Schedule D Form 1041

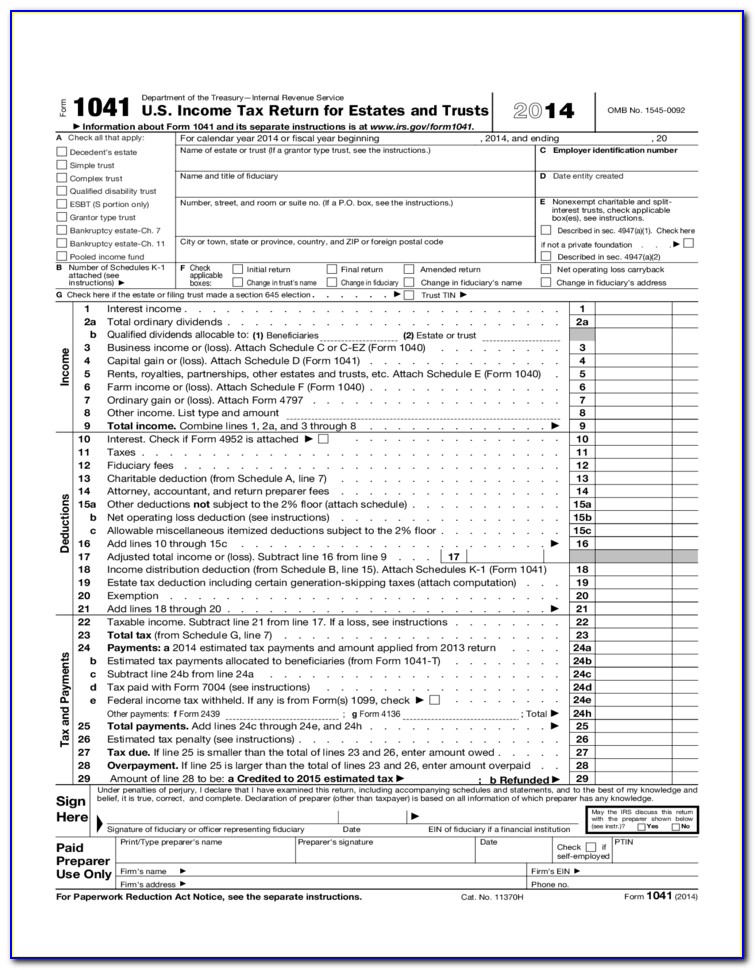

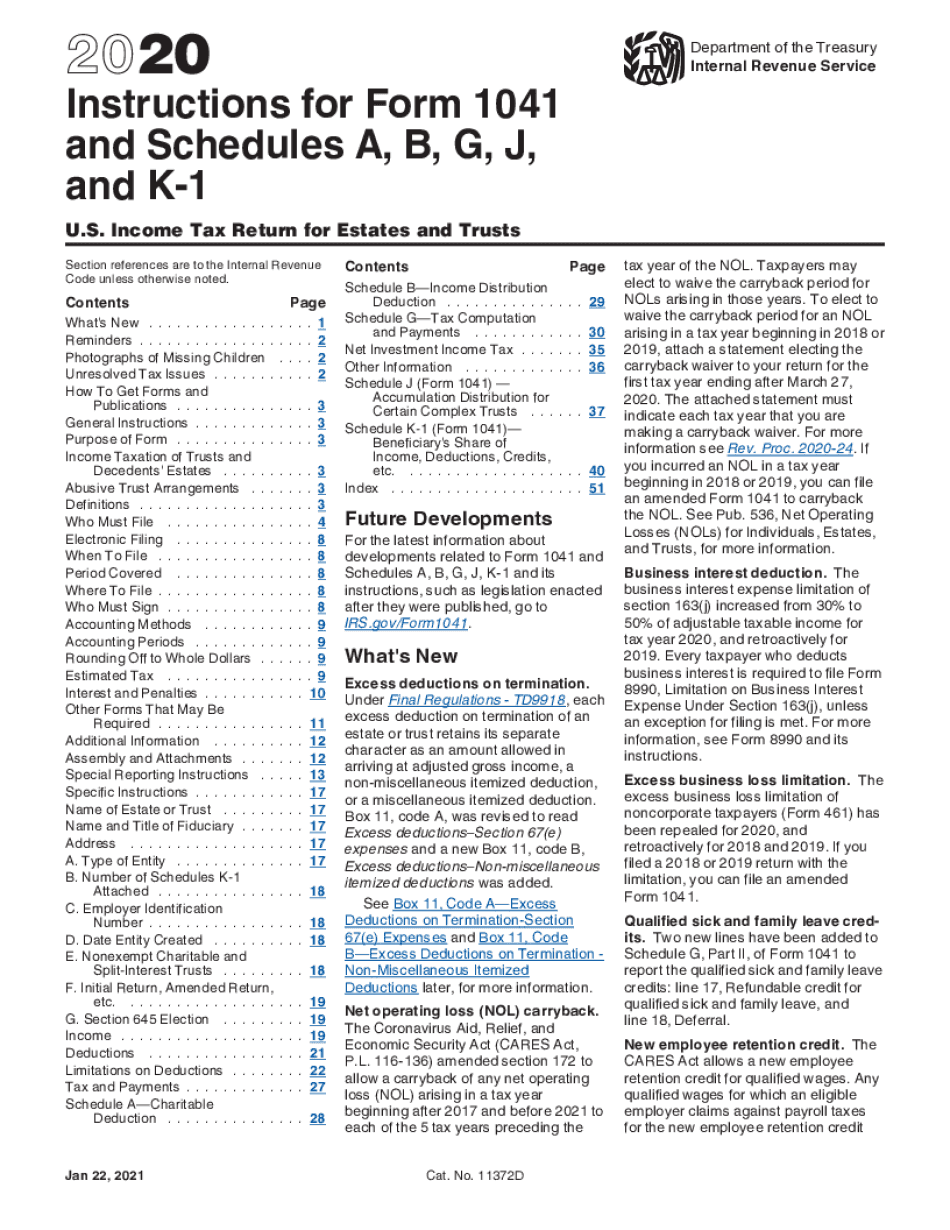

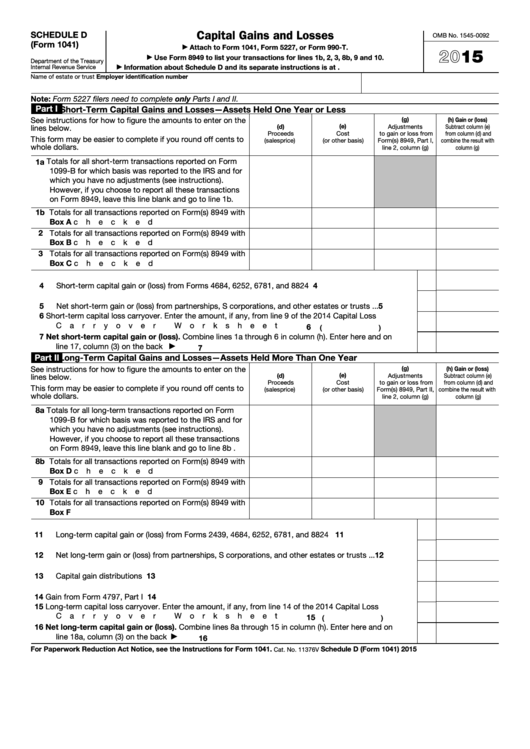

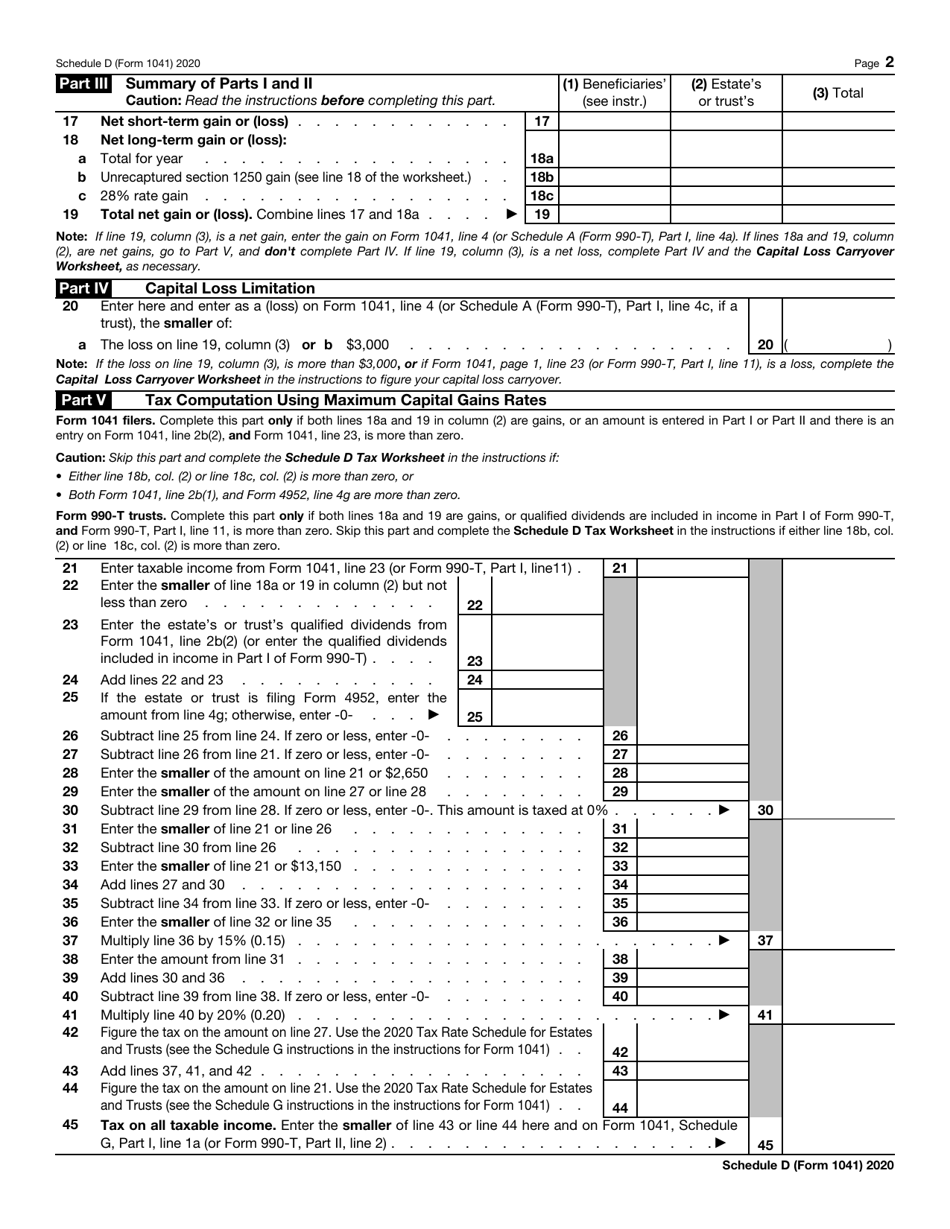

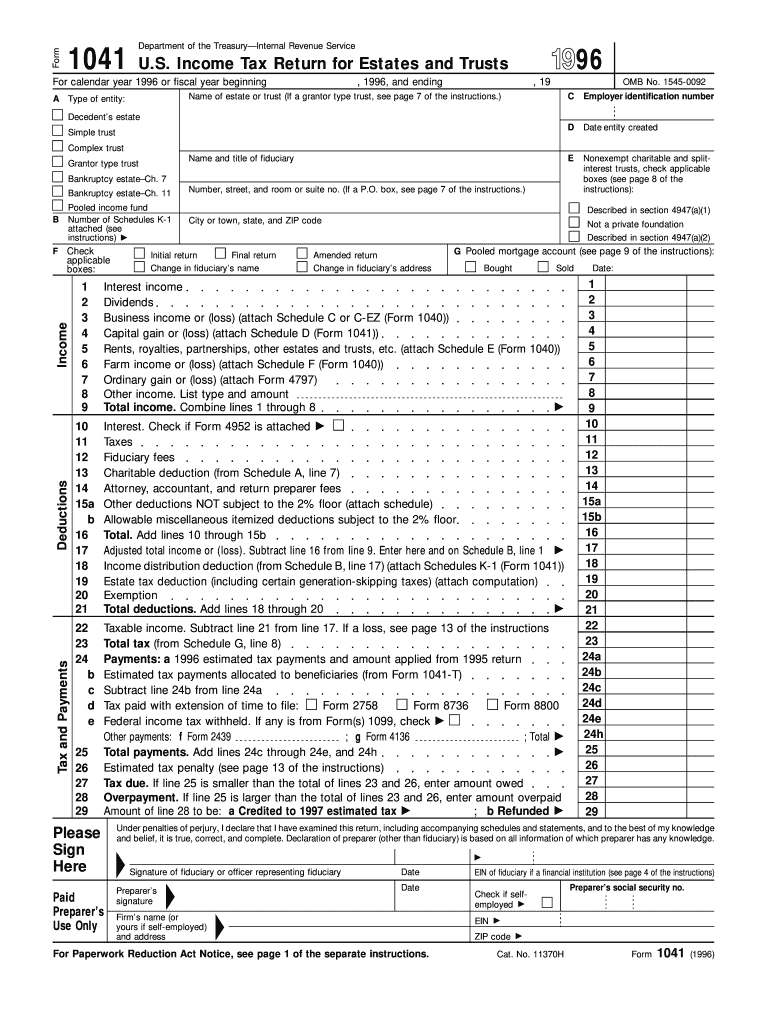

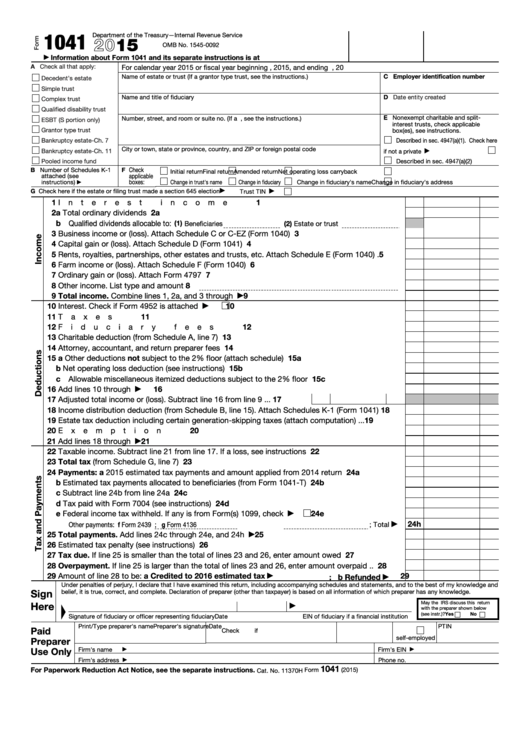

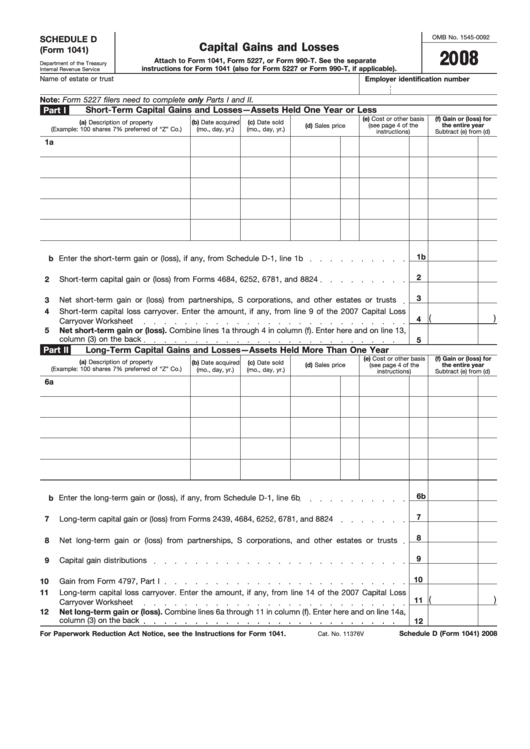

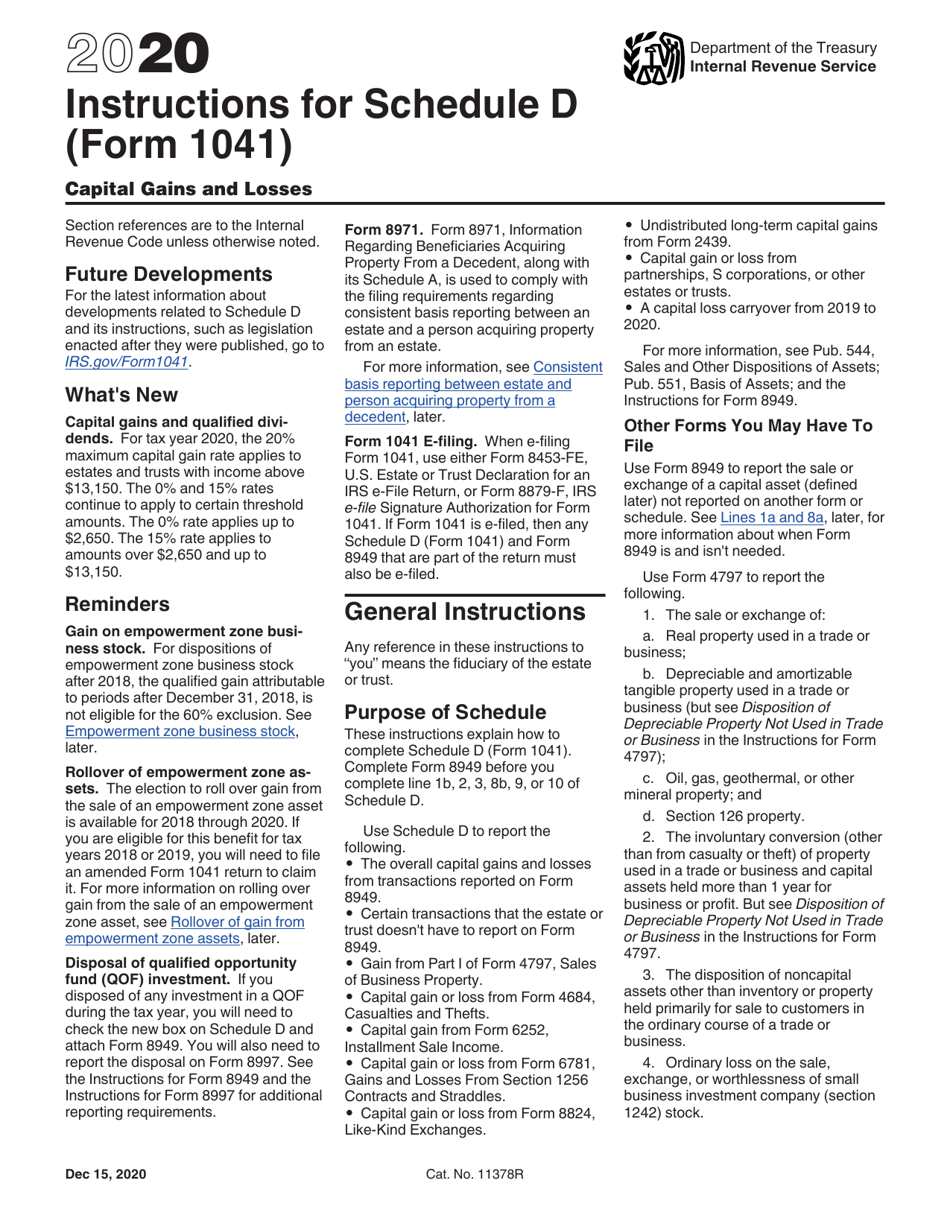

Schedule D Form 1041 - Web use this worksheet to figure the estate’s or trust’s tax if line 14a, column (2), or line 15, column (2), of schedule d or form 1041, line 22 is zero or less; It is used to help. Updated for tax year 2022 • june 2, 2023 8:43 am. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Form 1041 schedule d is a supplement to form 1041. Web these instructions explain how to complete schedule d (form 1041). Web use form 1041 schedule d to report gains or losses from capital assets associated with an estate or trust. Web 3 business income or (loss). The schedule d form is what. Complete, edit or print tax forms instantly. Web schedule d (form 941): Attach schedule d (form 1041).4 5 rents, royalties, partnerships, other. Report of discrepancies caused by acquisitions, statutory mergers, or consolidations (rev. Web use schedule d (541), capital gain or loss, to report gains and losses from the sale or exchange of capital assets by an exempt organization, estate, or trust. Web schedule d (form 1041). The schedule d form is what. Web there are amounts on lines 4e and 4g of form 4952. Ad access irs tax forms. Web complete schedule d (form 1041). Web use schedule d (541), capital gain or loss, to report gains and losses from the sale or exchange of capital assets by an exempt organization, estate, or trust. Web 3 business income or (loss). Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Web schedule d (form 941): Use schedule d to report the following. The overall capital gains and losses from transactions reported on form 8949. Web these instructions explain how to complete schedule d (form 1041). Web written by a turbotax expert • reviewed by a turbotax cpa. Web if federal schedules c, d, e, or f (form 1040) or federal schedule d (form 1041) were not completed and the amount entered on form 541, line 17, is less than $52,044, do not. The overall. Web files form 4952 and has an amount on line 4g, even if he or she does not need to file schedule d. Complete, edit or print tax forms instantly. Form 1041 schedule d is a supplement to form 1041. Ad read customer reviews & find best sellers. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web 3 business income or (loss). Web these instructions explain how to complete schedule d (form 1041). Attach schedule d (form 1041).4 5 rents, royalties, partnerships, other. Web schedule d (form 1040) is a tax schedule from the irs that attaches to the form 1040, u.s. Attach schedule d (form 1041).4 5 rents, royalties, partnerships, other. Complete, edit or print tax forms instantly. The overall capital gains and losses from transactions reported on form 8949. Web schedule d (form 941): Web complete schedule d (form 1041). Web use form 1041 schedule d to report gains or losses from capital assets associated with an estate or trust. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Use schedule d to report the following. Get ready for tax season deadlines by completing any required tax forms today. Web 3 business. The schedule d form is what. Don't use this worksheet to figure the estate's or trust's tax if line 18a, column (2), or line 19, column (2), of. Web schedule d (form 941): Complete, edit or print tax forms instantly. (form 1040) department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Web form 1041 consists of three pages for basic information about the estate or trust, breaking down income and deductions, and then tallying everything to. The schedule d form is what. Attach schedule d (form 1041).4 5 rents, royalties, partnerships, other. Use schedule d to report the following. Web if federal schedules c, d, e, or f (form 1040) or federal schedule d (form 1041) were not completed and the amount entered on form 541, line 17, is less than $52,044, do not. Web schedule d (form 941): Otherwise, complete the qualified dividends and capital gain tax. Web use schedule d (541), capital gain or loss, to report gains and losses from the sale or exchange of capital assets by an exempt organization, estate, or trust. Use schedule d to report the following. Web schedule d (form 1041) department of the treasury internal revenue service. The overall capital gains and losses from transactions reported on form 8949. The schedule d form is what. Web use schedule d (form 1041) to report gains and losses from the sale or exchange of capital assets by an estate or trust. Complete, edit or print tax forms instantly. It is used to help. June 2011) department of the treasury—internal. Web form 1041 consists of three pages for basic information about the estate or trust, breaking down income and deductions, and then tallying everything to. (form 1040) department of the treasury internal revenue service. Web complete schedule d (form 1041). Complete, edit or print tax forms instantly. Web 3 business income or (loss). Schedule d (from 1041) pdf. Don't use this worksheet to figure the estate's or trust's tax if line 18a, column (2), or line 19, column (2), of. Get ready for tax season deadlines by completing any required tax forms today.Irs Form 1041 Schedule B Form Resume Examples 0ekopggDmz

form 1041 schedule d Fill Online, Printable, Fillable Blank form

Form 1041 Schedule D

Fillable Schedule D (Form 1041) Capital Gains And Losses 2015

IRS Form 1041 Schedule D Download Fillable PDF or Fill Online Capital

Irs form 1041 for 1996 Fill out & sign online DocHub

Fillable Form 1041 U.s. Tax Return For Estates And Trusts

Fillable Form 1041 Schedule D Capital Gains And Losses 2008

Download Instructions for IRS Form 1041 Schedule D Capital Gains and

Form 1041 schedule d instructions Fill online, Printable, Fillable Blank

Related Post: