Maryland Income Tax Form 502

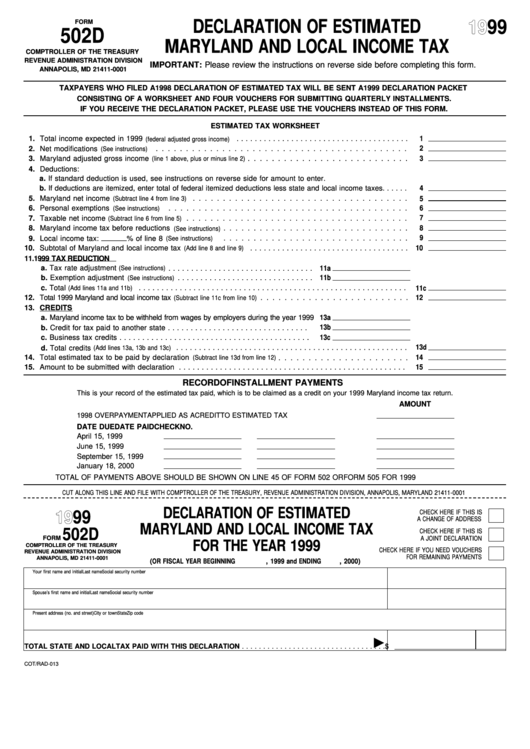

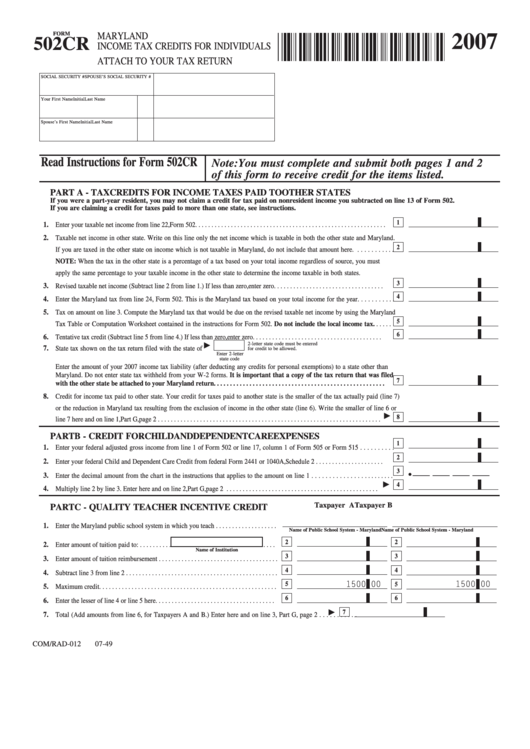

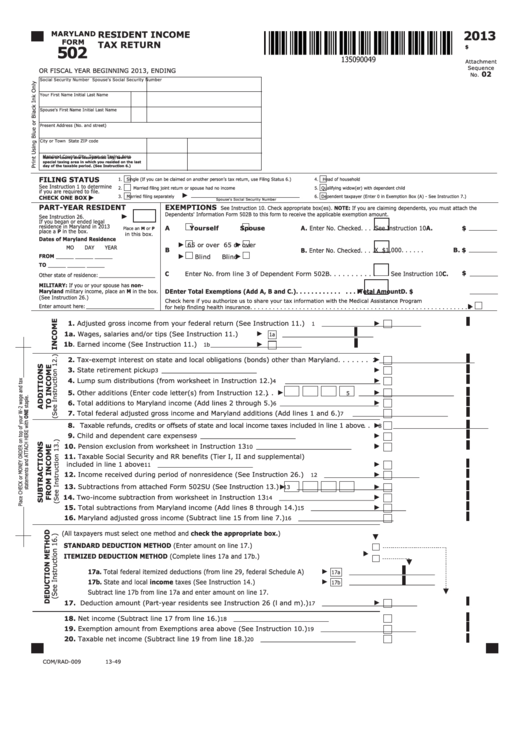

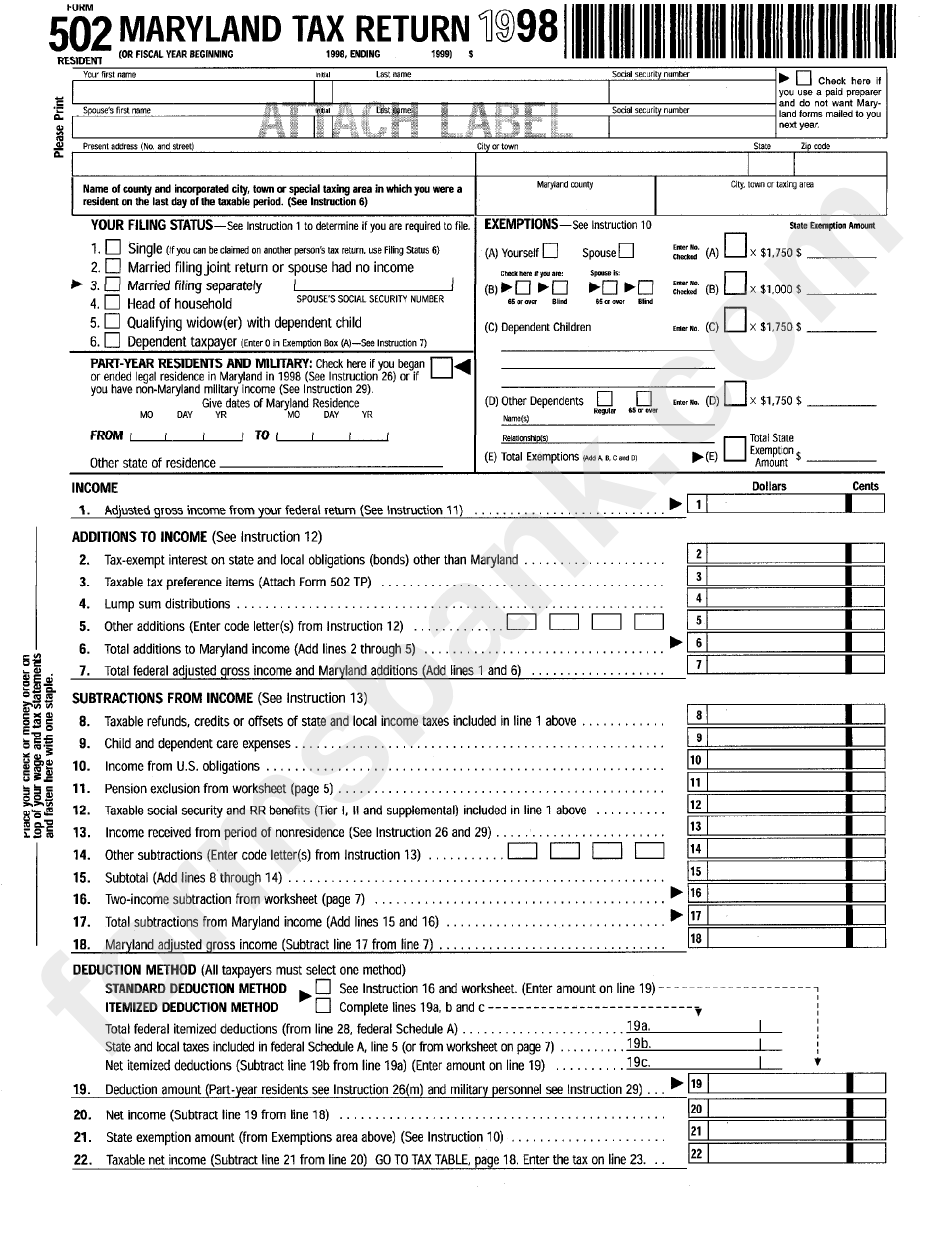

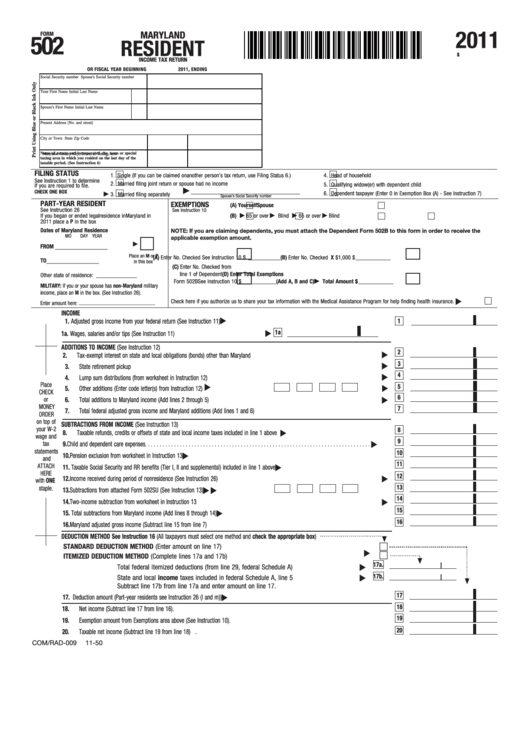

Maryland Income Tax Form 502 - We have modified our instructions to use more inclusive language as a result of maryland's recognition of same sex marriage. To claim a credit for taxes paid to the other state, and/or. Get ready for tax season deadlines by completing any required tax forms today. Line 1 on the worksheet is 1. Web maryland form 502 resident income tax return. Web if you wish to calculate your maryland 502 (resident) return on paper before using this application, click here for forms and instructions. Follow the links below for information on maryland's individual. Web the deadline for filing your maryland income tax is april 18, 2023, if you are filing on a calendar year basis. Maryland resident income tax return: Adjusted gross income from your federal return. you know what. If you are claiming any dependants, use form 502b. Attach to your tax return. Income tax credits for individuals. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. If you are claiming any dependants, use form 502b. Adjusted gross income from your federal return. you know what. The maryland general assembly enacted house bill 1148 in the 2016 session requiring the collection of information detailing the amount of retirement income reported. Web most taxpayers are required to file a yearly income tax return in april to both the. Adjusted gross income from your federal return. you know what. Explore these zero income tax states. Form to be used when claiming. Web if you wish to calculate your maryland 502 (resident) return on paper before using this application, click here for forms and instructions. Web the deadline for filing your maryland income tax is april 18, 2023, if you. We have modified our instructions to use more inclusive language as a result of maryland's recognition of same sex marriage. If you are claiming any dependants, use form 502b. Copies of your w2, w2g, 1099r and. If you are claiming any dependants, use form 502b. Web the deadline for filing your maryland income tax is april 18, 2023, if you. Income tax credits for individuals. The maryland general assembly enacted house bill 1148 in the 2016 session requiring the collection of information detailing the amount of retirement. It appears you don't have a pdf plugin for this browser. Follow the links below for information on maryland's individual. Web you can use our free ifile service if you are filing form. We have modified our instructions to use more inclusive language as a result of maryland's recognition of same sex marriage. If you are claiming any dependants, use form 502b. Web 2022 individual income tax instruction booklets. Payment voucher with instructions and worksheet for individuals sending check or. Web compute the maryland tax that would be due on the revised taxable. Web if you wish to calculate your maryland 502 (resident) return on paper before using this application, click here for forms and instructions. Web form 502 is the individual income tax return form for residents that are not claiming any dependants. Print using blue or black ink only. If you are claiming any dependants, use form 502b. You will need. Adjusted gross income from your federal return. you know what. Payment voucher with instructions and worksheet for individuals sending check or. Web the deadline for filing your maryland income tax is april 18, 2023, if you are filing on a calendar year basis. The maryland general assembly enacted house bill 1148 in the 2016 session requiring the collection of information. Web maryland form 502 resident income tax return. If you are claiming any dependants, use form 502b. Web form 502 is the individual income tax return form for residents that are not claiming any dependants. Complete, edit or print tax forms instantly. Web personal tax payment voucher for form 502/505, estimated tax and extensions. Payment voucher with instructions and worksheet for individuals sending check or. Web compute the maryland tax that would be due on the revised taxable net income by using the maryland tax table or computation worksheet contained in the instructions for. Line 1 on the worksheet is 1. To claim a credit for taxes paid to the other state, and/or. Web. You will need the following information and computer system setup to use ifile:. To claim a credit for taxes paid to the other state, and/or. Web compute the maryland tax that would be due on the revised taxable net income by using the maryland tax table or computation worksheet contained in the instructions for. Complete, edit or print tax forms instantly. Web form 502 is the individual income tax return form for residents that are not claiming any dependants. Web you can use our free ifile service if you are filing form 502 and most other maryland tax forms. Web form 502 is the individual income tax return form for residents that are not claiming any dependants. Web the new federal limitation impacts your maryland return because you must addback the amount of state income taxes you claimed as federal itemized deductions. Attach to your tax return. Web the deadline for filing your maryland income tax is april 18, 2023, if you are filing on a calendar year basis. The maryland general assembly enacted house bill 1148 in the 2016 session requiring the collection of information detailing the amount of retirement. Get ready for tax season deadlines by completing any required tax forms today. Check out the benefits and pros & cons of zero income tax to plan for your retirement. Web maryland form 502 resident income tax return. The maryland general assembly enacted house bill 1148 in the 2016 session requiring the collection of information detailing the amount of retirement income reported. Print using blue or black ink only. Copies of your w2, w2g, 1099r and. Web 2022 individual income tax instruction booklets. We have modified our instructions to use more inclusive language as a result of maryland's recognition of same sex marriage. Explore these zero income tax states.Fillable Form 502 D Declaration Of Estimated Maryland And Local

Fillable Form 502cr Maryland Tax Credits For Individuals

Fillable Maryland Form 502 Resident Tax Return 2013

Fillable Form 502 Maryland Tax Return 1998 printable pdf download

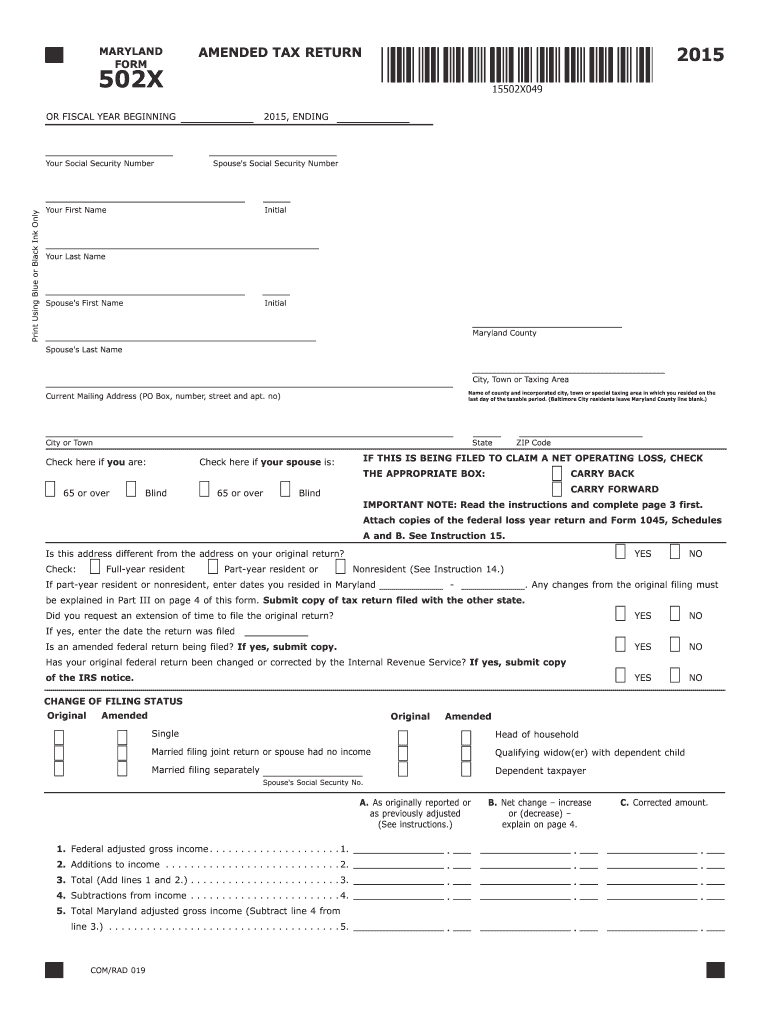

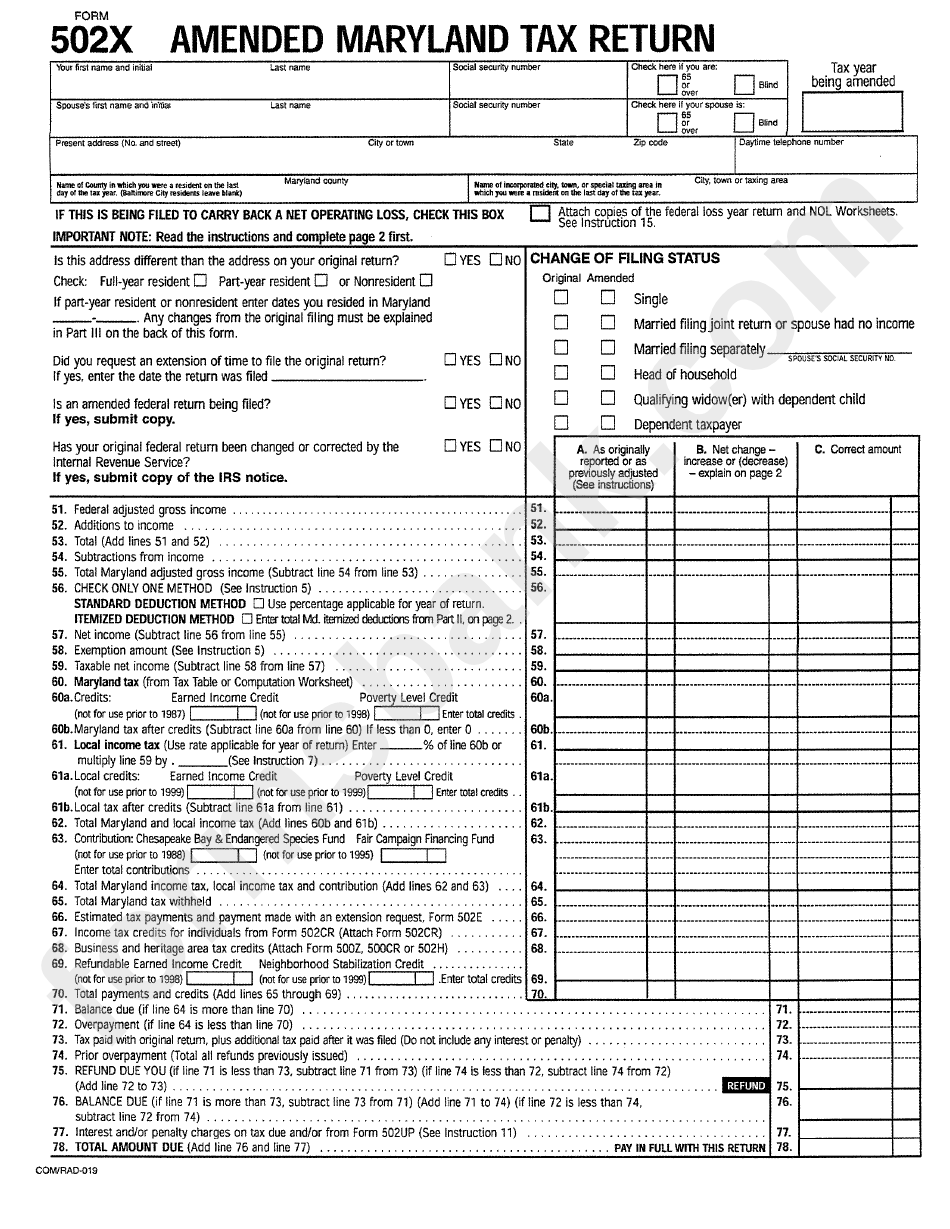

Maryland 502x Form Fill Out and Sign Printable PDF Template signNow

Form 502x Amended Maryland Tax Return printable pdf download

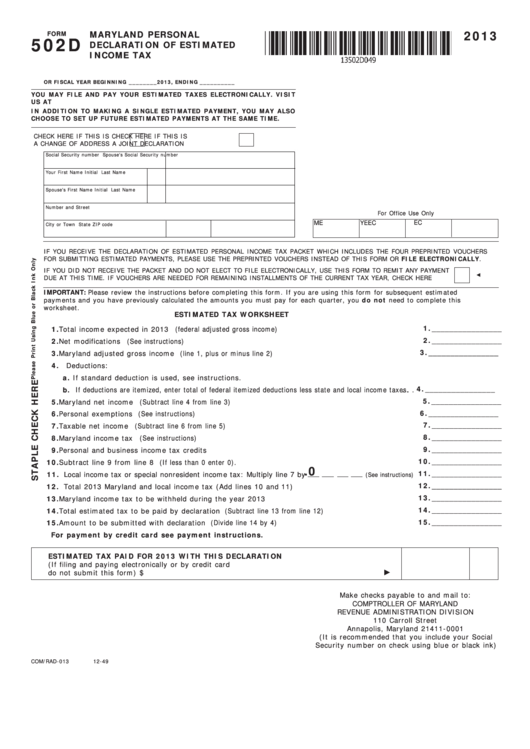

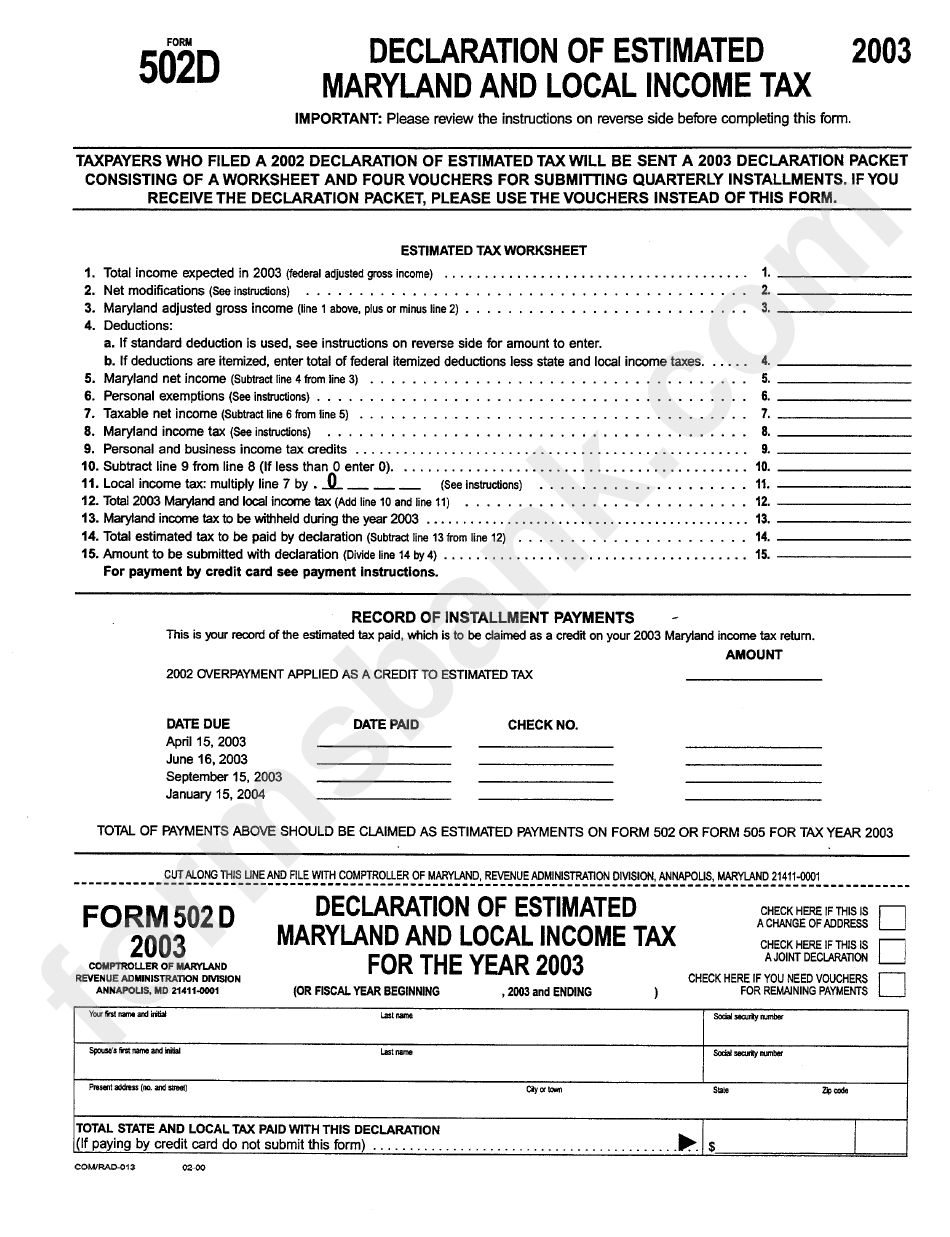

Fillable Form 502d Maryland Personal Declaration Of Estimated

2019 Maryland Form 502 Instructions designshavelife

Form 502d Declaration Of Estimated Maryland And Lockal Tax

Fillable Form 502 Maryland Resident Tax Return 2011

Related Post: