Form 592 B Instructions

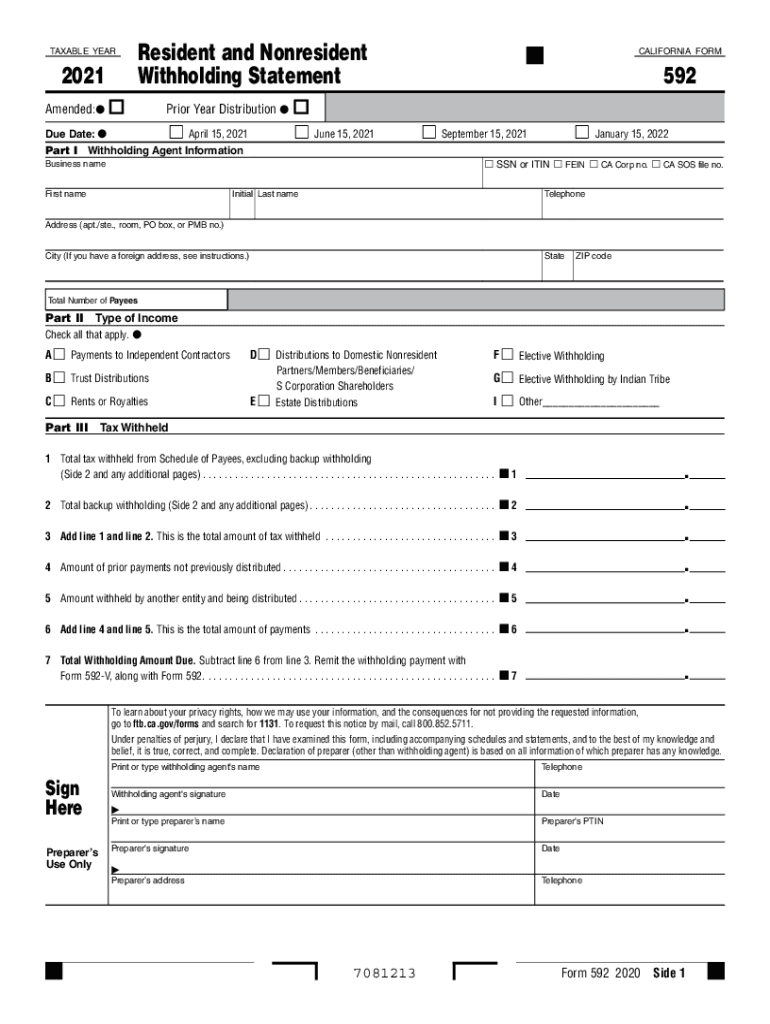

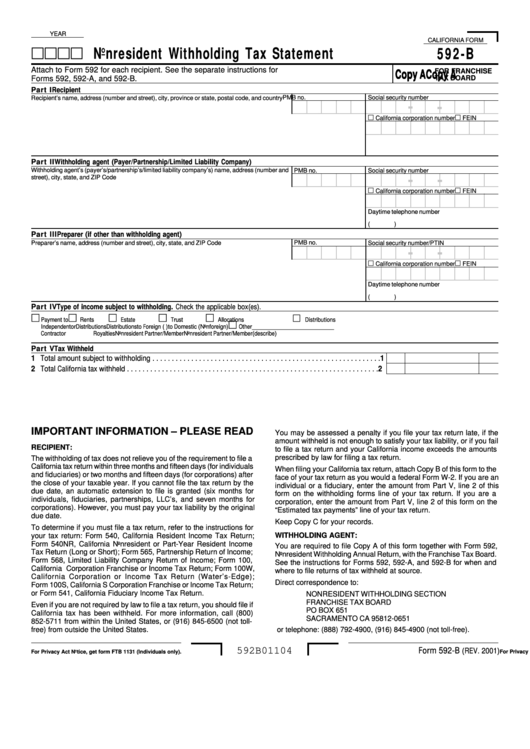

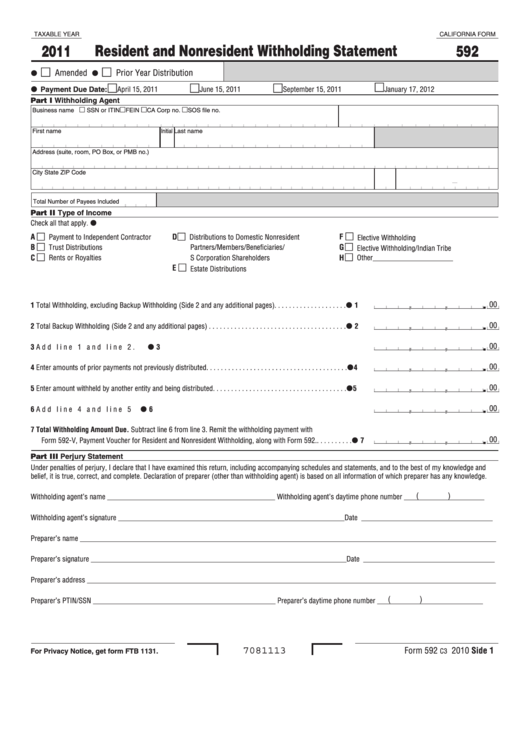

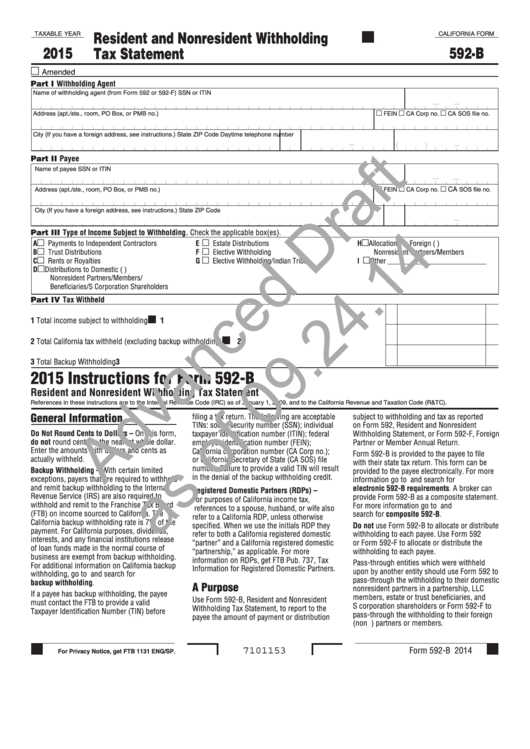

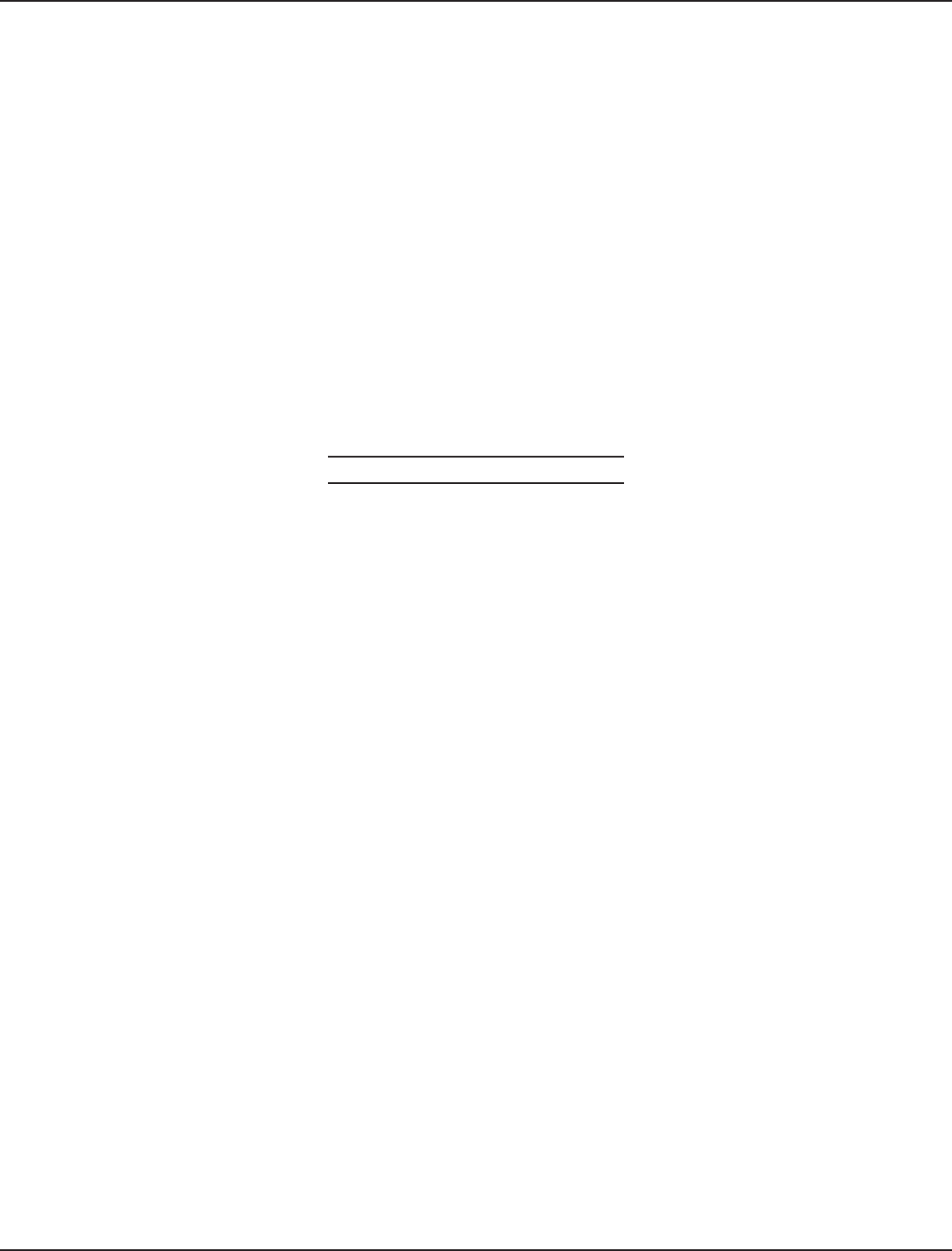

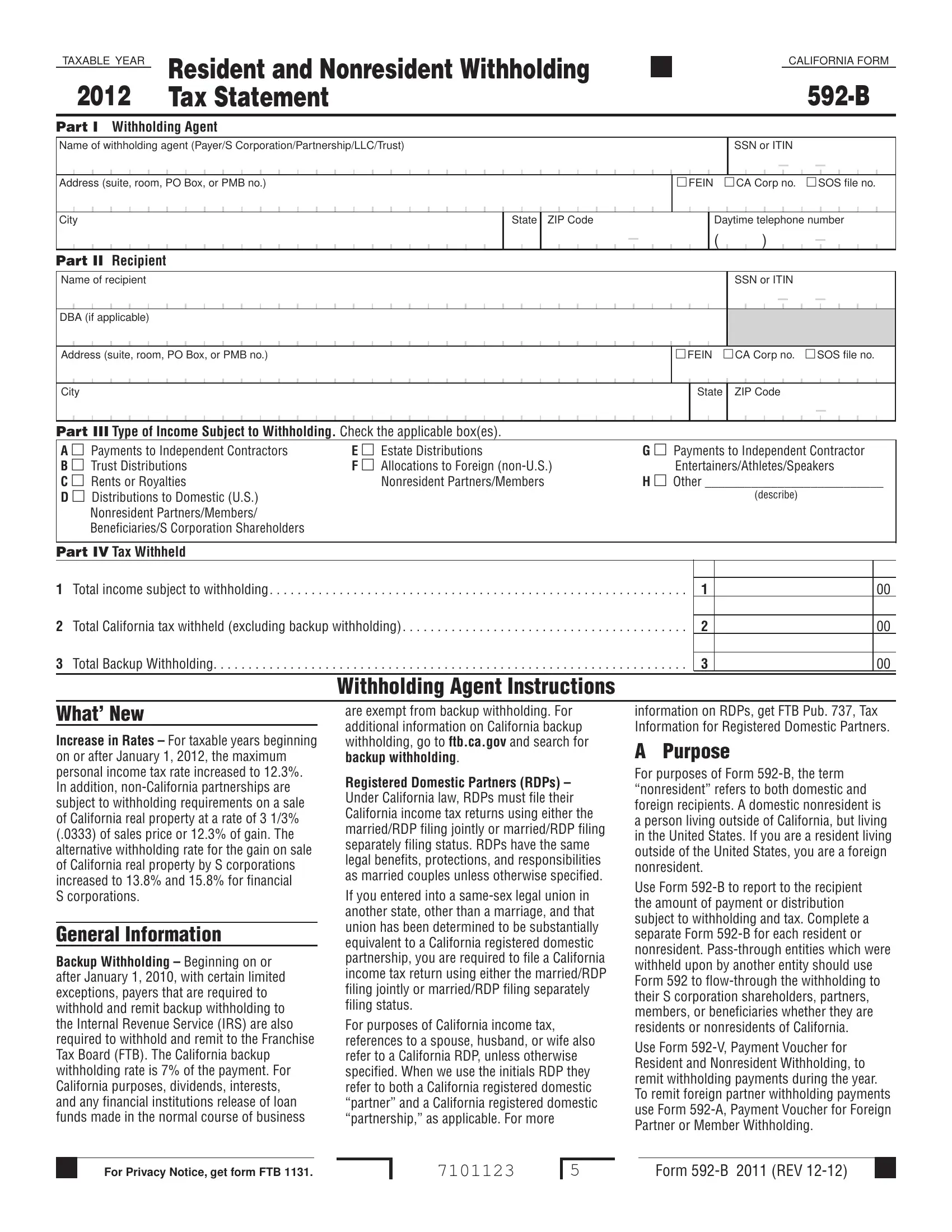

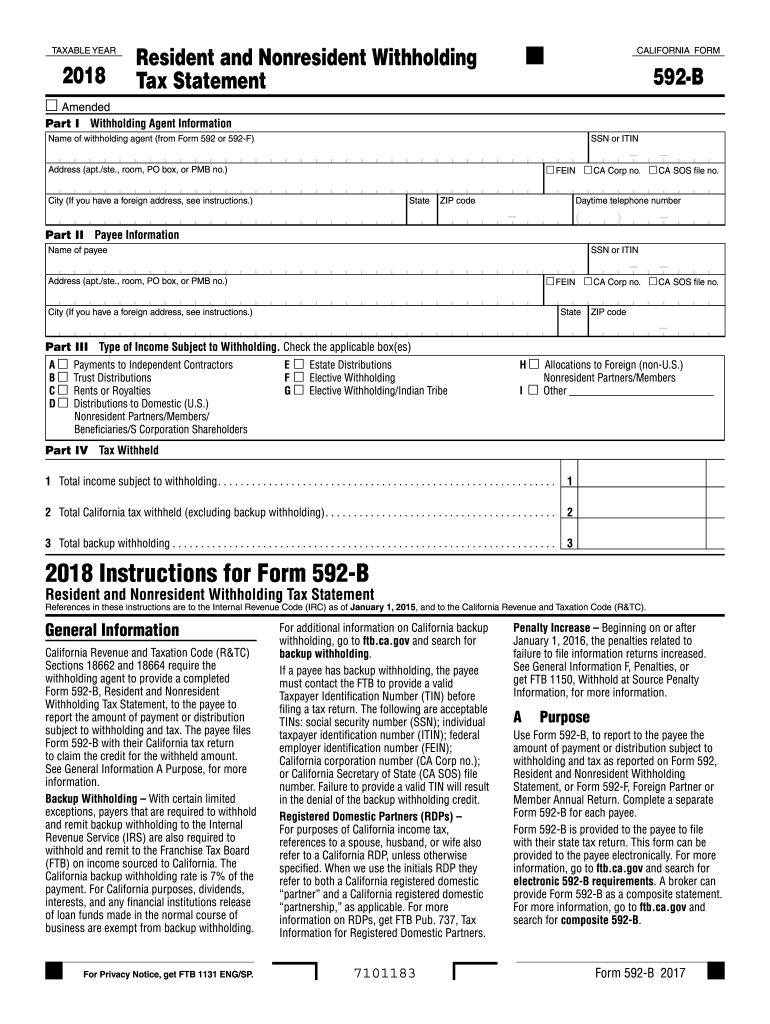

Form 592 B Instructions - Go to the input return tab and select state & Resident and nonresident withholding statement. When and where to file. Tax withheld on california source payments is reported to the franchise tax. Web form 592, resident and nonresident withholding statement information must be filed with the ftb to identify the payee, the income, and the withholding amount. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. Go to the california > other information worksheet. 2023 ca form 592 ,. Web instructions for form 592. See the 2022 form instructions. 2019 resident and nonresident withholding tax statement. Business name ssn or itin fein ca corp no. Web instructions for form 592. Go to the input return tab and select state & 2023 ca form 592 ,. Web solved•by intuit•updated june 14, 2023. Business name ssn or itin fein ca corp no. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. When and where to file. See the 2022 form instructions. Resident and nonresident withholding statement. Go to the input return tab and select state & This applies to domestic residents and nonresidents, regardless. To complete the form from vendor payment data, see transfer 1099. Click the links below to see the form instructions. Click the links below to see the form instructions. Web solved•by intuit•updated june 14, 2023. Business name ssn or itin fein ca corp no. Web form 592, resident and nonresident withholding statement information must be filed with the ftb to identify the payee, the income, and the withholding amount. Go to the california > other information worksheet. This applies to domestic residents and nonresidents, regardless. Click the links below to see the form instructions. Go to the california > other information worksheet. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. See the 2022 form instructions. Go to the california > other information worksheet. To complete the form from vendor payment data, see transfer 1099. See the 2022 form instructions. Web solved•by intuit•updated june 14, 2023. 2023 ca form 592 ,. Web instructions for form 592. When and where to file. Go to the input return tab and select state & 2019 resident and nonresident withholding tax statement. Go to the california > other information worksheet. Business name ssn or itin fein ca corp no. When and where to file. See the 2022 form instructions. Go to the california > other information worksheet. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. Business name ssn or itin fein ca corp no. Resident and nonresident withholding statement. Go to the input return tab and select state & When and where to file. Click the links below to see the form instructions. To complete the form from vendor payment data, see transfer 1099. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. Web solved•by intuit•updated june 14, 2023. When and where to file. Tax withheld on california source payments is reported to the franchise tax. Web instructions for form 592. 2019 resident and nonresident withholding tax statement. See the 2022 form instructions. Resident and nonresident withholding statement. Web form 592, resident and nonresident withholding statement information must be filed with the ftb to identify the payee, the income, and the withholding amount. Web 2023 instructions for form 592 resident and nonresident withholding statement. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. Web solved•by intuit•updated june 14, 2023. This applies to domestic residents and nonresidents, regardless. When and where to file. To complete the form from vendor payment data, see transfer 1099. Click the links below to see the form instructions. Business name ssn or itin fein ca corp no. 2023 ca form 592 ,. Tax withheld on california source payments is reported to the franchise tax. Go to the input return tab and select state & Go to the california > other information worksheet. Payee the amount of payment or distribution subject to withholding and tax as reported.2021 Form 592 Resident and Nonresident Withholding Statement 2021, Form

Form 592B Nonresident Withholding Tax Statement 2001 printable pdf

Form 592 Pte Fill Online, Printable, Fillable, Blank pdfFiller

592 f form Fill out & sign online DocHub

Fillable Form 592 Resident And Nonresident Withholding Statement

California Form 592B (Draft) Resident And Nonresident Withholding

Form 592B Franchise Tax Board Edit, Fill, Sign Online Handypdf

California PDF Forms Fillable and Printable

2018 Form CA FTB 592B Fill Online, Printable, Fillable, Blank pdfFiller

Fillable California Form 592B Nonresident Withholding Tax Statement

Related Post: