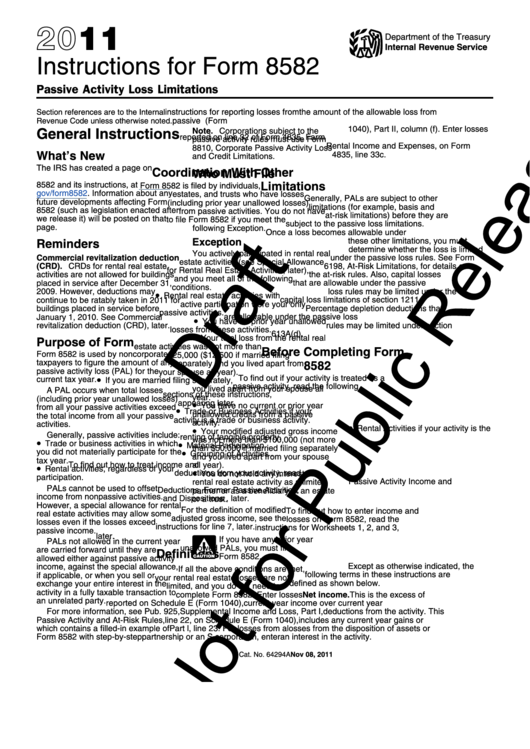

Form 8582 Instructions

Form 8582 Instructions - You do not qualify for the $25,000 special allowance for rental real estate with active participation. Web passive activity rules must use form 8810, corporate passive activity loss and credit limitations. Web (see instructions) (b) inconsistency is in, or aar is to correct. In this article, we’ll walk. If you actively participated in a passive rental real estate activity, you may. Department of the treasury internal revenue service (99) passive activity loss limitations. However, for purposes of the donor’s. Web when filing an individual return for your client, you may wish to generate form 8582 to figure the amount of any passive activity loss (pal) for the current or previous year. Ad a tax advisor will answer you now! Ad a tax advisor will answer you now! Web up to 10% cash back contact us. Ad download or email more irs fillable forms, try for free now! Who must file form 8582 is filed by individuals, estates, and trusts who. Enter losses form 8582 is used by noncorporate activity. This article will help you: Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: Enter losses form 8582 is used by noncorporate activity. Ad download or email more irs fillable forms, try for free now! Web get federal form 8582 for line instructions and examples. Free, fast, full version (2023) available! Department of the treasury internal revenue service (99) passive activity loss limitations. Enter losses form 8582 is used by noncorporate activity. Web when filing an individual return for your client, you may wish to generate form 8582 to figure the amount of any passive activity loss (pal) for the current or previous year. Ad download or email more irs fillable. However, for purposes of the donor’s. Web up to 10% cash back contact us. Web what is the purpose of the 8582: This article will help you: In this article, we’ll walk. Questions answered every 9 seconds. Department of the treasury internal revenue service. Who must file form 8582 is filed by individuals, estates, and trusts who. Web up to 10% cash back contact us. Department of the treasury internal revenue service (99) passive activity loss limitations. Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. Department of the treasury internal revenue service (99) passive activity loss limitations. Ad download or email more irs fillable forms, try for free now! Free, fast, full version (2023) available! However, for purposes. Web up to 10% cash back contact us. Enter losses reported on schedule e (form 1040), supplemental income and loss, part i, line 21, on schedule e (form 1040), part l, line 22. Ad a tax advisor will answer you now! Form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a. Form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current. This article will help you: Department of the treasury internal revenue service (99) passive activity loss limitations. Web when filing an individual return for your client, you may wish to generate form 8582 to figure the amount of any passive. Questions answered every 9 seconds. Ad download or email more irs fillable forms, try for free now! Enter losses form 8582 is used by noncorporate activity. Form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year. Department of the treasury internal revenue service. Form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current. Who must file form 8582 is filed by individuals, estates, and trusts who. Web form 8283 contains more than one item, this exception applies only to those items that are clearly identified as having a value of $500 or less.. Department of the treasury internal revenue service (99) passive activity loss limitations. Department of the treasury internal revenue service. Ad a tax advisor will answer you now! Web purpose of form 1. If you actively participated in a passive rental real estate activity, you may. Web (see instructions) (b) inconsistency is in, or aar is to correct. If you actively participated in a passive rental real estate activity,. In this article, we’ll walk. You can download or print current. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: Form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year. Web per irs instructions for form 8582 passive activity loss limitations, on page 3: You do not qualify for the $25,000 special allowance for rental real estate with active participation. Web get federal form 8582 for line instructions and examples. Treatment of item (c) amount as shown on. Web form 8582 department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. Enter losses form 8582 is used by noncorporate activity. Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. Enter losses reported on schedule e (form 1040), supplemental income and loss, part i, line 21, on schedule e (form 1040), part l, line 22. Form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current.Instructions For Form 8582 Draft 2011 printable pdf download

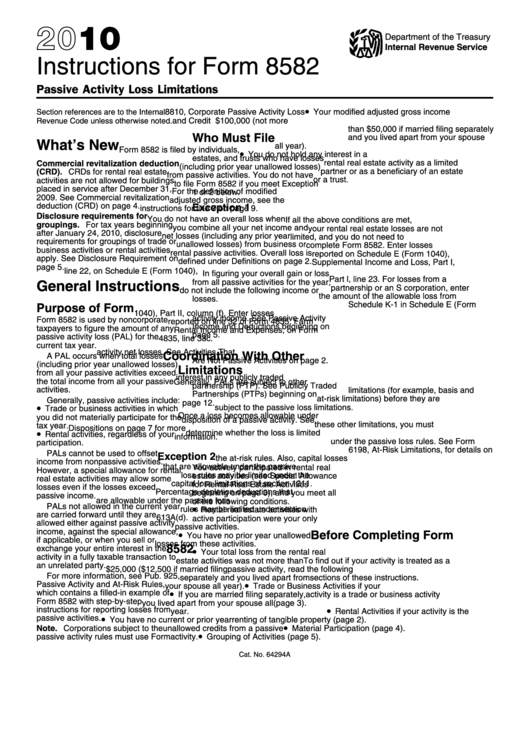

Instructions For Form 8582 2010 printable pdf download

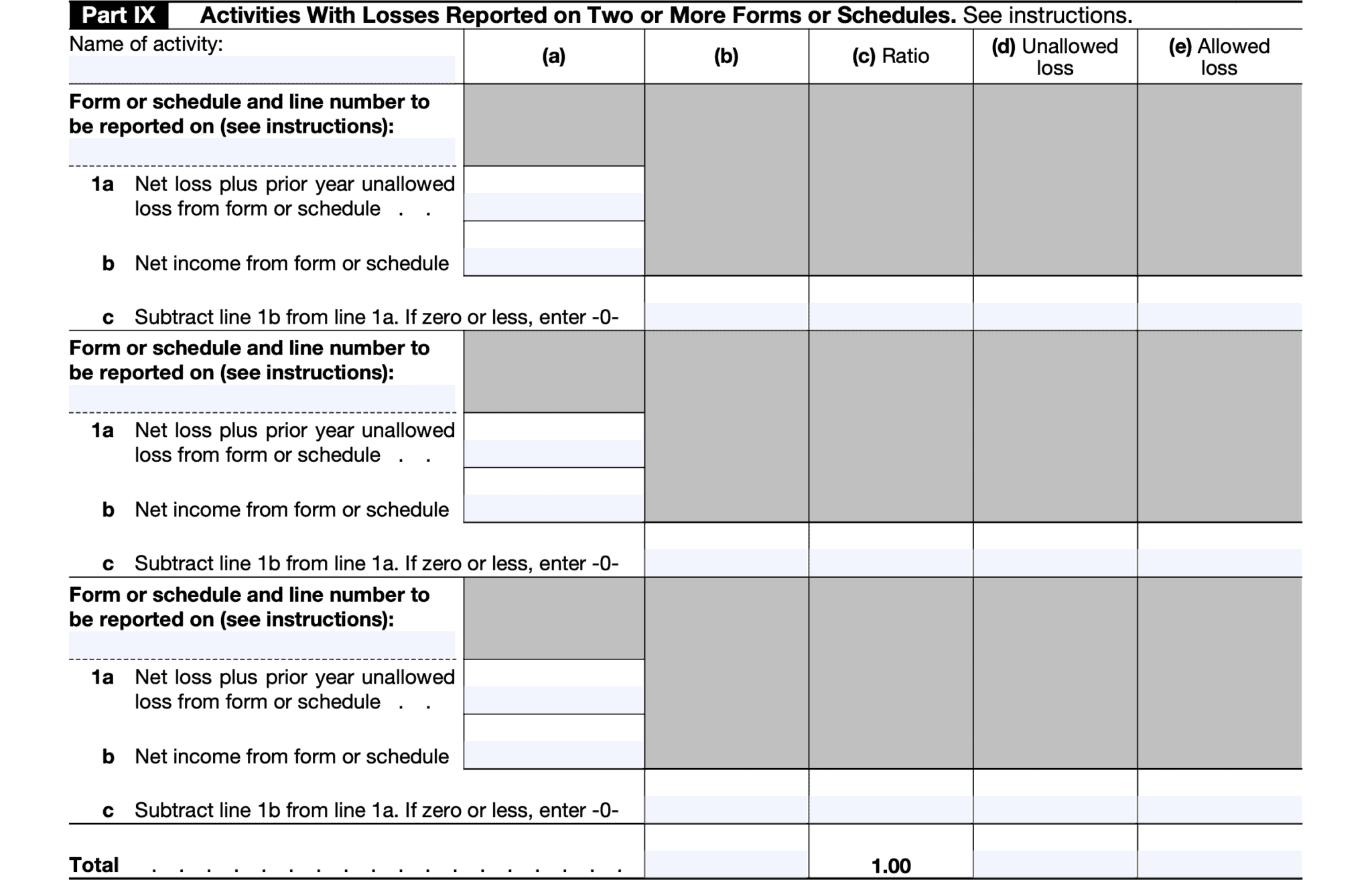

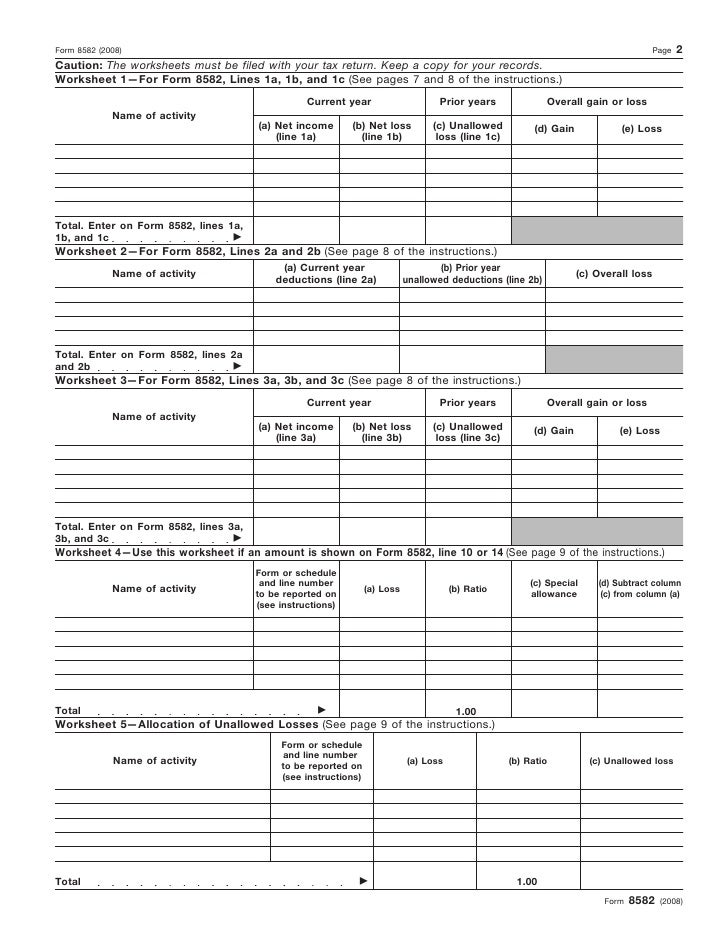

IRS Form 8582 Instructions A Guide to Passive Activity Losses

Form 8582Passive Activity Loss Limitations

Instructions For Form 8582Cr Passive Activity Credit Limitations

Instructions for Form 8582CR (12/2019) Internal Revenue Service

IRS 8582 Form PAL Blanks to Fill out and Download in PDF

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Download Instructions for IRS Form 8582 Passive Activity Loss

IRS Form 8582 Instructions A Guide to Passive Activity Losses

Related Post: