Dcad Homestead Exemption Form

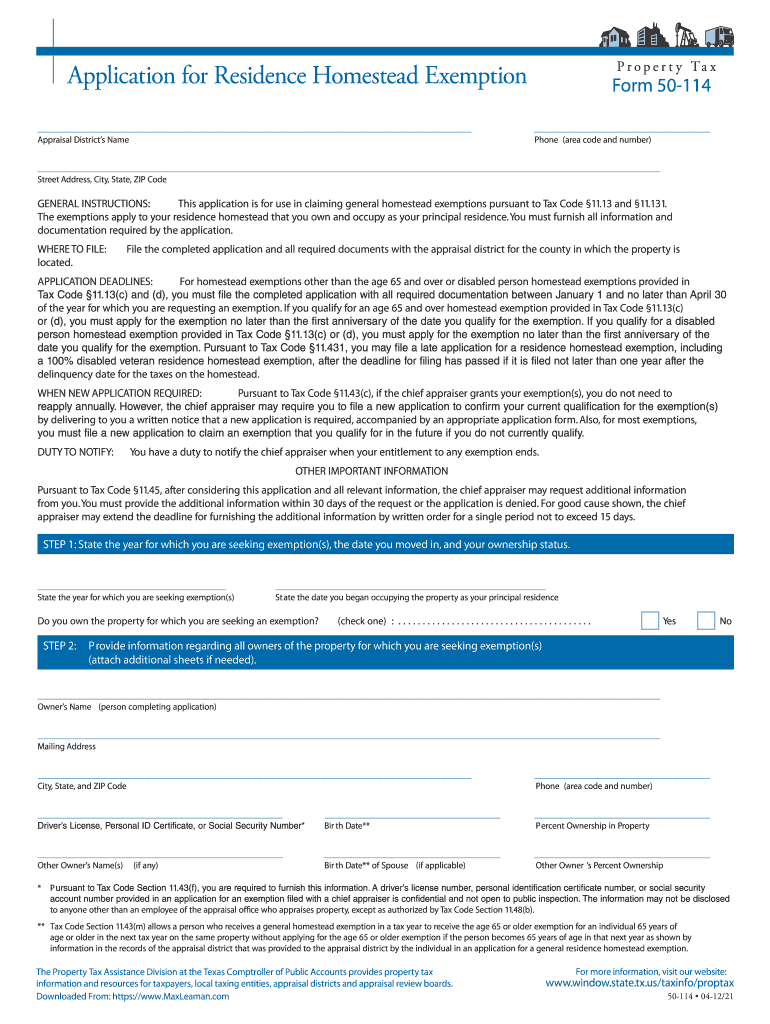

Dcad Homestead Exemption Form - Web the texas tax code stipulates a $40,000 residence homestead exemption for all qualified property owners. Complete step 2 and note any corrections to the owner name (top left side); Other sections of the tax code provide additional write. Web instructions for completing an affidavit of affixture. / / to qualify for a homestead exemption you must own and occupy your residence on the date the. You may qualify to file a homestead exemption online; Web if you encounter any difficulties with uploading files or submitting your residence homestead exemption application, then please mail your application and documents to. Web than april 30 of the year for which you are requesting an exemption. Personal property petition for review of valuation (dor 82530) dealer acquisition & sales report (dor. Web this application is for use in claiming a property tax exemption pursuant to tax code section 11.22 for property owned by a disabled veteran, the surviving spouse or. Web this application is for use in claiming a property tax exemption pursuant to tax code section 11.22 for property owned by a disabled veteran, the surviving spouse or. If you still have questions, feel free to reach. / / to qualify for a homestead exemption you must own and occupy your residence on the date the. Web instructions for. Web general residence homestead exemption application for 2023: Web click the blue property address link to view the details of your account. The residence homestead exemption application form is available from the details page of your. Web this application is for use in claiming a property tax exemption pursuant to tax code section 11.22 for property owned by a disabled. Other sections of the tax code provide additional write. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. / / to qualify for a homestead. The residence homestead exemption application link is available from the details page. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Dcad is pleased to provide this service to homeowners in dallas county. Web click the blue property address link to view the details of your account. Web. The residence homestead exemption application form is available from the details page of your. To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. / / to qualify for a homestead exemption you must own and occupy your residence on the date the. Web in this video,. Web to qualify for a residence homestead exemption you must own and occupy as your principal residence on the date you request the exemption. Web click the blue property address link to view the details of your account. Web the texas tax code stipulates a $40,000 residence homestead exemption for all qualified property owners. To qualify, you must own and. Web the exemption applies to the person’s house and land, condominium or cooperative, mobile home or mobile home and land, as well as to the identifiable cash proceeds from. You may qualify to file a homestead exemption online; Dcad is pleased to provide this service to homeowners in dallas county. The residence homestead exemption application form is available from the. Complete step 2 and note any corrections to the owner name (top left side); Web instructions for completing an affidavit of affixture. The residence homestead exemption application link is available from the details page. Select all exemptions that apply by checking the appropriate box. To qualify, you must own and reside in your home on january 1 of the year. Web in this video, we'll be walking you through the steps on how to file your homestead exemption in dallas county. Web to qualify for a residence homestead exemption you must own and occupy as your principal residence on the date you request the exemption. Attach the completed and notarized affidavit to your residence homestead exemption application for filing with. Web click the blue property address link to view the details of your account. Web in this video, we'll be walking you through the steps on how to file your homestead exemption in dallas county. If you still have questions, feel free to reach. Web instructions for completing an affidavit of affixture. Attach the completed and notarized affidavit to your. Web this application is for use in claiming a property tax exemption pursuant to tax code section 11.22 for property owned by a disabled veteran, the surviving spouse or. Personal property petition for review of valuation (dor 82530) dealer acquisition & sales report (dor. Web than april 30 of the year for which you are requesting an exemption. Dcad is pleased to provide this service to homeowners in dallas county. If you still have questions, feel free to reach. Other sections of the tax code provide additional write. The residence homestead exemption application form is available from the details page of your. Web instructions for completing an affidavit of affixture. You may qualify to file a homestead exemption online; Web click the blue property address link to view the details of your account. You must apply for this exemption each year you claim. Web residence homestead exemption application (includes age 65 or older, age 55 or older surviving spouse, and disabled person exemption) transfer request for tax ceiling of. The residence homestead exemption application link is available from the details page. On what date did you begin occupying this property? To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. Select all exemptions that apply by checking the appropriate box. Web the exemption applies to the person’s house and land, condominium or cooperative, mobile home or mobile home and land, as well as to the identifiable cash proceeds from. Web for the $40,000 general residence homestead exemption, you may submit an application for residential homestead exemption (pdf) and supporting documentation, with the. Web the texas tax code stipulates a $40,000 residence homestead exemption for all qualified property owners. First of all, to apply online, you.Harris County Homestead Exemption Form 2023 Printable Forms Free Online

Kendall County Homestead Exemption Fill Out and Sign Printable PDF

Riverside County Homestead Exemption Form

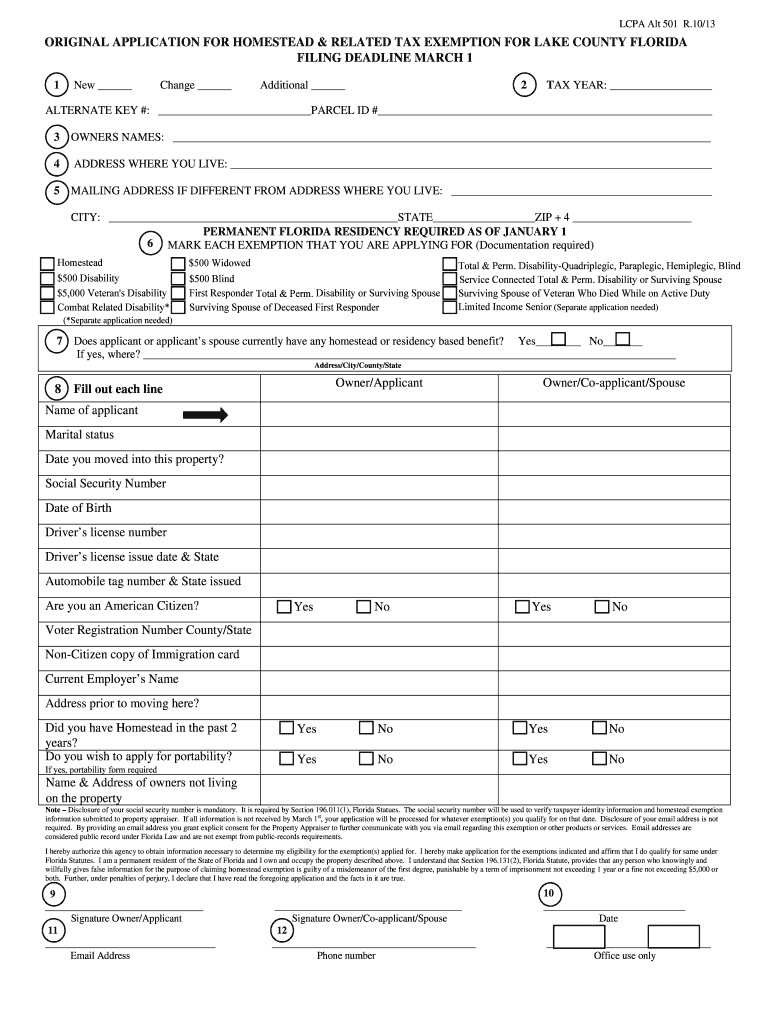

Fillable Application For Homestead Exemption Template printable pdf

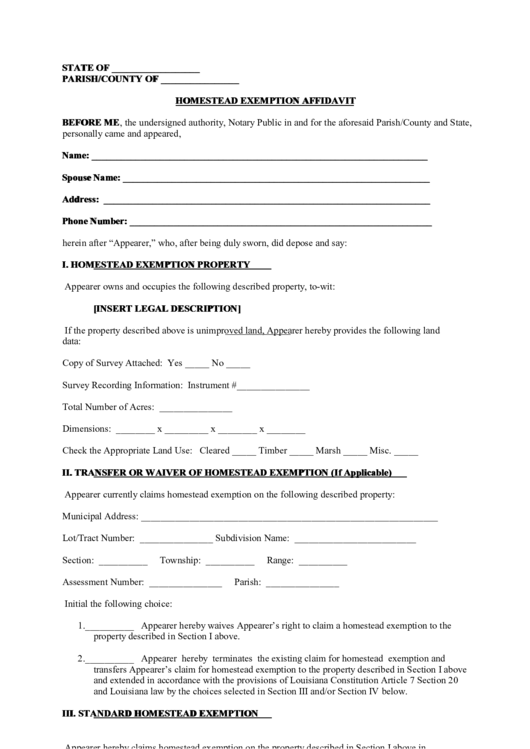

Homestead Exemption Affidavit printable pdf download

How To File Your Homestead Exemption in Dallas County (DCAD)

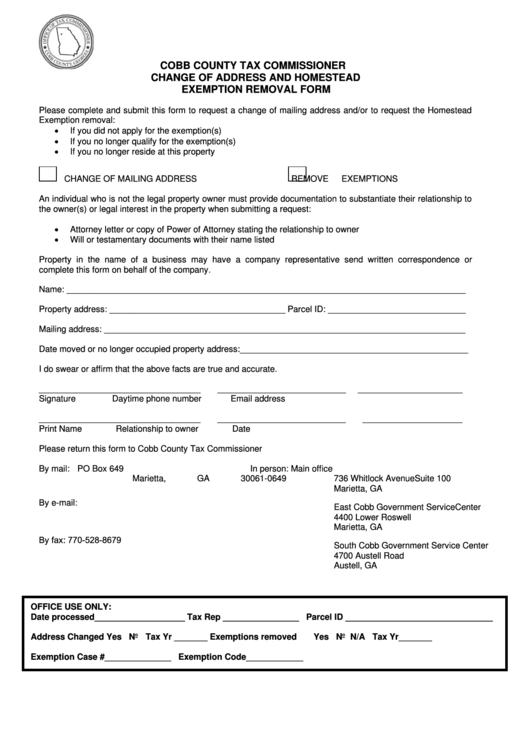

Cobb County Homestead Exemption Forms

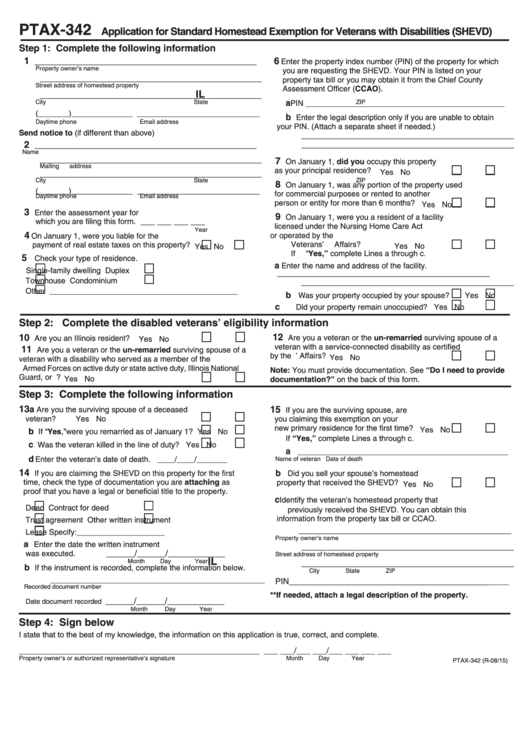

Ptax342 Form Application For Standard Homestead Exemption For

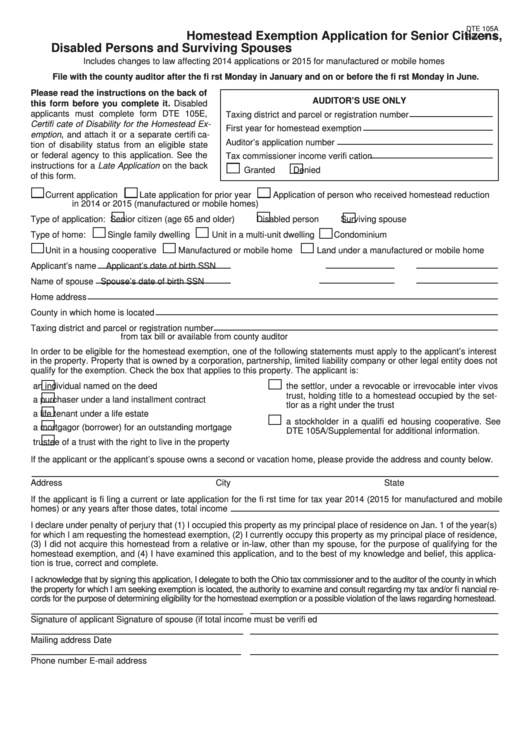

Cuyahoga County Homestead Exemption Form

Marion county indiana property homestead exemption forms Fill out

Related Post:

-c.jpg)