Irs Form 5329 Instructions

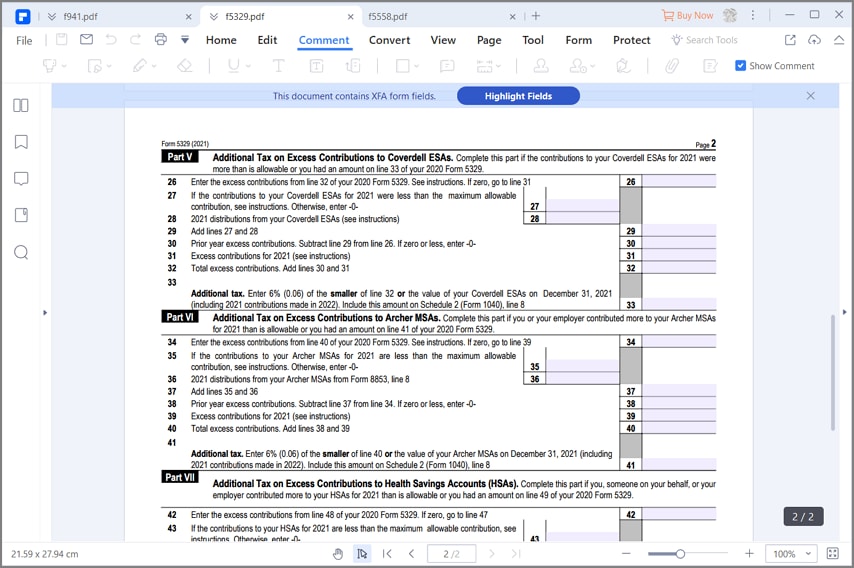

Irs Form 5329 Instructions - If you don’t have to file a 2020. Web instead, follow the instructions for requesting a waiver in the instructions for form 5329. Navigate to screen 24, adjustments to income. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Tip if you don’t have to file a 2021 income tax return,. File form 5329 with your 2022 form 1040,. Enter in the basis in roth ira conversions as of. Ad access irs tax forms. When and where to file. If the irs does not honor your waiver request, then you will be notified. Get ready for tax season deadlines by completing any required tax forms today. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. Web instructions for how to complete form 5329. Form 5329 includes detailed instructions for each part, which taxpayers should follow carefully to ensure accurate reporting. File form 5329 with your. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Web instead, follow the instructions for requesting a waiver in the instructions for form 5329. Form 5329 includes detailed instructions for each part, which taxpayers should follow carefully to ensure accurate reporting. If you don’t have to file a 2020. Web instructions for how to. Web enter the gross distribution amount. Get ready for tax season deadlines by completing any required tax forms today. Web below, you'll find answers to frequently asked questions on retirement plan taxes (form 5329).table of contents:‣ how do i enter excess contributions on form 53. Complete, edit or print tax forms instantly. Web instead, follow the instructions for requesting a. Complete, edit or print tax forms instantly. • form 940 • form 940 schedule r. Web below, you'll find answers to frequently asked questions on retirement plan taxes (form 5329).table of contents:‣ how do i enter excess contributions on form 53. File form 5329 with your 2022 form 1040,. Web instructions for each part. • form 940 • form 940 schedule r. Web below, you'll find answers to frequently asked questions on retirement plan taxes (form 5329).table of contents:‣ how do i enter excess contributions on form 53. If the irs does not honor your waiver request, then you will be notified. Complete, edit or print tax forms instantly. Ad access irs tax forms. Web instead, follow the instructions for requesting a waiver in the instructions for form 5329. Web instructions for how to complete form 5329. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. Locate the roth ira section. Ad access irs tax forms. Web instructions for how to complete form 5329. Get ready for tax season deadlines by completing any required tax forms today. Web when and where to file. • form 940 • form 940 schedule r. Enter in the basis in roth ira conversions as of. File form 5329 with your 2022 form 1040,. Web enter the gross distribution amount. Web instructions for how to complete form 5329. Ad access irs tax forms. Enter in the basis in roth ira conversions as of. If the irs does not honor your waiver request, then you will be notified. If you don’t have to file a 2020. Ad access irs tax forms. Form 5329 includes detailed instructions for each part, which taxpayers should follow carefully to ensure accurate reporting. Web instead, follow the instructions for requesting a waiver in the instructions for form 5329. Ad access irs tax forms. When you complete form 5329 for 2022, you enter $1,000 (not $800) on line 20 because you. Locate the roth ira section. • form 940 • form 940 schedule r. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. Get form 5329 from a tax preparation office, a government agency, or you can simply download it online and. When and where to file. Tax reporting of a carryforward when you. Locate the roth ira section. Web instructions for each part. • form 940 • form 940 schedule r. Tip if you don’t have to file a 2021 income tax return,. Web when and where to file. Web instructions for how to complete form 5329. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web instead, follow the instructions for requesting a waiver in the instructions for form 5329. If the irs does not honor your waiver request, then you will be notified. Complete, edit or print tax forms instantly. Ad access irs tax forms. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. Ad access irs tax forms. Web tax year 2023 940 mef ats scenario 3 crocus company. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira.IRS Form 5329 2018 2019 Printable & Fillable Sample in PDF

1099R Coding Change

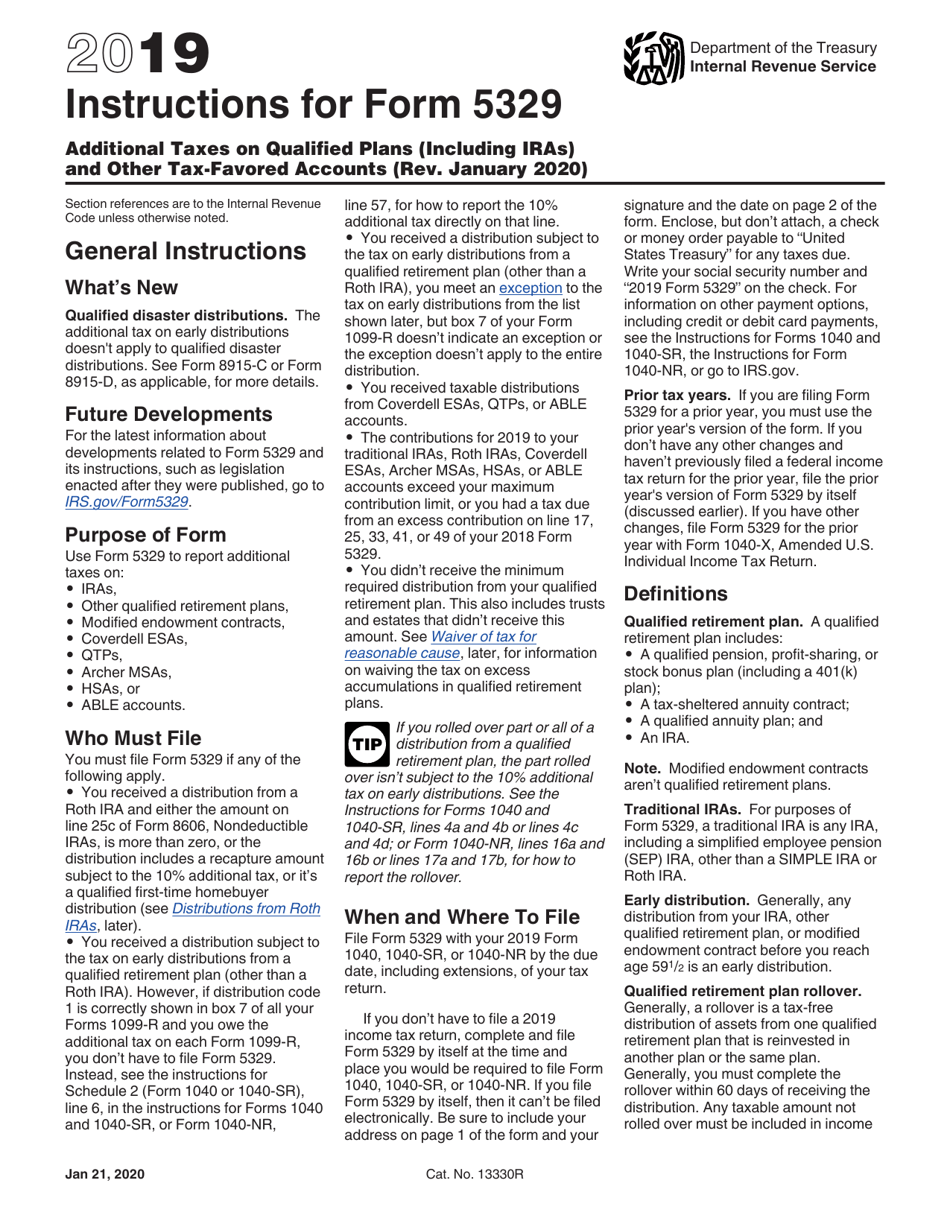

Form 5329 Instructions & Exception Information for IRS Form 5329

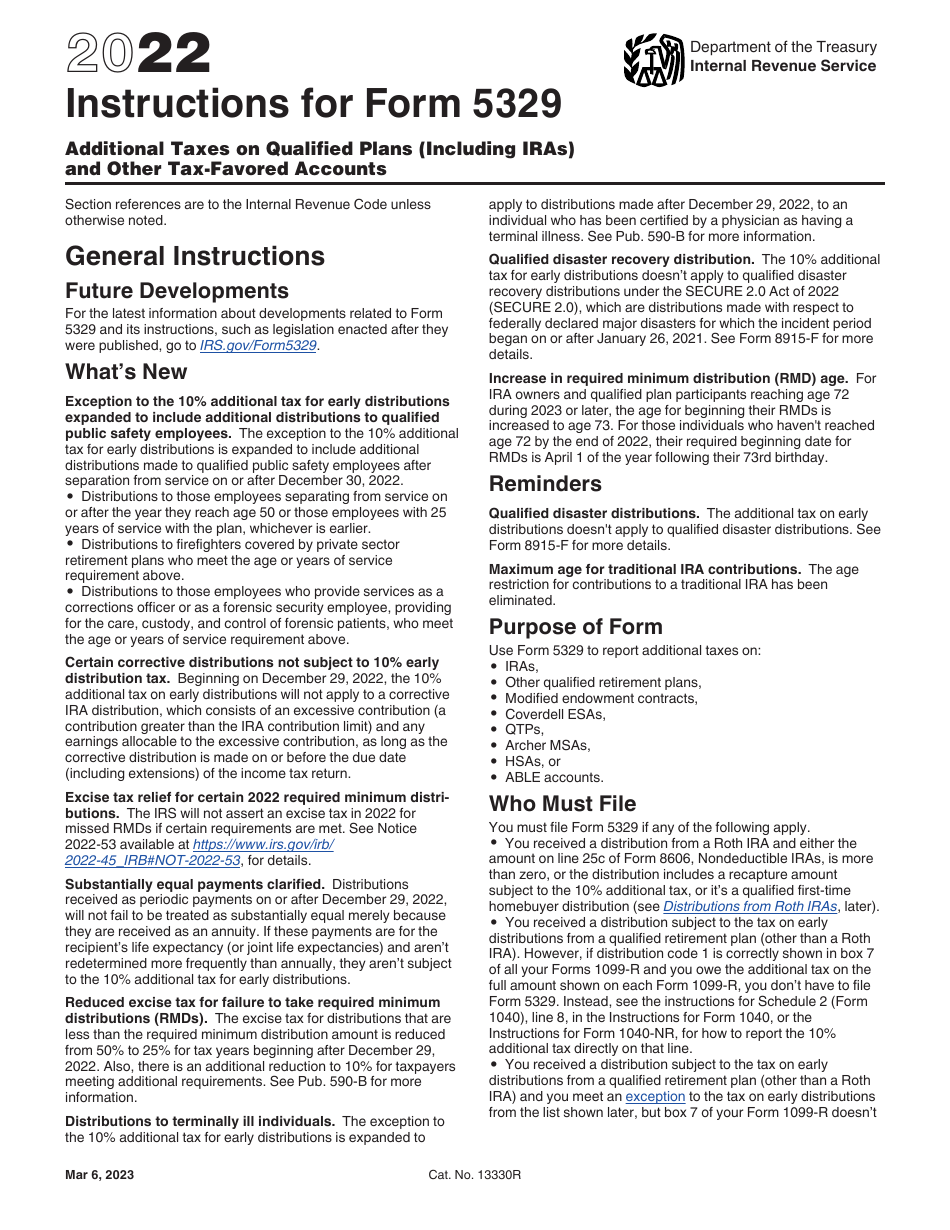

Download Instructions for IRS Form 5329 Additional Taxes on Qualified

IRS Form 5329 [For Retirement Savings And More] Tax Relief Center

Form 5329 Instructions & Exception Information for IRS Form 5329

Instructions for How to Fill in IRS Form 5329

Download Instructions for IRS Form 5329 Additional Taxes on Qualified

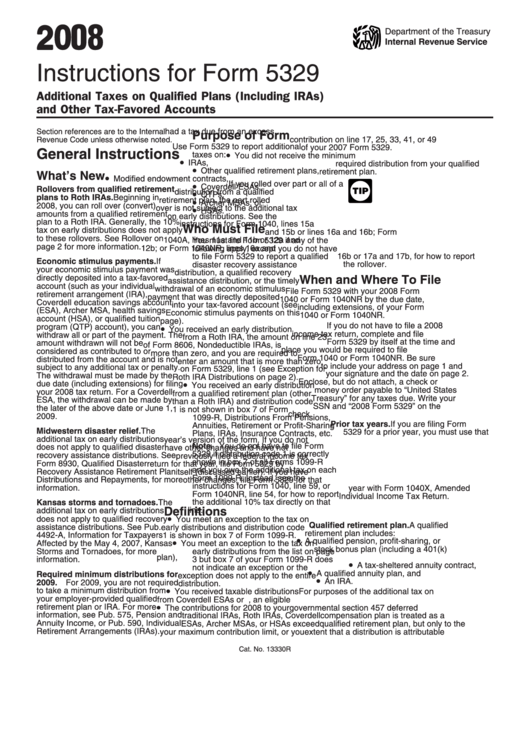

Instructions For Form 5329 Additional Taxes On Qualified Plans

How to Fill in IRS Form 5329

Related Post:

![IRS Form 5329 [For Retirement Savings And More] Tax Relief Center](https://help.taxreliefcenter.org/wp-content/uploads/2019/07/TRC-CFI-IRS-Form-5329.png)