Form 1065 Line 20 Other Deductions Worksheet

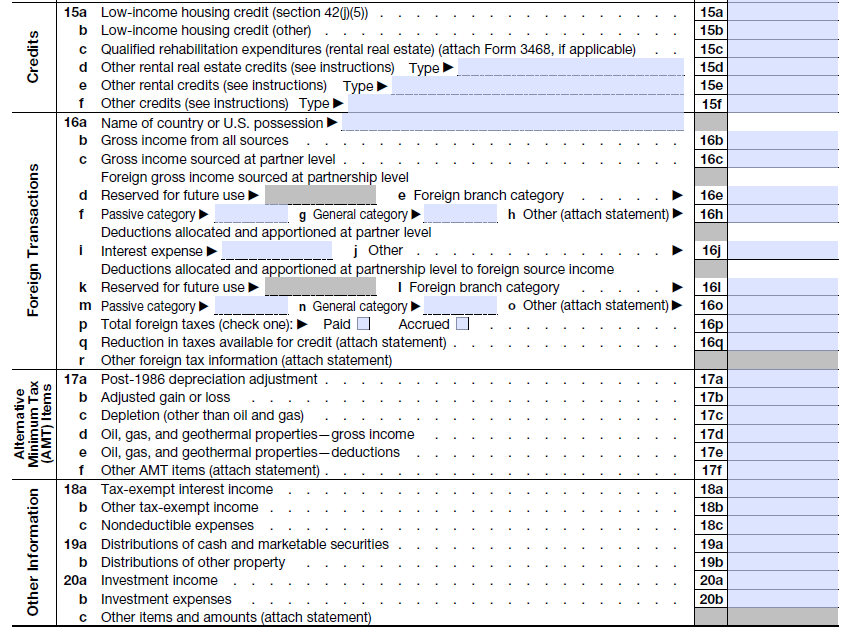

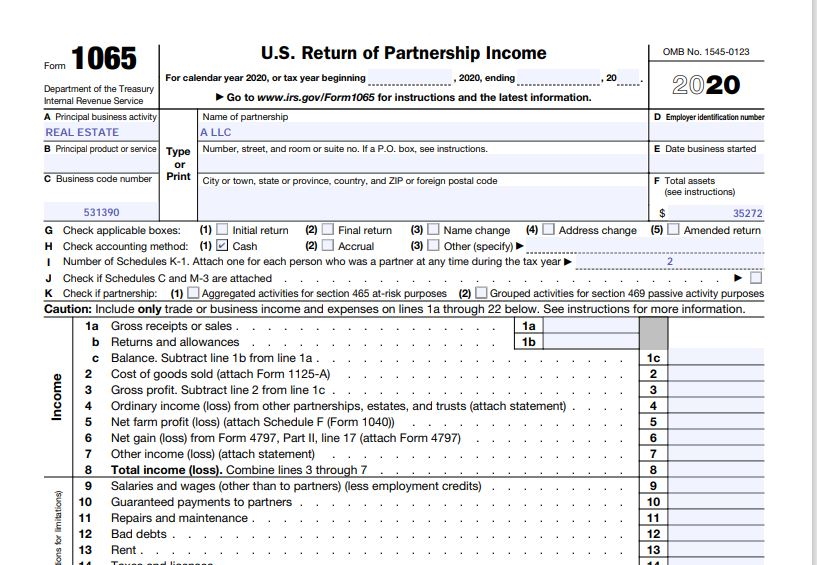

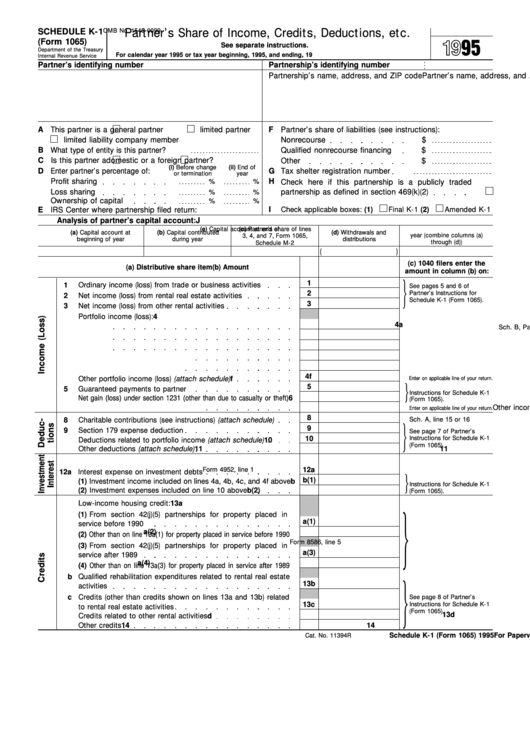

Form 1065 Line 20 Other Deductions Worksheet - Enter the total on line 26. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. Return of partnership income department of the treasury internal revenue service go to. Ad download or email irs 1065 & more fillable forms, register and subscribe now! Web showing 8 worksheets for 1065 other deductions. Web deduction by an employer for a reasonable allowance under [section] 162(a) for compensation paid with regard to personal services rendered. Worksheets are internal revenue service department of the treasury, partnershipllc tax organizer form. Web for partnership or s corporation returns, enter amounts related to form 8903 on: From the form 1065 instructions here : Web begin completing form 1065 by including general information about the partnership, including its employer id number (ein) and its business code (found in the. Web begin completing form 1065 by including general information about the partnership, including its employer id number (ein) and its business code (found in the. Web deduction by an employer for a reasonable allowance under [section] 162(a) for compensation paid with regard to personal services rendered. Web form 4684, line 44a, 44b, or 45: Web other deductions or expenses that. Web other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s. Per the worksheet instructions for form 1040, schedule 1, line 16: Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or. Add. Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or. Identify the item as reforestation expense. Web other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s. To enter this information in. Web. Web for partnership or s corporation returns, enter amounts related to form 8903 on: Add the amounts shown in the far right column for lines 9 through 20. Attach a statement, listing by type and amount, all allowable deductions that are not deductible elsewhere on form 1120. Web showing 8 worksheets for 1065 other deductions. Web other deductions or expenses. Enter the total allowable trade or business deductions that aren't. Web other deductions or expenses that do not conform to the separate lines for deductions on the form 1065 partnership return are reported on line 20. If you file form 1118, add the amount reported on this line to your other income and report the total on the form 1118,. Web begin completing form 1065 by including general information about the partnership, including its employer id number (ein) and its business code (found in the. Web showing 8 worksheets for 1065 other deductions. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. The amount entered will flow to form 8582, worksheet 3. Web from the. Web form 1065 2022 u.s. Add the amounts shown in the far right column for lines 9 through 20. Or income/deductions > schedule k income overrides: Web for partnership or s corporation returns, enter amounts related to form 8903 on: Web begin completing form 1065 by including general information about the partnership, including its employer id number (ein) and its. Web begin completing form 1065 by including general information about the partnership, including its employer id number (ein) and its business code (found in the. Web 20 other deductions (attach statement). Per the worksheet instructions for form 1040, schedule 1, line 16: Web other deductions or expenses that do not conform to the separate lines for deductions on form 1065. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Other deductions, for an individual return in intuit. Return of partnership income department of the treasury internal revenue service go to. Worksheets are internal revenue service department of the treasury, partnershipllc tax organizer form. Form 6781, line 5 and form 8621, lines 7, 9, 11b: Per the worksheet instructions for form 1040, schedule 1, line 16: 21 22 ordinary business income. Or income/deductions > schedule k income overrides: Web from the tax help for form 1065, page 4, line 13 a through g: Form 6781, line 5 and form 8621, lines 7, 9, 11b: Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or. Identify the item as reforestation expense. Enter the total allowable trade or business deductions that aren't. Other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. The amount entered will flow to form 8582, worksheet 3. Other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s. Form 6781, line 5 and form 8621, lines 7, 9, 11b: Web other deductions or expenses that do not conform to the separate lines for deductions on the form 1065 partnership return are reported on line 20. Return of partnership income are reported on line 20. Enter the total on line 26. Return of partnership income department of the treasury internal revenue service go to. Web form 4684, line 44a, 44b, or 45: Web 20 other deductions (attach statement). Add the amounts shown in the far right column for lines 9 through 20. Charitable contributions, is an expanding table, limited to 30 entries. Web other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s. Web showing 8 worksheets for 1065 other deductions. Web form 1065 2022 u.s. Ad download or email irs 1065 & more fillable forms, register and subscribe now!Fill Free fillable Form 1065 Partner’s Share of Deductions

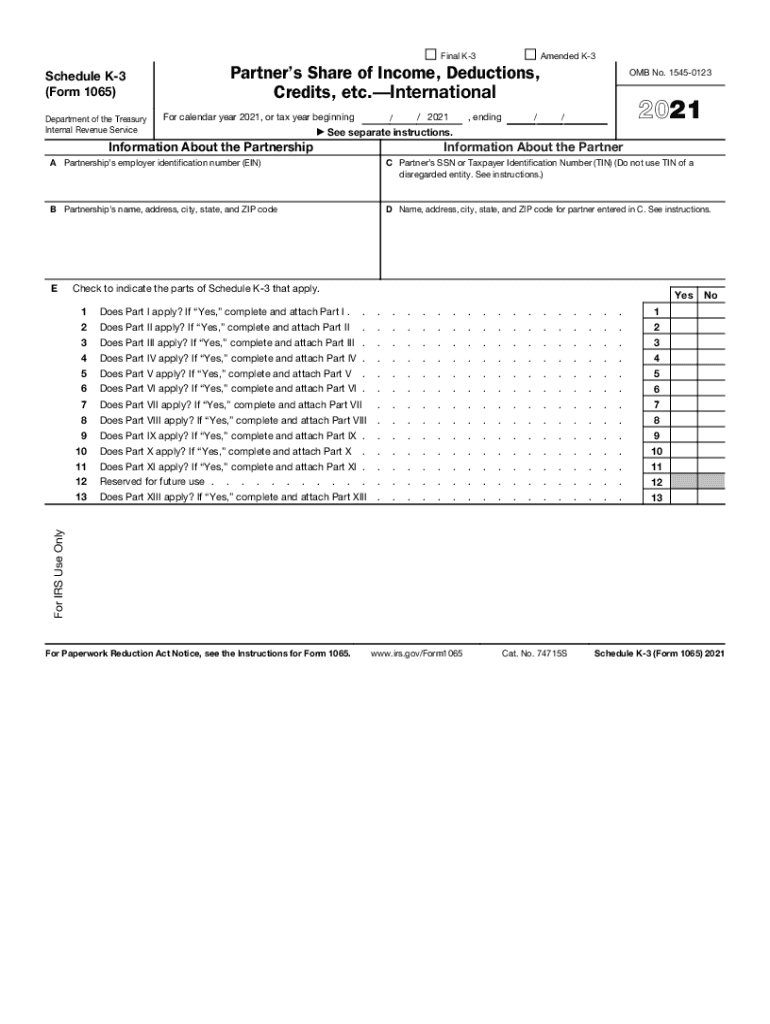

IRS 1065 Schedule K3 20212022 Fill and Sign Printable Template

How to Prepare Form 1065 in 8 Steps [+ Free Checklist]

form 1065 line 20 other deductions worksheet

Form 1065 Instructions in 8 Steps (+ Free Checklist)

Form 1065 Line 20 Other Deductions Worksheet Printable Word Searches

form 1065 line 20 other deductions worksheet

How to Complete 2020 Form 1065 Nina's Soap

Form 1065 Line 20 Other Deductions Worksheet

Form 1065 Line 20 Other Deductions Worksheet

Related Post:

![How to Prepare Form 1065 in 8 Steps [+ Free Checklist]](https://fitsmallbusiness.com/wp-content/uploads/2019/02/form-1065-income-and-expenses-section.png)