Idaho Form 967

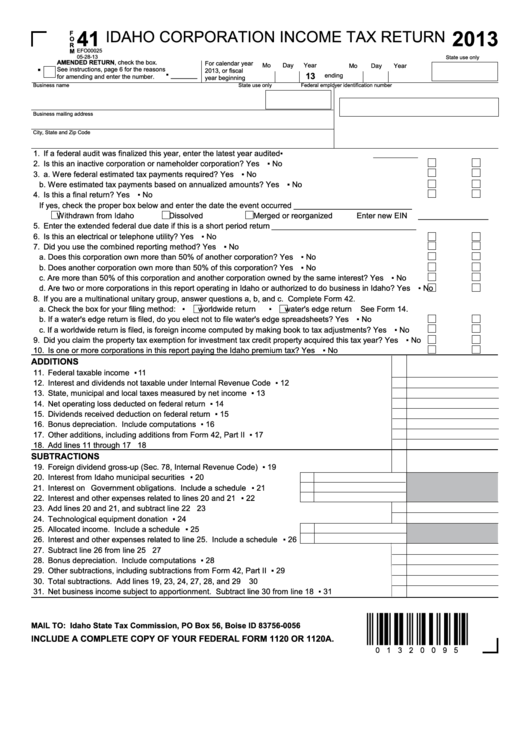

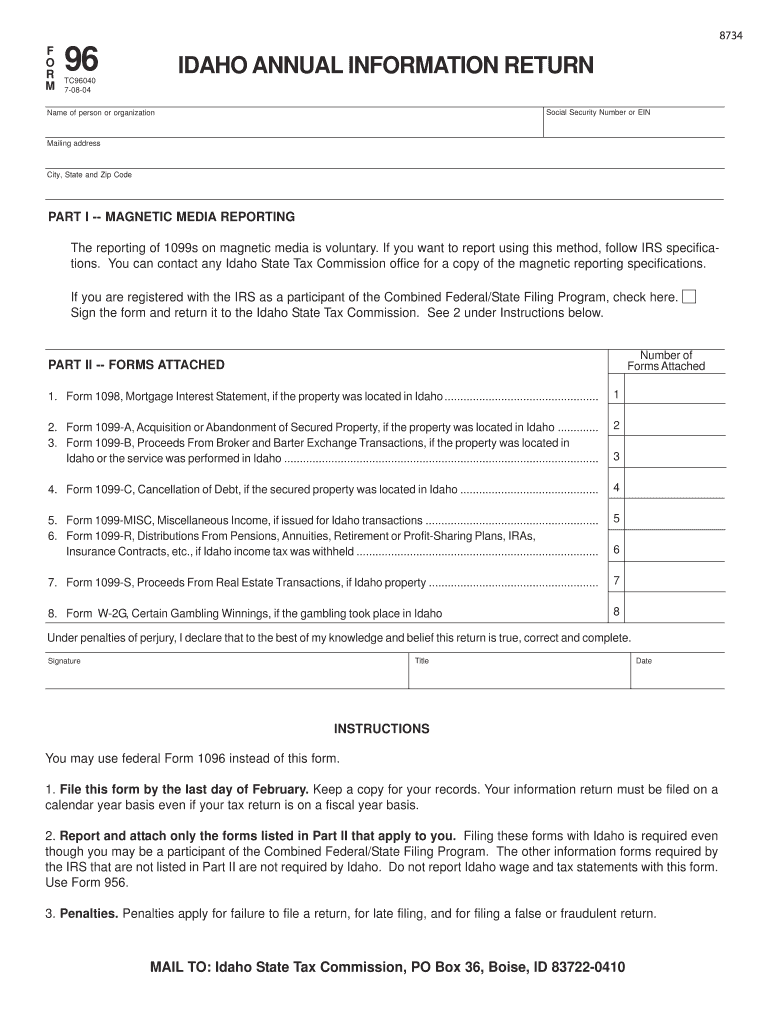

Idaho Form 967 - Web we last updated idaho form 967 in february 2023 from the idaho state tax commission. 2022 † comprehensive financial statement (cfs) download / print:. The deadline for filing the form 967, idaho annual withholding report is january 31. Download or email id form 96 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Following this schedule can help you reconcile your withholding since you’ll be working with all your records at. Web idaho 1099 filing requirements. Idaho annual withholding report instructions : Employers are required by idaho law to withhold income tax from their employees’ wages. The filing due date for both the form w2 & form 967 with idaho is january 31. Idaho annual withholding report instructions : Download or email id form 96 & more fillable forms, register and subscribe now! If you’re an employee, your employer probably withholds. This form is for income earned in tax year 2022, with tax returns due in april 2023. Following this schedule can help you reconcile your withholding since you’ll be working with all. The filing due date for both the form w2 & form 967 with idaho is january 31. A penalty of $2 per. Web we last updated idaho form 967 in february 2023 from the idaho state tax commission. This form is for income earned in tax year 2022, with tax returns due in april 2023. The deadline for filing the. Web when to file form 967. Following this schedule can help you reconcile your withholding since you’ll be working with all your records at. Web friday january 14, 2022. The state of idaho requires additional forms to be filed along with form w2, depending on your filing method. Web we last updated idaho form 967 in february 2023 from the. Web we last updated idaho form 967 in february 2023 from the idaho state tax commission. Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit your w‑2, 1099 forms,. The deadline for filing the form 967, idaho annual withholding report is. Please make sure to choose the correct tax type before entering your information. The filing due date for both the form w2 & form 967 with idaho is january 31. A penalty of $2 per. Web penalty and interest estimator. Complete, edit or print tax forms instantly. Don’t wait until the deadline. Web we last updated the idaho annual withholding report instructions in february 2023, so this is the latest version of form 967, fully updated for tax year 2022. Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and. The filing due date for both the form w2 & form 967 with idaho is january 31. Web friday january 14, 2022. The state of idaho requires additional forms to be filed along with form w2, depending on your filing method. Web idaho 1099 filing requirements. If you’re an employee, your employer probably withholds. You can do this either online. Download or email id form 96 & more fillable forms, register and subscribe now! Don’t wait until the deadline. This form is for income earned in tax year 2022, with tax returns due in april 2023. Following this schedule can help you reconcile your withholding since you’ll be working with all your records at. Web penalty and interest estimator. Please make sure to choose the correct tax type before entering your information. Employers can file online today by logging into their taxpayer. Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit your w‑2, 1099 forms,. A penalty of $2 per. This form is to help you estimate your penalty and interest. Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit your w‑2, 1099 forms, or both containing idaho withholding. Web when to file form 967. Following. Idaho state tax commission provides. This form is to help you estimate your penalty and interest. Please make sure to choose the correct tax type before entering your information. A penalty of $2 per. Don’t wait until the deadline. The state of idaho requires additional forms to be filed along with form w2, depending on your filing method. Complete, edit or print tax forms instantly. Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit your w‑2, 1099 forms, or both containing idaho withholding. 2022 † comprehensive financial statement (cfs) download / print:. If you’re an employee, your employer probably withholds. Web we last updated the idaho annual withholding report instructions in february 2023, so this is the latest version of form 967, fully updated for tax year 2022. Employers are required by idaho law to withhold income tax from their employees’ wages. The filing due date for both the form w2 & form 967 with idaho is january 31. Download or email id form 96 & more fillable forms, register and subscribe now! This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated idaho form 967 in february 2023 from the idaho state tax commission. Following this schedule can help you reconcile your withholding since you’ll be working with all your records at. Web use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and submit your w‑2, 1099 forms,. The deadline for filing the form 967, idaho annual withholding report is january 31. Web friday january 14, 2022.Fillable Form 41 Idaho Corporation Tax Return 2013 printable

1+ Idaho Do Not Resuscitate Form Free Download

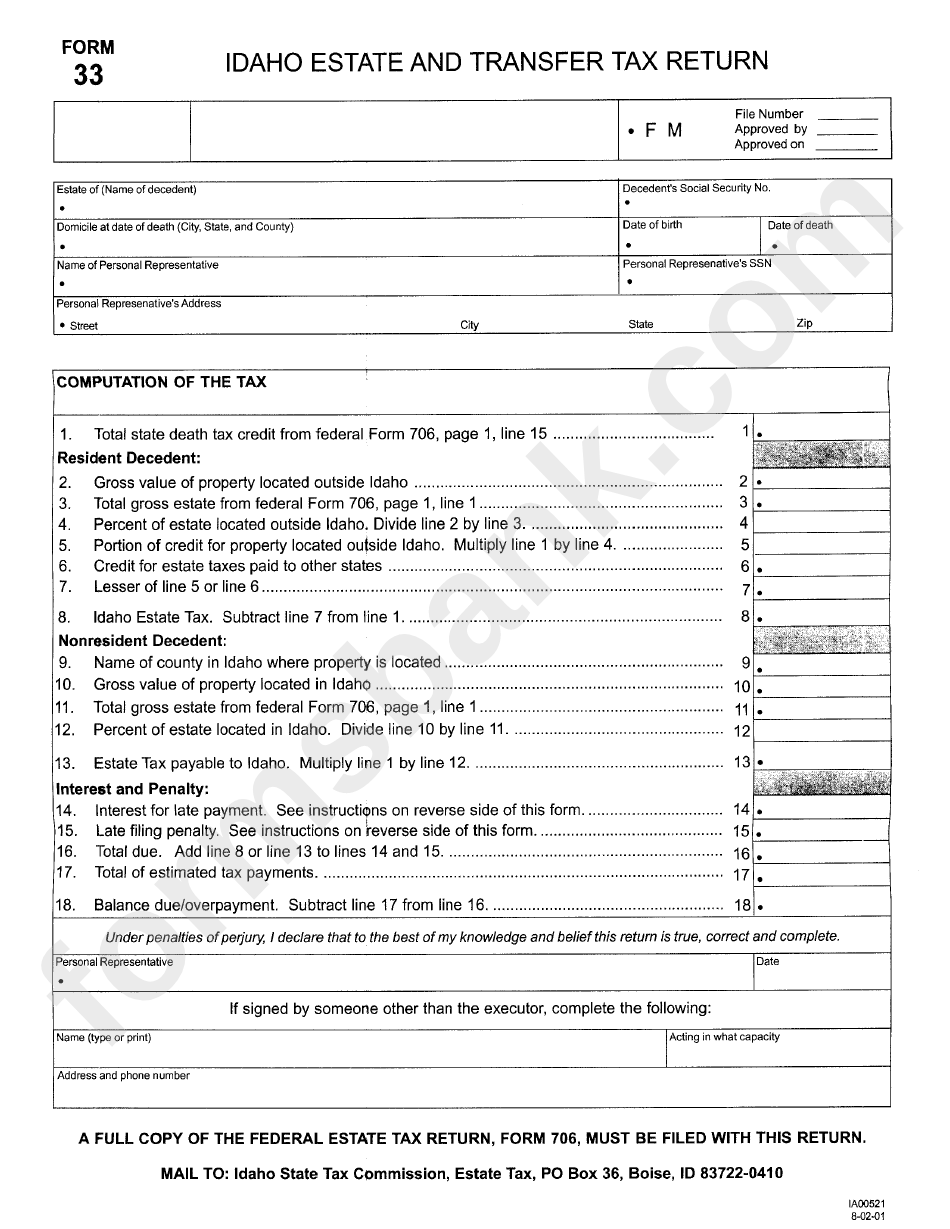

Form 33 Idaho Estate And Transfer Tax Return printable pdf download

Idaho Form 967 Fill and Sign Printable Template Online US Legal Forms

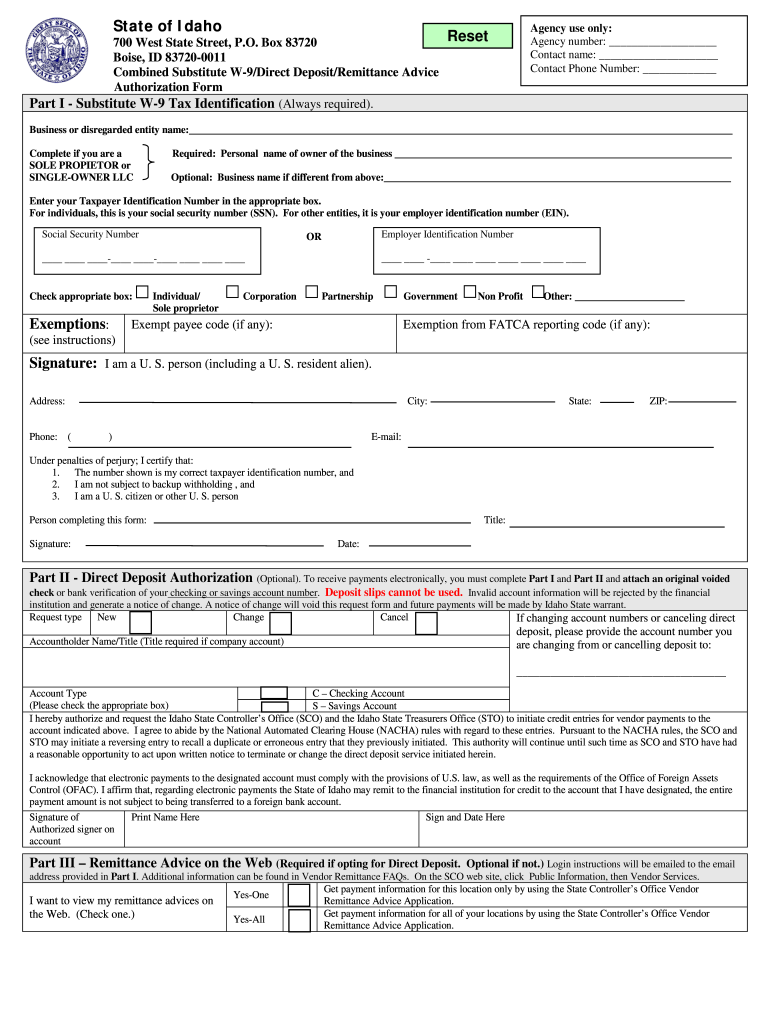

Idaho W9 Form Fill Out and Sign Printable PDF Template signNow

Idaho Form 96 Fill Out and Sign Printable PDF Template signNow

Idaho Effective Labor Form Fill Out and Sign Printable PDF Template

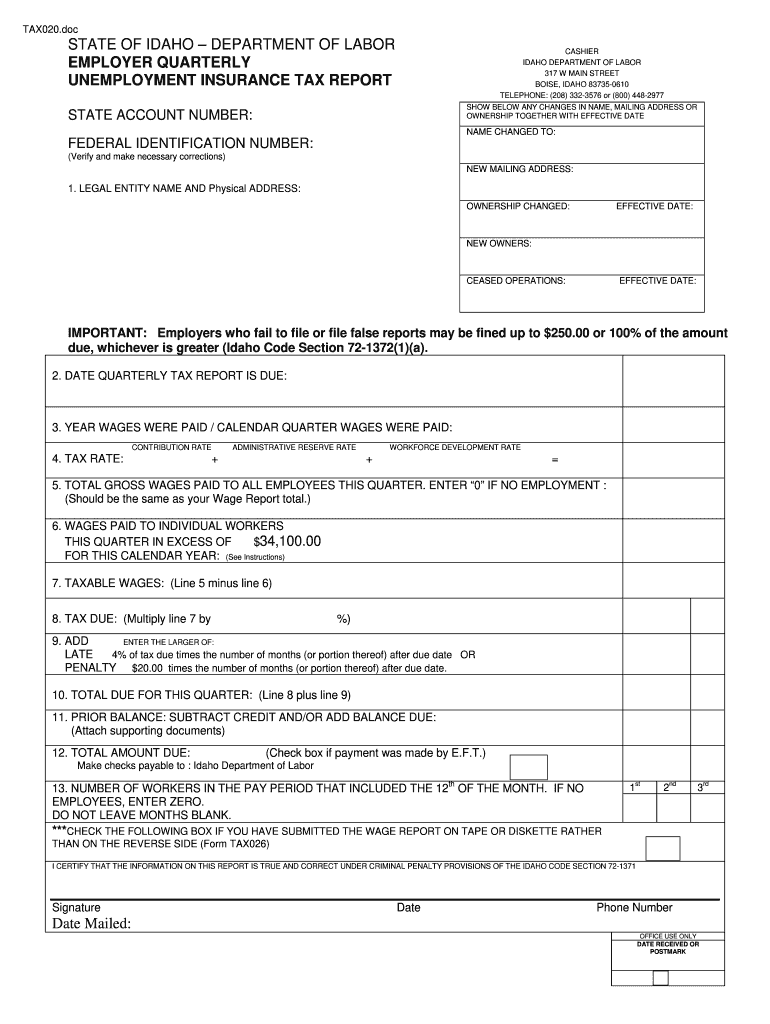

Form Ro967a Idaho Annual Withholding Report printable pdf download

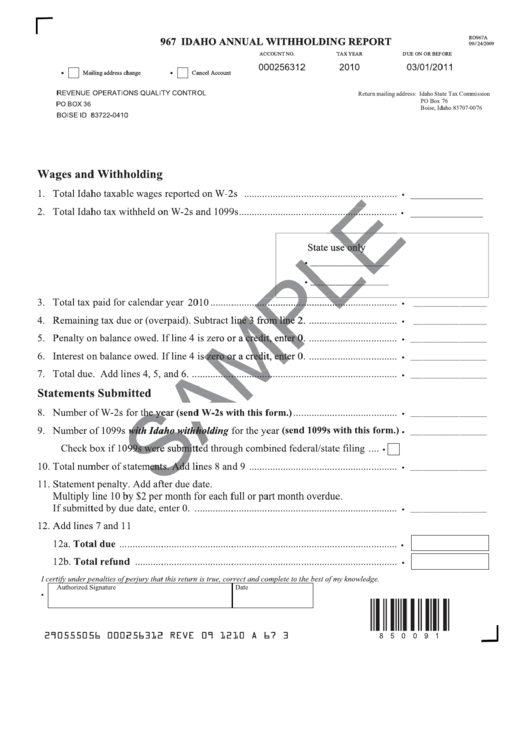

Declaration Under Idaho Code printable pdf download

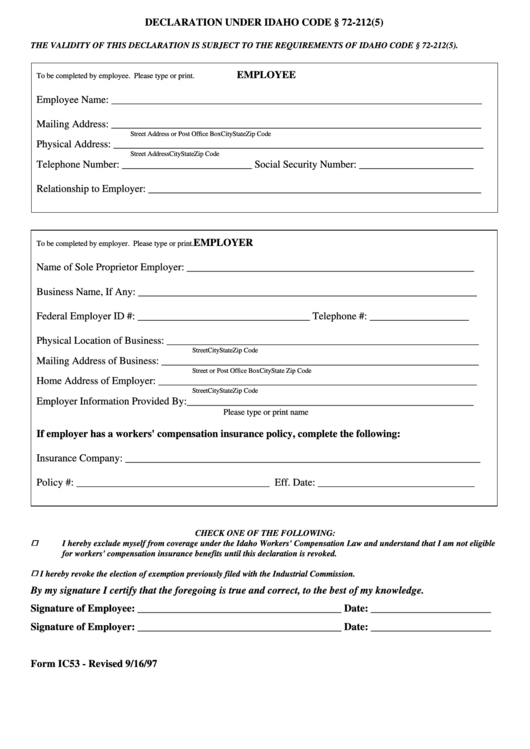

Fill Free fillable forms State of Idaho

Related Post: