Where To Mail Irs Form 8862

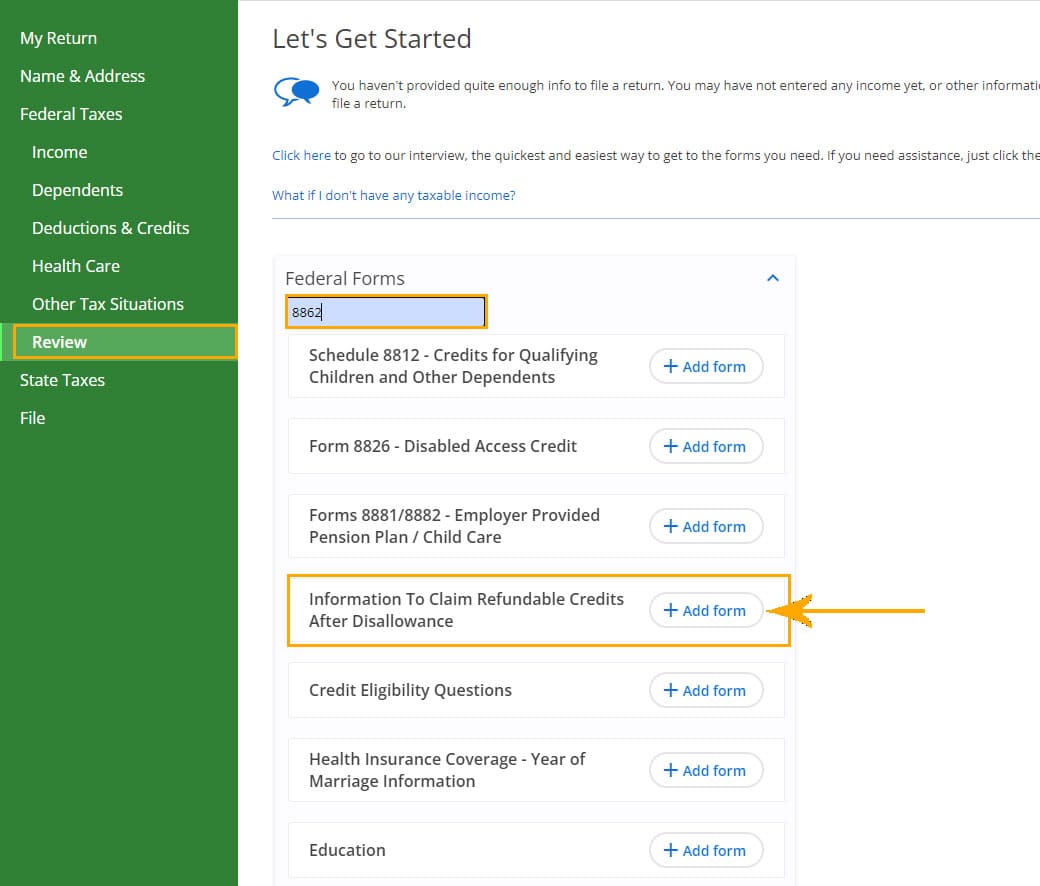

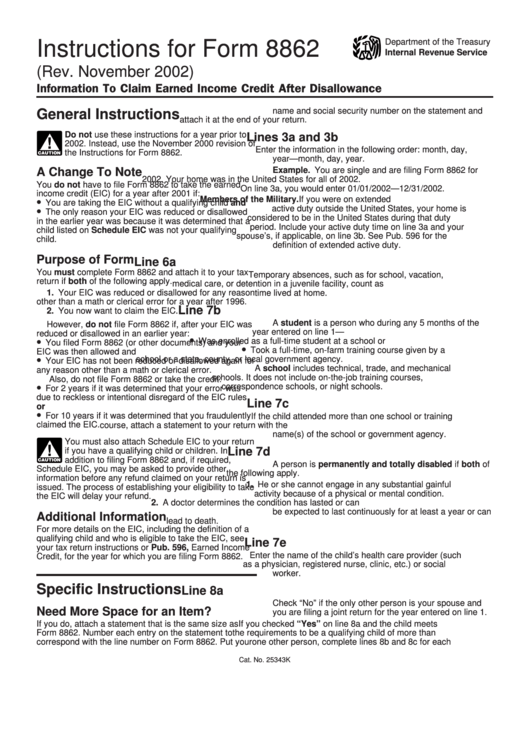

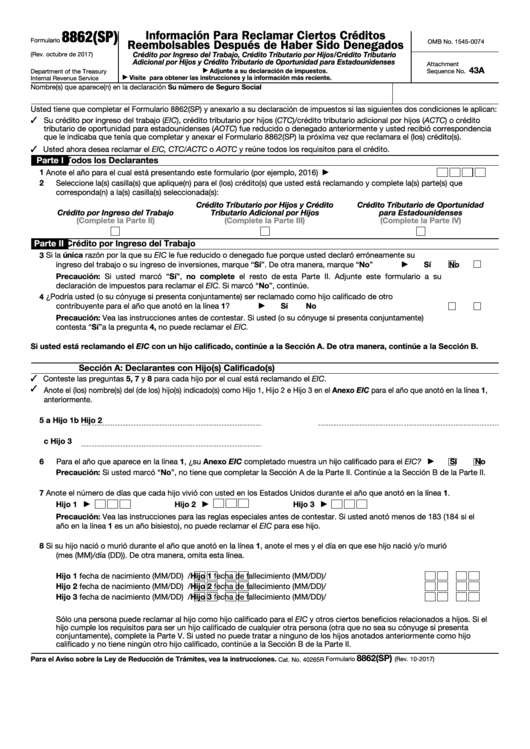

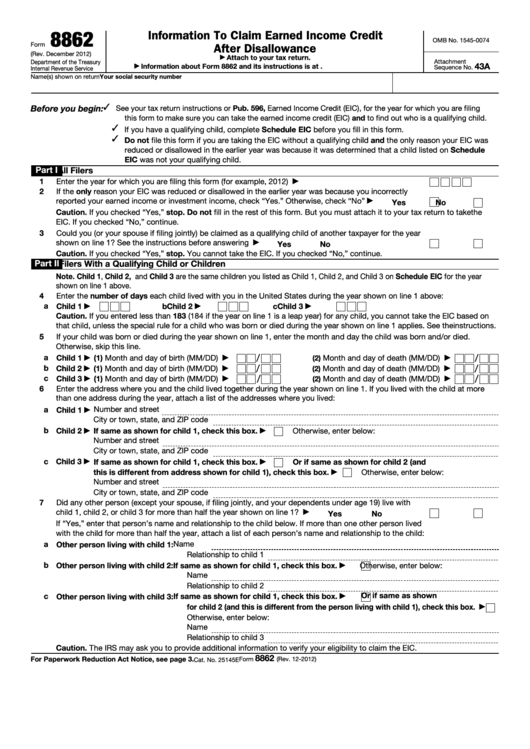

Where To Mail Irs Form 8862 - You can find tax form 8862 on the irs website. Ensure you have attached it to your tax return if required. Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits select search,. Web form 8832 if you are located in. You need to attach form 8862 to your tax return and mail it to the same address where you would normally file your return. Web where to send form 8862? Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Web once the penalty expires, you’ll need to file form 8862 along with your irs tax return in order to reclaim these credits. Web the last step to send irs form by fax, is to click the send button. Web the last step to send irs form by fax, is to click the send button. Web overview the earned income credit (eic) is a valuable, refundable tax credit available to low and moderate income taxpayers and families. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Obtain the correct mailing address for. Ensure. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Begin by filling out form 8862 accurately and completely. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result. Web enter the year for which you are filing this form (for example, 2012). Web internal revenue service attachment sequence no.43a ' attach to your tax return. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. You must complete form 8862 and attach it. For paperwork reduction act notice, see back of form. You need to attach form 8862 to your tax return and mail it to the same address where you would normally file your return. You can find tax form 8862 on the irs website. Web most taxpayers are required to file a yearly income tax return in april to both the. Try it for free now! Web overview the earned income credit (eic) is a valuable, refundable tax credit available to low and moderate income taxpayers and families. Begin by filling out form 8862 accurately and completely. Web home forms and instructions about form 8822, change of address about form 8822, change of address use form 8822 to notify the internal. Web home forms and instructions about form 8822, change of address about form 8822, change of address use form 8822 to notify the internal revenue service. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Try. Web earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american. Web overview the earned income credit (eic) is a valuable, refundable tax credit available to low and moderate income taxpayers and families. Web home forms and instructions about form 8822, change of address about. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Ad edit, sign or email. For paperwork reduction act notice, see back of form. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Web home forms and instructions about form 8822, change of address about form 8822, change of address use form 8822 to notify. Web once the penalty expires, you’ll need to file form 8862 along with your irs tax return in order to reclaim these credits. Begin by filling out form 8862 accurately and completely. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Web for the latest information about developments related to form 8862 and its. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Web please mail to the. If the only reason your eic was reduced or disallowed in the earlier year was because you. Web earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american. Obtain the correct mailing address for. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire,. You need to attach form 8862 to your tax return and mail it to the same address where you would normally file your return. This rejection will instruct you. Address to mail form to irs: Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits select search,. Web overview the earned income credit (eic) is a valuable, refundable tax credit available to low and moderate income taxpayers and families. Web once the penalty expires, you’ll need to file form 8862 along with your irs tax return in order to reclaim these credits. Web the last step to send irs form by fax, is to click the send button. Ad download or email irs 8862 & more fillable forms, try for free now! Web where to send form 8862? Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Web internal revenue service attachment sequence no.43a ' attach to your tax return. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. For paperwork reduction act notice, see back of form.Top 14 Form 8862 Templates free to download in PDF format

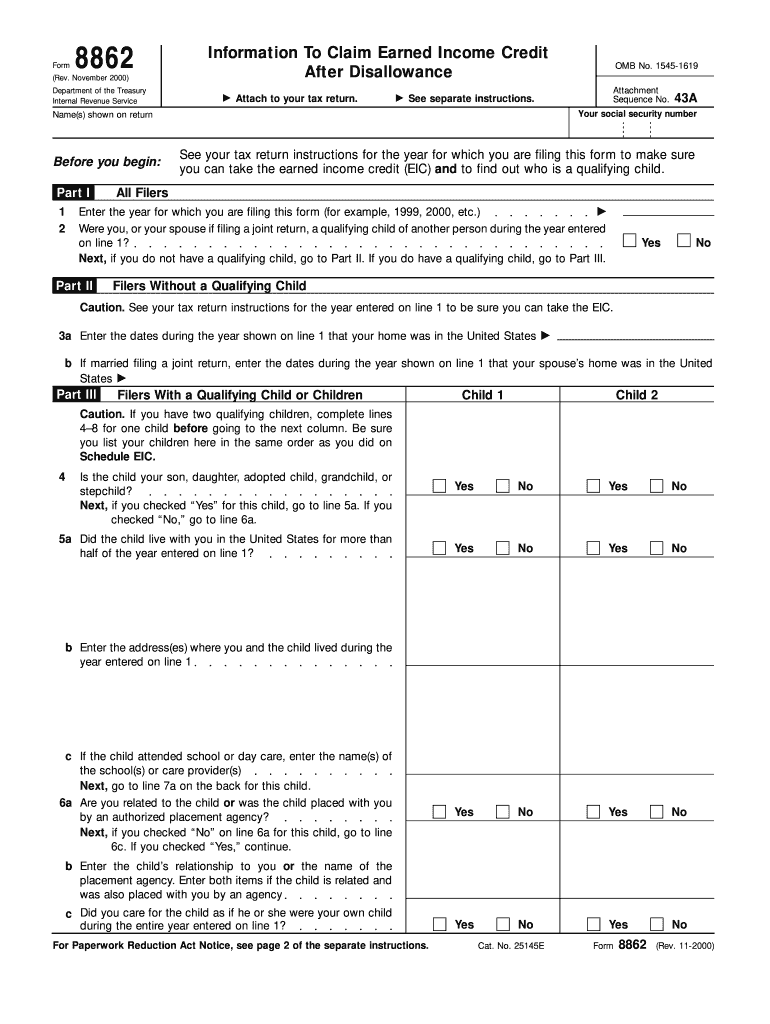

2021 Form IRS 8862 Fill Online, Printable, Fillable, Blank pdfFiller

Form 8862 Pdf Fillable Printable Forms Free Online

8862 Form Fill Out and Sign Printable PDF Template signNow

Form 8862 Information to Claim Earned Credit After

Form 8862 For 2019 PERINGKAT

Irs Form 8862 Printable Master of Documents

Form 8862 Added To Your IRS Tax Return Instructions eFile

Printable Irs Form 8862 Printable Forms Free Online

IRS Form 8862 Diagram Quizlet

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2021-05-05at3.12.40PM-ad486e92d61441a9b09a3e39b758696c.png)