Form 5329 Instructions

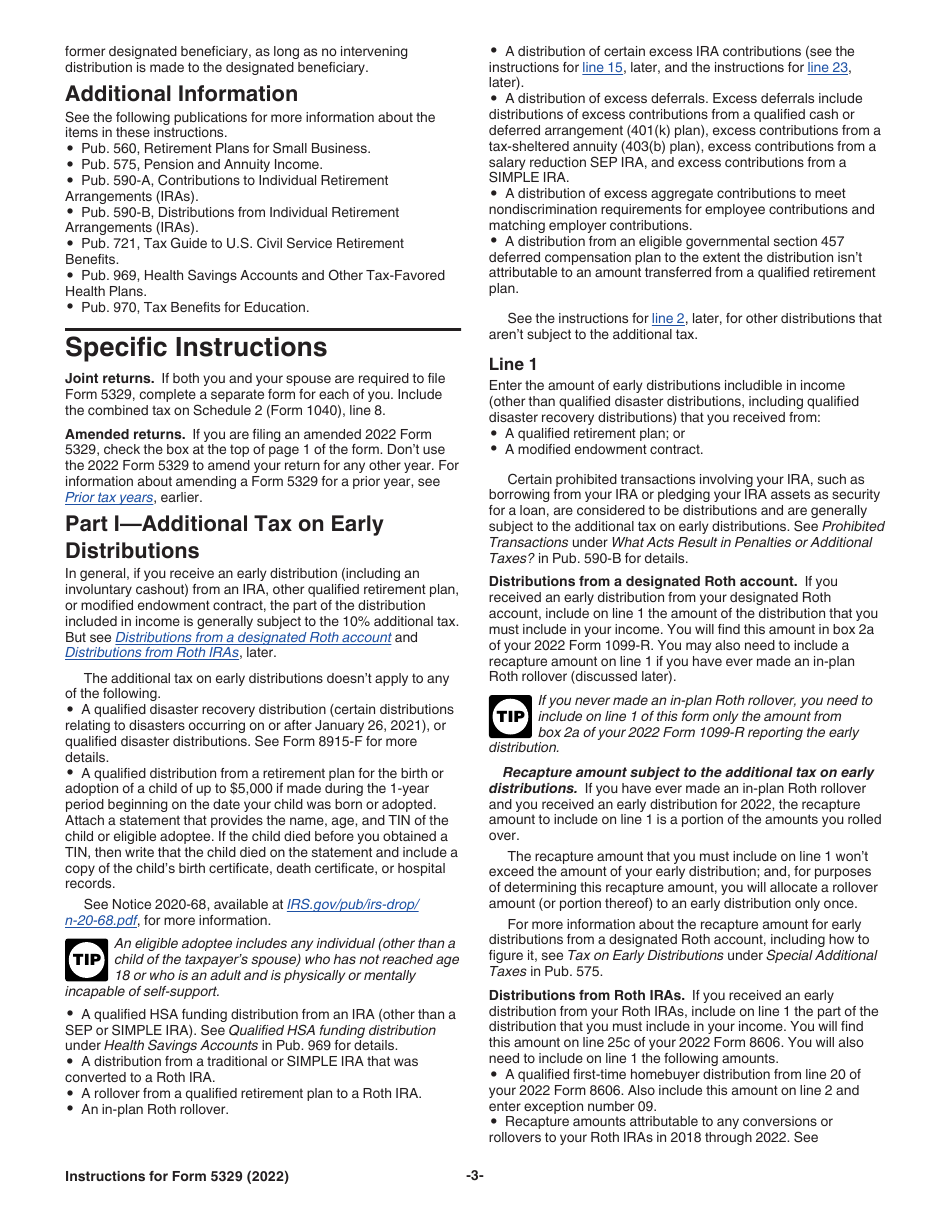

Form 5329 Instructions - Web form 5329 includes detailed instructions for each part, which taxpayers should follow carefully to ensure accurate reporting. Ad get ready for tax season deadlines by completing any required tax forms today. Web if you’ve missed an rmd, here’s what to do to correct the error. When and where to file. Web more about the federal form 5329 other ty 2022. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Tip if you don’t have to file a 2021 income tax return,. In the second box, if no amount of your rmd was withdrawn before. Complete, edit or print tax forms instantly. From the input return tab, go to taxes ⮕ retirement plan taxes (5329).; The nine parts of form 5329 are:. Web please refer to form 5329 instructions , in the first box enter the amount of your rmd for the 2022 tax year. Web form 5329 is used by any individual who has established a retirement account, annuity or retirement. When you complete form 5329 for 2022, you enter $1,000 (not $800) on line 20 because you. Get ready for tax season deadlines by completing any required tax forms today. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Use form 5329 to report additional taxes on iras, other qualified. Web if you plan. Scroll down to the section titled other. Purpose of form use form 5329 to. For the latest information about developments related to form 5329 and its instructions, such. Web form 5329 includes detailed instructions for each part, which taxpayers should follow carefully to ensure accurate reporting. Take the rmd as soon as you discover you have missed it. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Use form 5329 to report additional taxes on iras, other qualified. Ad get ready for tax season deadlines by completing any required tax forms today. It’s best to take it as a separate. The nine parts of form 5329 are:. Complete, edit or print tax forms instantly. It’s best to take it as a separate. Web if you plan on filing the form 5329 on it's own, this can be indicated on screen 41.1 retirement plan taxes (5329). Get ready for tax season deadlines by completing any required tax forms today. Scroll down to the section titled other. Ad get ready for tax season deadlines by completing any required tax forms today. The nine parts of form 5329 are:. Web developments related to form 5329 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5329. Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. File. Complete, edit or print tax forms instantly. In the second box, if no amount of your rmd was withdrawn before. From the input return tab, go to taxes ⮕ retirement plan taxes (5329).; Web more about the federal form 5329 other ty 2022. Web form 5329 is used by any individual who has established a retirement account, annuity or retirement. Web developments related to form 5329 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5329. File form 5329 with your 2022 form 1040,. Use form 5329 to report additional taxes on iras, other qualified. Take the rmd as soon as you discover you have missed it. The nine parts of form 5329 are:. Web more about the federal form 5329 other ty 2022. For the latest information about developments related to form 5329 and its instructions, such. Web if you’ve missed an rmd, here’s what to do to correct the error. Web form 5329 includes detailed instructions for each part, which taxpayers should follow carefully to ensure accurate reporting. From the input return. In the second box, if no amount of your rmd was withdrawn before. Web please refer to form 5329 instructions , in the first box enter the amount of your rmd for the 2022 tax year. The nine parts of form 5329 are:. Get ready for tax season deadlines by completing any required tax forms today. Web developments related to. Use form 5329 to report additional taxes on iras, other qualified. Complete, edit or print tax forms instantly. When and where to file. For the latest information about developments related to form 5329 and its instructions, such. Web if you plan on filing the form 5329 on it's own, this can be indicated on screen 41.1 retirement plan taxes (5329). Scroll down to the excess. Tip if you don’t have to file a 2021 income tax return,. Web form 5329 includes detailed instructions for each part, which taxpayers should follow carefully to ensure accurate reporting. Take the rmd as soon as you discover you have missed it. It’s best to take it as a separate. Get ready for tax season deadlines by completing any required tax forms today. In the second box, if no amount of your rmd was withdrawn before. From the input return tab, go to taxes ⮕ retirement plan taxes (5329).; Purpose of form use form 5329 to. File form 5329 with your 2022 form 1040,. Ad complete irs tax forms online or print government tax documents. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Web more about the federal form 5329 other ty 2022. When you complete form 5329 for 2022, you enter $1,000 (not $800) on line 20 because you. Ad get ready for tax season deadlines by completing any required tax forms today.Instructions for How to Fill in IRS Form 5329

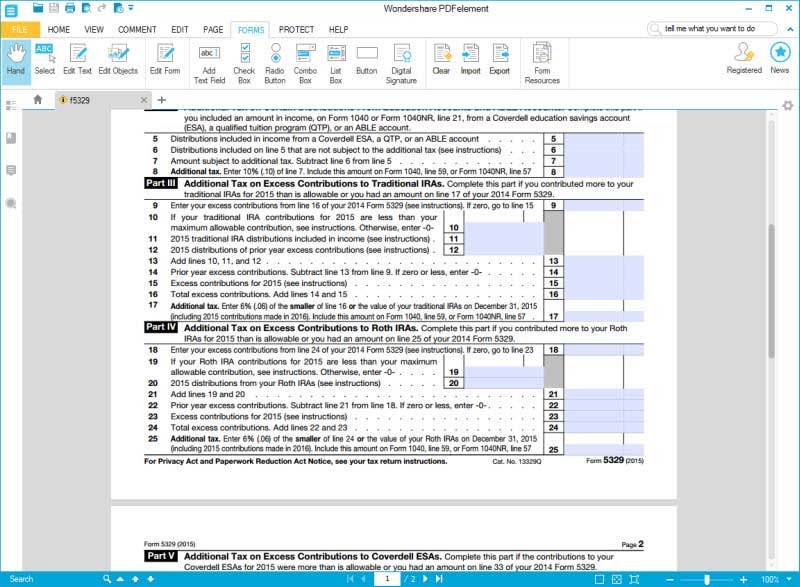

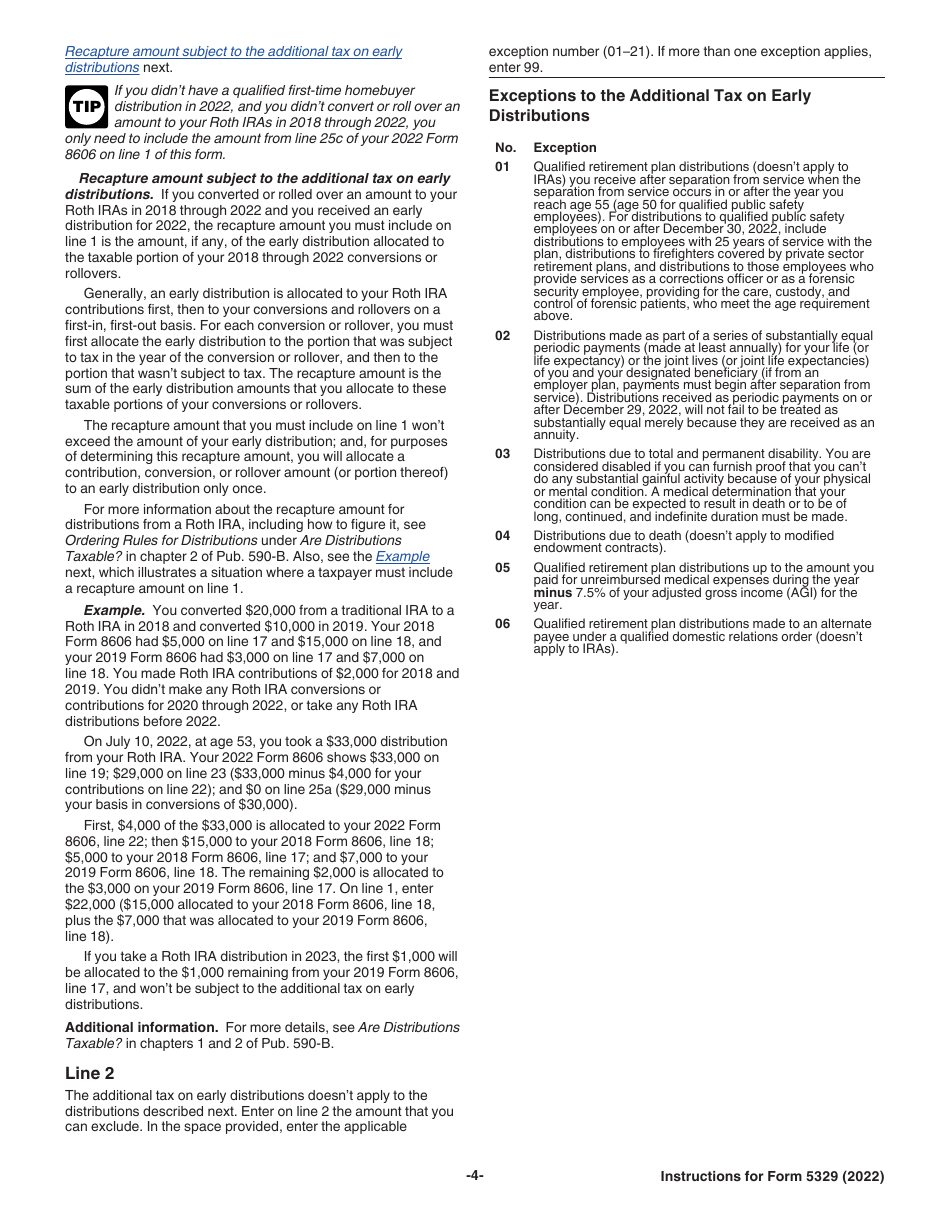

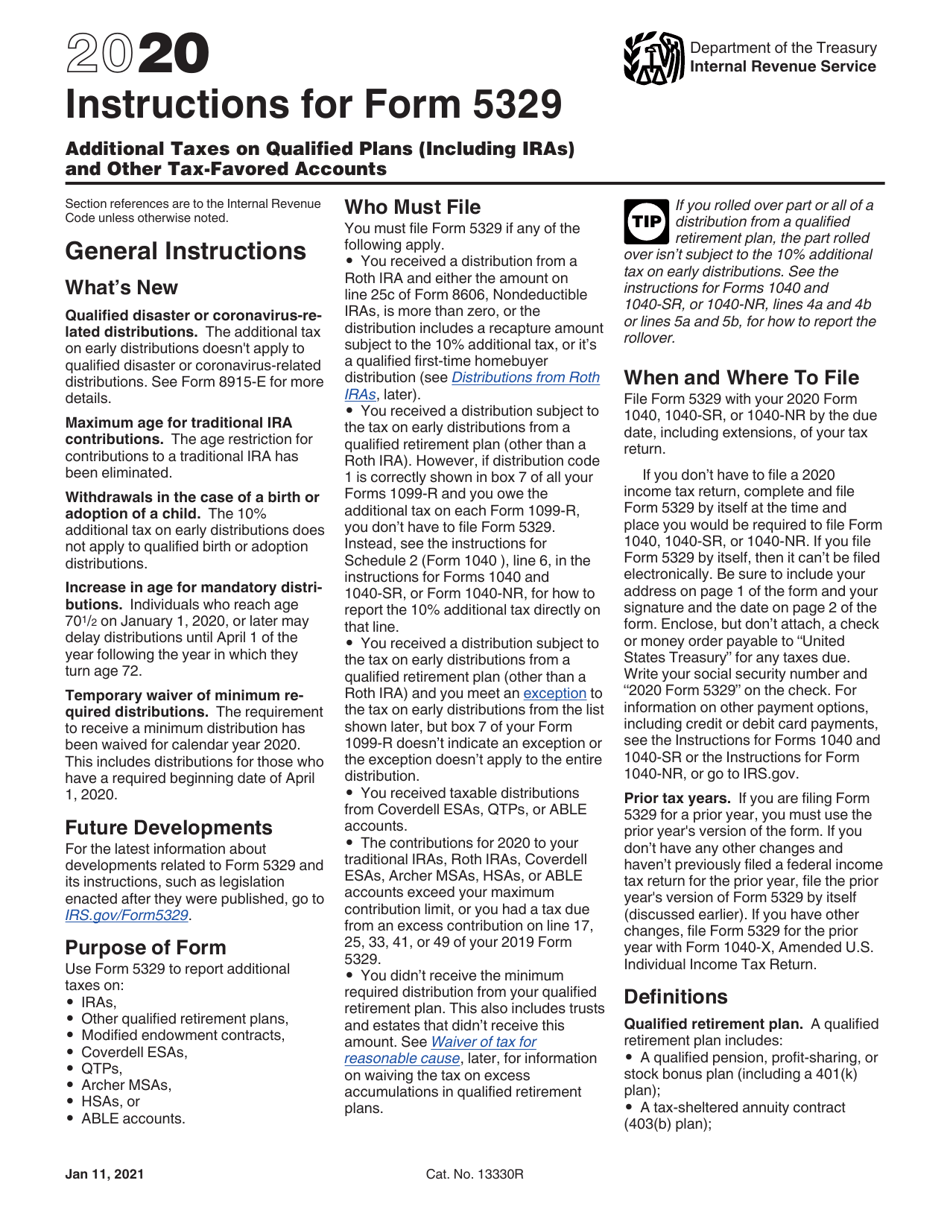

Instructions For Form 5329 Additional Taxes On Qualified Plans And

2012 Instructions for Form 5329

Instructions For Form 5329 Additional Taxes Attributable To Iras

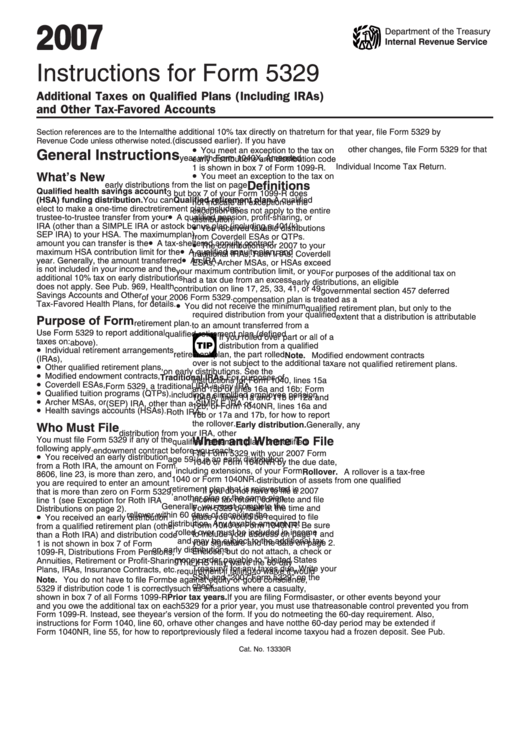

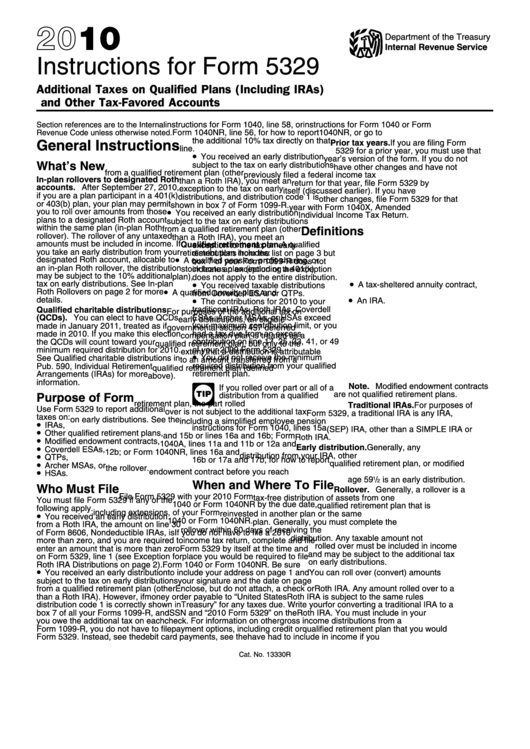

Instructions For Form 5329 2010 printable pdf download

Download Instructions for IRS Form 5329 Additional Taxes on Qualified

Download Instructions for IRS Form 5329 Additional Taxes on Qualified

Download Instructions for IRS Form 5329 Additional Taxes on Qualified

Instructions For Form 5329 Additional Taxes On Qualified Plans And

Instructions For Form 5329 Additional Taxes On Qualified Plans And

Related Post: