Ca State Tax Form 540Ez

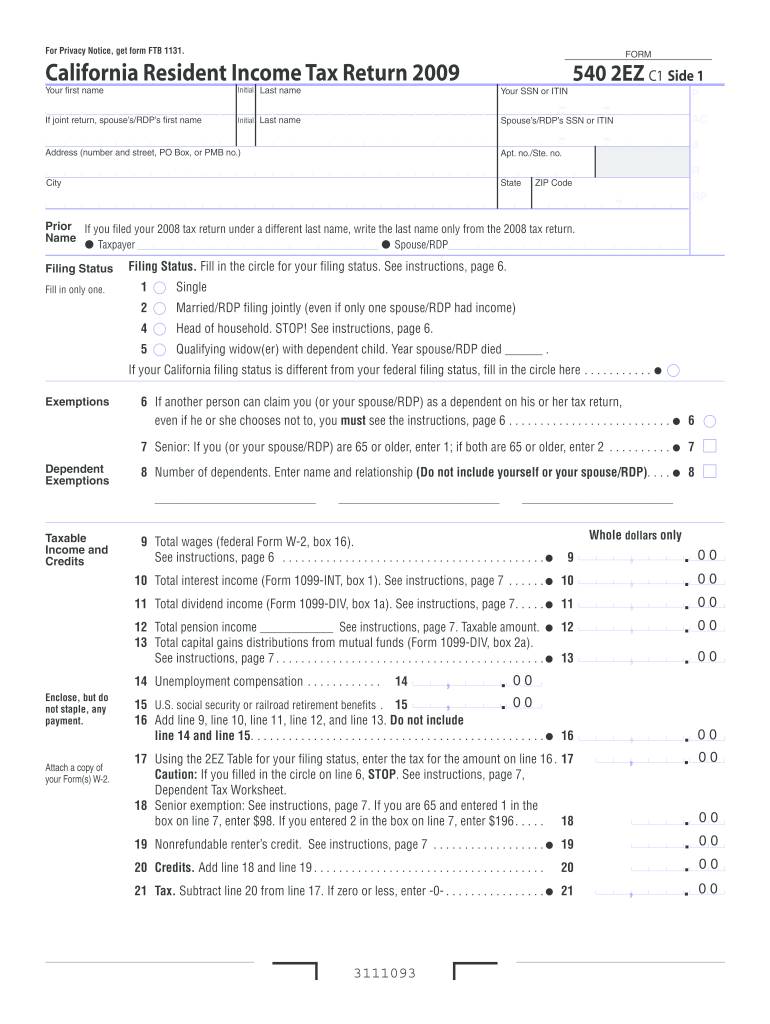

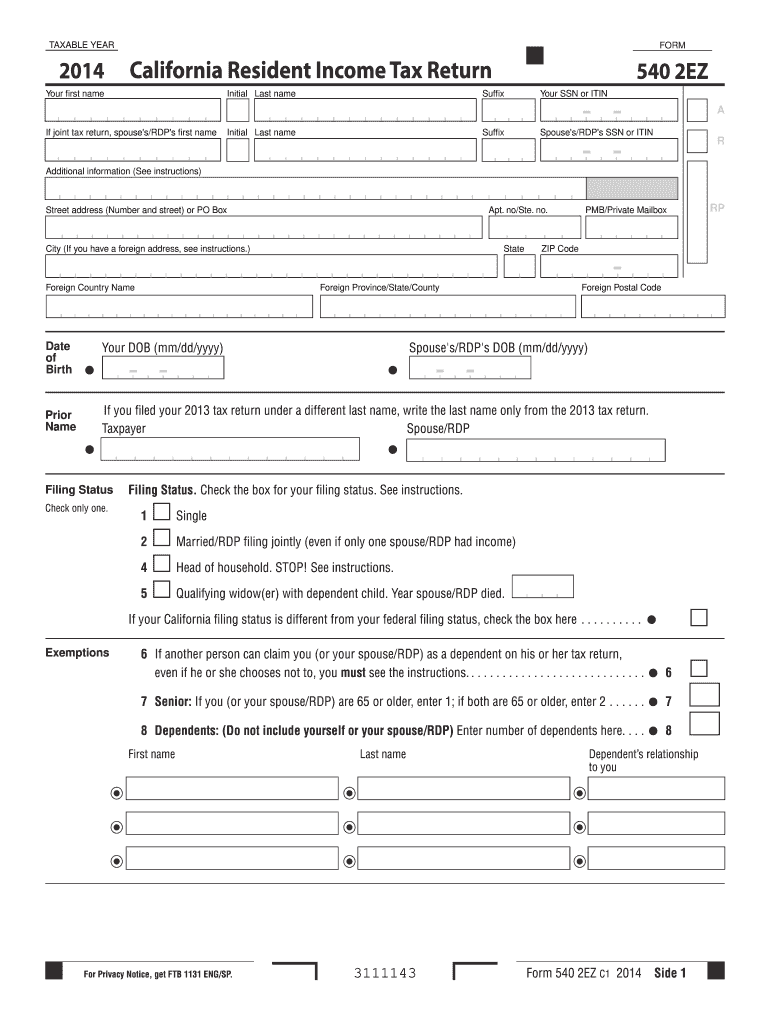

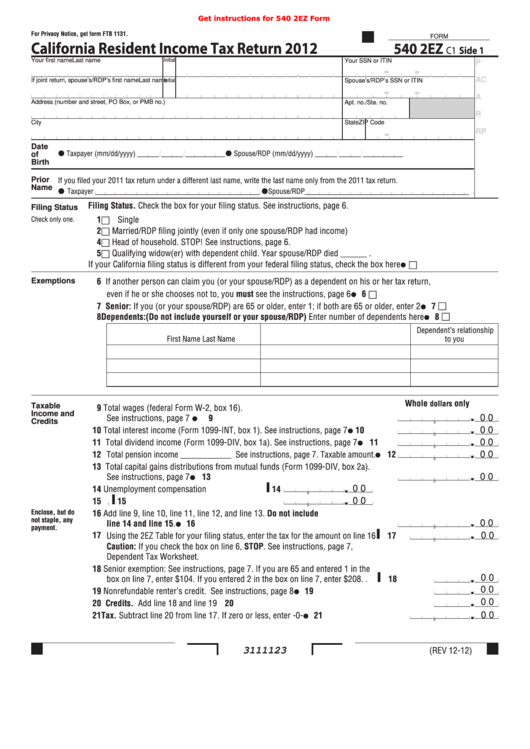

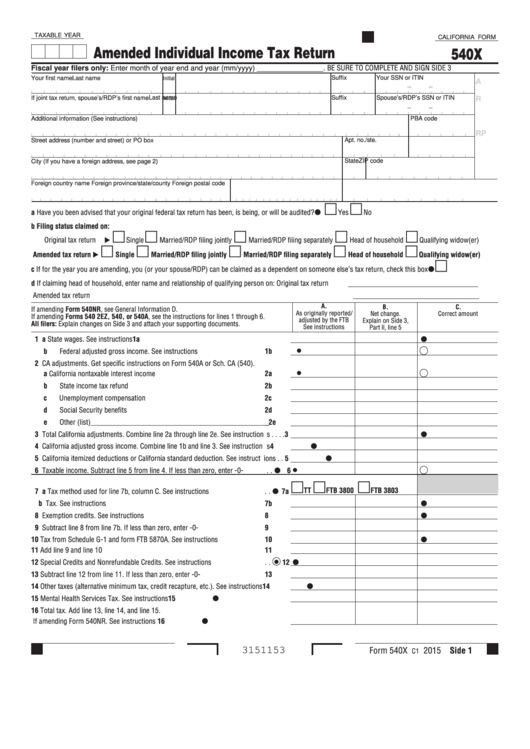

Ca State Tax Form 540Ez - Web form 540 2ez tax booklet 2020 this table gives you credit of $4,601 for your standard deduction, $124 for your personal exemption credit, and $383 for each dependent. Check here if this is an amended return. Domiciled in california, but outside california for a temporary or. Your first name initial last name sufix your ssn or itin if joint tax return,. Enclose, but do not staple, any. Web you're a resident if either apply: However, with our predesigned online templates, everything gets. Web *required field california taxable income enter line 19 of 2022 form 540 or form 540nr. Find out which form you should use and get a list of all state and federal income tax forms. Enter month of year end: However, with our predesigned online templates, everything gets. Web for taxable years beginning on or after january 1, 2017, california conforms to federal law to include in the definition of earned income net earnings from self employment. Your first name initial last name sufix your ssn or itin if joint tax return,. Enclose, but do not staple, any. Complete, edit. Your first name initial last name sufix your ssn or itin if joint tax return, spouse’s/rdp’s first name initial last name. The credit amount phases out as earned income exceeds the threshold amount of $25,000, and. 16, 2023 | more information x Web form 540 2ez tax booklet 2020 this table gives you credit of $4,601 for your standard deduction,. Web for taxable years beginning on or after january 1, 2017, california conforms to federal law to include in the definition of earned income net earnings from self employment. Web completing the dependent tax worksheet. Web *required field california taxable income enter line 19 of 2022 form 540 or form 540nr. This table gives you credit of $4,803 for your. Domiciled in california, but outside california for a temporary or. Your first name initial last name sufix your ssn or itin if joint tax return, spouse’s/rdp’s first name initial last name. 16, 2023 | more information x Web for taxable years beginning on or after january 1, 2017, california conforms to federal law to include in the definition of earned. Web form 540 2ez tax booklet 2021. Web form 540 2ez check here if this is an amended return. Your first name initial last name suffix your ssn or itin if joint tax return, spouse’s/rdp’s first name initial last name. Use the 540 2ez tax. Your first name initial last name sufix your ssn or itin if joint tax return,. Your first name initial last name suffix your ssn or itin if joint tax return, spouse’s/rdp’s first name initial last name. Web the maximum amount of credit allowable for a qualified taxpayer is $1,000. Domiciled in california, but outside california for a temporary or. Web 2022 california resident income tax return 540. Get form 540, california resident income tax return. Web simplified income, payroll, sales and use tax information for you and your business 16, 2023 | more information x Enter month of year end: This table gives you credit of $4,803 for your standard deduction, $129 for your personal exemption credit, and $400 for each dependent. Web follow the simple instructions below: Domiciled in california, but outside california for a temporary or. Your first name initial last name suffix your ssn or itin if joint tax return, spouse’s/rdp’s first name initial last name. Enter month of year end: Enclose, but do not staple, any. Web simplified income, payroll, sales and use tax information for you and your business This table gives you credit of $4,803 for your standard deduction, $129 for your personal exemption credit, and $400 for each dependent. Domiciled in california, but outside california for a temporary or. Web form 540 2ez check here if this is an amended return. Get form 540, california resident income tax return at. Web *required field california taxable income enter. Web you cannot use form 540 2ez. Get form 540, california resident income tax return at. Try it for free now! Web for taxable years beginning on or after january 1, 2017, california conforms to federal law to include in the definition of earned income net earnings from self employment. What form you should file; Web *required field california taxable income enter line 19 of 2022 form 540 or form 540nr. However, with our predesigned online templates, everything gets. Web form 540 2ez tax booklet 2020 this table gives you credit of $4,601 for your standard deduction, $124 for your personal exemption credit, and $383 for each dependent. Web follow the simple instructions below: This table gives you credit of $4,803 for your standard deduction, $129 for your personal exemption credit, and $400 for each dependent. Web form 540 2ez check here if this is an amended return. Web for taxable years beginning on or after january 1, 2017, california conforms to federal law to include in the definition of earned income net earnings from self employment. 16, 2023 | more information x This calculator does not figure tax for form 540 2ez. This table gives you credit of $5,202 for your standard deduction, $140 for your personal exemption. Present in california for other than a temporary or transitory purpose. Get form 540, california resident income tax return at. Web simplified income, payroll, sales and use tax information for you and your business Enter month of year end: Use the 540 2ez tax. Upload, modify or create forms. Domiciled in california, but outside california for a temporary or. Try it for free now! Your first name initial last name suffix your ssn or itin if joint tax return, spouse’s/rdp’s first name initial last name. Your first name initial last name sufix your ssn or itin if joint tax return,.2009 Form 540 2EZ California Resident Tax Return ftb ca

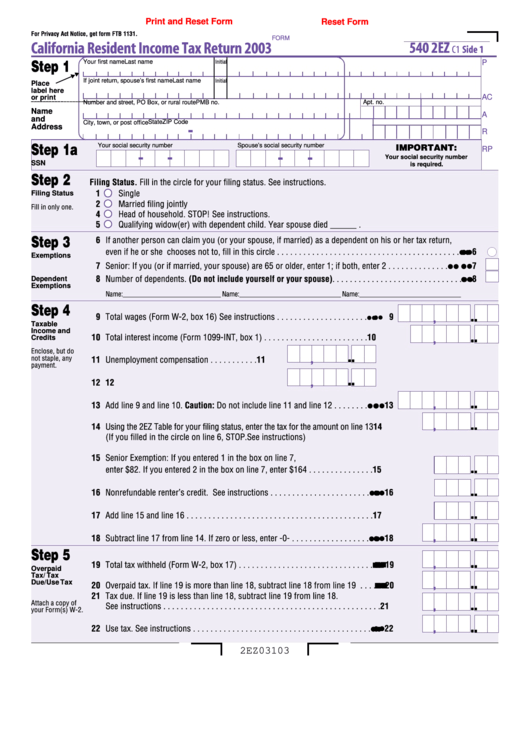

Fillable Form 540 2ez California Resident Tax Return 2003

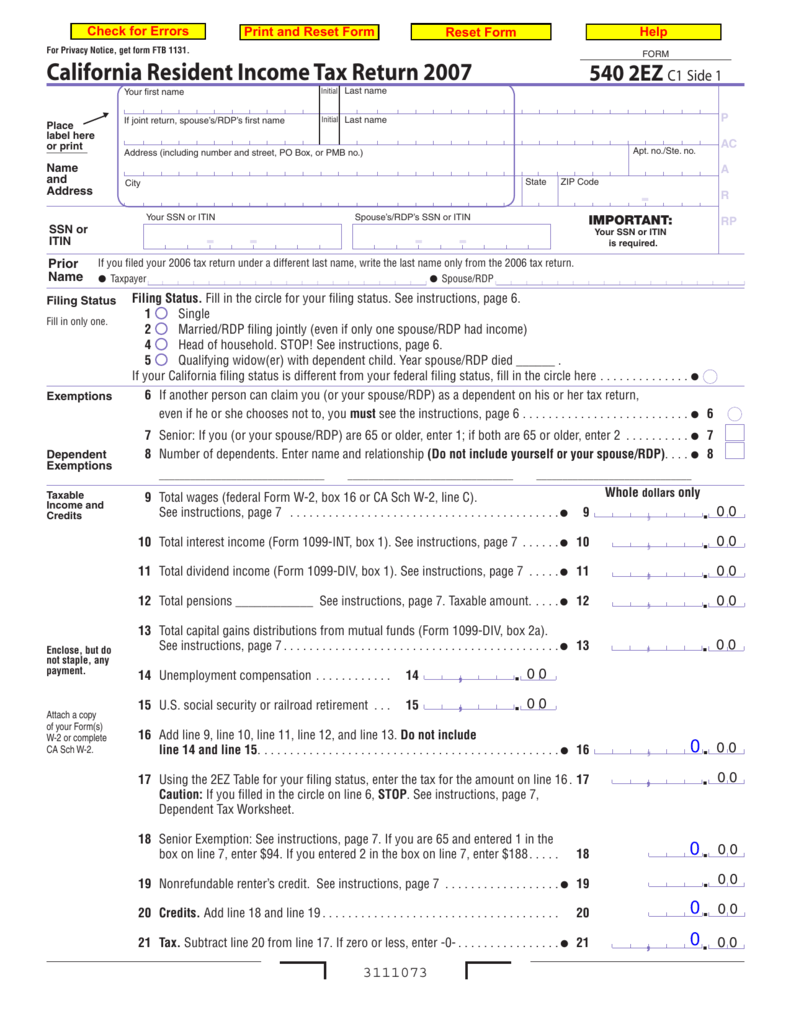

2007 Form 540 2EZ California Resident Tax Return

Ca tax rate schedule 2017 Fill out & sign online DocHub

Tax Form California Free Download

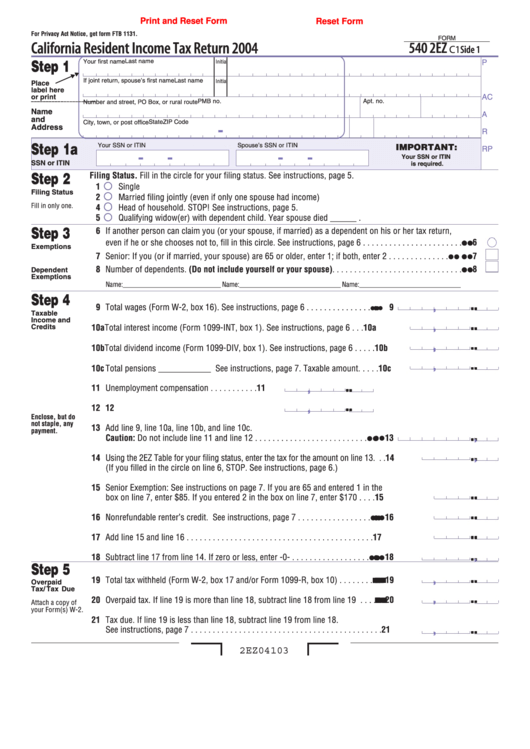

Fillable Form 540 2ez California Resident Tax Return 2004

California 540ez Form Fill Out and Sign Printable PDF Template signNow

2018 California Resident Tax Return Form 540 Instructions DocHub

Fillable Form 540 2ez California Resident Tax Return 2012

California State Fillable Tax Forms Fillable Form 2023

Related Post: