Irs Form 1116 Schedule B

Irs Form 1116 Schedule B - Complete, edit or print tax forms instantly. Future developments for the latest information about developments. December 2022) foreign tax carryover reconciliation schedule. Web internal revenue service section references are to the internal revenue code unless otherwise noted. Web solved•by intuit•50•updated january 17, 2023. Schedule b now standardizes what should. Schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web form 1116 (schedule b) (final rev. Please see the image below. Web first, the schedule b; Web form 1116 (schedule b) (final rev. Complete, edit or print tax forms instantly. Web purpose of schedule. Web solved•by intuit•50•updated january 17, 2023. Use form 2555 to claim the. Prior to 2021, taxpayers were instructed to attach a detailed computation on line 10 of the form 1116. Generating the schedule b for form 1116 in proseries starting in 2021: Web to help these taxpayers, you must determine which taxes and types of foreign income are eligible for the foreign tax credit and accurately compute the credit using form 1116,.. Generally, unused foreign taxes can be carried forward up. Complete, edit or print tax forms instantly. Use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid. Got this diagnostics message from pto: Web entering income for the foreign tax credit form 1116. Form 1116 schedule b, foreign tax carryover reconcilliation schedule must be attached as a pdf for. There is a new schedule b (form 1116) which is used to reconcile your prior year foreign tax. Generating the schedule b for form 1116 in proseries starting in 2021: Got this diagnostics message from pto: Web how to enter form 1116 schedule b. Got this diagnostics message from pto: Ad access irs tax forms. There is a new schedule b (form 1116) which is used to reconcile your prior year foreign tax. Enter foreign income and taxes paid on. Web purpose of schedule. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Prior to 2021, taxpayers were instructed to attach a detailed computation on line 10 of the form. Web purpose of schedule. Web schedule b (form 1116) (rev. Web instructions for schedule b (form 1116), foreign tax carryover reconciliation schedule, have been revised to clarify the definition of excess limitation. Please see the image below. Prior to 2021, taxpayers were instructed to attach a detailed computation on line 10 of the form 1116. See schedule b (form 1116). Web to help these taxpayers, you must determine which taxes and types of foreign income are eligible for the foreign tax credit and accurately compute the credit using form 1116,. Please see the image below. Web deduct their foreign taxes on schedule a, like other common deductions. H&r block tax software has this seemingly innocent. Generally, unused foreign taxes can be carried forward up. Please see the image below. Schedule b now standardizes what should. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Enter foreign income and taxes paid on. This article will help you: Future developments for the latest information about developments. Web deduct their foreign taxes on schedule a, like other common deductions. Department of the treasury internal revenue service. Enter foreign income and taxes paid on dividend. Web internal revenue service section references are to the internal revenue code unless otherwise noted. Starting in tax year 2021, the. Web schedule b (form 1116) (rev. Use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid. Department of the treasury internal revenue service. Future developments for the latest information about developments. Schedule b now standardizes what should. H&r block tax software has this seemingly innocent note. This new schedule is used to reconcile [the taxpayer's] prior year foreign tax carryover. Enter foreign income and taxes paid on dividend. Ad access irs tax forms. Web instructions for schedule b (form 1116), foreign tax carryover reconciliation schedule, have been revised to clarify the definition of excess limitation. Web first, the schedule b; Web form 1116 schedule b is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web form 1116 (schedule b) (final rev. Taxpayers are therefore reporting running balances of. Web purpose of schedule. Web how to enter form 1116 schedule b in proconnect (ref #56669) solved • by intuit • 32 • updated june 12, 2023 this article will help you enter foreign tax credit. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. There is a new schedule b (form 1116) which is used to reconcile your prior year foreign tax.The Expat's Guide to Form 1116 Foreign Tax Credit

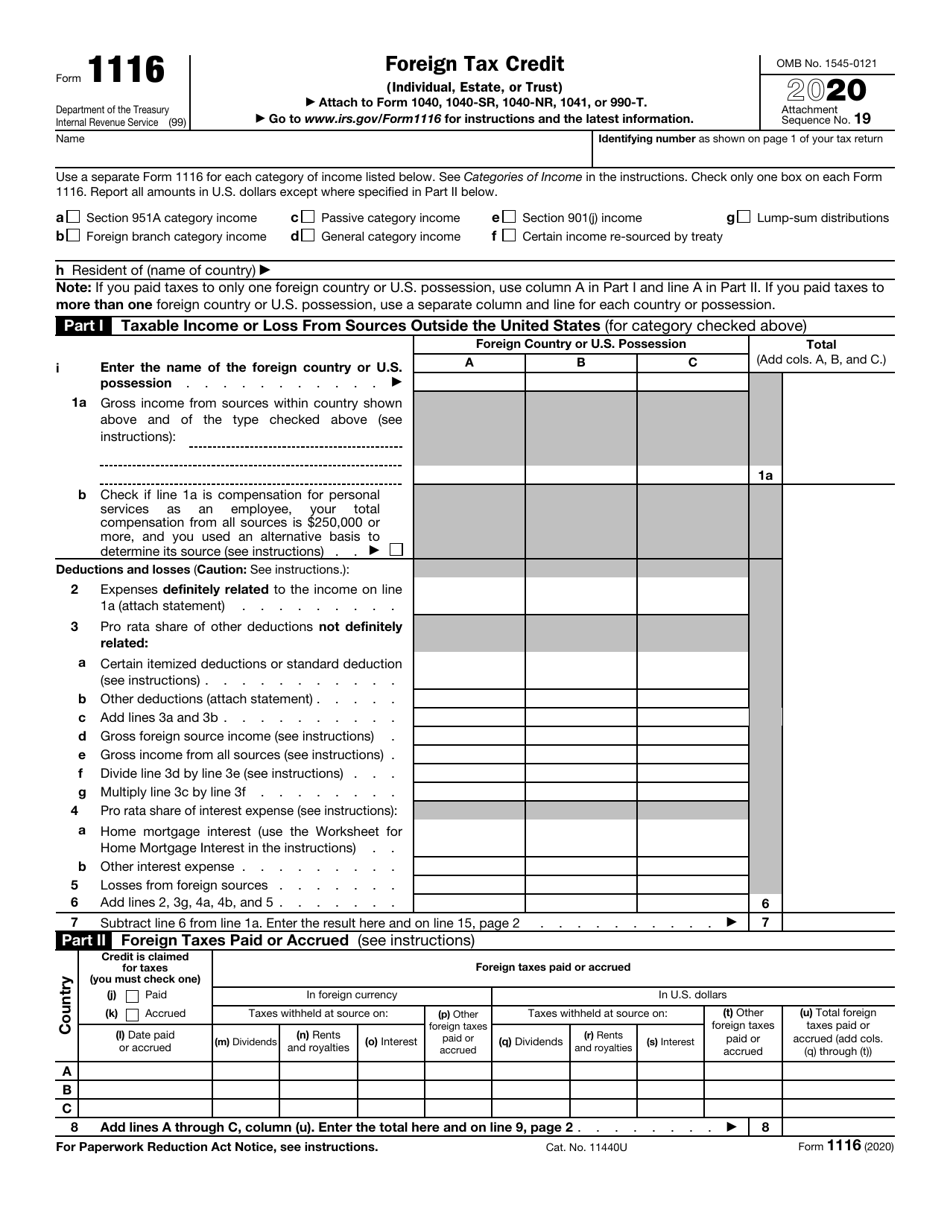

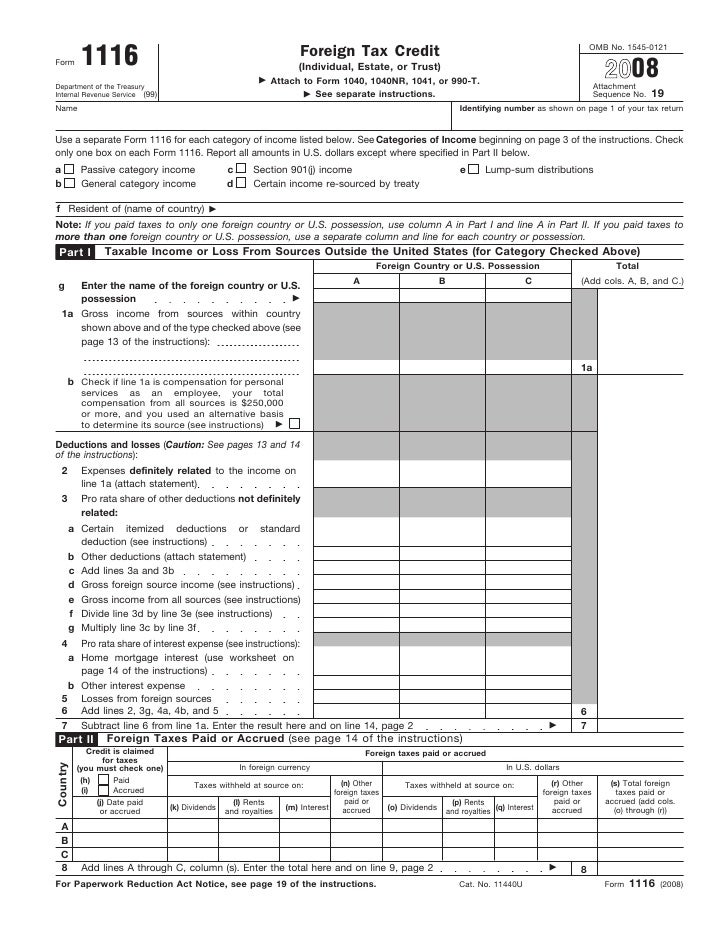

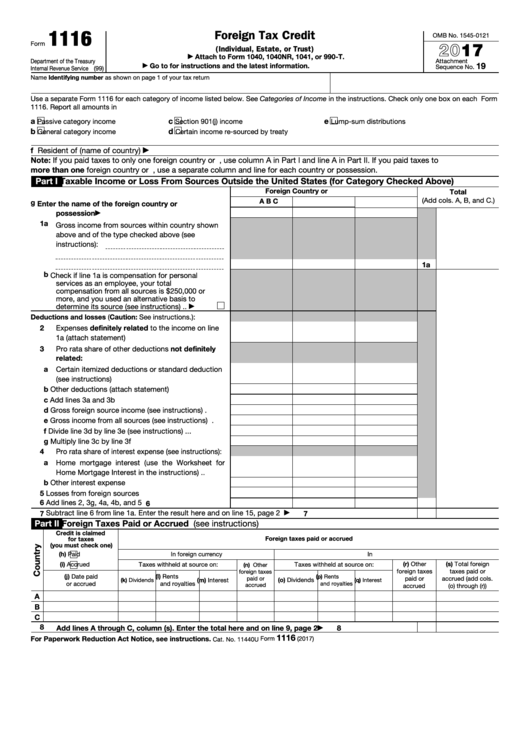

IRS Form 1116 Download Fillable PDF or Fill Online Foreign Tax Credit

U.S. Expatriates Can Claim Foreign Tax Credit Filing Form 1116

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

Foreign Tax Credit Form 1116 and how to file it (example for US expats)

Form 1116Foreign Tax Credit

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

Foreign Tax Credit Form 1116 and how to file it (example for US expats)

Fillable Form 1116 Foreign Tax Credit (Individual, Estate, Or Trust

Form 1116 Fill out & sign online DocHub

Related Post: