Form 8915-F Release Date

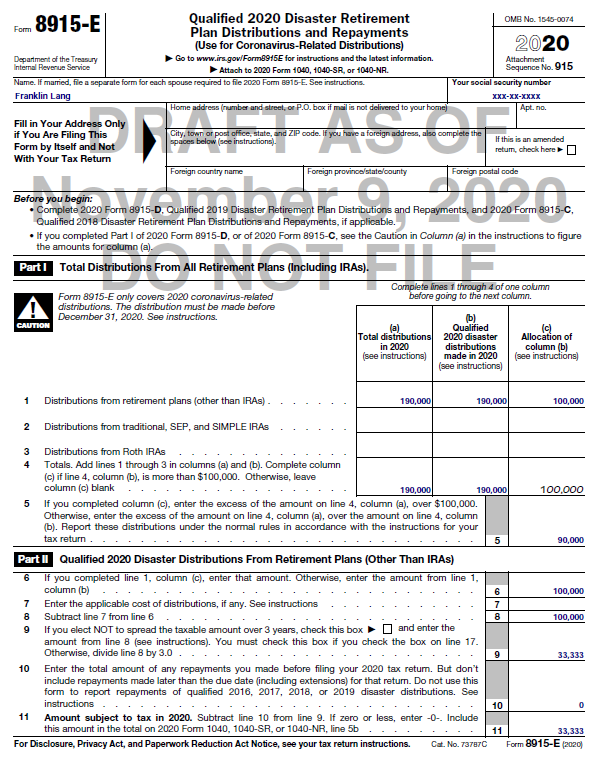

Form 8915-F Release Date - 2023) form instructions the irs has. Web it also allows you to spread the taxable portion of the distribution over three years, if needed and report prior year distribution amounts which are to be taxed in 2021. In it affects you, remember to vote:. Web on november 19, 2022, you make a repayment of $65,000. Web the qualified disaster distribution period for each disaster still begins on the day the disaster began. January 2022), please be advised that those. The last day of the qualified disaster distribution period for most qualified 2021 disasters and many qualified 2022 disasters is june 26, 2023. See worksheet 1b, later, to determine whether you must use worksheet 1b. As of this update, the irs has only released draft instructions as well as a new draft (2/24/2023) of. In this public forum, we are provided with form availability information, but not an explanation as to why certain forms are not. You complete a 2022 form. Web taxslayer pro desktop income menu other income desktop: In this public forum, we are provided with form availability information, but not an explanation as to why certain forms are not. See worksheet 1b, later, to determine whether you must use worksheet 1b. In it affects you, remember to vote:. As of this update, the irs has only released draft instructions as well as a new draft (2/24/2023) of. In this public forum, we are provided with form availability information, but not an explanation as to why certain forms are not. See worksheet 1b, later, to determine whether you must use worksheet 1b. You complete a 2022 form. January 2022),. Looks like tax season isn't going to start until 3/17 for some tax preparers. Web taxslayer pro desktop income menu other income desktop: The last day of the qualified disaster distribution period for most qualified 2021 disasters and many qualified 2022 disasters is june 26, 2023. Web the qualified disaster distribution period for each disaster still begins on the day. Web on november 19, 2022, you make a repayment of $65,000. In it affects you, remember to vote:. Looks like tax season isn't going to start until 3/17 for some tax preparers. You can choose to use worksheet 1b even if you are not required to do so. January 2022), please be advised that those. In it affects you, remember to vote:. Web it also allows you to spread the taxable portion of the distribution over three years, if needed and report prior year distribution amounts which are to be taxed in 2021. Web taxslayer pro desktop income menu other income desktop: 2023) form instructions the irs has. As of this update, the irs has. The last day of the qualified disaster distribution period for most qualified 2021 disasters and many qualified 2022 disasters is june 26, 2023. In it affects you, remember to vote:. You can choose to use worksheet 1b even if you are not required to do so. Web it also allows you to spread the taxable portion of the distribution over. See worksheet 1b, later, to determine whether you must use worksheet 1b. In it affects you, remember to vote:. Web the qualified disaster distribution period for each disaster still begins on the day the disaster began. As of this update, the irs has only released draft instructions as well as a new draft (2/24/2023) of. Web taxslayer pro desktop income. Web it also allows you to spread the taxable portion of the distribution over three years, if needed and report prior year distribution amounts which are to be taxed in 2021. Web on november 19, 2022, you make a repayment of $65,000. 2023) form instructions the irs has. January 2022), please be advised that those. Looks like tax season isn't. As of this update, the irs has only released draft instructions as well as a new draft (2/24/2023) of. You complete a 2022 form. The last day of the qualified disaster distribution period for most qualified 2021 disasters and many qualified 2022 disasters is june 26, 2023. Web it also allows you to spread the taxable portion of the distribution. As of this update, the irs has only released draft instructions as well as a new draft (2/24/2023) of. January 2022), please be advised that those. Web taxslayer pro desktop income menu other income desktop: 2023) form instructions the irs has. You complete a 2022 form. Web (january 2022) qualified disaster retirement plan distributions and repayments department of the treasury internal revenue service go to www.irs.gov/form8915f. The last day of the qualified disaster distribution period for most qualified 2021 disasters and many qualified 2022 disasters is june 26, 2023. Web it also allows you to spread the taxable portion of the distribution over three years, if needed and report prior year distribution amounts which are to be taxed in 2021. As of this update, the irs has only released draft instructions as well as a new draft (2/24/2023) of. You complete a 2022 form. In it affects you, remember to vote:. January 2022), please be advised that those. Web on november 19, 2022, you make a repayment of $65,000. For information about drake20 and prior, see. 2023) form instructions the irs has. See worksheet 1b, later, to determine whether you must use worksheet 1b. In this public forum, we are provided with form availability information, but not an explanation as to why certain forms are not. You can choose to use worksheet 1b even if you are not required to do so. Web the qualified disaster distribution period for each disaster still begins on the day the disaster began. Web taxslayer pro desktop income menu other income desktop: Looks like tax season isn't going to start until 3/17 for some tax preparers.NY Federal Form 8915F and NY Pension Exclusion (Drake21)

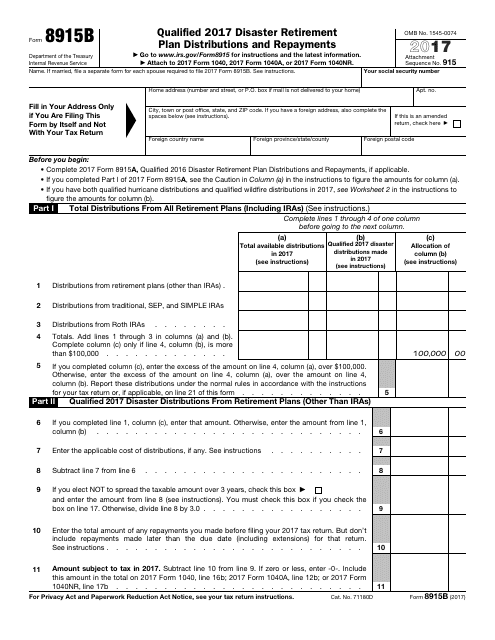

IRS Form 8915B Download Fillable PDF 2017, Qualified 2017 Disaster

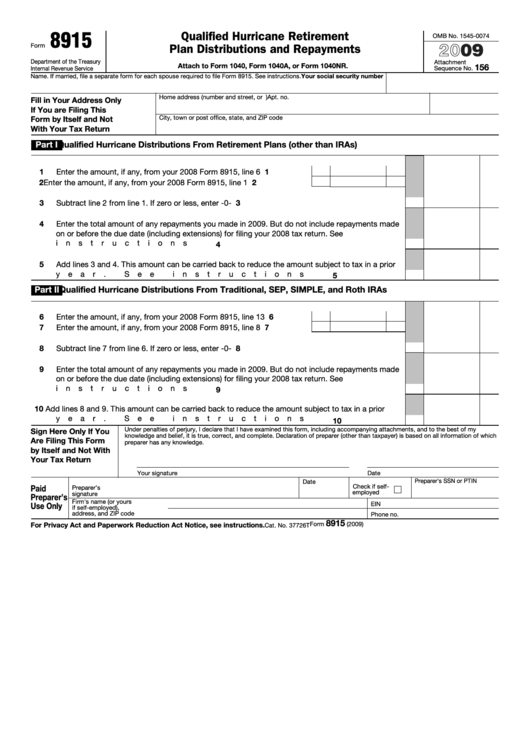

Fillable Form 8915 Qualified Hurricane Retirement Plan Distributions

When will the 2021 8915f form be available on Turbo Tax to efile

Form 8915 F Release Date 2023 Printable Forms Free Online

Wordly Account Gallery Of Photos

Download Instructions for IRS Form 8915F Qualified Disaster Retirement

About Form 8915F, Qualified Disaster Retirement Plan Distributions and

Instructions 8915 Fill Out and Sign Printable PDF Template signNow

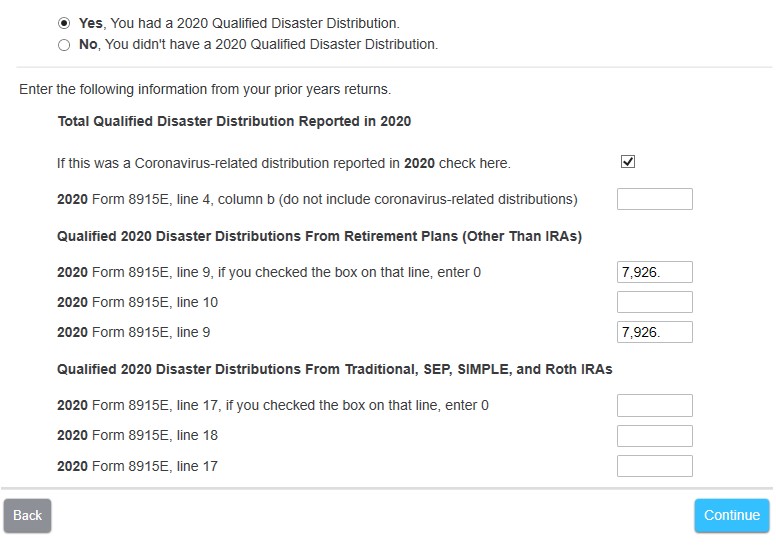

form 8915 e instructions turbotax Renita Wimberly

Related Post: