Nc Tax Form D-400

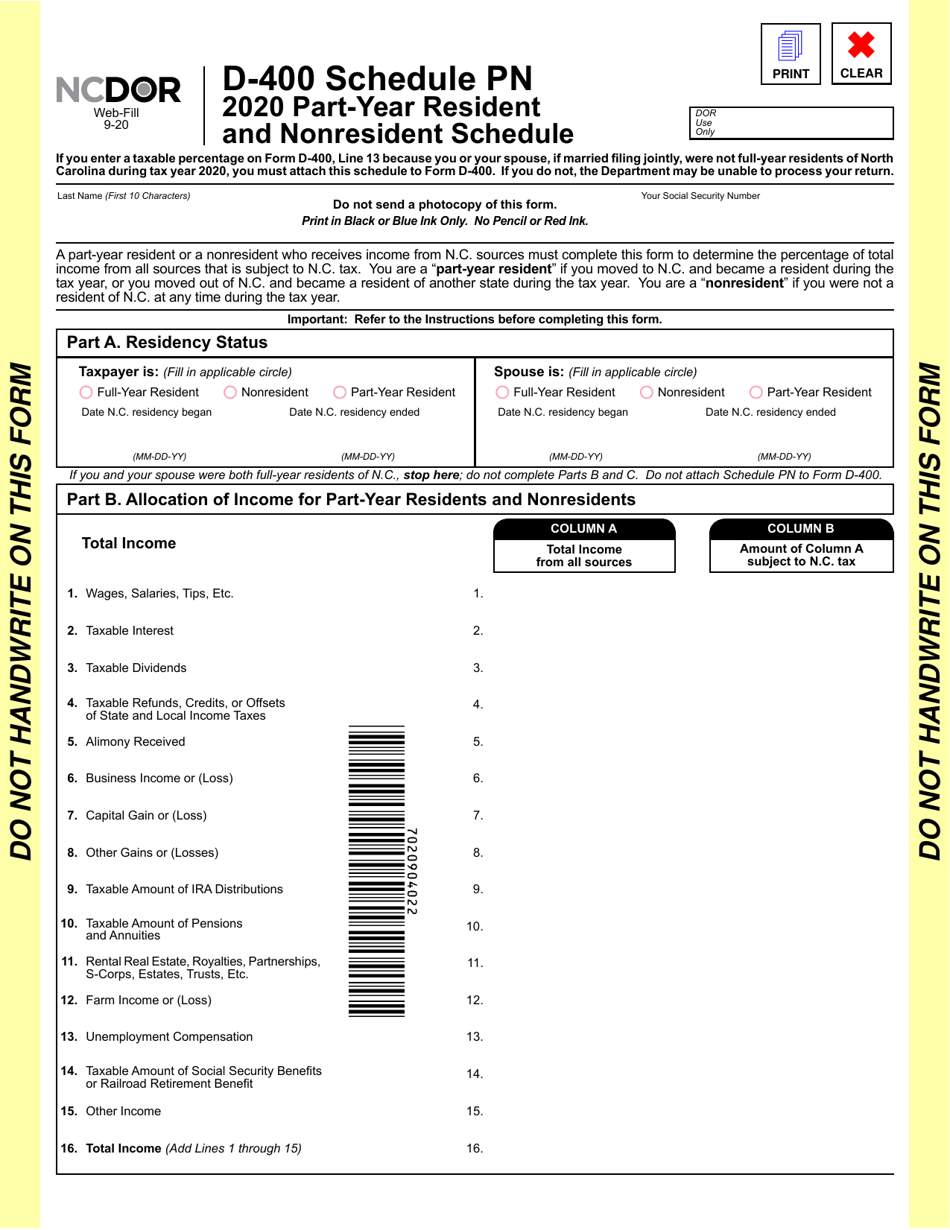

Nc Tax Form D-400 - Web north carolina income tax multiply line 14 by 5.499% (0.05499). Web the starting point for determining north carolina taxable income is federal adjusted gross income. Web individual income tax forms instructions; You can enter your information, save, and print the form for mailing or electronic filing. Get ready for tax season deadlines by completing any required tax forms today. Add lines 6 and 7 8. If zero or less, enter a zero. Easily fill out pdf blank, edit, and sign them. Complete, edit or print tax forms instantly. For more information about the north. Web north carolina income tax multiply line 14 by 5.499% (0.05499). Save or instantly send your ready documents. For more information about the north. Add lines 6 and 7 8. Sales and use electronic data interchange (edi) step by step instructions for. You can download or print. Get ready for tax season deadlines by completing any required tax forms today. Web file your 2021 individual income tax return online with the ncdor web fill form. You can enter your information, save, and print the form for mailing or electronic filing. Complete, edit or print tax forms instantly. Easily fill out pdf blank, edit, and sign them. Complete, edit or print tax forms instantly. Web the starting point for determining north carolina taxable income is federal adjusted gross income. Web file your 2021 individual income tax return online with the ncdor web fill form. Therefore, a taxpayer must determine federal adjusted gross income before. Web individual income tax forms instructions; You can enter your information, save, and print the form for mailing or electronic filing. Add lines 6 and 7 8. Get ready for tax season deadlines by completing any required tax forms today. Easily fill out pdf blank, edit, and sign them. Add lines 6 and 7 8. Web the starting point for determining north carolina taxable income is federal adjusted gross income. Easily fill out pdf blank, edit, and sign them. You can enter your information, save, and print the form for mailing or electronic filing. This form is for income earned in tax year 2022, with tax. You can enter your information, save, and print the form for mailing or electronic filing. Get ready for tax season deadlines by completing any required tax forms today. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. You can download or print. If zero or less, enter. Get ready for tax season deadlines by completing any required tax forms today. Therefore, a taxpayer must determine federal adjusted gross income before. For more information about the north. Complete, edit or print tax forms instantly. Web individual income tax forms instructions; Web individual income tax forms instructions; Web north carolina income tax multiply line 14 by 5.499% (0.05499). Enter amount as decimal.) 13. You can download or print. Add lines 6 and 7 8. Enter amount as decimal.) 13. Web north carolina income tax multiply line 14 by 5.499% (0.05499). Save or instantly send your ready documents. Get ready for tax season deadlines by completing any required tax forms today. Web individual income tax forms instructions; Add lines 6 and 7 8. Sales and use electronic data interchange (edi) step by step instructions for. If zero or less, enter a zero. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Easily fill out pdf blank, edit, and sign them. Enter amount as decimal.) 13. For more information about the north. If zero or less, enter a zero. Complete, edit or print tax forms instantly. Web file your 2021 individual income tax return online with the ncdor web fill form. Get ready for tax season deadlines by completing any required tax forms today. You can download or print. Web individual income tax forms instructions; Add lines 6 and 7 8. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. This form is for income earned in tax year 2022, with tax. You can enter your information, save, and print the form for mailing or electronic filing. Sales and use electronic data interchange (edi) step by step instructions for. Web north carolina income tax multiply line 14 by 5.499% (0.05499). Therefore, a taxpayer must determine federal adjusted gross income before. Web the starting point for determining north carolina taxable income is federal adjusted gross income. Save or instantly send your ready documents.Form D400 Schedule PN Download Fillable PDF or Fill Online PartYear

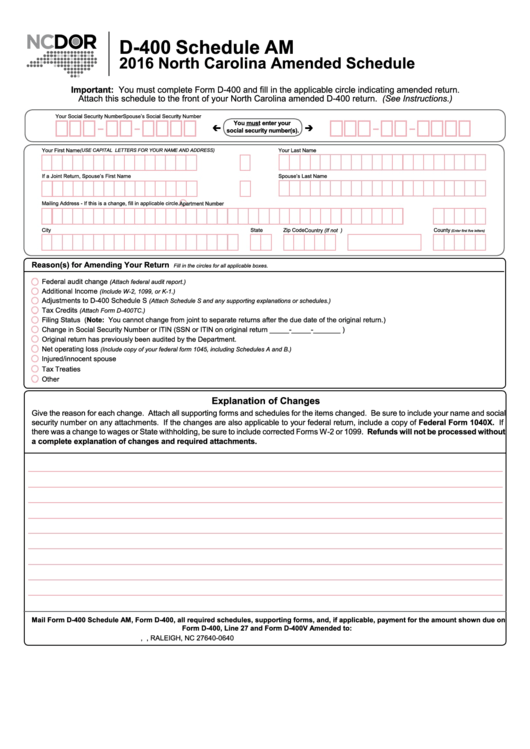

Form D400 Schedule Am North Carolina Amended Schedule 2016

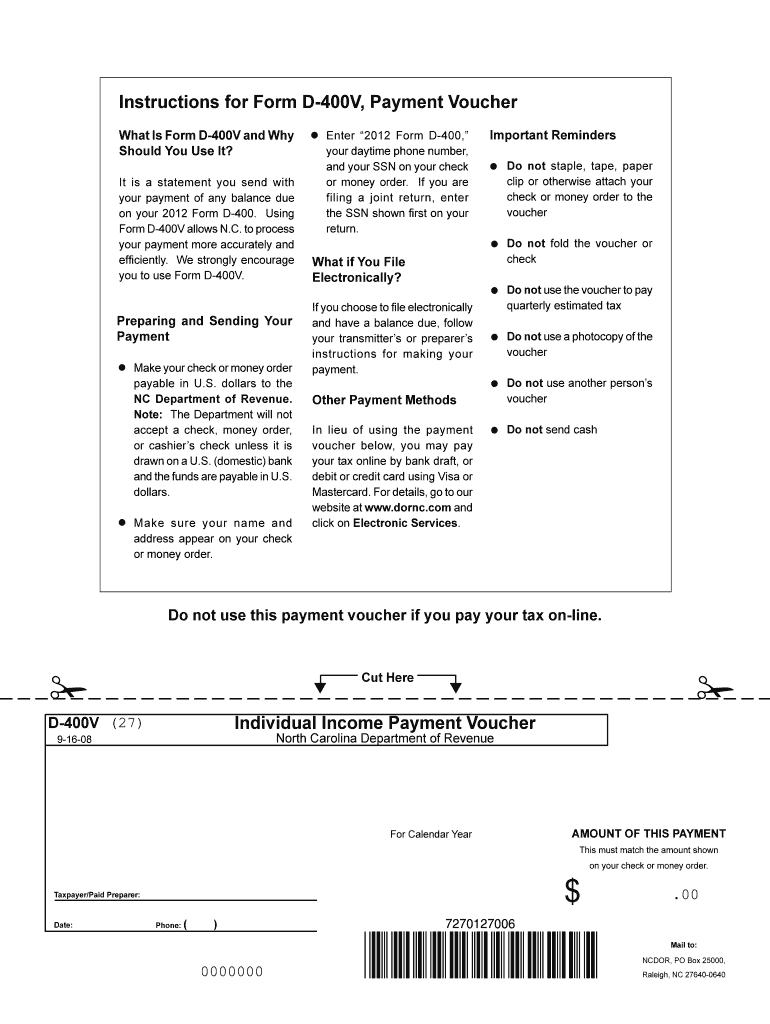

NC DoR D400V 20082022 Fill out Tax Template Online US Legal Forms

2015 North Carolina D400 Individual Tax Return Form DocHub

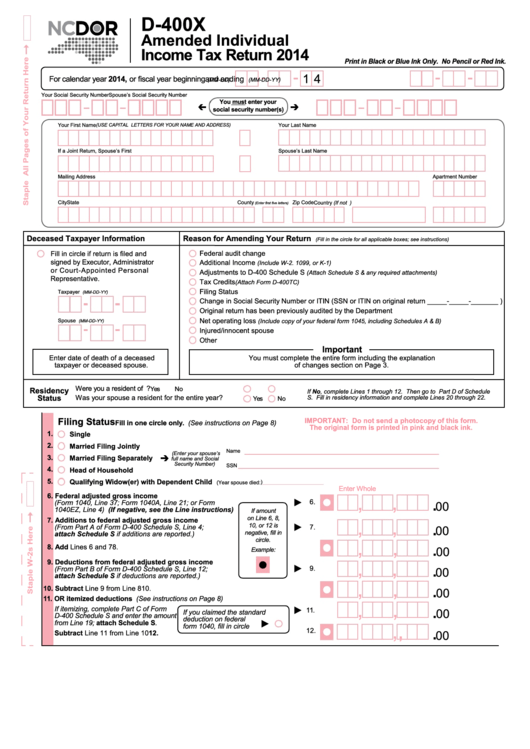

Form D400x Amended Individual Tax Return 2014 printable pdf

NC DoR D400XWS 2010 Fill out Tax Template Online US Legal Forms

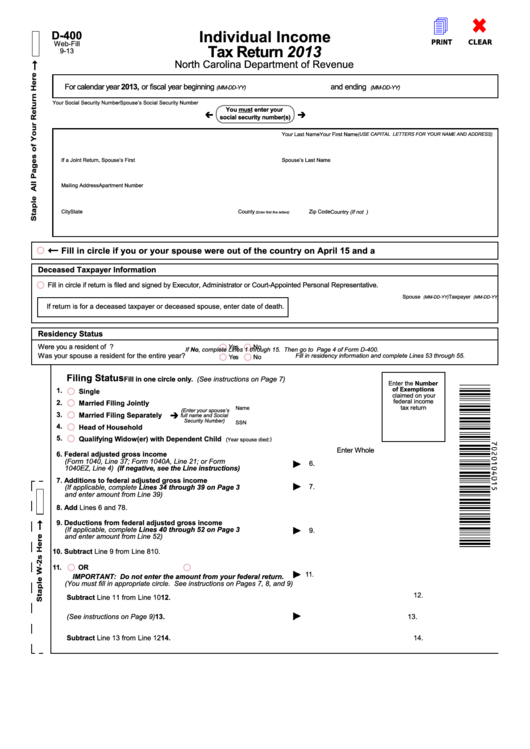

Fillable Form D400 Individual Tax Return 2013 printable pdf

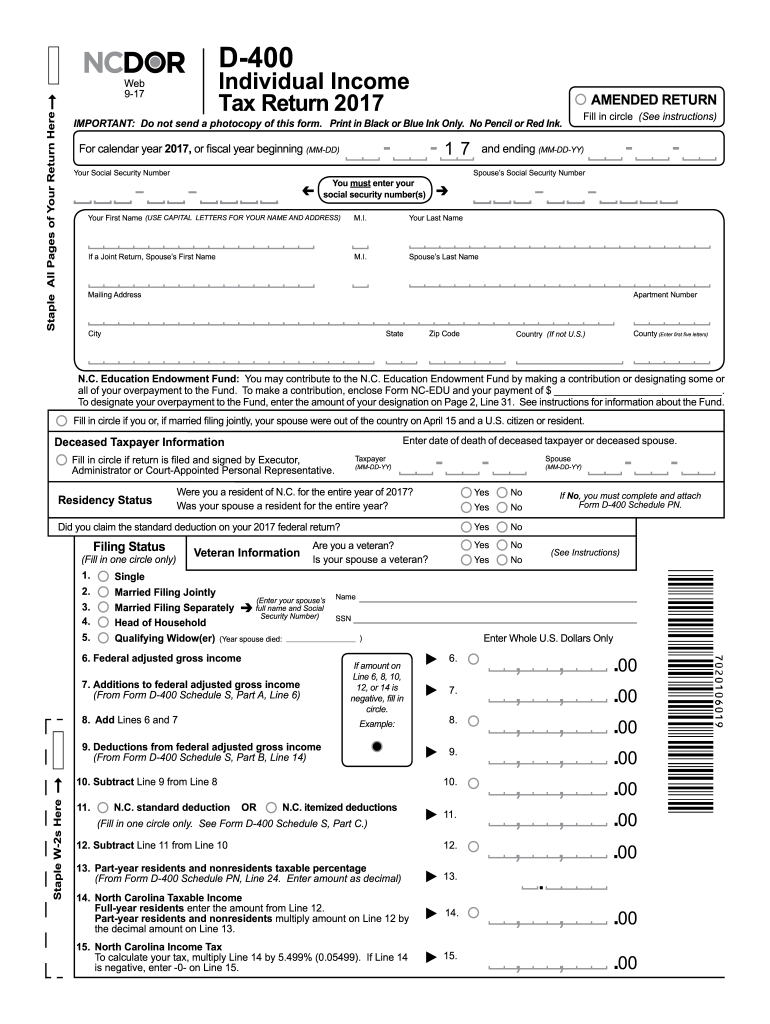

NC DoR D400 2017 Fill out Tax Template Online US Legal Forms

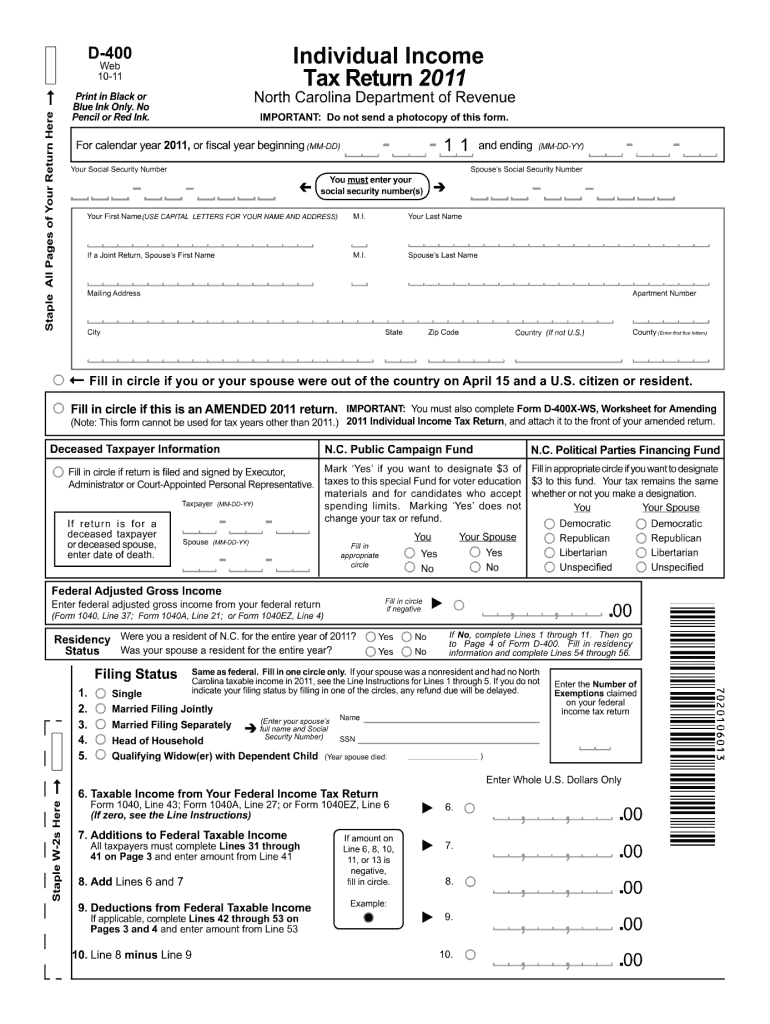

NC DoR D400 2011 Fill out Tax Template Online US Legal Forms

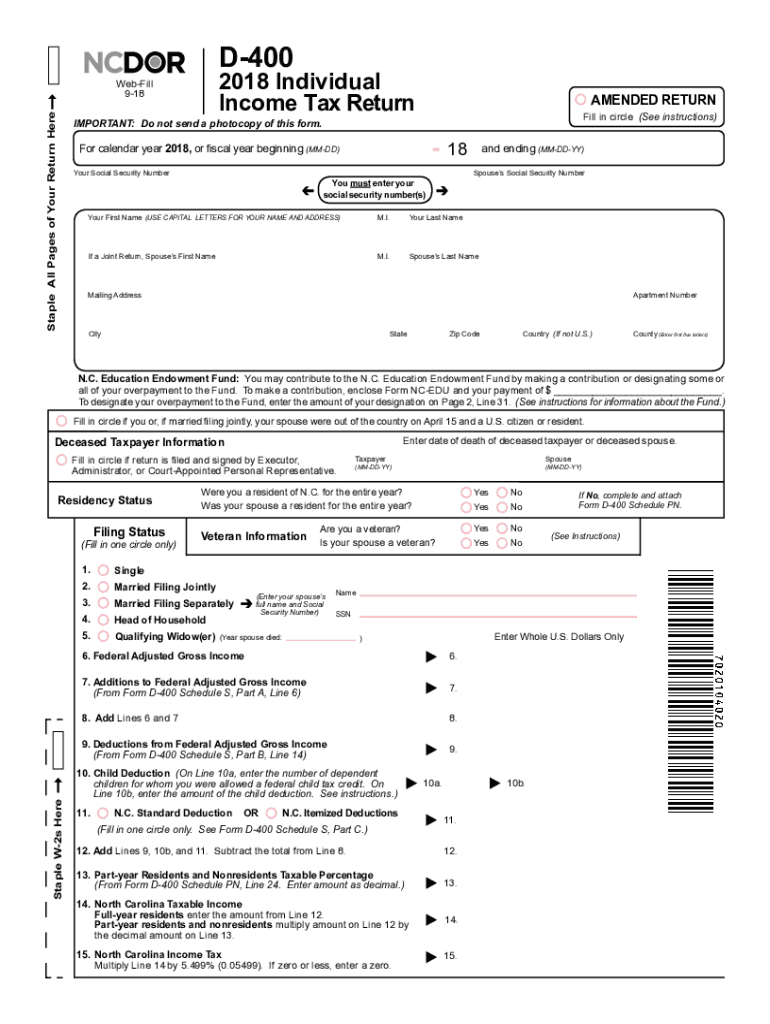

NC DoR D400 2018 Fill out Tax Template Online US Legal Forms

Related Post: