Where Does Form 3922 Go On 1040

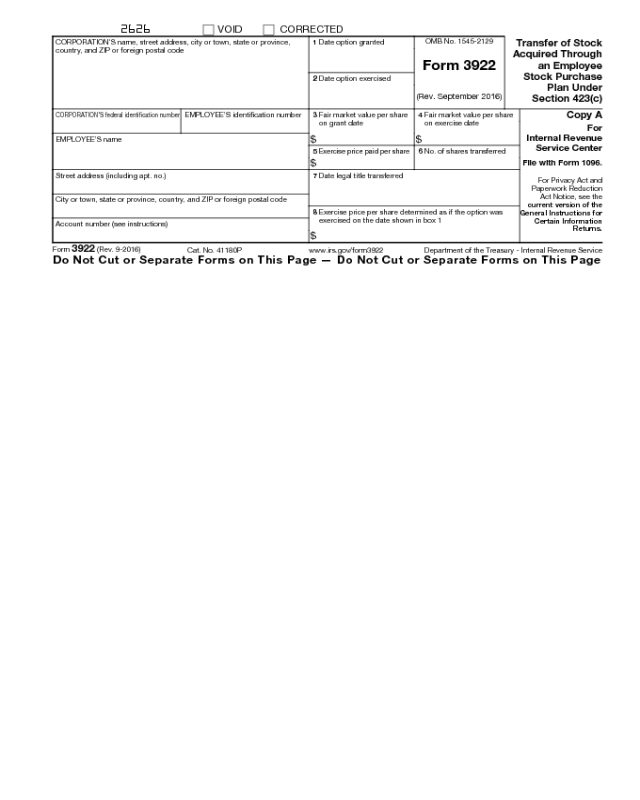

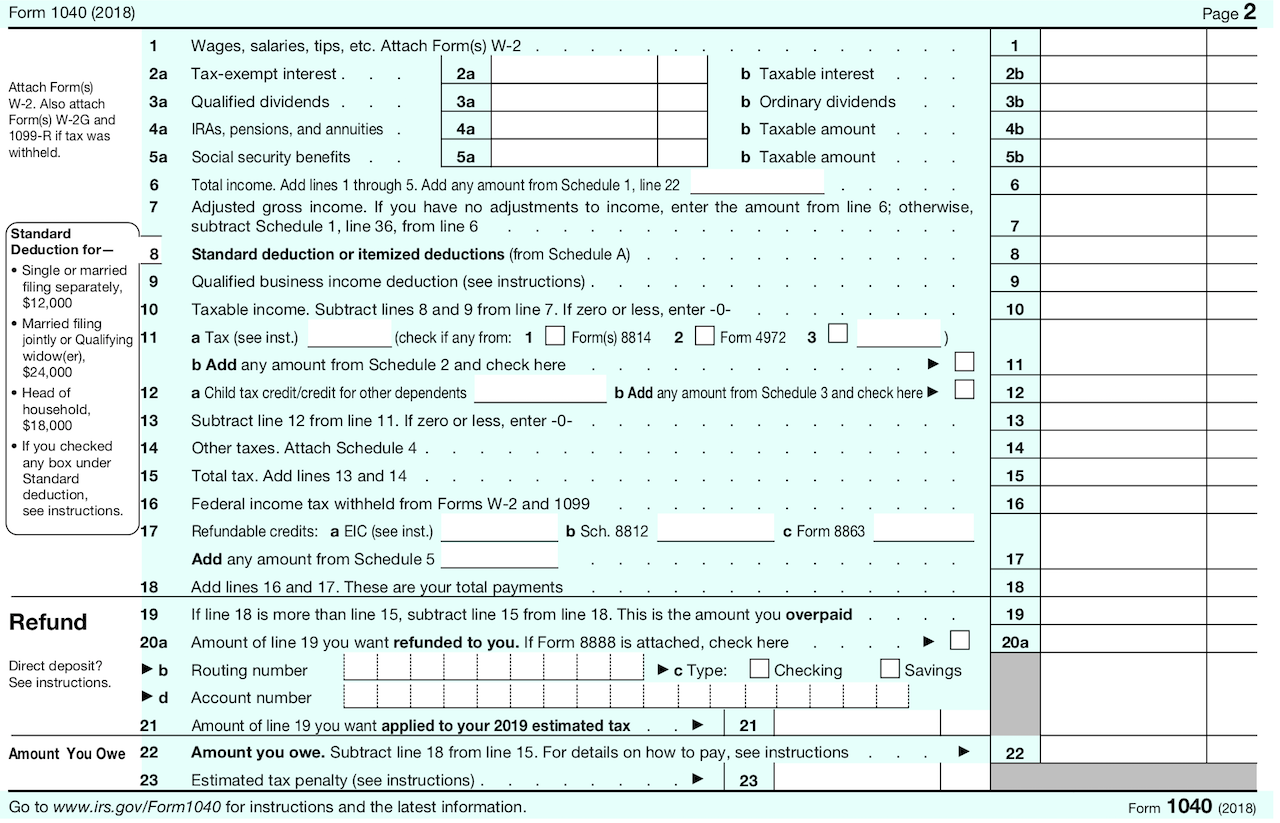

Where Does Form 3922 Go On 1040 - I received both 1099b and 3922 for the sale of. Review and transmit it to the irs. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and is not entered into your. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. Information about form 3922, transfer of stock acquired through an employee stock purchase plan under section. Web 1 best answer. To get or to order these instructions, go to www.irs.gov/form3922. Since you have not sold the stock, the holding period requirements have not been. Ad justanswer.com has been visited by 100k+ users in the past month Web solved•by turbotax•16130•updated march 13, 2023. I sold espp stock and got a form 3922 where do i put it on my return? Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and is not entered into your. Web page last reviewed or updated: Discover helpful information and resources on taxes from. Web it's sent to you for informational purposes only. Your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), if you purchased espp stock during the tax year. I sold espp stock and got a form 3922 where do i put it on my return? File form 3922 online with. Review and transmit it to the irs. File form 3922 online with taxbandits to receive. Keep the form for your records because you’ll need the information when you sell, assign, or. Information about form 3921, exercise of an incentive stock option under section 422 (b), including recent. I received both 1099b and 3922 for the sale of. Ad justanswer.com has been visited by 100k+ users in the past month I sold espp stock and got a form 3922 where do i put it on my return? Web investors & landlords. Ad enter your status, income, deductions and credits and estimate your total taxes. File form 3922 online with taxbandits to receive. I received both 1099b and 3922 for the sale of. Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to. Form 3922 is issued for employee stock options you purchased but do not sell. Web page last reviewed or updated: Web irs form 3922. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Ad enter your status, income, deductions and credits and estimate your total taxes. Form 3922 is issued for employee stock options you purchased but do not sell. Web form 3922 transfer of stock. Web forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to irs.gov/ form3921 or irs.gov/form3922. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. The official printed version of this irs form is scannable, but. I received both 1099b and 3922 for the sale of. Review and transmit it to the irs. Web solved•by turbotax•16130•updated march 13, 2023. Ad enter your status, income, deductions and credits and estimate your total taxes. Form 3922 is issued for employee stock options you purchased but do not sell. Your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), if you purchased espp stock during the tax year. Information about form 3921, exercise of an incentive stock option under section 422 (b), including recent. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section. File form 3922 online with taxbandits to receive. Web 1 best answer. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. To get or to order these instructions, go to www.irs.gov/form3922. Discover helpful information and resources on taxes from aarp. Form 3922 is issued for employee stock options you purchased but do not sell. Information about form 3922, transfer of stock acquired through an employee stock purchase plan under section. Web form 940, line 9 or line 10 (f) credit reduction amount allocated to the listed client ein from form 940, line 11 (g) total futa tax after adjustments allocated to the listed client ein. Web to the official irs form. Discover helpful information and resources on taxes from aarp. Web solved•by turbotax•16130•updated march 13, 2023. Ad justanswer.com has been visited by 100k+ users in the past month Since you have not sold the stock, the holding period requirements have not been. Keep the form for your records because you’ll need the information when you sell, assign, or. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. However, hang on to form 3922 as you'll need it to figure your cost basis when you sell your espp shares in. Your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), if you purchased espp stock during the tax year. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and is not. Web investors & landlords. Web forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to irs.gov/ form3921 or irs.gov/form3922. The official printed version of this irs form is scannable, but the online version of it, printed from. Web page last reviewed or updated: Web • the current instructions for forms 3921 and 3922. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return.IRS Form 3922 Software 289 eFile 3922 Software

3922 Forms, Employee Stock Purchase, Employee Copy B DiscountTaxForms

File IRS Form 3922 Online EFile Form 3922 for 2022

Form 3922 Edit, Fill, Sign Online Handypdf

Describes new Form 1040, Schedules & Tax Tables

IRS Form 3922

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

IRS Form 3922 Instructions 2022 How to Fill out Form 3922

3922 2020 Public Documents 1099 Pro Wiki

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

Related Post: