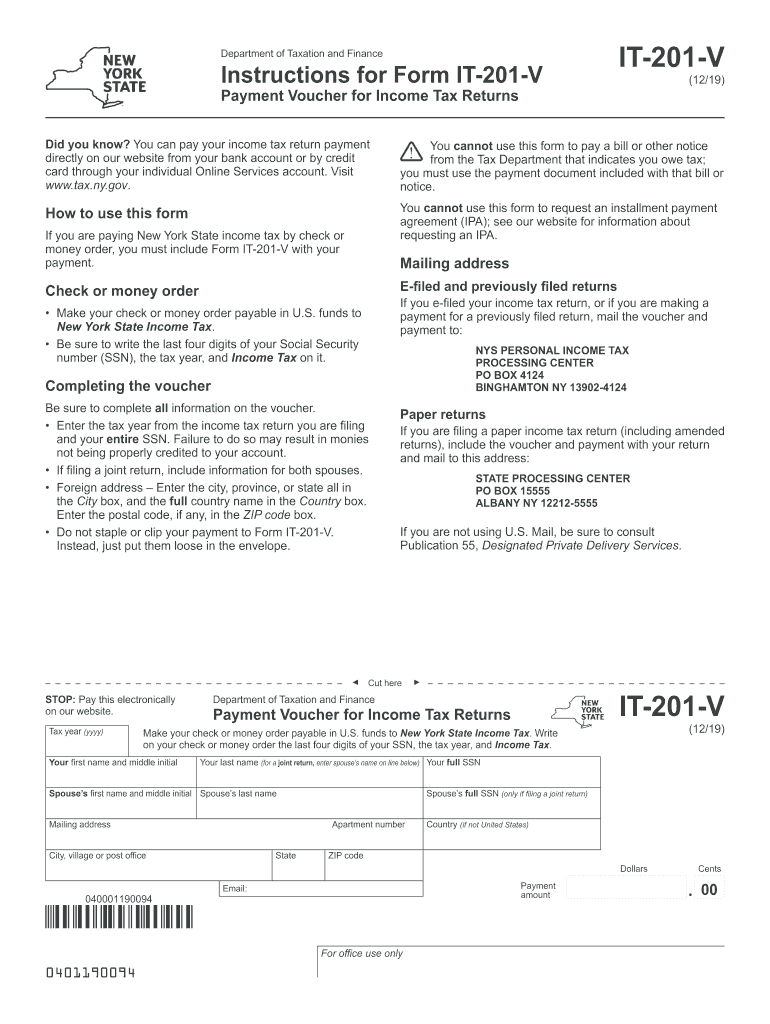

Form it 201 v 2018 Fill out & sign online DocHub

Form IT204 2019 Fill Out, Sign Online and Download Fillable PDF

Related Post: