Schedule B Form 1041

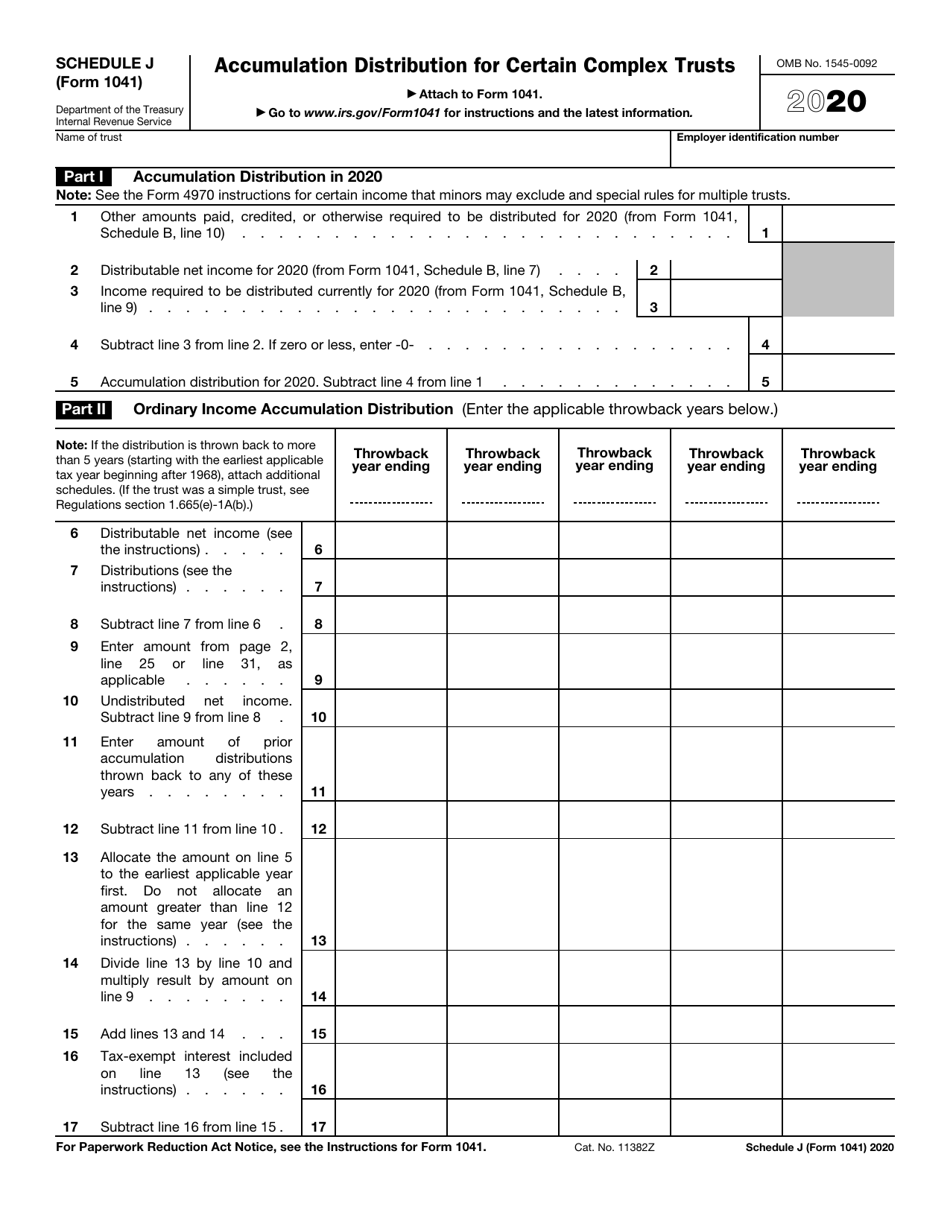

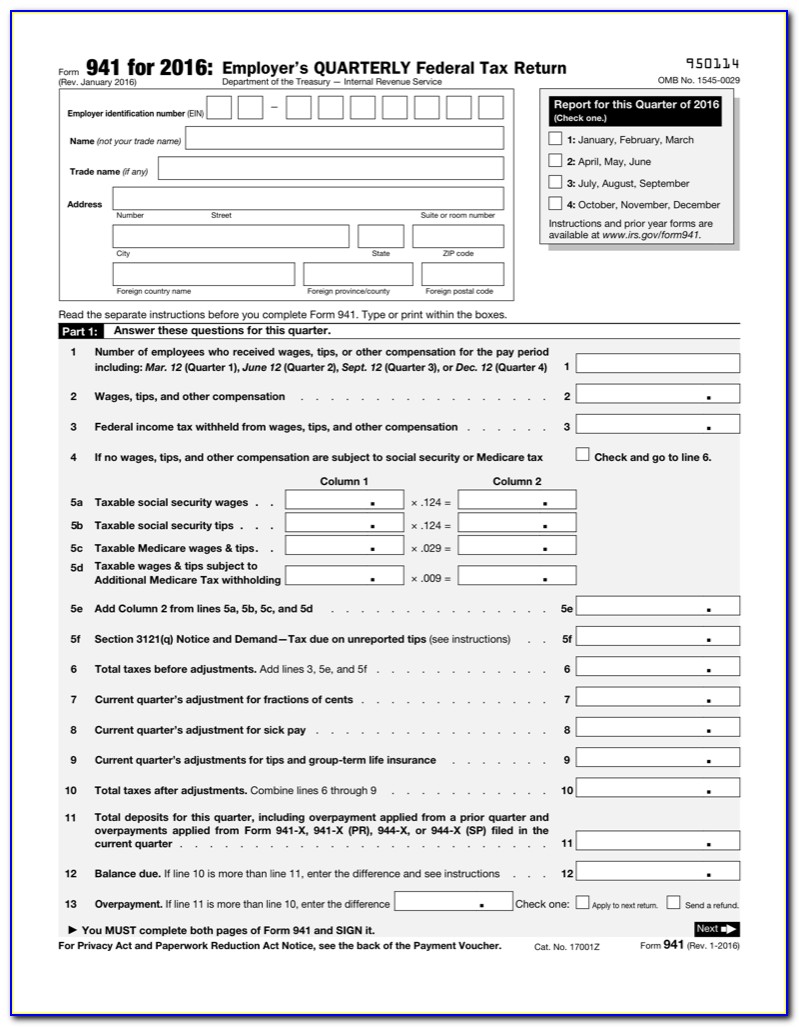

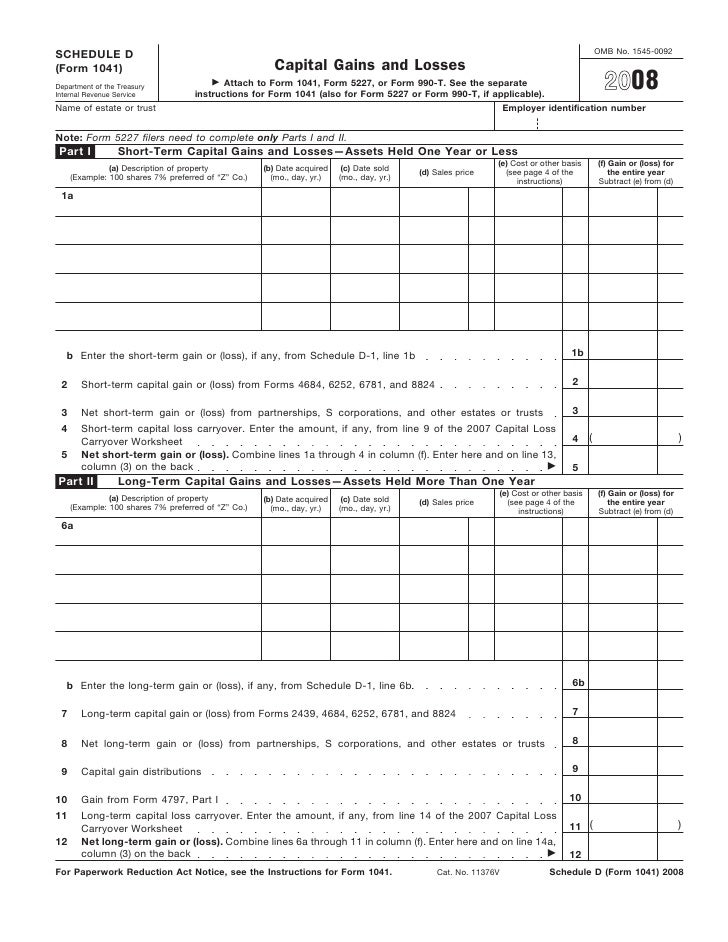

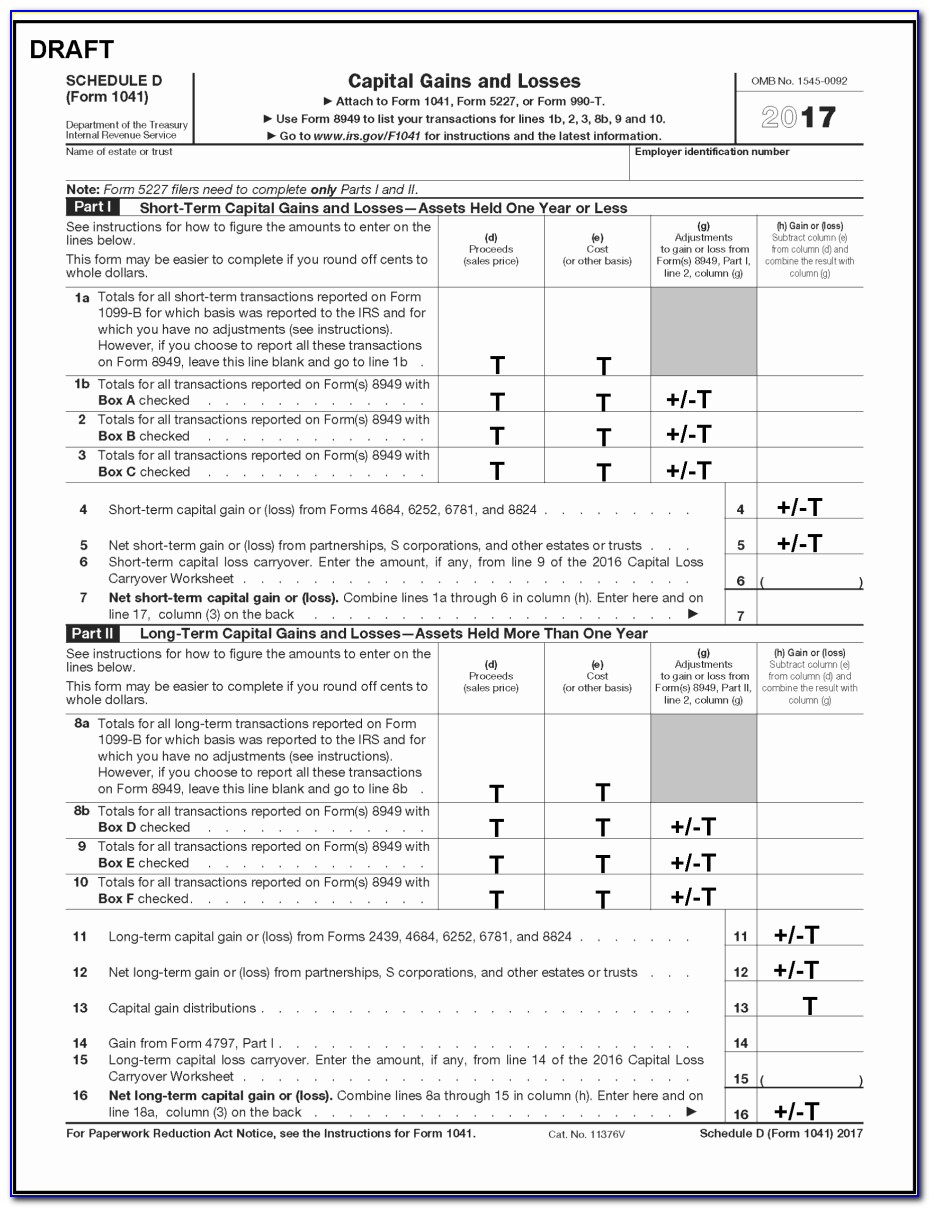

Schedule B Form 1041 - Web use screen 7, 1041 distributions, to enter distribution percentages, dollar distributions, and schedule b overrides. The allowable deduction is the lesser of the following: Web page last reviewed or updated: However, you don’t need to attach a schedule b every year you earn interest. Schedule b is filed with form 941. Schedule j (form 1041)—accumulation distribution for certain complex trusts. For instructions and the latest. Use this field to override the. Web schedule b (form 1040) 2022 interest and ordinary dividends department of the treasury internal revenue service go to www.irs.gov/scheduleb for instructions and. Web the income distribution deduction is calculated on schedule b (form 1041). Use schedule b (form 1040) if any of the following applies. Web b qualified dividends allocable to: Web schedule b (form 1040) 2022 interest and ordinary dividends department of the treasury internal revenue service go to www.irs.gov/scheduleb for instructions and. You had over $1,500 of taxable. However, you don’t need to attach a schedule b every year you earn interest. Web the irs has updated form 8974, qualified small business payroll tax credit for increasing research activities, to allow small businesses to claim up to $250,000 in credit against. Web 2022 instructions for schedule b (2022) interest and ordinary dividends. Web the income distribution deduction is calculated on schedule b (form 1041). Schedule j (form 1041)—accumulation distribution for certain complex. Web b qualified dividends allocable to: To complete schedule b, follow these steps. Web use screen 7, 1041 distributions, to enter distribution percentages, dollar distributions, and schedule b overrides. Web schedule b reports the interest and dividend income you receive during the tax year. Web the irs has updated form 8974, qualified small business payroll tax credit for increasing research. (1) the distributable net income (dni), or. Information about schedule b (form 1040), interest and ordinary dividends, including recent updates, related forms,. Web b qualified dividends allocable to: Web the irs has updated form 8974, qualified small business payroll tax credit for increasing research activities, to allow small businesses to claim up to $250,000 in credit against. However, you don’t. (1) beneficiaries (2) estate or trust 3 business income or (loss). Web b qualified dividends allocable to: You had over $1,500 of taxable. The allowable deduction is the lesser of the following: (1) the distributable net income (dni), or. Schedule j (form 1041)—accumulation distribution for certain complex trusts. Web use screen 7, 1041 distributions, to enter distribution percentages, dollar distributions, and schedule b overrides. For instructions and the latest. The allowable deduction is the lesser of the following: Web schedule b reports the interest and dividend income you receive during the tax year. Web schedule b—income distribution deduction. Information about schedule b (form 1040), interest and ordinary dividends, including recent updates, related forms,. For instructions and the latest. Completes schedule b by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social security. Department of the treasury—internal revenue service. Income tax return for estates and trusts. Ad get ready for tax season deadlines by completing any required tax forms today. Web the irs has updated form 8974, qualified small business payroll tax credit for increasing research activities, to allow small businesses to claim up to $250,000 in credit against. Web 2022 instructions for schedule b (2022) interest and ordinary. Complete, edit or print tax forms instantly. You had over $1,500 of taxable. For instructions and the latest. Web the irs has updated form 8974, qualified small business payroll tax credit for increasing research activities, to allow small businesses to claim up to $250,000 in credit against. Schedule b is filed with form 941. You had over $1,500 of taxable. Web use screen 7, 1041 distributions, to enter distribution percentages, dollar distributions, and schedule b overrides. Web schedule b reports the interest and dividend income you receive during the tax year. Complete, edit or print tax forms instantly. For instructions and the latest. Web don’t complete schedule b if you have a tax liability on form 941, line 12, that is less than $2,500 during the quarter. Web b qualified dividends allocable to: You had over $1,500 of taxable. Web the income distribution deduction is calculated on schedule b (form 1041). Web schedule b (form 1040) 2022 interest and ordinary dividends department of the treasury internal revenue service go to www.irs.gov/scheduleb for instructions and. Schedule b is filed with form 941. Web schedule b reports the interest and dividend income you receive during the tax year. Web department of the treasury—internal revenue service. Web the irs has updated form 8974, qualified small business payroll tax credit for increasing research activities, to allow small businesses to claim up to $250,000 in credit against. (1) beneficiaries (2) estate or trust 3 business income or (loss). Complete, edit or print tax forms instantly. Web form 1041 schedule b i am currently working on form 1041 for my mom's estate. The only asset in the estate was her home. Information about schedule b (form 1040), interest and ordinary dividends, including recent updates, related forms,. Department of the treasury—internal revenue service. For instructions and the latest information. Web page last reviewed or updated: To complete schedule b, follow these steps. Completes schedule b by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social security. Use schedule b (form 1040) if any of the following applies.IRS Form 1041 Schedule J Download Fillable PDF or Fill Online

SCHEDULE B Interest & Dividends Miller Financial Services

Irs Forms 1041 Schedule B Form Resume Examples EpDLBYgOxR

Irs Form 1041 Schedule B prosecution2012

U.S. Tax Return for Estates and Trusts, Form 1041

Form 1041 Schedule D

3.11.14 Tax Returns for Estates and Trusts (Forms 1041, 1041QFT

Irs Form 1041 Schedule B Form Resume Examples 0ekopggDmz

Who Needs to Fill out IRS Form Schedule B?

IRS Form 1041 Download Printable PDF 2018, Beneficiary's Share of

Related Post:

:max_bytes(150000):strip_icc()/ScheduleB-InterestandOrdinaryDividends-c6ff80bf2c1f4de981e0b0625a4e3dc7.png)