Late Filing Form 2553 Reasonable Cause

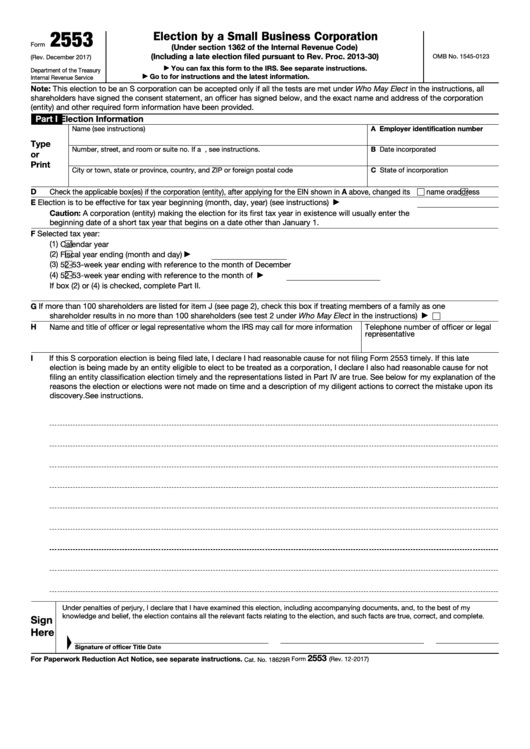

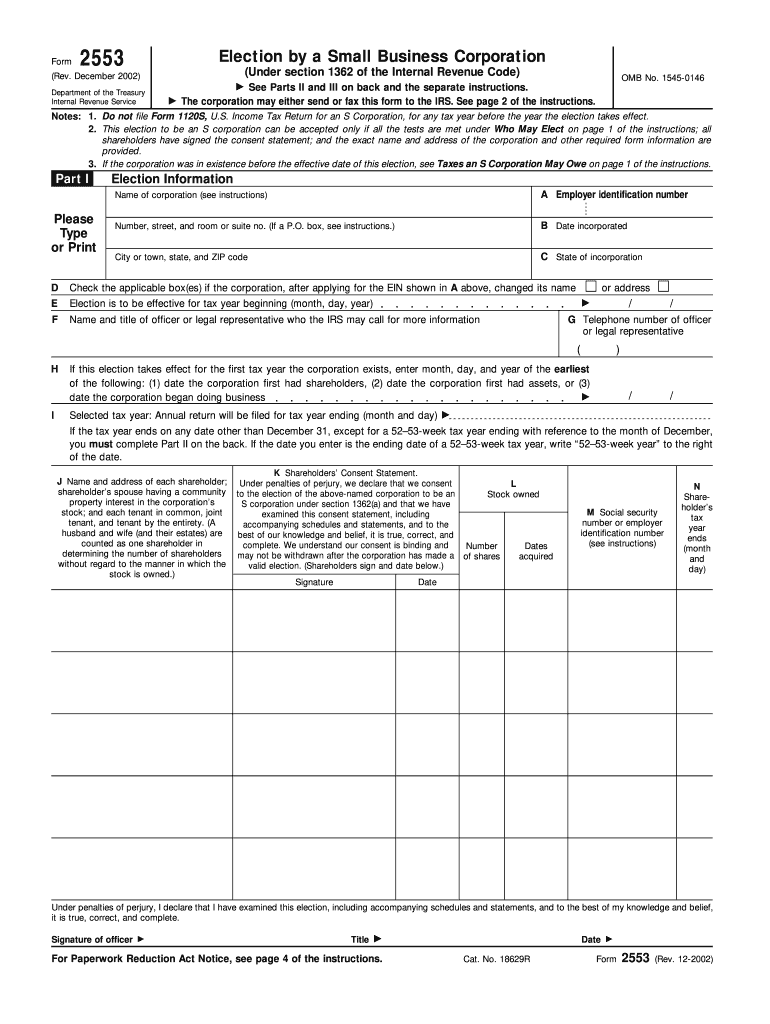

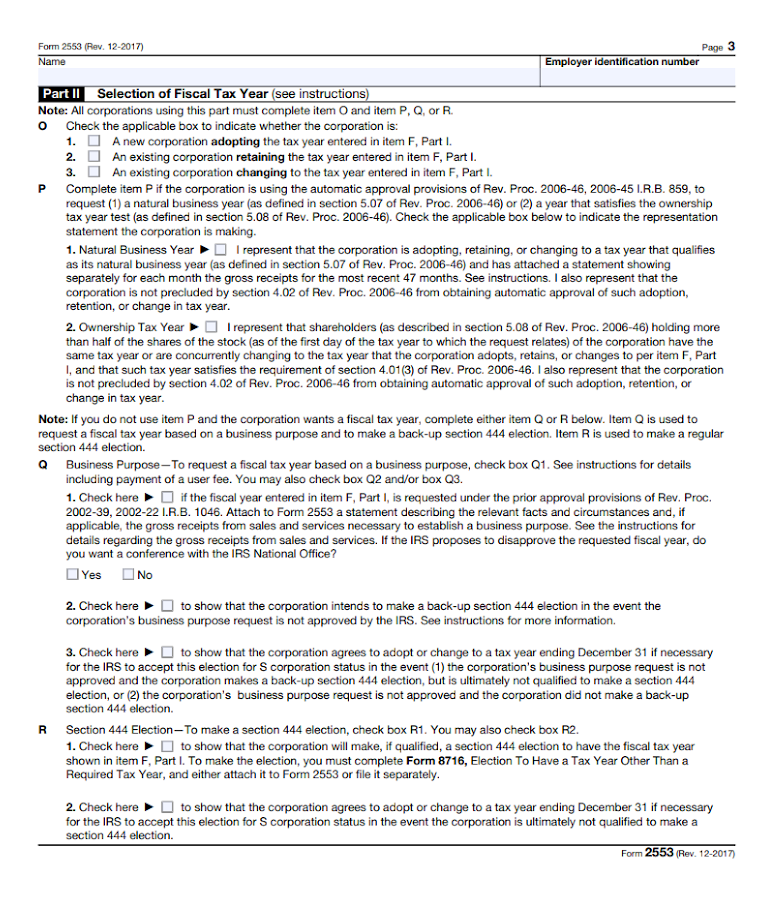

Late Filing Form 2553 Reasonable Cause - Web if this s corporation election is being filed late, i declare i had reasonable cause for not filing form 2553 timely. If the entity does not qualify under the. 9.9k views 8 months ago #entrepreneur #scorp. The irs does not specify what. In this video i show you how to prepare and file a late s corp. Web also, the taxpayer must have and disclose reasonable cause for requesting late relief. Filing form 2553 is critical to being. To request relief for a late election, an entity that meets. Web the form should be filed before the 16th day of the third month of the corporation's tax year, or before the 15th day of the second month of a tax year if the tax. Web with the preparation and filing of a late form 2553 for your s corporation election, a reasonable cause letter must be attached. Web to make an election, the corporation must meet certain criteria and show reasonable cause for missing the filing deadline. Web making the s corporation election. Web if this s corporation election is being filed late, i declare i had reasonable cause for not filing form 2553 timely. If this late election is being made by an entity eligible to. Ad we know the irs from the inside out. If this late election is being made by an entity eligible to elect to. The service must consider the election as timely if it can. Get ready for tax season deadlines by completing any required tax forms today. To request relief for a late election, an entity that meets. Web the form should be filed before the 16th day of the third month of the corporation's tax year, or before the 15th day of the second month of a tax year if the tax. Web to make an election, the corporation must meet certain criteria and show reasonable cause for missing the filing deadline. Web in order to reduce. Web if the entity qualifies and files timely in accordance with rev. The election is made on form 2553. If the entity does not qualify under the. A legal entity, be it a corporation or an llc, can make an election to be an s corporation. The irs does not specify what. Web to do so: If this late election is being made by an entity eligible to elect to. Instead, some of that income will be. Ad download or email irs 2553 & more fillable forms, register and subscribe now! A legal entity, be it a corporation or an llc, can make an election to be an s corporation. Web also, the taxpayer must have and disclose reasonable cause for requesting late relief. We have a template that we’ve. A legal entity, be it a corporation or an llc, can make an election to be an s corporation. Web relief must be requested within 3 years and 75 days of the effective date entered on line e of form. Web to request relief from a late filing for reasonable cause, complete the narrative section at the bottom of page 1, explaining why you are filing late (you can use. Web if this s corporation election is being filed late, i declare i had reasonable cause for not filing form 2553 timely. If this late election is being made by. Instead, some of that income will be. Reasons that qualify for relief due to. Web if this s corporation election is being filed late, i declare i had reasonable cause for not filing form 2553 timely. If the entity does not qualify under the. 9.9k views 8 months ago #entrepreneur #scorp. Web if this s corporation election is being filed late, i declare i had reasonable cause for not filing form 2553 timely. Web if this s corporation election is being filed late, i declare i had reasonable cause for not filing form 2553 timely. Web if the entity qualifies and files timely in accordance with rev. In this video i. Ad download or email irs 2553 & more fillable forms, register and subscribe now! Web to do so: Reasons that qualify for relief due to. Web if this s corporation election is being filed late, i declare i had reasonable cause for not filing form 2553 timely. Web making the s corporation election. Filing form 2553 is critical to being. If this late election is being made by an entity eligible to elect to. Web navi maraj, cpa. Instead, some of that income will be. Web in order to reduce paperwork, irs only requires form 2553 election by a small business corporation when an llc is electing to be taxed as an s corporation, but when form. 9.9k views 8 months ago #entrepreneur #scorp. Reasons that qualify for relief due to. Call the irs if you. Web if you need to make an election on the s corporation status, you can request late relief for form 2553. Web to do so: A legal entity, be it a corporation or an llc, can make an election to be an s corporation. Web making the s corporation election. Web if the entity qualifies and files timely in accordance with rev. Web if this s corporation election is being filed late, i declare i had reasonable cause for not filing form 2553 timely. Get ready for tax season deadlines by completing any required tax forms today. Web you must have reasonable cause for your failure to timely file the form 2553 by its due date. Web relief must be requested within 3 years and 75 days of the effective date entered on line e of form 2553. Ad download or email irs 2553 & more fillable forms, register and subscribe now! If this late election is being made by an entity eligible to elect to. Web also, the taxpayer must have and disclose reasonable cause for requesting late relief.Form 2553 Election by a Small Business Corporation (2014) Free Download

IRS Form 2553 Instructions How and Where to File This Tax Form

Top 10 Form 2553 Templates free to download in PDF format

Learn How to Fill the Form 2553 Election by a Small Business

IRS Form 2553 No Error Anymore If Following the Instructions

2002 Form IRS 2553Fill Online, Printable, Fillable, Blank pdfFiller

IRS Form 2553 Filing Instructions Real Check Stubs

How to Fill in Form 2553 Election by a Small Business Corporation S

IRS Form 2553 Filing Instructions Real Check Stubs

3 Reasons to File a Form 2553 for Your Business The Blueprint

Related Post: