How To Fill Out Missouri Form 149

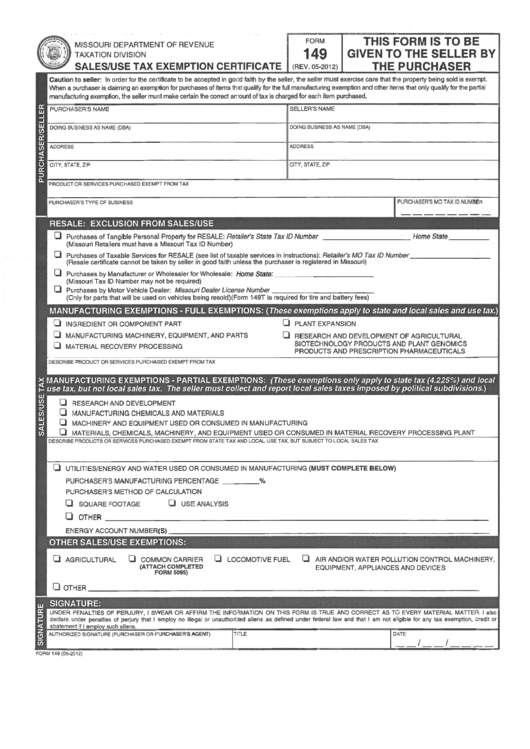

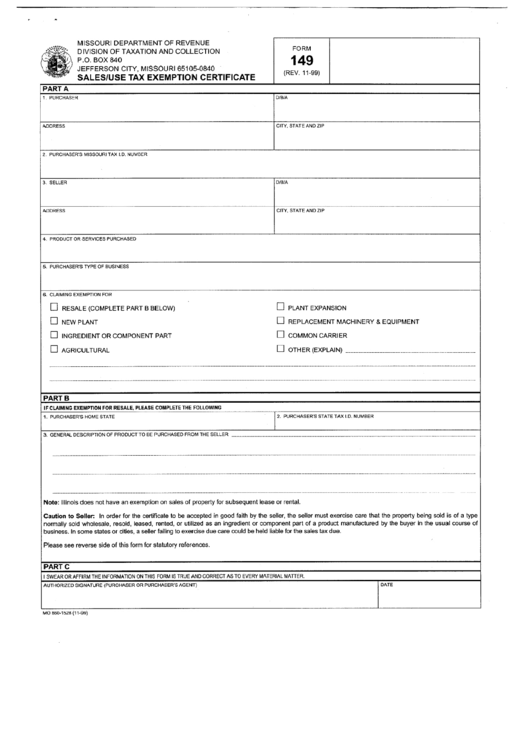

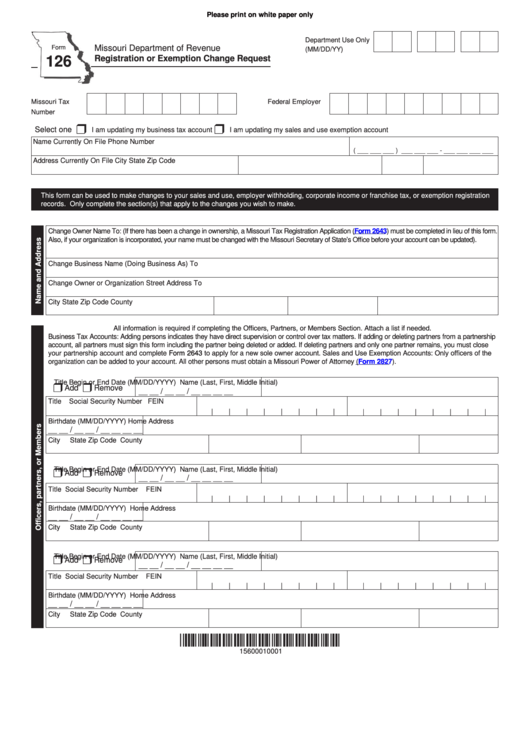

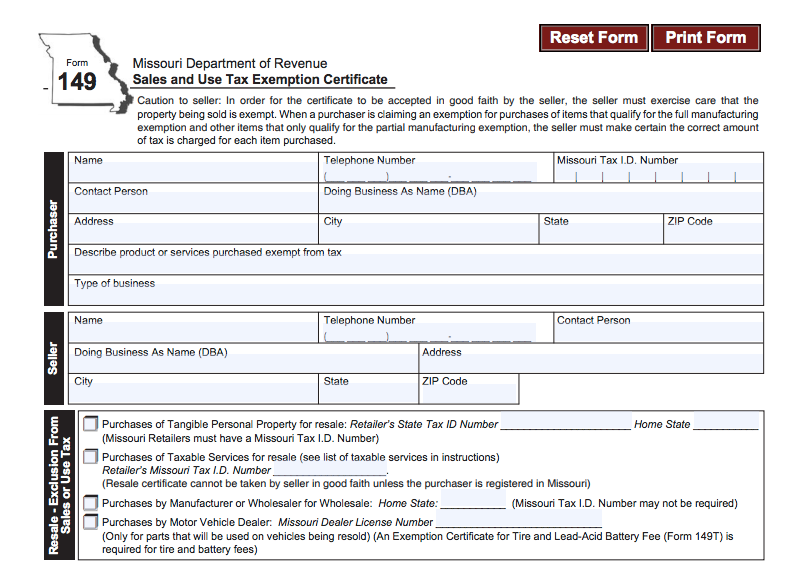

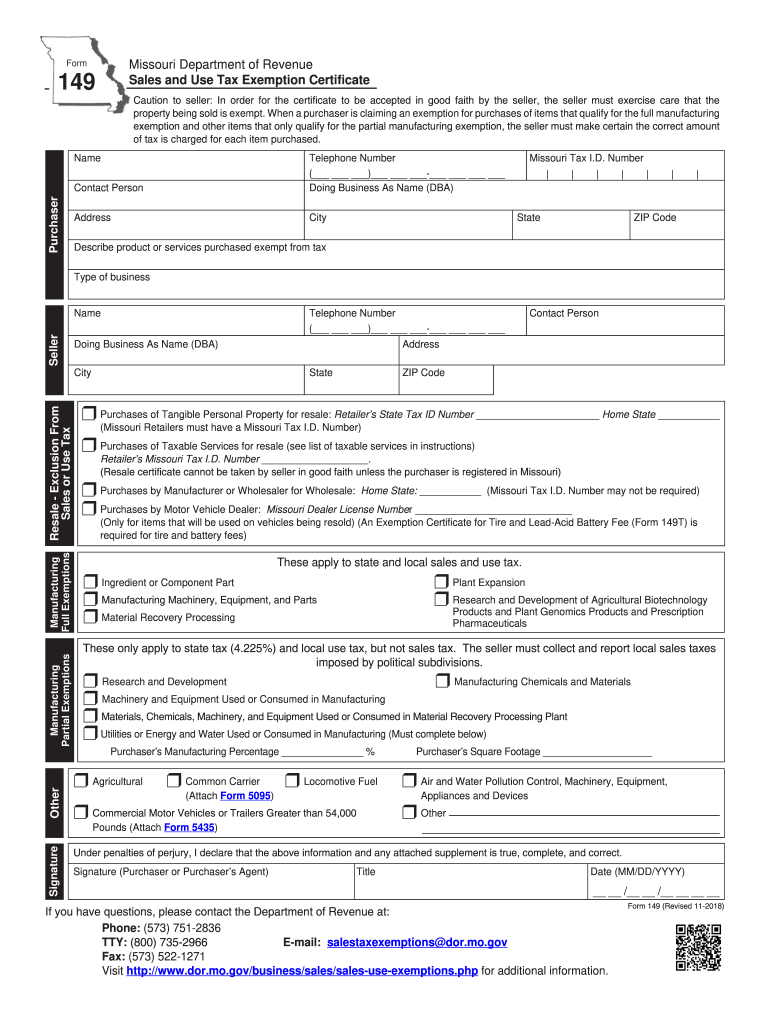

How To Fill Out Missouri Form 149 - Missouri form 149 is used to amend a missouri sales and use tax return. Exemptions represent a legislative decision that a taxable item. Fill out the mo 149 sales & use tax exemption certificate form. Web have questions, please contact the department of revenue at: Missouri department of revenue created date: Ad download or email dd form 149 & more fillable forms, register and subscribe now! Exemptions are specific provisions of law eliminating the tax due on an item ordinarily subject to tax. Turn on the wizard mode on the top toolbar to have extra suggestions. Web hit the get form option to begin filling out. Ad download or email form 149 & more fillable forms, register and subscribe now! Download blank or fill out online in pdf format. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Use get form or simply click on the template preview to open it in the editor. Fill out the mo 149 sales & use tax exemption certificate form. Fillable and editable pdf forms. Obtain a missouri tax id number. Start completing the fillable fields and. Exemption certificate for sales of handicraft items. Missouri department of revenue created date: Web the following tips can help you fill out missouri department of revenue form 149 easily and quickly: Ad download or email form 149 & more fillable forms, register and subscribe now! Web when completing a missouri purchase which is exempt from state sales or use tax, the purchaser must file a certificate with the seller. Tax registration application, instructions and. Web hit the get form option to begin filling out. Complete, sign, print and send your tax. This form 149 is found on the website of. Web when completing a missouri purchase which is exempt from state sales or use tax, the purchaser must file a certificate with the seller. Fill in each fillable area. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Missouri department of. Web you may need to file form 149 if you had any of the following in 2017: Fill in each fillable area. Web have questions, please contact the department of revenue at: Exemptions are specific provisions of law eliminating the tax due on an item ordinarily subject to tax. Exemptions represent a legislative decision that a taxable item. If you have any questions, please contact the taxation bureau, p.o. Complete, sign, print and send your tax documents easily with us legal forms. Missouri adjusted gross income of more than $100,000, interest and dividends of more than $1,000, capital. Web sales and use tax exemption certificate. Exemption certificate for sales of handicraft items. Start completing the fillable fields and. Web sign and date the form. Web quick steps to complete and design mo form 149 online: Use get form or simply click on the template preview to open it in the editor. Web sales and use tax exemption certificate. Exemptions are specific provisions of law eliminating the tax due on an item ordinarily subject to tax. Exemptions represent a legislative decision that a taxable item. Tax registration application, instructions and. Obtain a missouri tax id number. Make sure the details you add to the. Use get form or simply click on the template preview to open it in the editor. Obtain a missouri tax id number. Form 149 sales and use tax exemption certificate author: Web you may need to file form 149 if you had any of the following in 2017: Web quick steps to complete and design mo form 149 online: Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web hit the get form option to begin filling out. Present a copy of this certificate to suppliers when. Web the following tips can help you fill out missouri department of revenue form 149 easily and quickly: Check out how easy it is to complete and. Fillable and editable pdf forms. Obtain a missouri tax id number. Exemptions represent a legislative decision that a taxable item. For optimal functionality, save the form to your computer before completing or printing. Get everything done in minutes. Fill out the mo 149 sales & use tax exemption certificate form. Tax registration application, instructions and. Missouri adjusted gross income of more than $100,000, interest and dividends of more than $1,000, capital. Use get form or simply click on the template preview to open it in the editor. Web hit the get form option to begin filling out. Use get form or simply click on the template preview to open it in the editor. Web you may need to file form 149 if you had any of the following in 2017: Web the following tips can help you fill out missouri department of revenue form 149 easily and quickly: Exemption certificate for sales of handicraft items. Web have questions, please contact the department of revenue at: Present a copy of this certificate to suppliers when. Web when completing a missouri purchase which is exempt from state sales or use tax, the purchaser must file a certificate with the seller. Web quick steps to complete and design mo form 149 online: If you have any questions, please contact the taxation bureau, p.o. Turn on the wizard mode on the top toolbar to have extra suggestions.Missouri Department Of Revenue Form Form 149 Sales/use Tax

Missouri revenue form mo 941 Fill out & sign online DocHub

Missouri Form 149 ≡ Fill Out Printable PDF Forms Online

Form 149 Sales/use Tax Exemption Certificate Missouri Department Of

2022 Form MO DoR 149 Fill Online, Printable, Fillable, Blank pdfFiller

Fill Free fillable forms for the state of Missouri

Fillable Missouri Tax Exempt Form 149 Printable Forms Free Online

149 form Fill out & sign online DocHub

How to Use a Missouri Resale CertificateTaxJar Blog

Form 149 Missouri Fill Out and Sign Printable PDF Template signNow

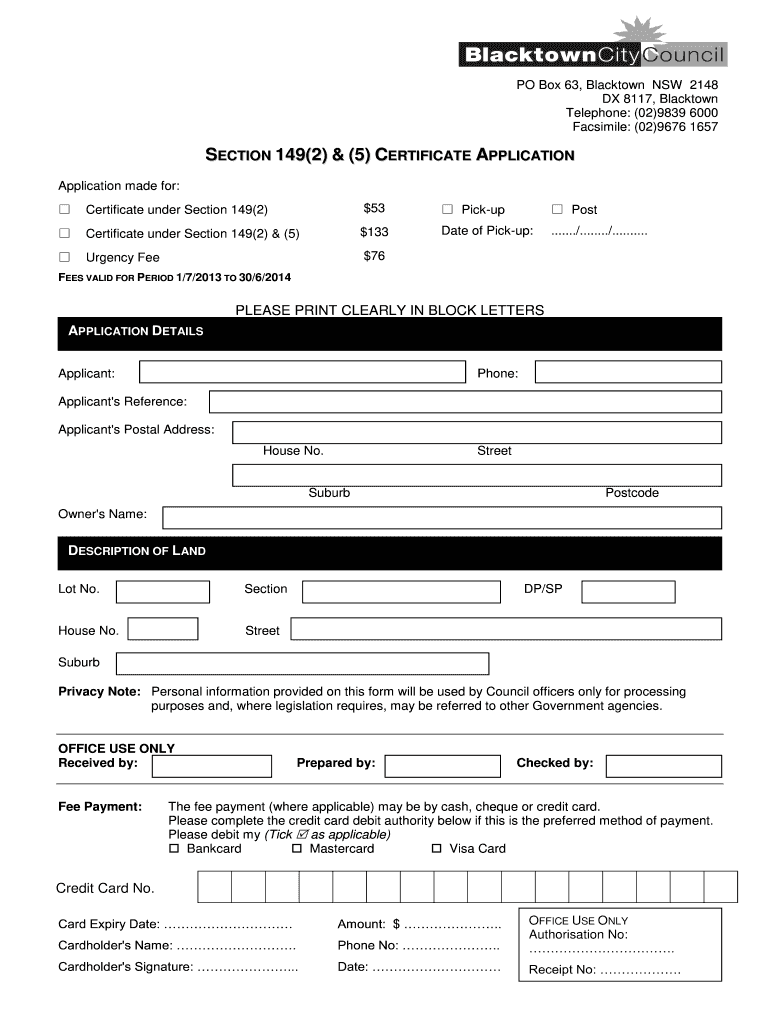

Related Post: