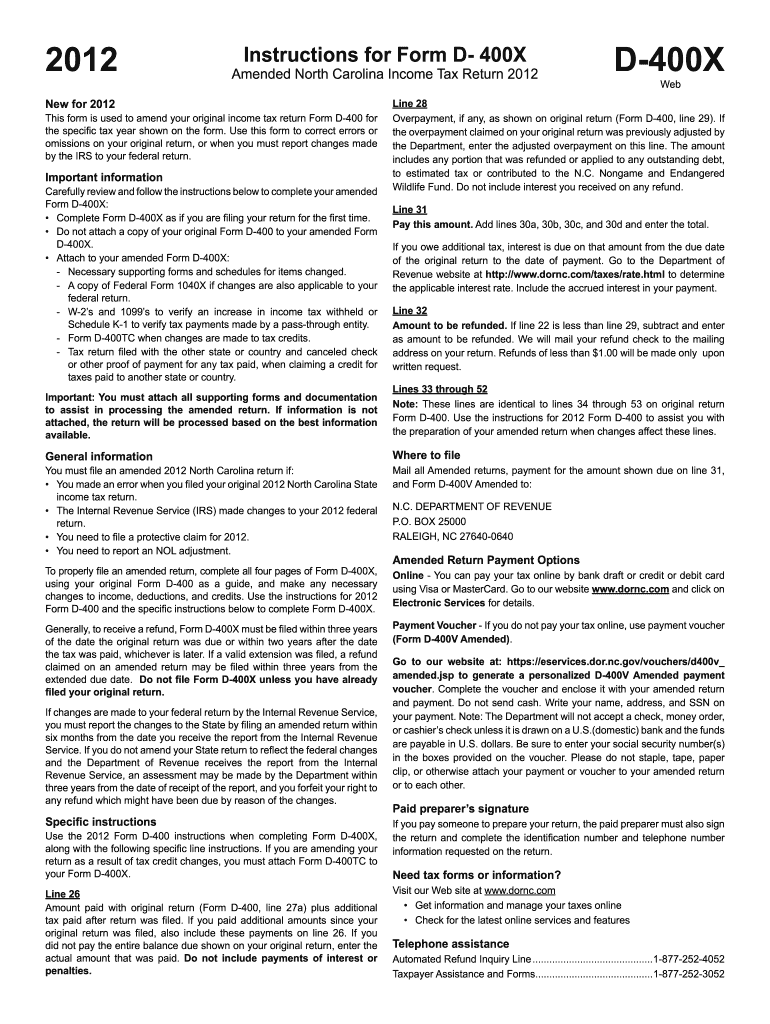

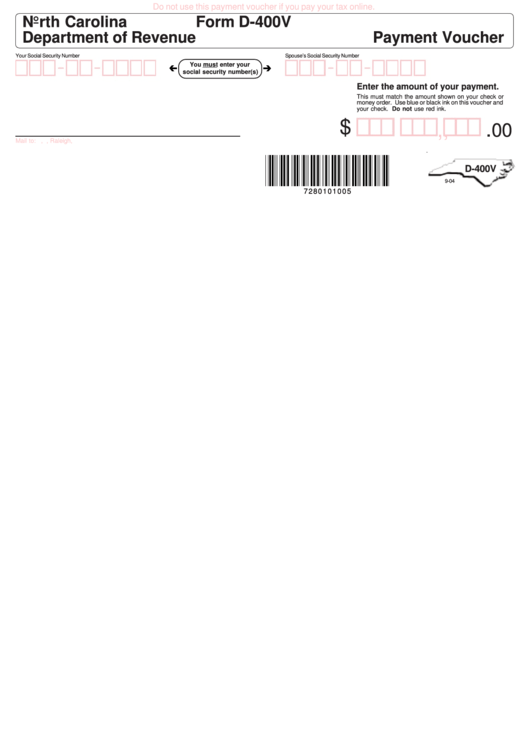

North Carolina Form D-400V

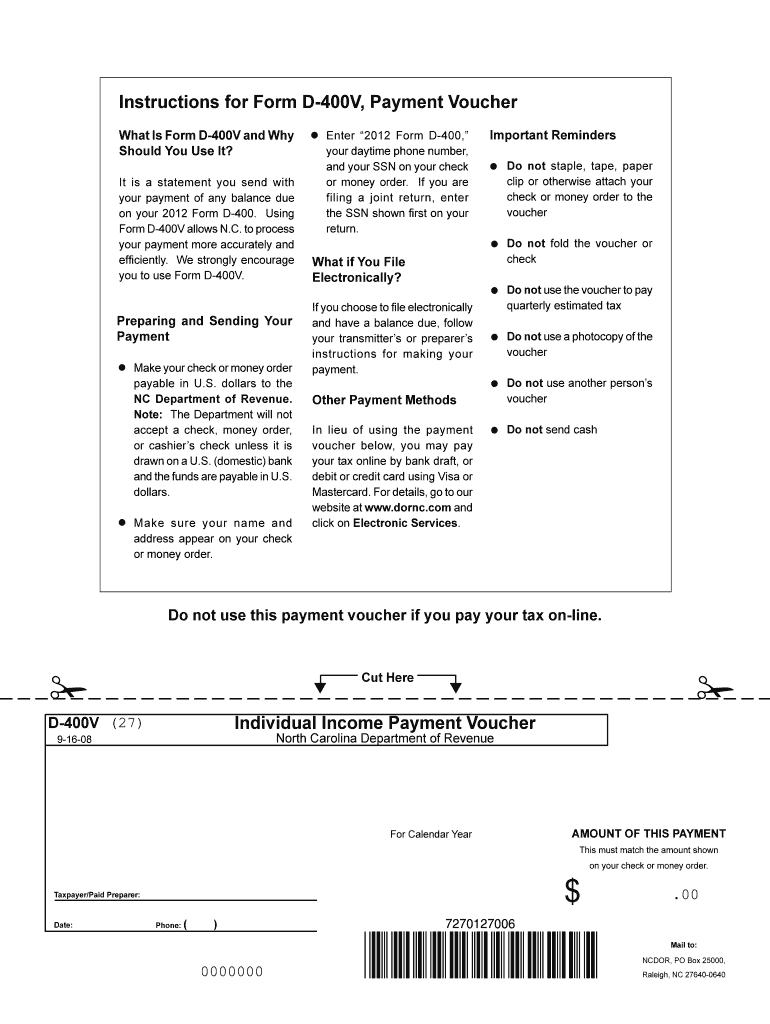

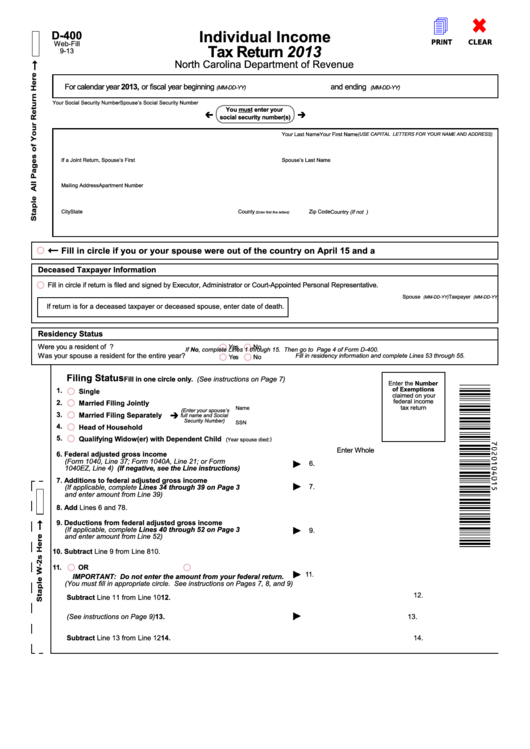

North Carolina Form D-400V - Pay a bill or notice (notice required) sales and use tax. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. Web north carolina taxable income. Printable north carolina state tax. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. Third party file and pay option: Single married filing joint married. Third party file and pay option: Were you a resident of n.c. If the form does not appear after you click create form. Complete, edit or print tax forms instantly. If you are filing a joint return, write both social security numbers on your. Were you a resident of n.c. This form is for income earned in tax year 2022, with tax. Third party file and pay option: This form is for income earned in tax year 2022, with tax. If you are filing a joint return, write both social security numbers on your. After clicking the print icon or selecting print from the file menu, you will see the print options screen. Third party file and pay option: Single married filing joint married. This form is for income earned in tax year 2022, with tax. Complete, edit or print tax forms instantly. If you are filing a joint return, write both social security numbers on your. After clicking the print icon or selecting print from the file menu, you will see the print options screen. If the form does not appear after you click create form. Third party file and pay option: This form is for income earned in tax year 2022, with tax. Printable north carolina state tax. Web we would like to show you a description here but the site won’t allow us. Close window the form will open in the main window. Fill in circle if you, or if married filing jointly, your spouse were out of the country on. This form is for income earned in tax year 2022, with tax. Single married filing joint married. Web north carolina taxable income. If you are filing a joint return, write both social security numbers on your. After clicking the print icon or selecting print from the file menu, you will see the print options screen. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. Complete, edit or print tax forms instantly. Single married filing. Complete, edit or print tax forms instantly. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. Close window the form will open in the main window. Third party file and pay option: Single married filing joint married. Single married filing joint married. Web we would like to show you a description here but the site won’t allow us. Fill in circle if you, or if married filing jointly, your spouse were out of the country on. Third party file and pay option: Get ready for tax season deadlines by completing any required tax forms today. This payment application should be used only for the payment of tax owed on an amended north carolina individual. Pay a bill or notice (notice required) sales and use tax. After clicking the print icon or selecting print from the file menu, you will see the print options screen. If you are filing a joint return, write both social security. Complete, edit or print tax forms instantly. If the form does not appear after you click create form. Printable north carolina state tax. Single married filing joint married. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. Web north carolina taxable income. Third party file and pay option: After clicking the print icon or selecting print from the file menu, you will see the print options screen. Web we would like to show you a description here but the site won’t allow us. Printable north carolina state tax. Third party file and pay option: This form is for income earned in tax year 2022, with tax. Get ready for tax season deadlines by completing any required tax forms today. This payment application should be used only for the payment of tax owed on an amended north carolina individual. Single married filing joint married. If you are filing a joint return, write both social security numbers on your. Complete, edit or print tax forms instantly. Were you a resident of n.c. Fill in circle if you, or if married filing jointly, your spouse were out of the country on. Complete, edit or print tax forms instantly. If the form does not appear after you click create form. Close window the form will open in the main window. Pay a bill or notice (notice required) sales and use tax. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003.2006 Form NC DoR D400Fill Online, Printable, Fillable, Blank pdfFiller

Nc D 400 Fillable Form Printable Forms Free Online

Nc D 400v Printable Form Fill Online, Printable, Fillable, Blank

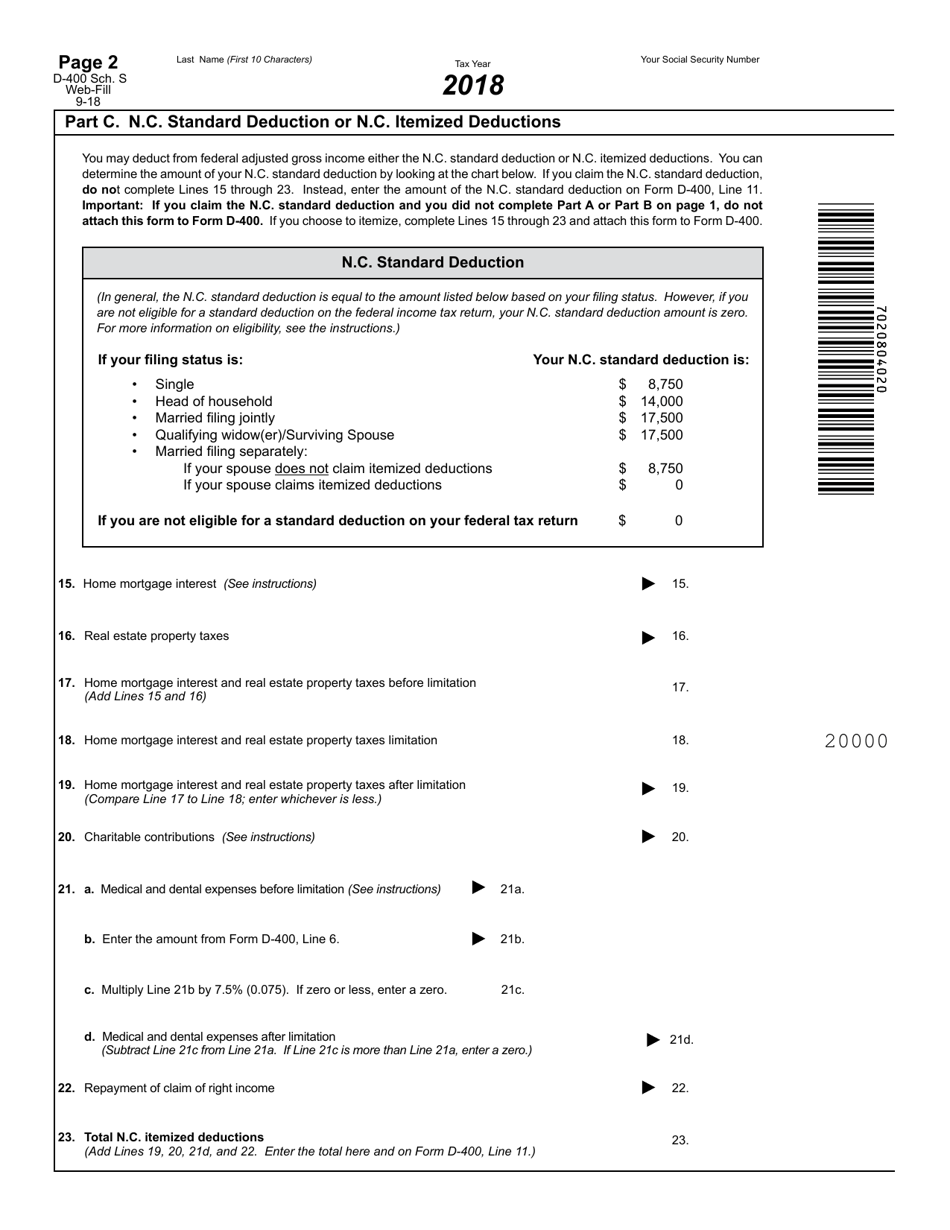

Form D400 Schedule S Download Fillable PDF or Fill Online Supplemental

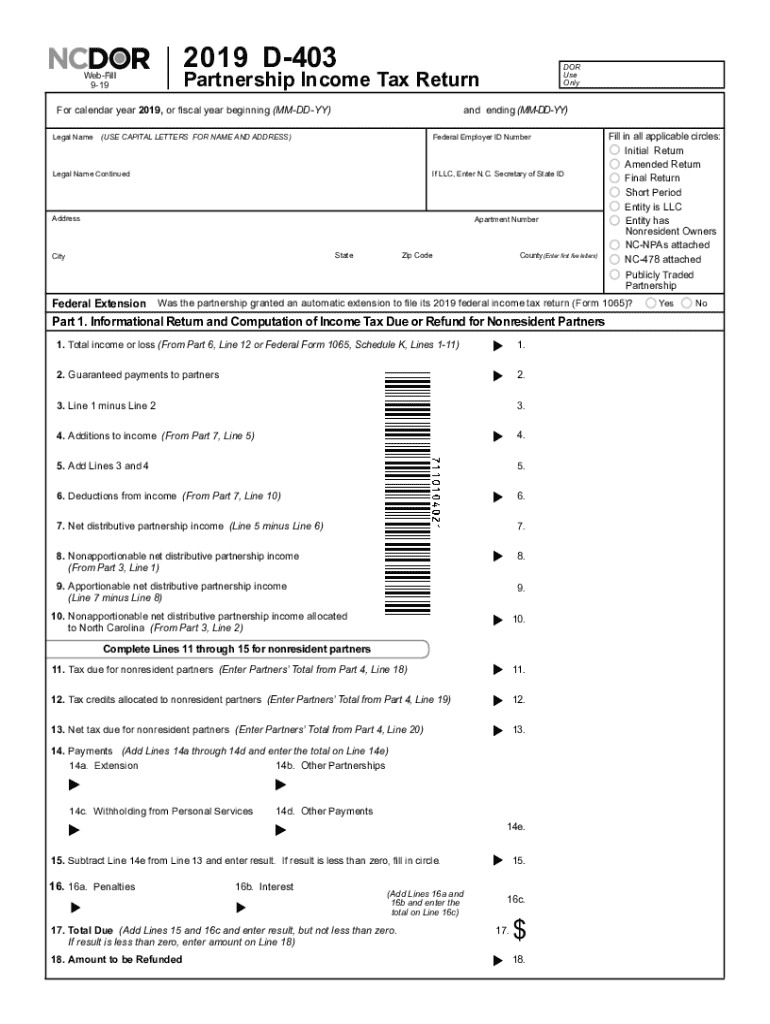

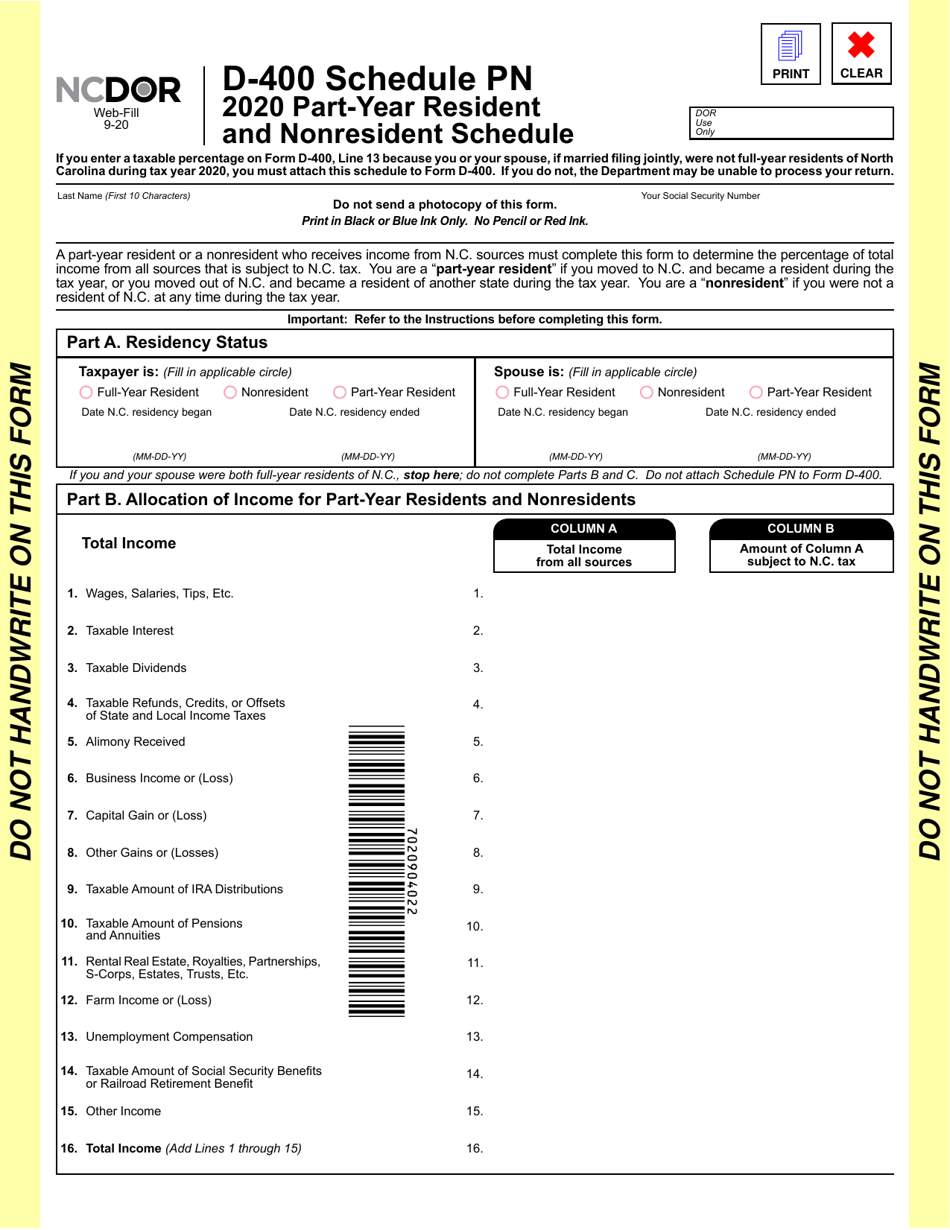

Form D400 Schedule PN Download Fillable PDF or Fill Online PartYear

Nc Form D 400v Printable Printable Forms Free Online

Printable D 400v Form Fill and Sign Printable Template Online US

Form D400v Payment Voucher North Carolina Department Of Revenue

Nc D400V Printable Form

Printable Form D 400v Printable Forms Free Online

Related Post: