Irs Form 5310

Irs Form 5310 - Ad do you have irs debt & need an irs payment plan? Web we last updated the application for determination for terminating plan in february 2023, so this is the latest version of form 5310, fully updated for tax year 2022. Department of the treasury (under sections 401(a) and 501(a) of the internal revenue code) internal. To submit form 5310, you must: Notice of qualified separate lines of business. Once completed you can sign your fillable form or send for signing. Web the form 5310, application for determination for terminating plan, asks the irs to make a determination of your plan’s qualification status at the time of termination. Web irs will continue to accept paper versions of form 5310 through july 31, 2021. Enter 2 for a notice of. Enter 1 for a notice of qualified separate lines of business. Web the internal revenue service (irs) recently published revised forms and instructions for form 5300, application for determination for employee benefit plan and form 5310,. Get back in irs good standing. Ad signnow.com has been visited by 100k+ users in the past month Web form 5310 must be submitted electronically through pay.gov. Web the updated form 8717 instructions specify that. Web we last updated the application for determination for terminating plan in february 2023, so this is the latest version of form 5310, fully updated for tax year 2022. Web please use this form to pay the fee associated with form 8717. Enter 2 for a notice of. Web page last reviewed or updated: You can access the most recent. Enter the ale member’s complete address (including. Web please use this form to pay the fee associated with form 8717. Enter 2 for a notice of. Web the updated form 8717 instructions specify that form 8717 should no longer be used for form 5300 (or form 5310, for which electronic filing has been required. Web application for determination upon termination. It ensure compliance with the requirement that account balances. All forms are printable and downloadable. Web form 5310 must be submitted electronically through pay.gov. Get back in irs good standing. Web sections 6.02 and 30.07 are revised to provide that form 5310 may be submitted electronically beginning on april 16, 2021, and must be submitted. Web irs will continue to accept paper versions of form 5310 through july 31, 2021. Web by submitting the form 5310, you are asking the irs for a favorable determination letter, which is the irs’ approval of the plan document at the time of. Ad do you have irs debt & need an irs payment plan? Register for an account. Web form 5310 must be submitted electronically through pay.gov. Web if you are filing irs form 5310 in order to have the irs make a determination about the plan’s qualification status at termination. Ad outgrow.us has been visited by 10k+ users in the past month Web the form 5310, application for determination for terminating plan, asks the irs to make. After july 31, 2021, all form 5310 applications must be submitted electronically. You can access the most recent version of the form at pay.gov. Go to www.irs.gov/form5310 for more information. As of july 1, 2019, employers applying to the irs for a. Enter the ale member’s complete address (including. Web by submitting the form 5310, you are asking the irs for a favorable determination letter, which is the irs’ approval of the plan document at the time of. For form 5310, submitted on or after august 1, 2021, form 5300 submitted on or after july. Department of the treasury (under sections 401(a) and 501(a) of the internal revenue code). Enter the ale member’s complete address (including. Ad signnow.com has been visited by 100k+ users in the past month Web please use this form to pay the fee associated with form 8717. Web use fill to complete blank online irs pdf forms for free. You can access the most recent version of the form at pay.gov. Ad do you have irs debt & need an irs payment plan? Ad outgrow.us has been visited by 10k+ users in the past month All forms are printable and downloadable. Register for an account on pay.gov, 2. Web the form 5310, application for determination for terminating plan, asks the irs to make a determination of your plan’s qualification status at. Web by submitting the form 5310, you are asking the irs for a favorable determination letter, which is the irs’ approval of the plan document at the time of. For form 5310, submitted on or after august 1, 2021, form 5300 submitted on or after july. This form should not be returned to fidelity. Enter the ale member’s complete address (including. Web the form 5310, application for determination for terminating plan, asks the irs to make a determination of your plan’s qualification status at the time of termination. Web plan termination determination letters form 5310 pros and cons. Web as of april 16, 2021, the irs requires that form 5310 be completed and submitted through pay.gov. Web sections 6.02 and 30.07 are revised to provide that form 5310 may be submitted electronically beginning on april 16, 2021, and must be submitted. Get back in irs good standing. Web the internal revenue service (irs) recently published revised forms and instructions for form 5300, application for determination for employee benefit plan and form 5310,. It ensure compliance with the requirement that account balances. After july 31, 2021, all form 5310 applications must be submitted electronically. To submit form 5310, you must: As of july 1, 2019, employers applying to the irs for a. Web form 5310 must be submitted electronically through pay.gov. Web please use this form to pay the fee associated with form 8717. Once completed you can sign your fillable form or send for signing. Notice of qualified separate lines of business. Web use fill to complete blank online irs pdf forms for free. Enter 1 for a notice of qualified separate lines of business.Form 5310A Notice of Plan Merger or Consolidation, Spinoff, or

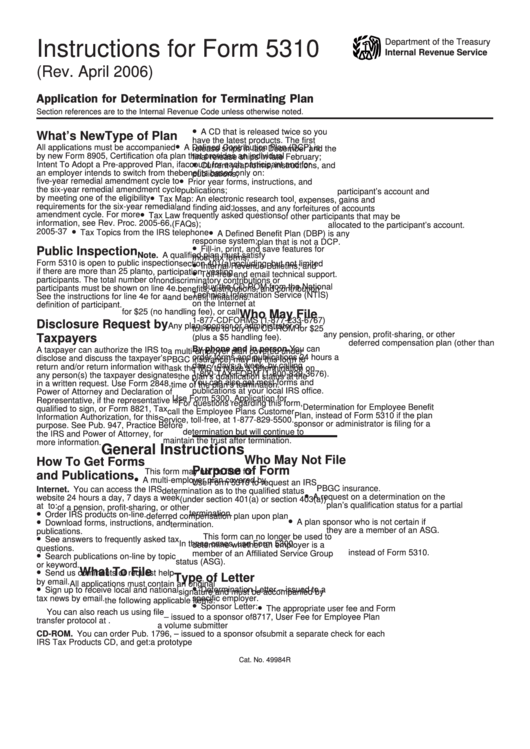

Instructions For Form 5310 Application For Determination For

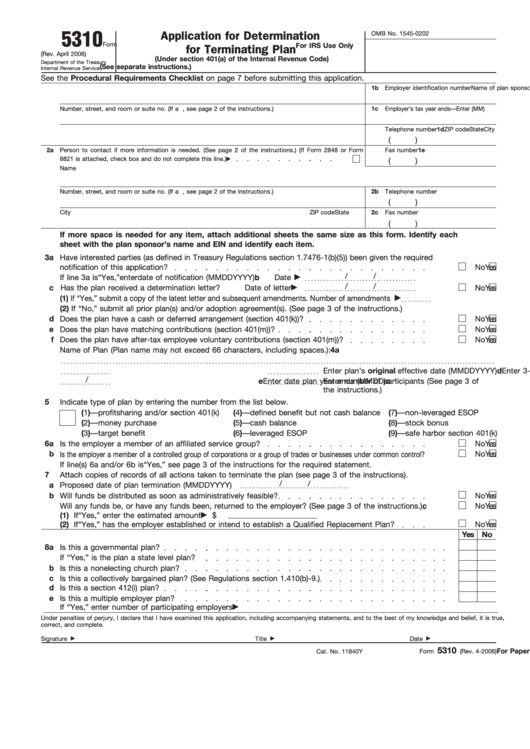

Fillable Form 5310 Application For Determination For Terminating Plan

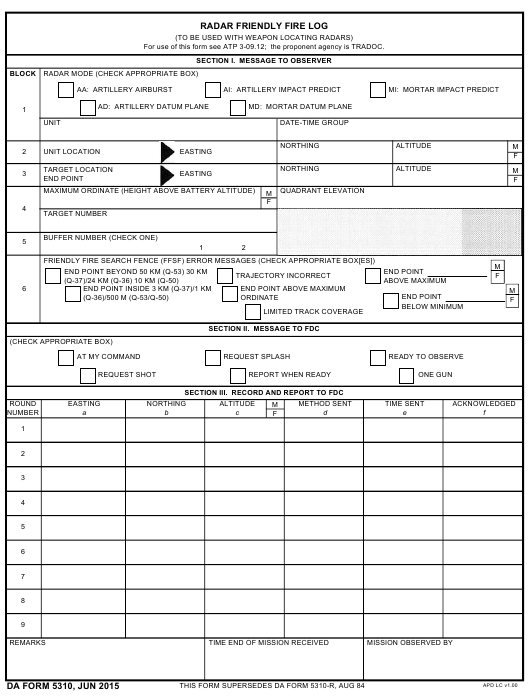

Download Fillable da Form 5310

Fillable Form 5310 Printable Forms Free Online

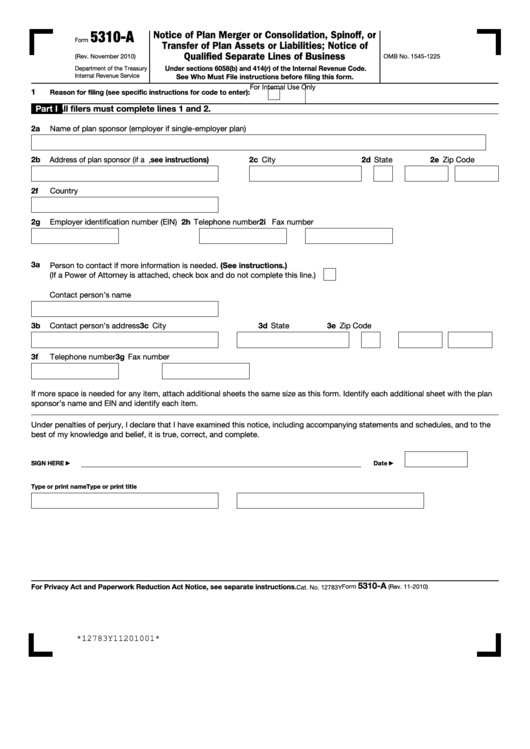

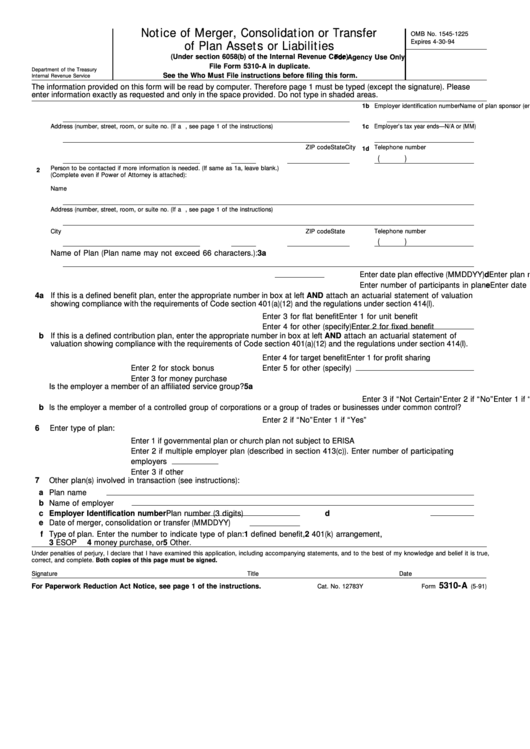

Fillable Form 5310A Notice Of Merger, Consolidation Or Transfer Of

Irs.gov Form 1040a 2016 Form Resume Examples dO3wPXGE8E

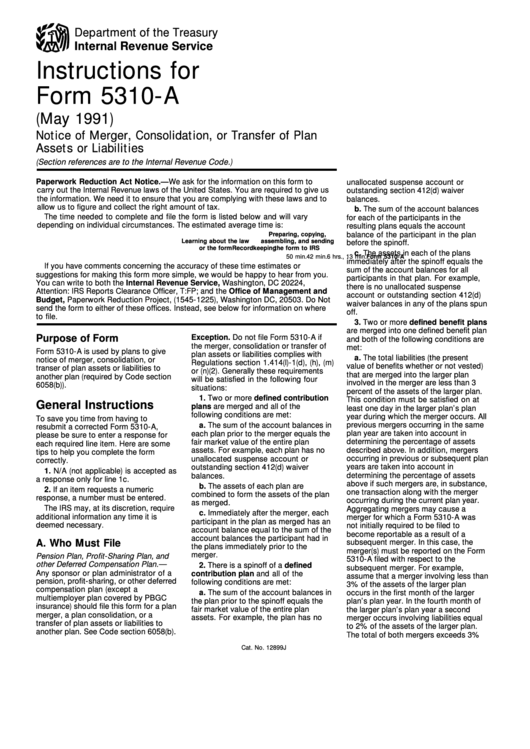

Instructions For Form 5310A (May 1991) Notice Of Merger, Consolidation

Form 5310A Notice of Plan Merger or Consolidation, Spinoff, or

Form 5310 Application for Determination upon Termination (2013) Free

Related Post: