Form 8826 Turbotax

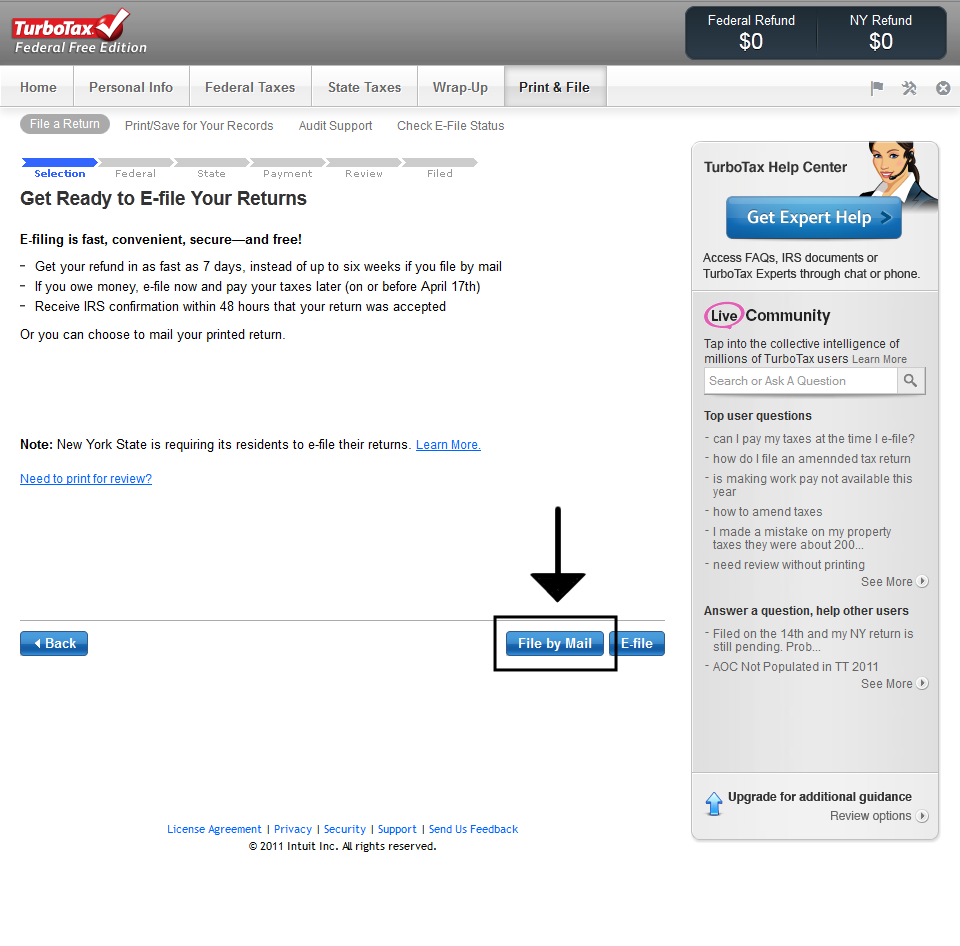

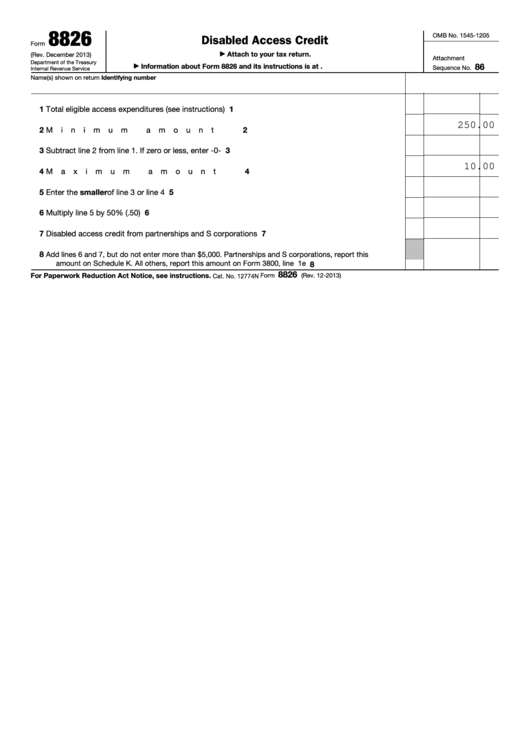

Form 8826 Turbotax - See eligible access expenditures above for a definition and other details. Form 8828 recapture of federal mortgage subsidy; Web here's how to file form 8862 in turbotax. The irs is currently working on building its own free tax filing program. Web the irs submitted the results in a report to congress on may 16, 2023. Web tax gap $688 billion. Taxpayers, other than partnerships or s corporations,. Foreign gift and trust reporting on. Web more instructions can also be found on page 2 of form 8826. Click the links below to see solutions for frequently asked. Web a corporation (other than an s corporation) must complete and file form 8926 if it paid or accrued disqualified interest during the current tax year or had a. See eligible access expenditures above for a definition and other details. Web eligible small businesses use form 8826 to claim the disabled access credit. Web tax return with which this form. Web according to an ordinance that auditor miranda meginness submitted to the marion city council finance committee on oct. Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits select search,. I have been using turbotax home &. Web form 8820 orphan drug credit; And the good news is you can. Form 8828 recapture of federal mortgage subsidy; Web tax gap $688 billion. 12, the irs has fined the city. Web we last updated the disabled access credit in february 2023, so this is the latest version of form 8826, fully updated for tax year 2022. Recapture of federal mortgage subsidy form 8830: You can download or print current or past. The tax data from the form 8826 is entered in the turbotax program using the general business credit form 3800 part iii. Enhanced oil recovery credit form 8834: Web here's how to file form 8862 in turbotax. Disabled access credit form 8828: You can also read more on the irs tax credits and deductions page on the americans with. Enter the ale member’s complete address (including. See eligible access expenditures above for a definition and other details. 12, the irs has fined the city. You can download or print current or past. Web eligible small businesses use form 8826 to claim the disabled access credit. Web however, small business owners may claim a tax credit for this commitment. Preparing and sending the form the time needed to complete and. Web page last reviewed or updated: You can download or print current or past. Recapture of federal mortgage subsidy form 8830: Web tax return with which this form is filed. Ad easy guidance & tools for c corporation tax returns. The tax data from the form 8826 is entered in the turbotax program using the general business credit form 3800 part iii. Web eligible small businesses use form 8826 to claim the disabled access. Disabled access credit form 8828: Recordkeeping 4 hr., 18 min. Form 8826 disabled access credit; Web we last updated the disabled access credit in february 2023, so this is the latest version of form 8826, fully updated for tax year 2022. To access the form, you will need to open a 1040/business return on the online/desktop and then go to. This credit is part of the general business credit. Web follow these steps to generate form 8826 in the partnership module: Click the links below to see solutions for frequently asked. Ad easy guidance & tools for c corporation tax returns. You can also read more on the irs tax credits and deductions page on the americans with. Definitions eligible small business for purposes of. Web 2 days agowhy the irs is testing a free direct file program. Web eligible small businesses use form 8826 to claim the disabled access credit. Web in the sections list, select disabled access credit (8826) and enter the total eligible access expenditures. Web eligible small businesses use form 8826 to claim the. Recordkeeping 4 hr., 18 min. Web tax return with which this form is filed. Web a corporation (other than an s corporation) must complete and file form 8926 if it paid or accrued disqualified interest during the current tax year or had a. The tax data from the form 8826 is entered in the turbotax program using the general business credit form 3800 part iii. The irs has also put a plan in motion to digitize. Form 8828 recapture of federal mortgage subsidy; Web tax gap $688 billion. Web eligible small businesses use form 8826 to claim the disabled access credit. Web according to an ordinance that auditor miranda meginness submitted to the marion city council finance committee on oct. Web does any turbotax product include form 8826 i have a sole proprietor business and commercial rental property. Web here's how to file form 8862 in turbotax. Foreign gift and trust reporting on. Currently, the irs allows taxpayers with adjusted gross incomes up to $73,000 to file their federal tax returns. Enhanced oil recovery credit form 8834: Learning about the law or the form 47 min. Web form 8826 is not supported by turbotax. Form 8826 disabled access credit; You can download or print current or past. Web in the sections list, select disabled access credit (8826) and enter the total eligible access expenditures. Enter total eligible access expenditures paid or incurred during the tax year.Blog TurboTax Online How to Print your Tax Return

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Turbo Tax Return Tax In The United States Tax Deduction

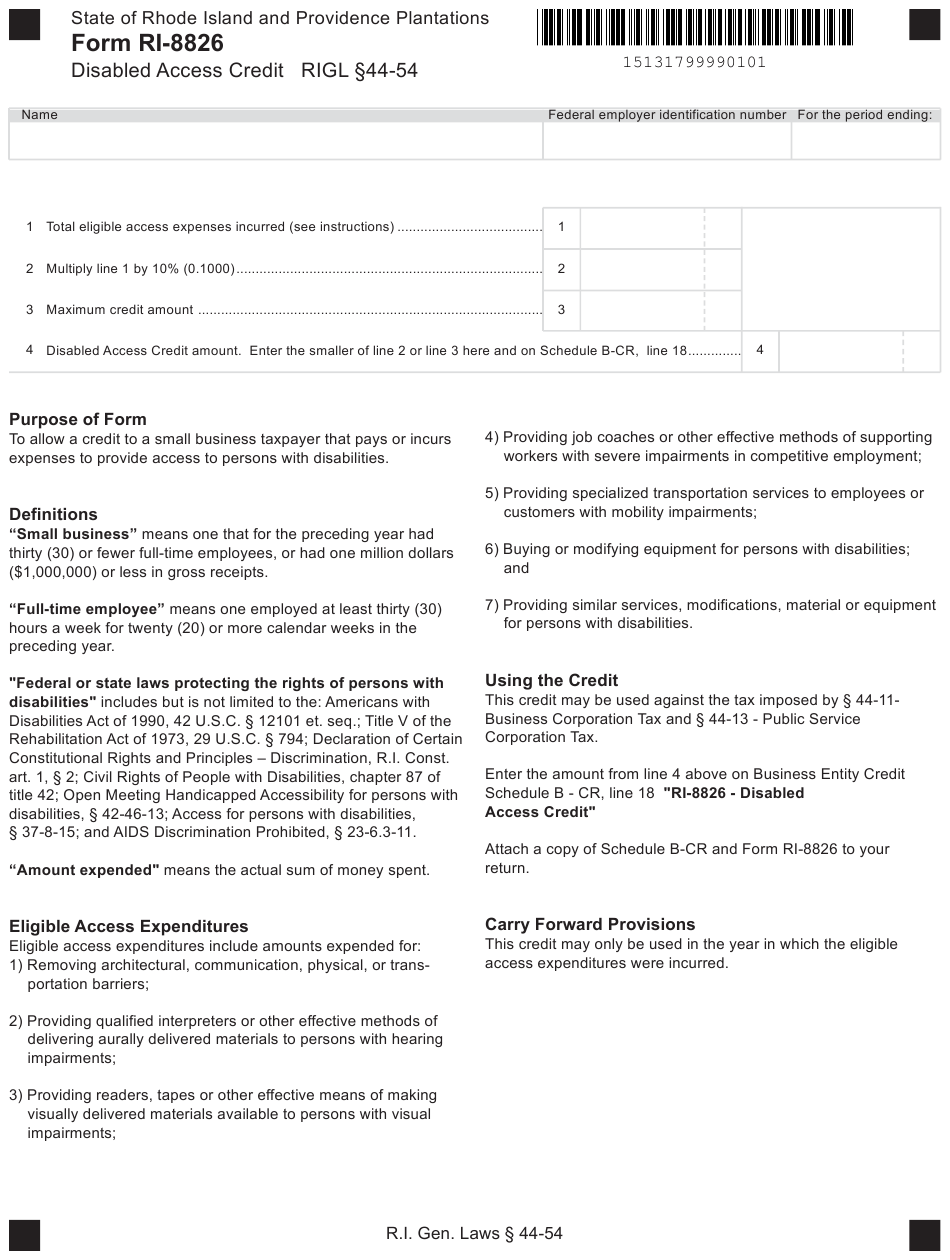

Form RI8826 Download Fillable PDF or Fill Online Disabled Access

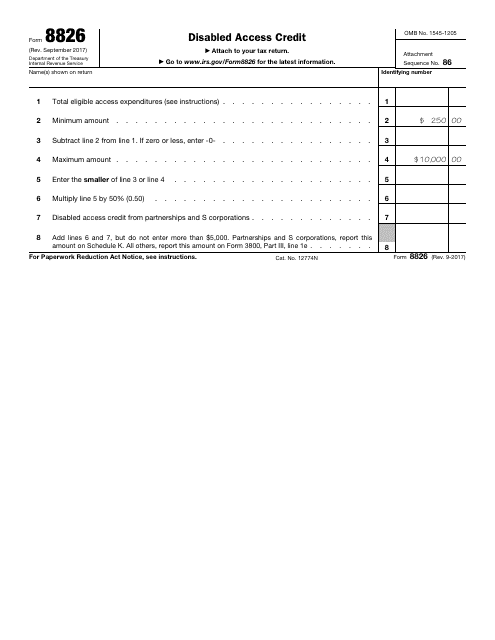

IRS Form 8826 Fill Out, Sign Online and Download Fillable PDF

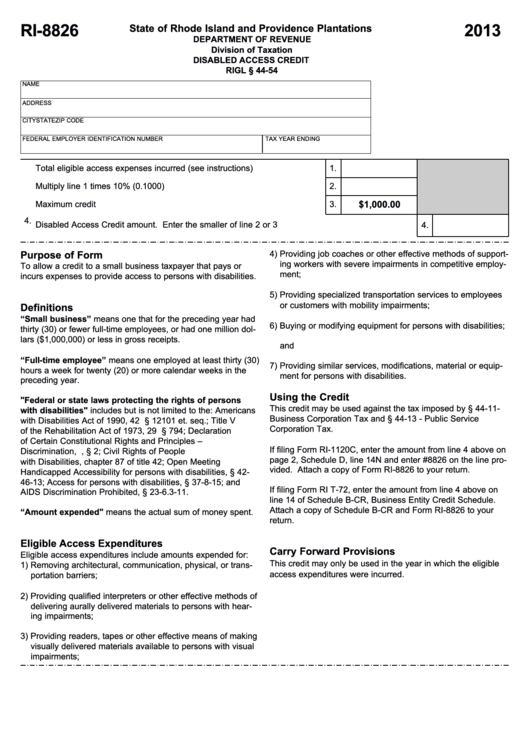

Fillable Form Ri8826 Rhode Island Disabled Access Credit 2013

Form 8826 Disabled Access Credit Form (2013) Free Download

Fillable Form 8826 Disabled Access Credit printable pdf download

Form 8826 Disabled Access Credit Form (2013) Free Download

Form Mo8826 Disabled Access Credit Edit, Fill, Sign Online Handypdf

Related Post: