Nc 40 Estimated Tax Form

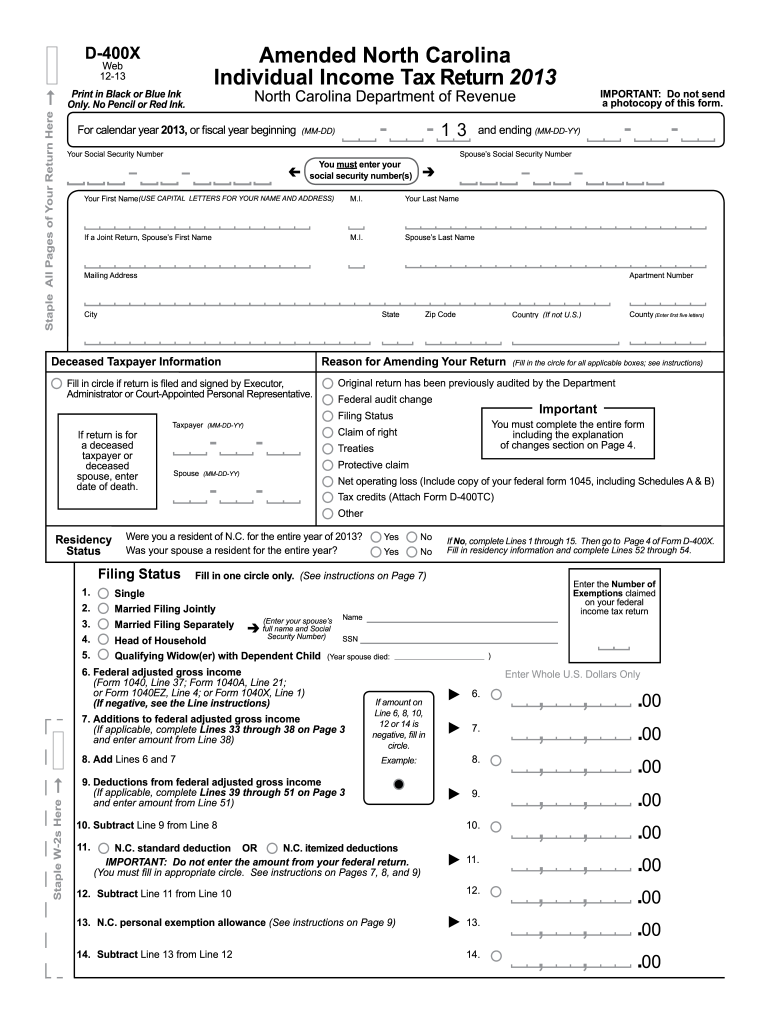

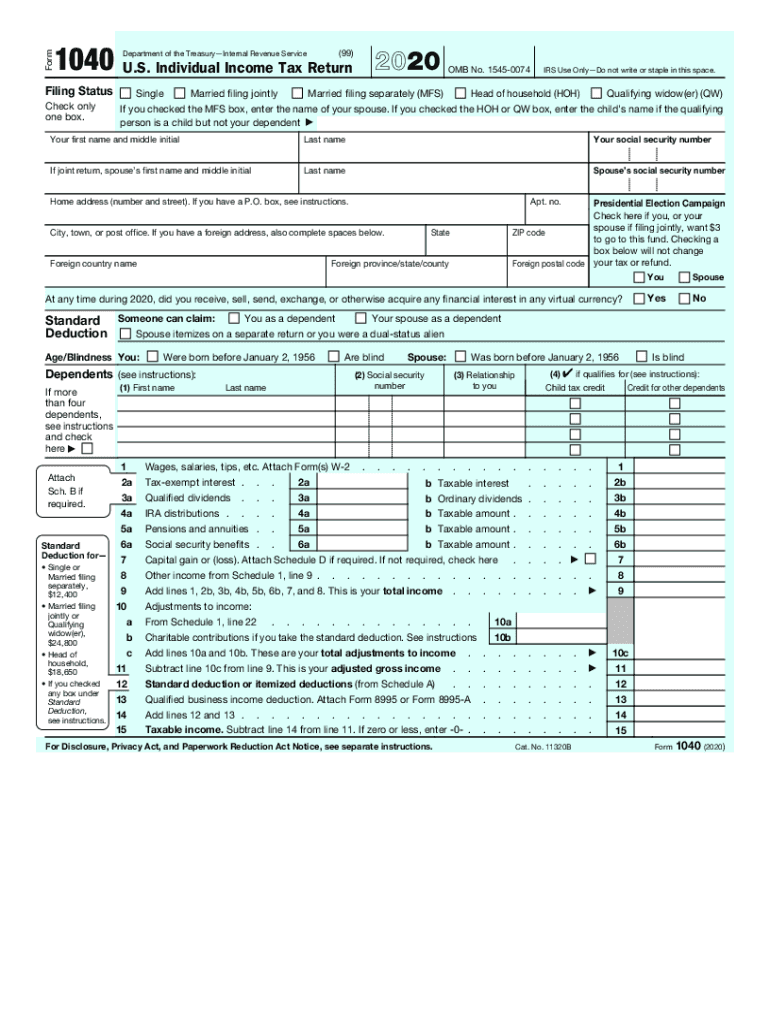

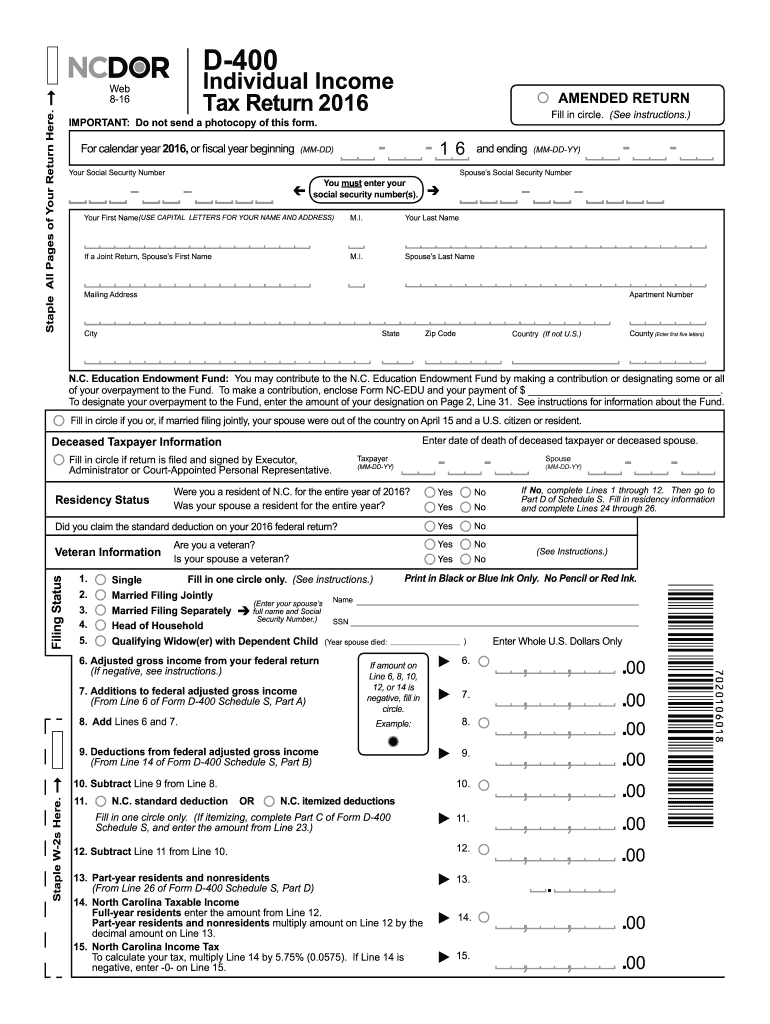

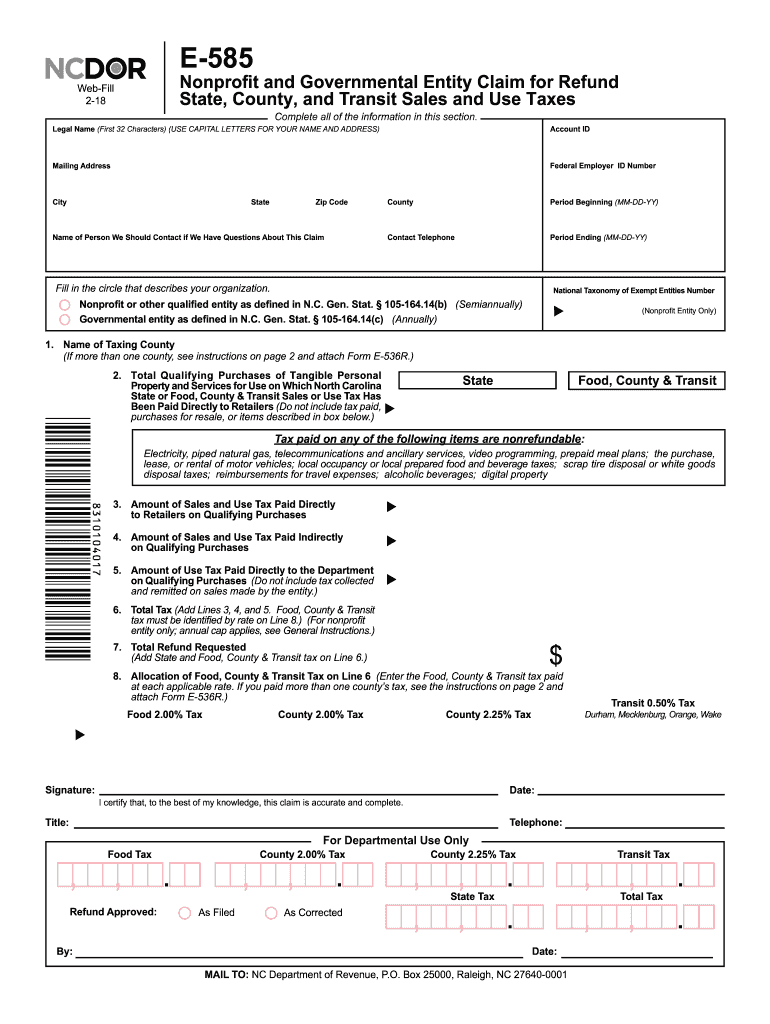

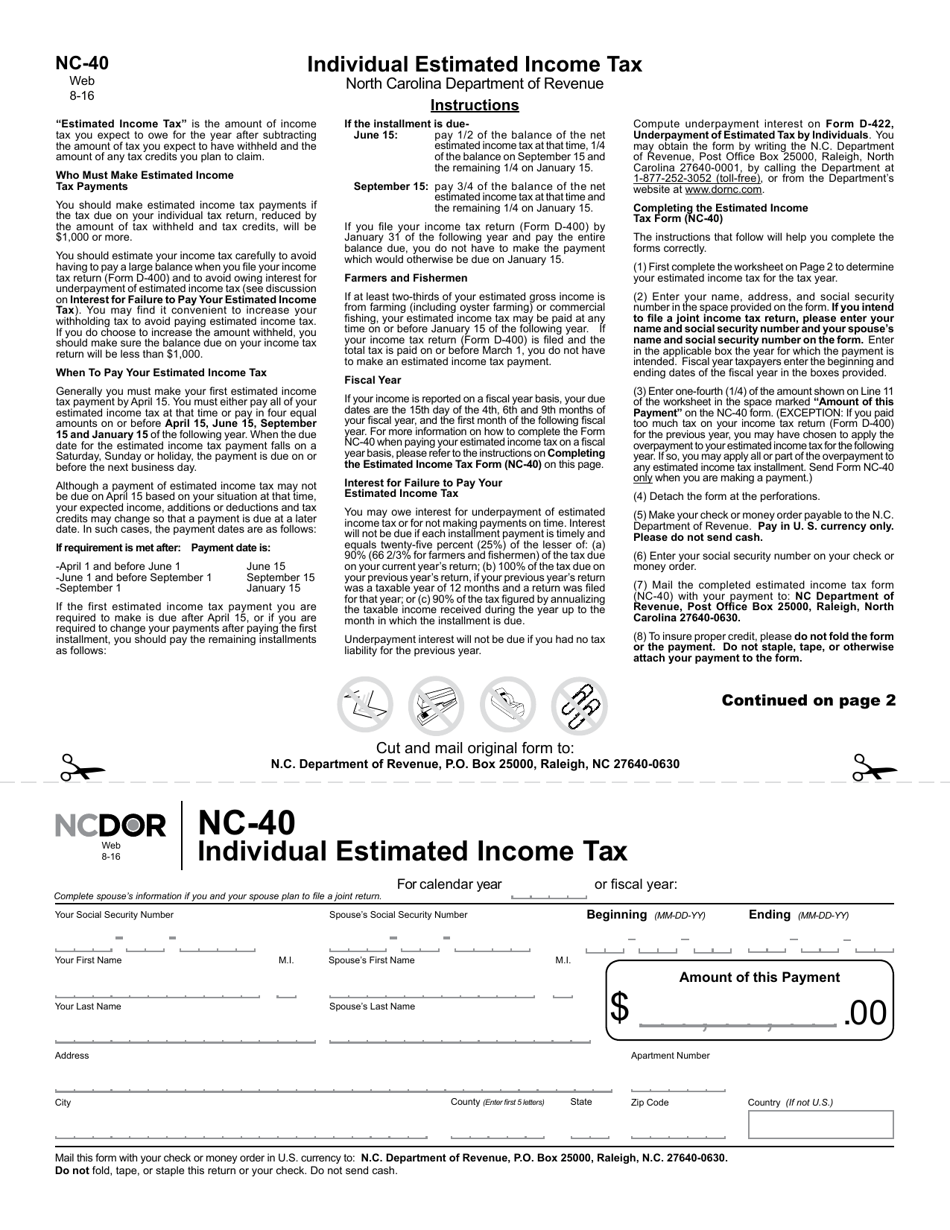

Nc 40 Estimated Tax Form - You can download or print. Schedule payments up to 365 days in advance; You may be able to avoid. Pay a bill or notice (notice required) sales and use tax file and pay. Choose calendar year or select a begin date and end date:. Therefore, a taxpayer must determine federal adjusted gross income before. Web the starting point for determining north carolina taxable income is federal adjusted gross income. Finding it harder than ever to file efficiently without risking costly errors? Ad discover helpful information and resources on taxes from aarp. Web to pay individual estimated income tax: Want to schedule all four payments? You can use this form to make all of your estimated income tax payments for the year. Estimated income tax is the amount of income tax you expect to owe for the year after subtracting. Schedule payments up to 365 days in advance; Web to pay individual estimated income tax: Get ready for tax season deadlines by completing any required tax forms today. You can use this form to make all of your estimated income tax payments for the year. Enter your status, income, deductions and credits and estimate your total taxes. Finding it harder than ever to file efficiently without risking costly errors? Web to pay individual estimated income. Click here for help if the form does not appear after you click create form. Want to schedule all four payments? Ad discover helpful information and resources on taxes from aarp. However, you may pay your estimated tax online. Pay a bill or notice (notice required) sales and use tax file and pay. Finding it harder than ever to file efficiently without risking costly errors? Complete, edit or print tax forms instantly. However, you may pay your estimated tax online. Pay a bill or notice (notice required) sales and use tax file and pay. Get ready for tax season deadlines by completing any required tax forms today. You may be able to avoid. Get ready for tax season deadlines by completing any required tax forms today. However, you may pay your estimated tax online. The department’s online filing and. Web safety measures are in place to protect your tax information. Schedule payments up to 365 days in advance; Complete, edit or print tax forms instantly. Ad discover helpful information and resources on taxes from aarp. We last updated the estimated tax. You can use this form to make all of your estimated income tax payments for the year. You can use this form to make all of your estimated income tax payments for the year. Web the starting point for determining north carolina taxable income is federal adjusted gross income. Web you may obtain the form by writing the n.c. Finding it harder than ever to file efficiently without risking costly errors? Stop here and enter four (4). Pay a bill or notice (notice required) sales and use tax file and pay. Stop here and enter four (4) as total. Therefore, a taxpayer must determine federal adjusted gross income before. Schedule payments up to 365 days in advance; You can download or print. However, you may pay your estimated tax online. Ad our tax preparers will ensure that your tax returns are complete, accurate and on time. Web you may obtain the form by writing the n.c. Pay a bill or notice (notice required) sales and use tax file and pay. We last updated the estimated tax. Get ready for tax season deadlines by completing any required tax forms today. You may be able to avoid. Pay a bill or notice (notice required) sales and use tax file and pay. Enter your status, income, deductions and credits and estimate your total taxes. Want to schedule all four payments? The department’s online filing and. Pay a bill or notice (notice required) sales and use tax file and pay. Click here for help if the form does not appear after you click create form. Enter your status, income, deductions and credits and estimate your total taxes. Web you may obtain the form by writing the n.c. However, you may pay your estimated tax online. Ad our tax preparers will ensure that your tax returns are complete, accurate and on time. You may be able to avoid. We last updated the estimated tax. Schedule payments up to 365 days in advance; Get ready for tax season deadlines by completing any required tax forms today. Estimated income tax is the amount of income tax you expect to owe for the year after subtracting. Therefore, a taxpayer must determine federal adjusted gross income before. Want to schedule all four payments? Choose calendar year or select a begin date and end date:. Pay a bill or notice (notice required) sales and use tax file and pay. However, you may pay your estimated tax online. Ad discover helpful information and resources on taxes from aarp. Finding it harder than ever to file efficiently without risking costly errors? Complete, edit or print tax forms instantly.Amended North Carolina Individual Tax Return 2012 dor state nc

Printable Forms For Nc Tax Returns Printable Forms Free Online

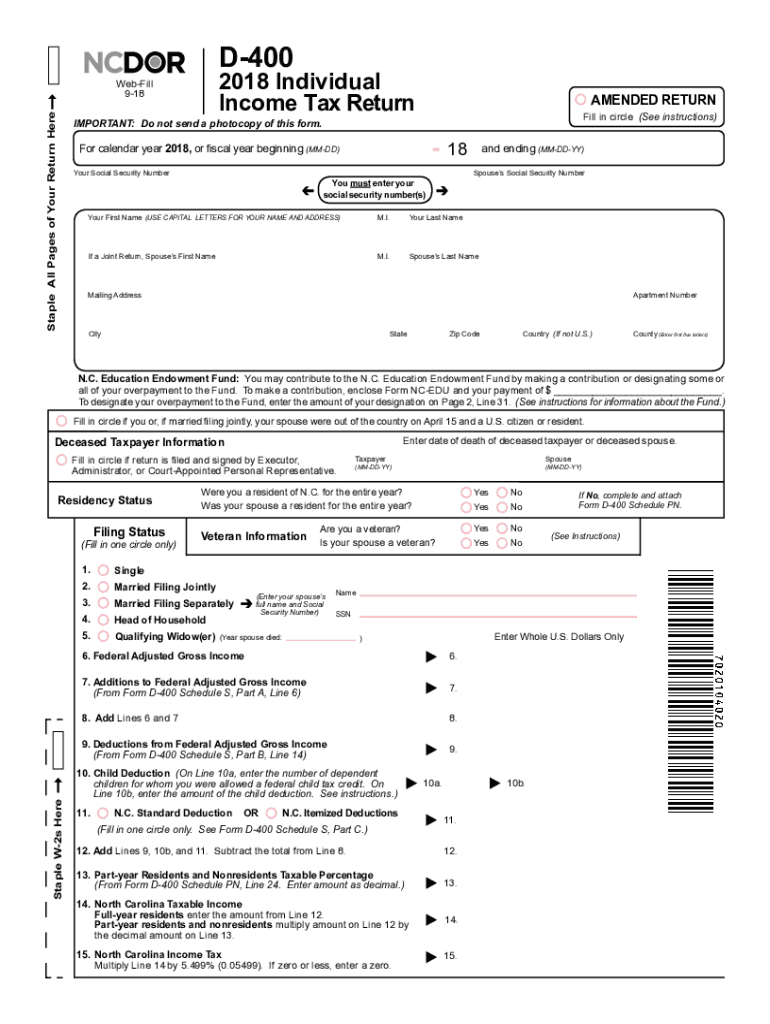

Nc D400 For Form Fill Out and Sign Printable PDF Template signNow

Ncdor form e 585 Fill out & sign online DocHub

Printable Forms For Nc Tax Returns Printable Forms Free Online

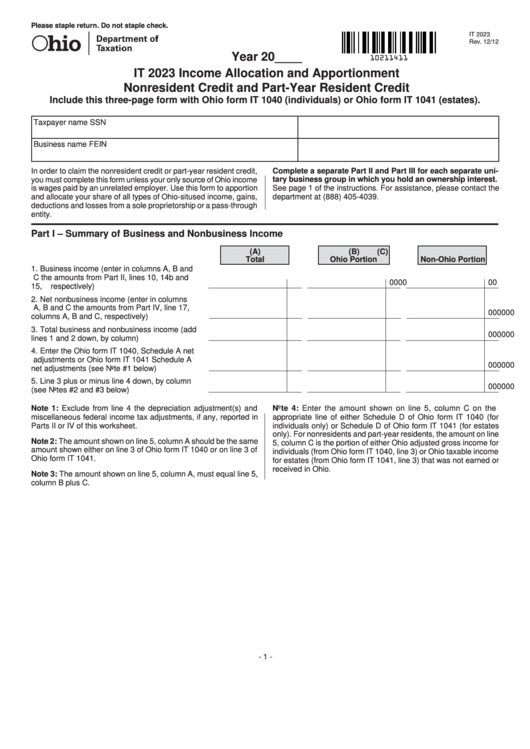

Fillable Form It 2023 Allocation And Apportionment Nonresident

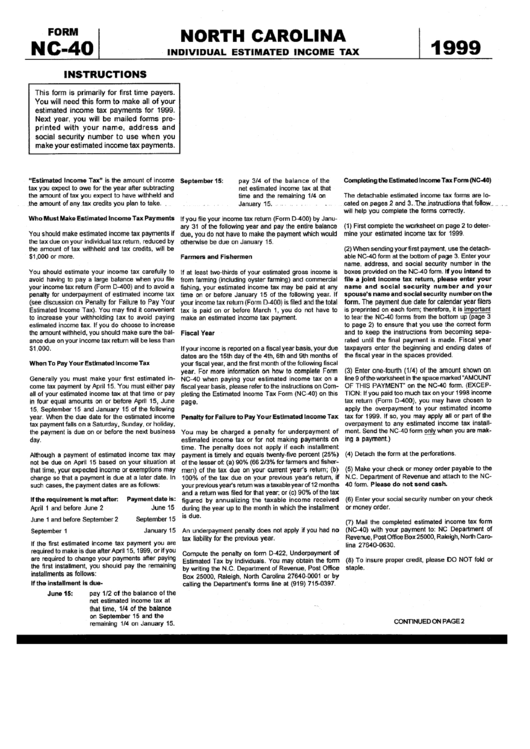

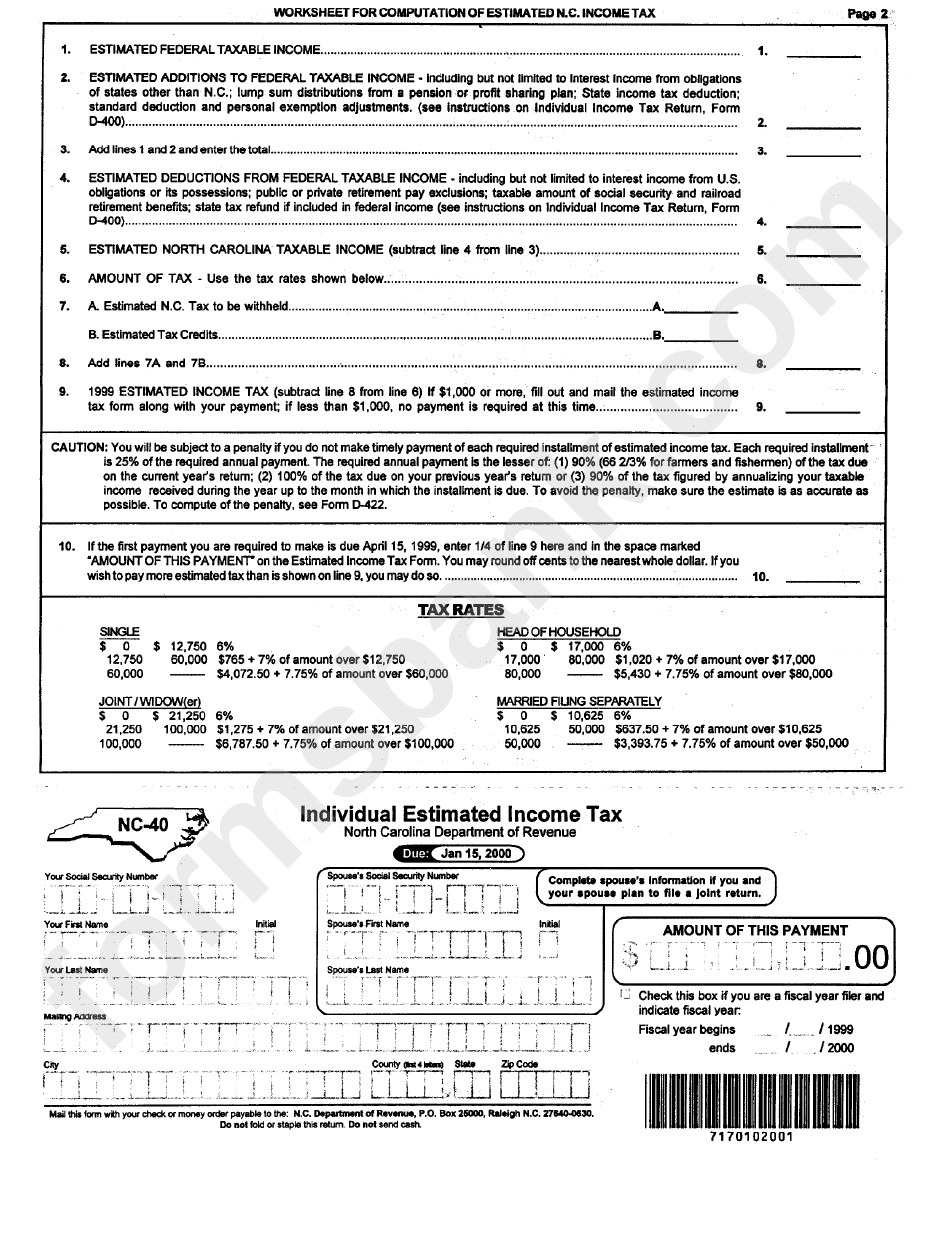

Form Nc40 Individual Estimated Tax 1999 printable pdf download

NC NC3 2018 Fill out Tax Template Online US Legal Forms

Form NC40 Fill Out, Sign Online and Download Printable PDF, North

Fillable Form Nc40 Individual Estimated Tax printable pdf

Related Post: