Maryland Individual Income Tax Extension Form

Maryland Individual Income Tax Extension Form - Web individual tax forms and instructions. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Maryland personal income tax returns are due by the 15th day of the 4th month following the close of the. We will update this page with a new version of the form for 2024 as soon as it is made available. You are not required to file form 502e in order to obtain this. The instruction booklets listed here do not include forms. Web the comptroller has extended the due dates for maryland individual income tax first and second quarter estimated tax declarations and payments for tax year 2022 to july 15,. Web follow the links below for information on maryland's individual income tax, including what's new for the current tax year, as well as rates, tax legislation, and frequently asked. Web maryland form 504e application for extension to file fiduciary income tax return instructions 2020 general instructions purpose of form. Web $34.95 now only $29.95 file your personal tax extension now! Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Web online payment application options. Opening of the 2022 tax filing system maryland will begin processing personal income tax returns for tax year 2022 on 01/25/2023 or earlier. Web follow the links below for information on maryland's individual income tax, including what's new for the. Web $34.95 now only $29.95 file your personal tax extension now! Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Marylanders now have until july 15, 2022, to file and pay 2021 state individual income taxes, comptroller peter franchot announced. Web maryland form 504e application for extension to file fiduciary income. Web individual tax forms and instructions. Forms are available for downloading in the resident individuals income tax forms section. Web the comptroller has extended the due dates for maryland individual income tax first and second quarter estimated tax declarations and payments for tax year 2022 to july 15,. Marylanders now have until july 15, 2022, to file and pay 2021. View history of payments filed via this system. Web the comptroller has extended the due dates for maryland individual income tax first and second quarter estimated tax declarations and payments for tax year 2022 to july 15,. Opening of the 2022 tax filing system maryland will begin processing personal income tax returns for tax year 2022 on 01/25/2023 or earlier.. Web individuals residing in maryland are not required to file a separate extension form if they owe zero maryland tax and have a valid federal tax extension. View history of payments filed via this system. Opening of the 2022 tax filing system maryland will begin processing personal income tax returns for tax year 2022 on 01/25/2023 or earlier. Web individual. Web individual tax forms and instructions. View history of payments filed via this system. You are not required to file form 502e in order to obtain this. Web 2022 individual income tax instruction booklets. Web file an extension where's my 1099g? Web form 502e is a maryland individual income tax form. Marylanders now have until july 15, 2022, to file and pay 2021 state individual income taxes, comptroller peter franchot announced. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web the comptroller has extended the due dates for maryland individual income. Web individual tax forms and instructions. Web form 502e is a maryland individual income tax form. Web 2022 individual income tax instruction booklets. Opening of the 2022 tax filing system maryland will begin processing personal income tax returns for tax year 2022 on 01/25/2023 or earlier. Forms are available for downloading in the resident individuals income tax forms section. Web 2022 individual income tax instruction booklets. Web $34.95 now only $29.95 file your personal tax extension now! Web online payment application options. The instruction booklets listed here do not include forms. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Web maryland form 504e application for extension to file fiduciary income tax return instructions 2020 general instructions purpose of form. Web individual tax forms and instructions. Marylanders now have until july 15, 2022, to file and pay 2021 state individual income taxes, comptroller peter franchot announced. The instruction booklets listed here do not include forms. Web individuals residing in maryland. Web follow the links below for information on maryland's individual income tax, including what's new for the current tax year, as well as rates, tax legislation, and frequently asked. View history of payments filed via this system. Maryland personal income tax returns are due by the 15th day of the 4th month following the close of the. Web 2022 individual income tax instruction booklets. Marylanders now have until july 15, 2022, to file and pay 2021 state individual income taxes, comptroller peter franchot announced. The instruction booklets listed here do not include forms. Below you will find links to individual income tax forms and instructions from tax year 2010 through the current year. Web form 502e is a maryland individual income tax form. Web individuals residing in maryland are not required to file a separate extension form if they owe zero maryland tax and have a valid federal tax extension. Web $34.95 now only $29.95 file your personal tax extension now! You are not required to file form 502e in order to obtain this. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Forms are available for downloading in the resident individuals income tax forms section. We will update this page with a new version of the form for 2024 as soon as it is made available. Web maryland form 504e application for extension to file fiduciary income tax return instructions 2020 general instructions purpose of form. Web the comptroller has extended the due dates for maryland individual income tax first and second quarter estimated tax declarations and payments for tax year 2022 to july 15,. Opening of the 2022 tax filing system maryland will begin processing personal income tax returns for tax year 2022 on 01/25/2023 or earlier. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Web online payment application options. Web individual tax forms and instructions.IRS Tax Extension Efile Federal Extension

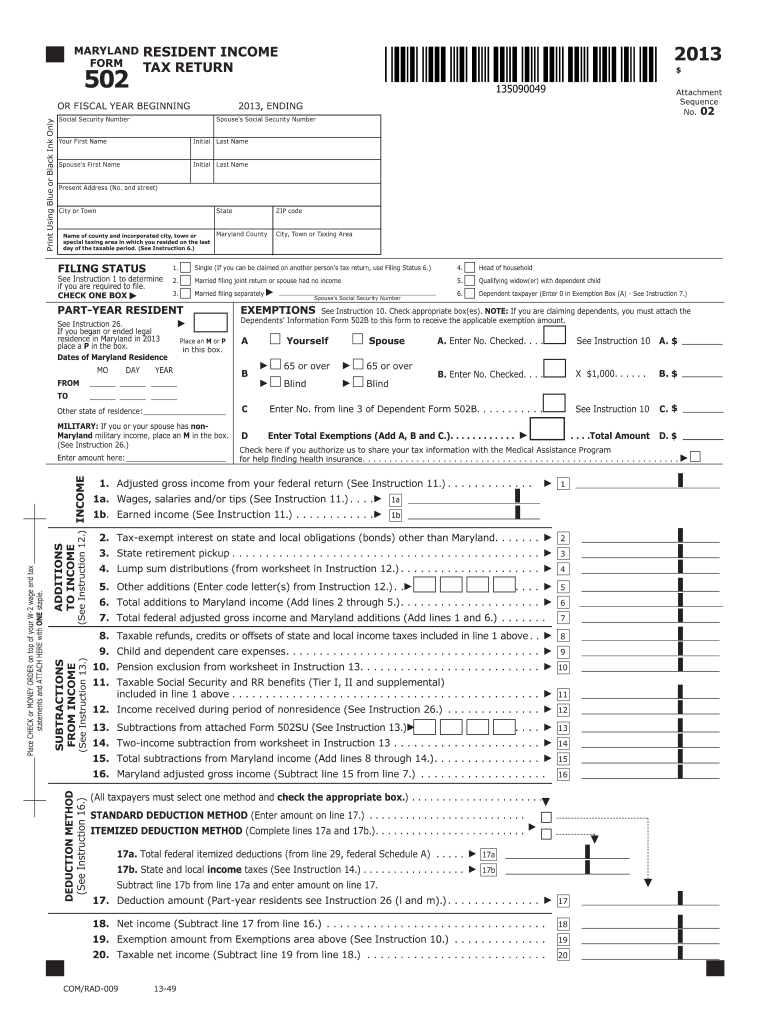

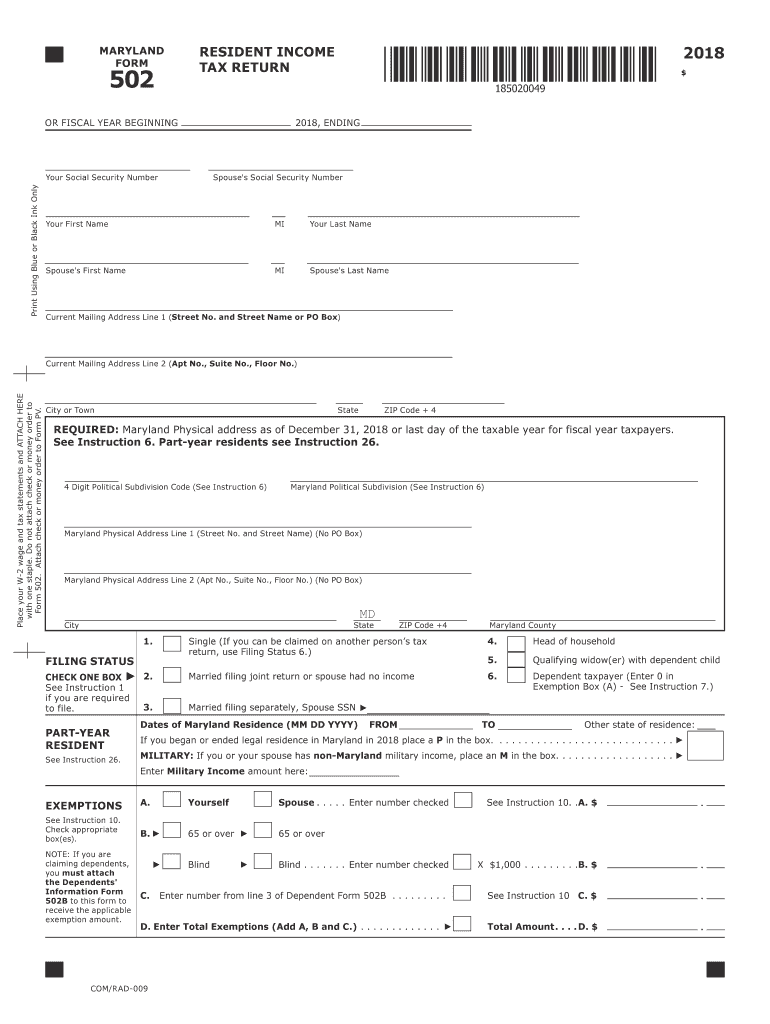

Hm Md 502 Form Fill Out and Sign Printable PDF Template signNow

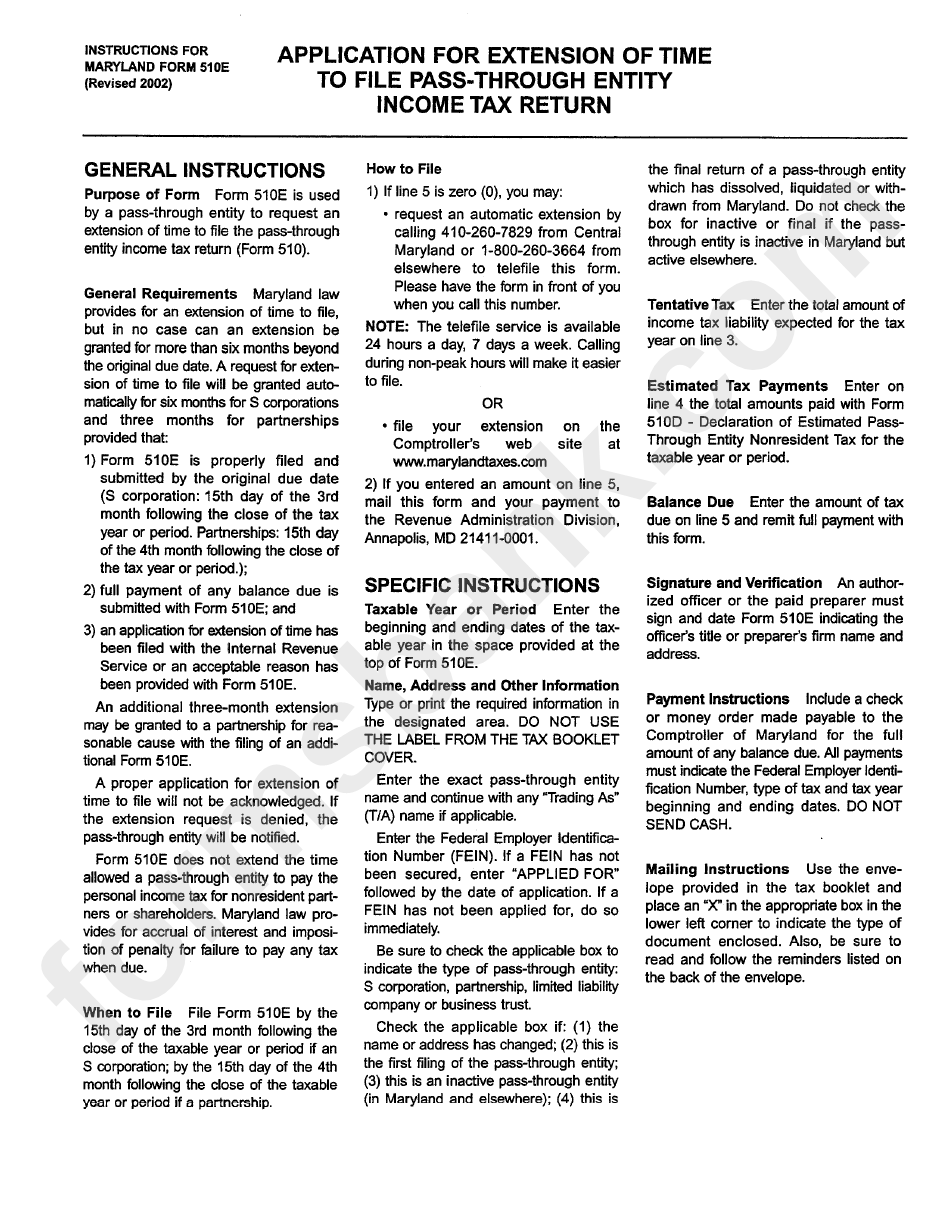

Instructions For Maryland Form 510e Application For Extension Oftime

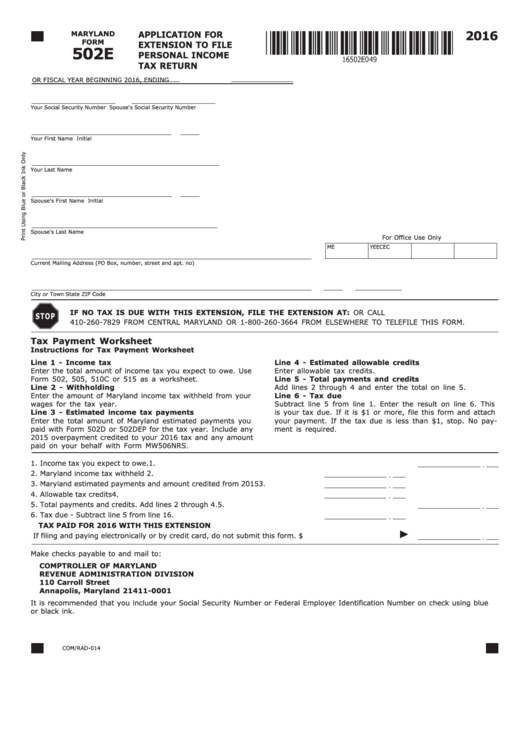

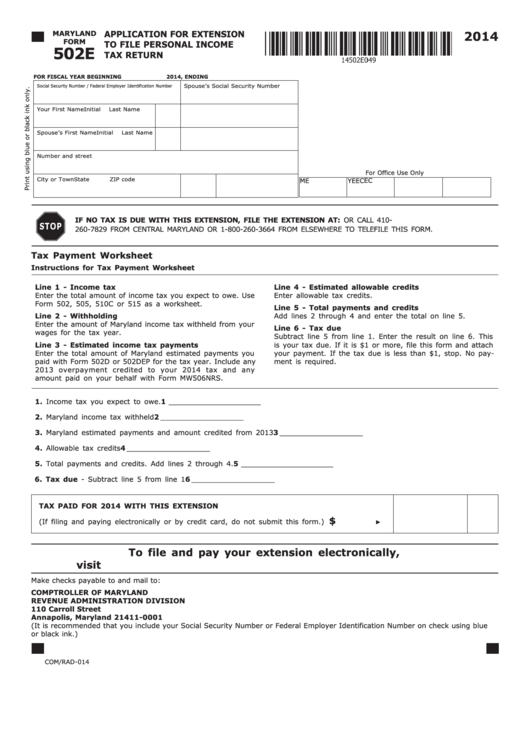

502e Maryland Tax Forms And Instructions printable pdf download

Maryland Form 202 20202022 Fill and Sign Printable Template Online

Fillable Maryland Form 502e Application For Extension To File

Tax Extension Form Printable Printable Forms Free Online

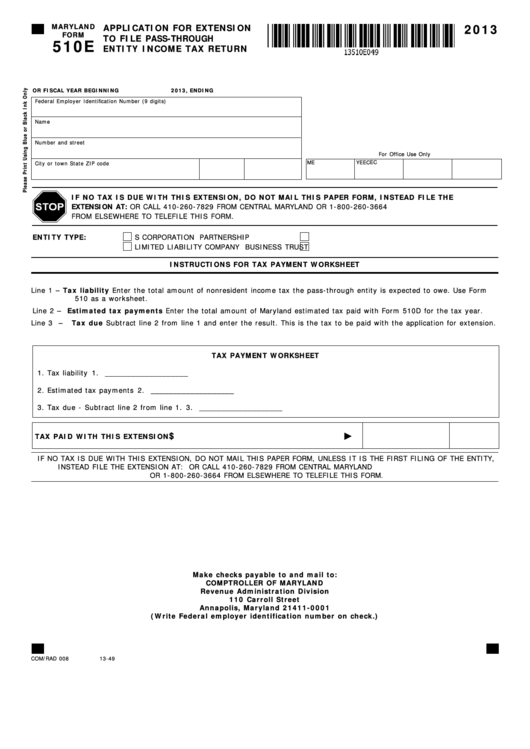

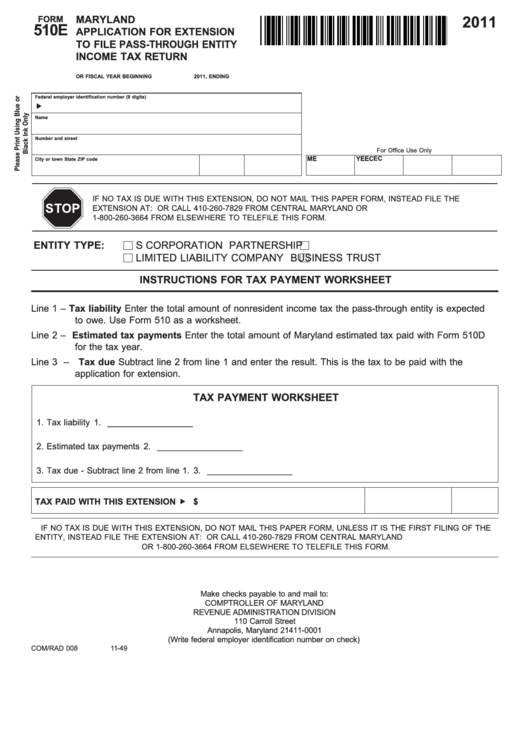

Fillable Maryland Form 510e Application For Extension To File Pass

Fillable Form 510e Maryland Application For Extension To File Pass

Md 502 instructions 2018 Fill out & sign online DocHub

Related Post: