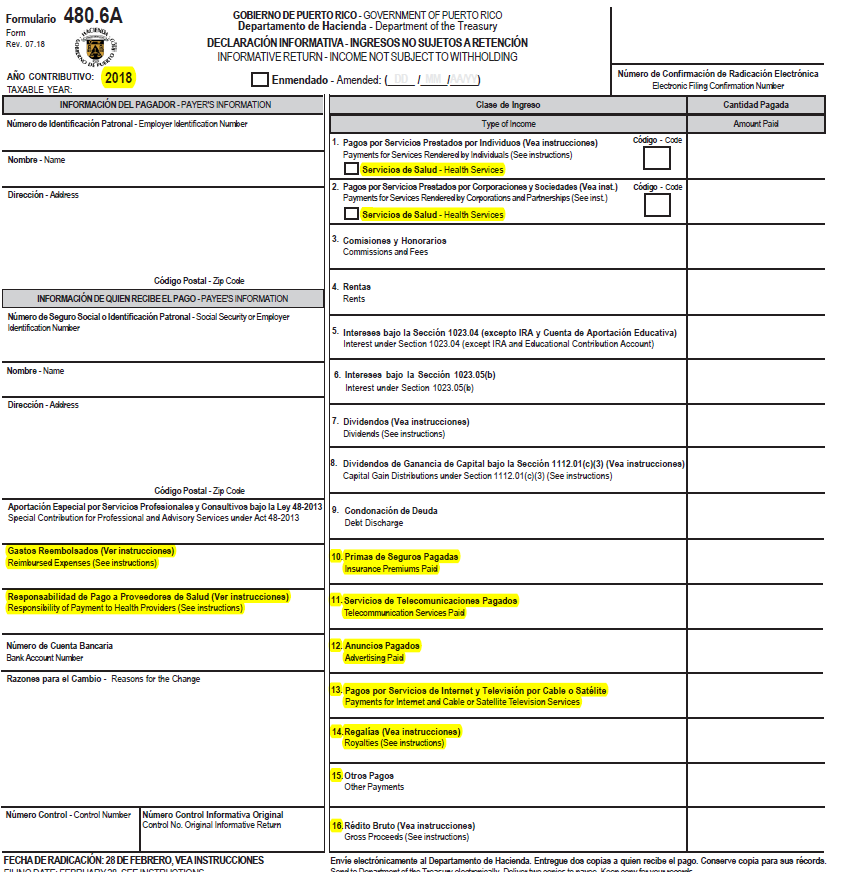

480.6A Form

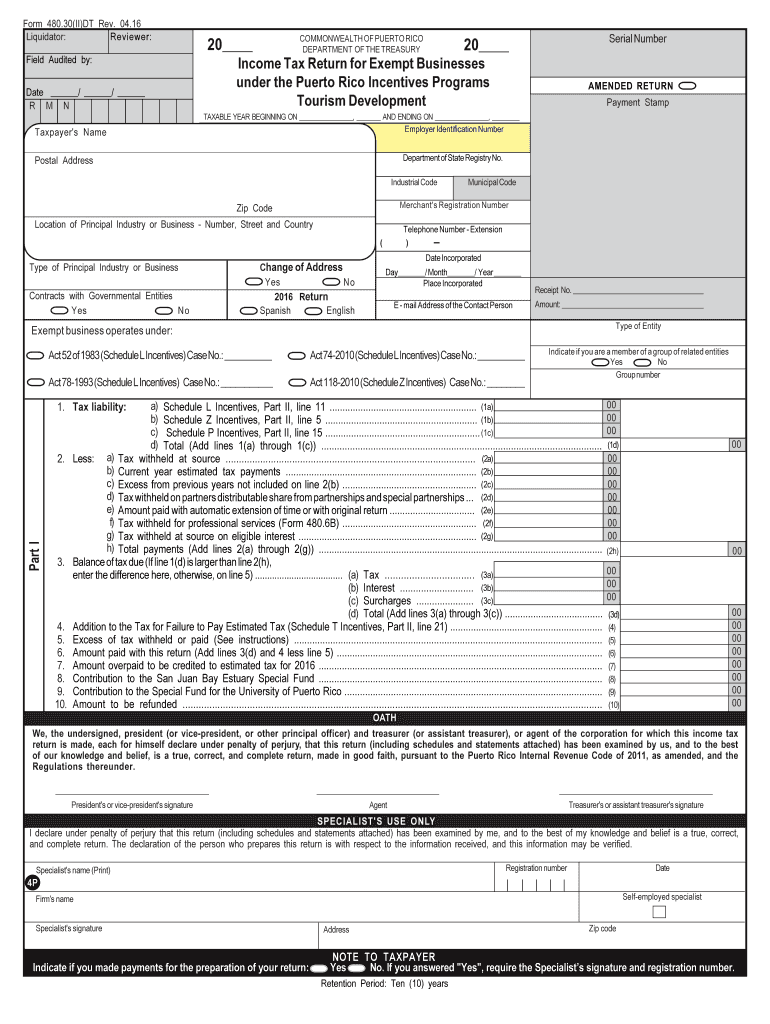

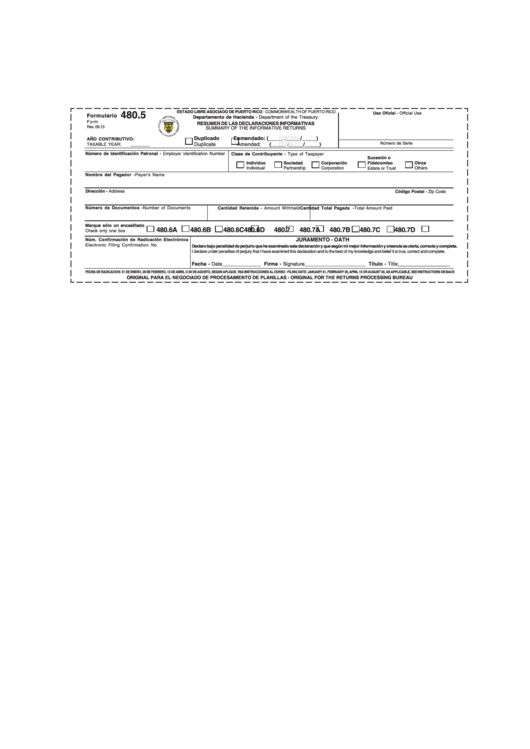

480.6A Form - O commissions and fees and. This form was created so. The form type 480.6a, 480.7a, and/or 480.6b has to be an authorized form allowed to be filed, in the payer/client suri account, in order for. Web what is tax form 480.6a? 1 beginning in calendar 2019, payments for. Hacienda 480.6a form and instructions: Web in the case of int erests, form 480.6a will be required when the amount paid in the year is $50 or more. Make tax season a little less taxing with these tax form filing dates. The form must be prepared on a calendar year basis and must be filed. That's why we're committed to. Created by jonathan cunanan, last modified on feb 10, 2020. O commissions and fees and. Form 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. If you receive these forms, it is. Web there is no de minimis for either form. Web forms 480.6a and 480.6d bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. Web there is no de minimis for either form. Web in the case of int erests, form 480.6a will be required when the amount paid in the year is $50 or more. The form must be. The form must be prepared on a calendar year basis and must be provided. The form must be prepared on a calendar year basis and must be filed. Hacienda 480.6a form and instructions: Web to report payments for services rendered during the year that were previously reported on forms 480.6a, 480.6b and 480.6b.1, taxpayers must file form 480.6sp.1 to comply.. Hacienda 480.6a form and instructions: Web to report payments for services rendered during the year that were previously reported on forms 480.6a, 480.6b and 480.6b.1, taxpayers must file form 480.6sp.1 to comply. Web puerto rico forms 480.6a, 480.6b, and 480.6d end of february forms 480.6a, 480.6b, and 480.6d section in “tax form reporting” to learn more about which account type. Make tax season a little less taxing with these tax form filing dates. That's why we're committed to. The key to filing your taxes is being prepared. Hacienda 480.6a form and instructions: O commissions and fees and. Web what is tax form 480.6a? Form 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Created by jonathan cunanan, last modified on feb 10, 2020. Web 16 rows puerto rico informative returns. Web in the case of interests, form 480.6a will be required when the amount paid in the. Web changes to 480 forms form 480.6a informative return other income not subject to withholding the following boxes were eliminated: Web in the case of int erests, form 480.6a will be required when the amount paid in the year is $50 or more. Web 16 rows puerto rico informative returns. Since we are only interested in whole. Web aii persons. Make tax season a little less taxing with these tax form filing dates. The form type 480.6a, 480.7a, and/or 480.6b has to be an authorized form allowed to be filed, in the payer/client suri account, in order for. If you receive these forms, it is. Web puerto rico forms 480.6a, 480.6b, and 480.6d end of february forms 480.6a, 480.6b, and. Web items were previously under the form 480.6a and 480.6b. 1 beginning in calendar 2019, payments for. Hacienda 480.6a form and instructions: Since we are only interested in whole. The form type 480.6a, 480.7a, and/or 480.6b has to be an authorized form allowed to be filed, in the payer/client suri account, in order for. Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services rendered or to individuals for any of the. The form must be prepared on a calendar year basis and must be filed. We first want to find the whole number, and to do this we divide the numerator by the. Web forms 480.6a and 480.6d bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. O commissions and fees and. Series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable. The form type 480.6a, 480.7a, and/or 480.6b has to be an authorized form allowed to be filed, in the payer/client suri account, in order for. 1 beginning in calendar 2019, payments for. Web there is no de minimis for either form. If you receive these forms, it is. Web changes to 480 forms form 480.6a informative return other income not subject to withholding the following boxes were eliminated: Form 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. The form must be prepared on a calendar year basis and must be provided. Web in the case of interests, form 480.6a will be required when the amount paid in the year is $50 or more. This form was created so. Since we are only interested in whole. Web what is tax form 480.6a? Web in the case of int erests, form 480.6a will be required when the amount paid in the year is $50 or more. Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services rendered or to individuals for any of the. We first want to find the whole number, and to do this we divide the numerator by the denominator. Created by jonathan cunanan, last modified on feb 10, 2020. Web to report payments for services rendered during the year that were previously reported on forms 480.6a, 480.6b and 480.6b.1, taxpayers must file form 480.6sp.1 to comply. Web items were previously under the form 480.6a and 480.6b.Form 480 6c Instructions Fill Out and Sign Printable PDF Template

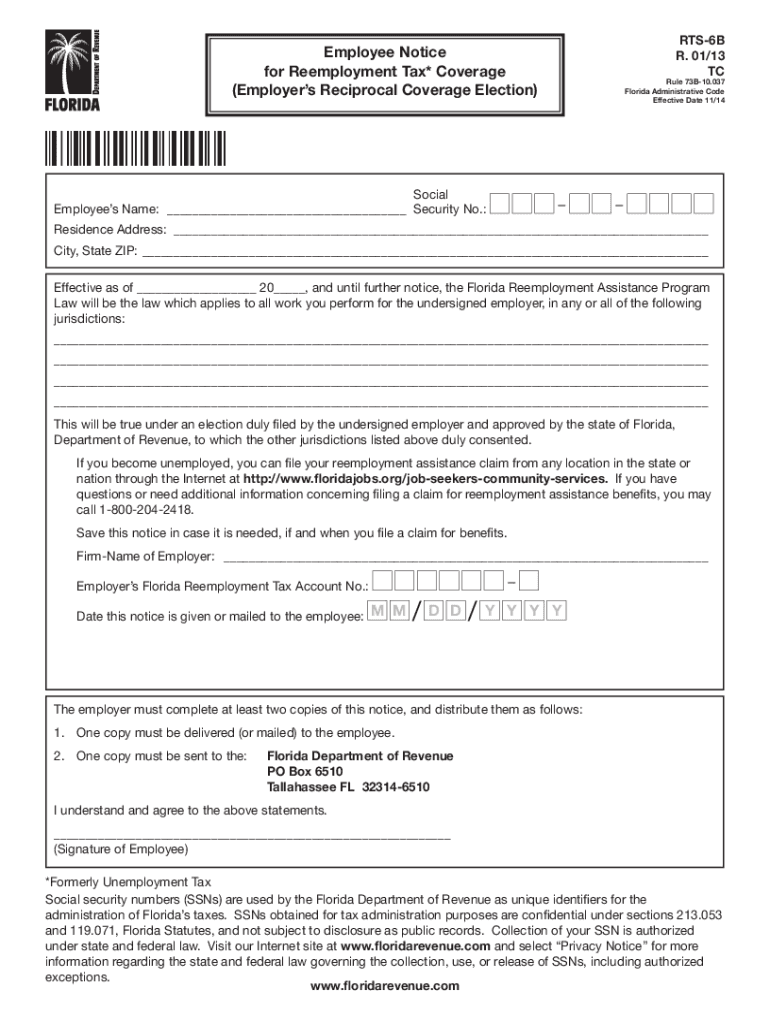

Rt 6a Form Fill Out and Sign Printable PDF Template signNow

Formulario 480.5 Resumen De Las Declarationes Informativas printable

ATF Importation Release and Receipt Form for Firearms, Ammunition, and

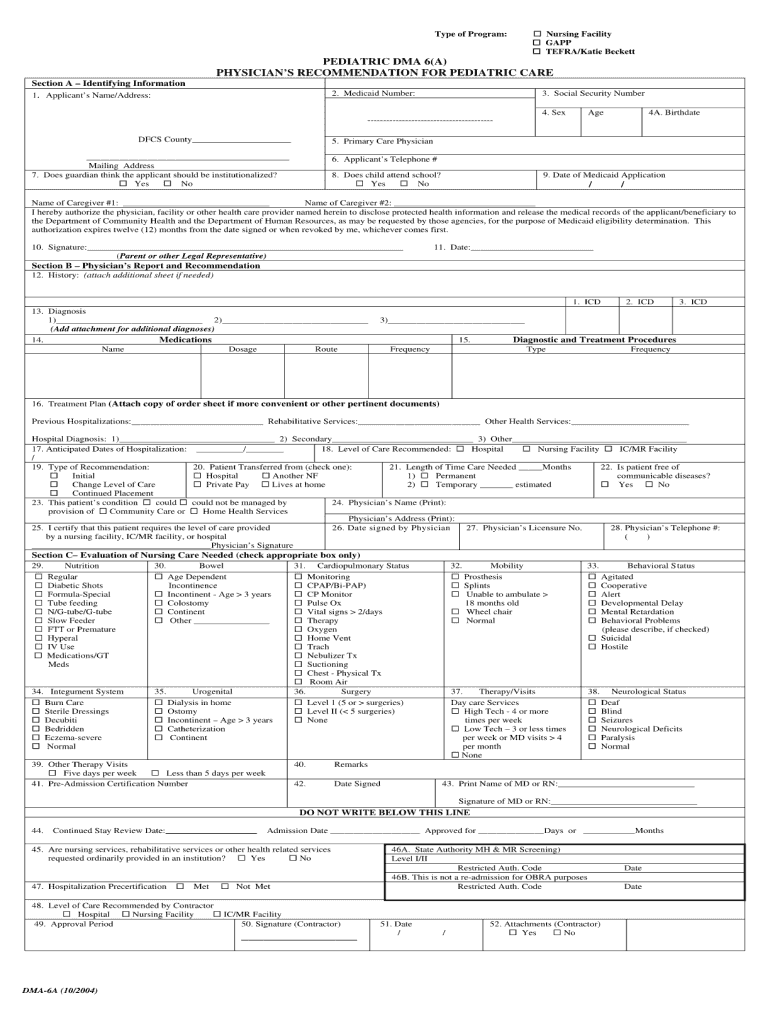

Dma 6 Fill out & sign online DocHub

20192023 Form PR 480.6A Fill Online, Printable, Fillable, Blank

480.6A 2018 Public Documents 1099 Pro Wiki

Table Structure for Informative Returns data

480 7a 2018 Fill Online, Printable, Fillable, Blank pdfFiller

Formulario 480.6a 2017 Actualizado agosto 2023

Related Post: