Illinois State Tax Form 1040

Illinois State Tax Form 1040 - Here is a comprehensive list of. Documents are in adobe acrobat portable. Please use the link below. Ad discover helpful information and resources on taxes from aarp. If you owe more then $500 a year in income tax on april 15th (because of self employment or other income without tax. For more information about the illinois income tax, see the illinois income tax. Individual tax return form 1040 instructions; This form is used by illinois residents who file an individual income tax return. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in illinois. These 2021 forms and more are available: Web illinois tax forms 2022. Complete, edit or print tax forms instantly. Please use the link below. For more information about the illinois income tax, see the illinois income tax. These where to file addresses. Please use the link below. You earned enough taxable income from illinois sources to have a tax liability (i.e., your illinois base income from. Complete, edit or print tax forms instantly. If you owe more then $500 a year in income tax on april 15th (because of self employment or other income without tax. We last updated the individual income. Go to service provided by department of. Web the standard deduction is adjusted for inflation every year, and for single taxpayers (and married individuals filing separately), the standard deduction increased. You earned enough taxable income from illinois sources to have a tax liability (i.e., your illinois base income from. Documents are in adobe acrobat portable. These where to file addresses. Ad discover helpful information and resources on taxes from aarp. Here is a comprehensive list of. Web illinois tax forms 2022. Web arizona, california, massachusetts, and new york will work with the irs in the direct file pilot for filing season 2024 to integrate their state taxes into the pilot. These 2021 forms and more are available: Web us individual income tax return annual income tax return filed by citizens or residents of the united states. Please use the link below. You earned enough taxable income from illinois sources to have a tax liability (i.e., your illinois base income from. Web arizona, california, massachusetts, and new york will work with the irs in the direct file pilot. Filing online is quick and easy! We last updated the individual income tax return in january 2023, so this is. These 2021 forms and more are available: If you owe more then $500 a year in income tax on april 15th (because of self employment or other income without tax. Estimate your taxes and refunds easily with this free tax. 2021 estimated income tax payments for individuals. Please use the link below. Documents are in adobe acrobat portable. Web if an excess expense was a deduction to arrive at agi for the estate or trust, that same expense is a deduction to arrive at agi on the beneficiary’s tax return as an. Here is a comprehensive list of. The illinois income tax rate is 4.95 percent (.0495). These 2021 forms and more are available: Use this form for payments that are due on april 15, 2021, june 15, 2021, september 15, 2021, and. Web if an excess expense was a deduction to arrive at agi for the estate or trust, that same expense is a deduction to arrive. We last updated the individual income tax return in january 2023, so this is. Web arizona, california, massachusetts, and new york will work with the irs in the direct file pilot for filing season 2024 to integrate their state taxes into the pilot. 2023 estimated income tax payments for individuals. Estimate your taxes and refunds easily with this free tax. Web popular forms & instructions; Use this form for payments. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in illinois. Get ready for tax season deadlines by completing any required tax forms today. Web illinois tax forms 2022. Use this form for payments. Web us individual income tax return annual income tax return filed by citizens or residents of the united states. Complete, edit or print tax forms instantly. Ad discover helpful information and resources on taxes from aarp. Individual tax return form 1040 instructions; 2023 estimated income tax payments for individuals. Web illinois tax forms 2022. Web the standard deduction is adjusted for inflation every year, and for single taxpayers (and married individuals filing separately), the standard deduction increased. Web if an excess expense was a deduction to arrive at agi for the estate or trust, that same expense is a deduction to arrive at agi on the beneficiary’s tax return as an. Estimate your taxes and refunds easily with this free tax calculator from aarp. Please use the link below. Go to service provided by department of. You earned enough taxable income from illinois sources to have a tax liability (i.e., your illinois base income from. Filing online is quick and easy! 2021 estimated income tax payments for individuals. Use this form for payments that are due on april 15, 2021, june 15, 2021, september 15, 2021, and. We last updated the individual income tax return in january 2023, so this is. Web arizona, california, massachusetts, and new york will work with the irs in the direct file pilot for filing season 2024 to integrate their state taxes into the pilot. These 2021 forms and more are available: Web illinois department of revenue.Irs 1040 Form 2020 Printable Illinois 1040 Tax Form 2019 1040 Form

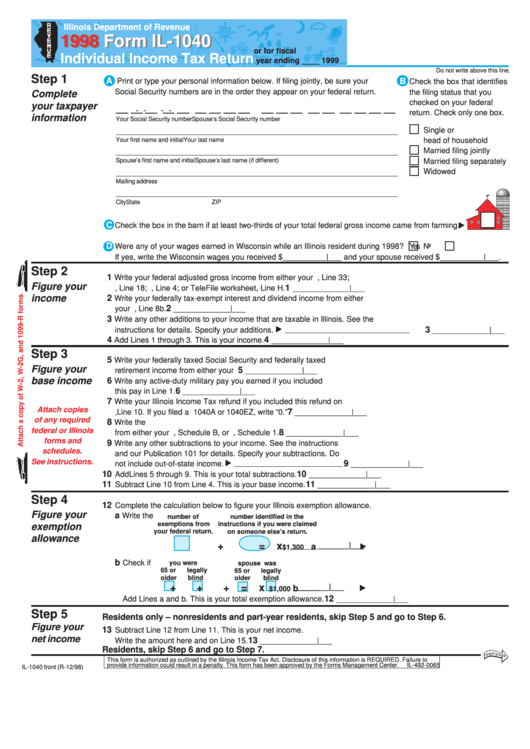

Fillable Form Il1040 Individual Tax Return 1998 printable

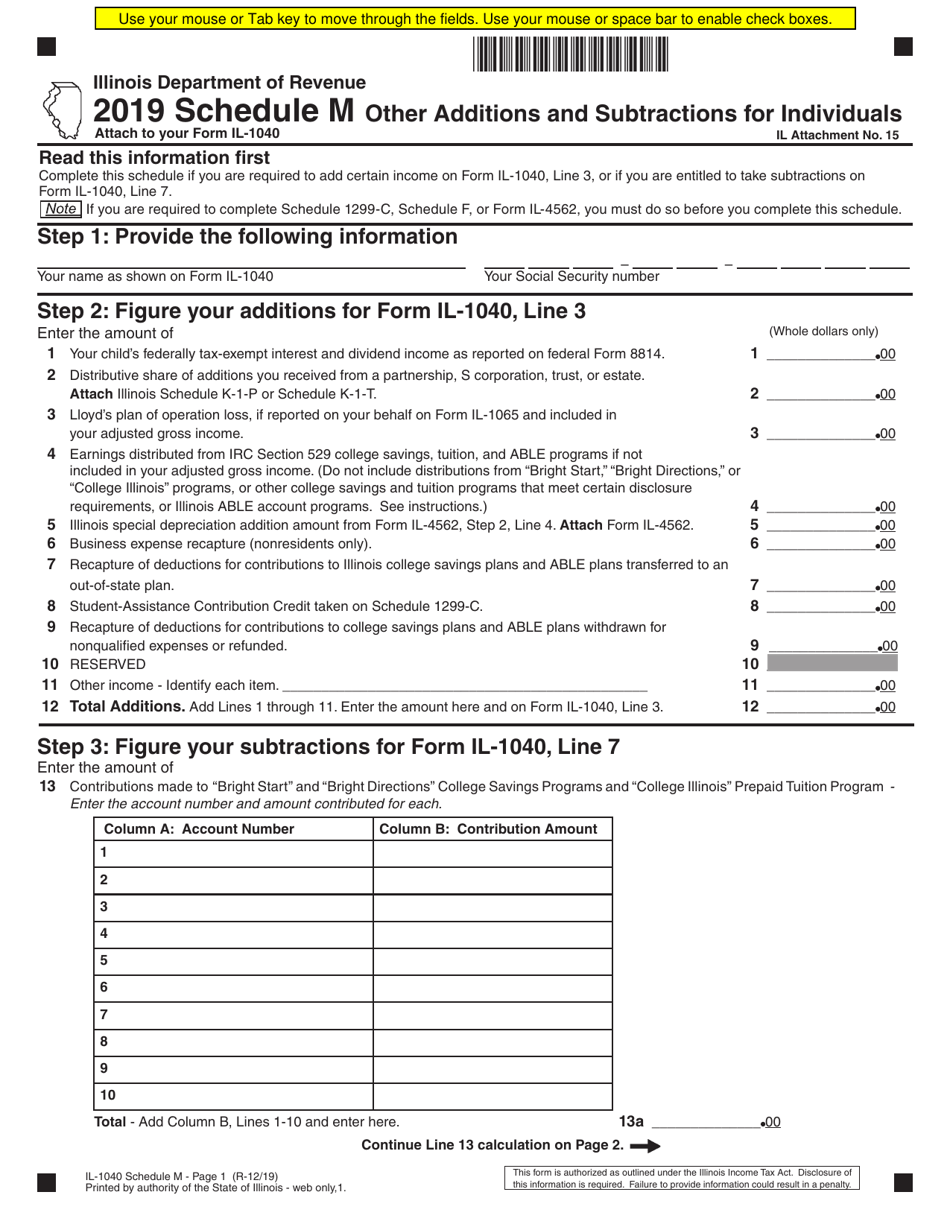

Form IL1040 Schedule M 2019 Fill Out, Sign Online and Download

Il 1040 Fill Out and Sign Printable PDF Template signNow

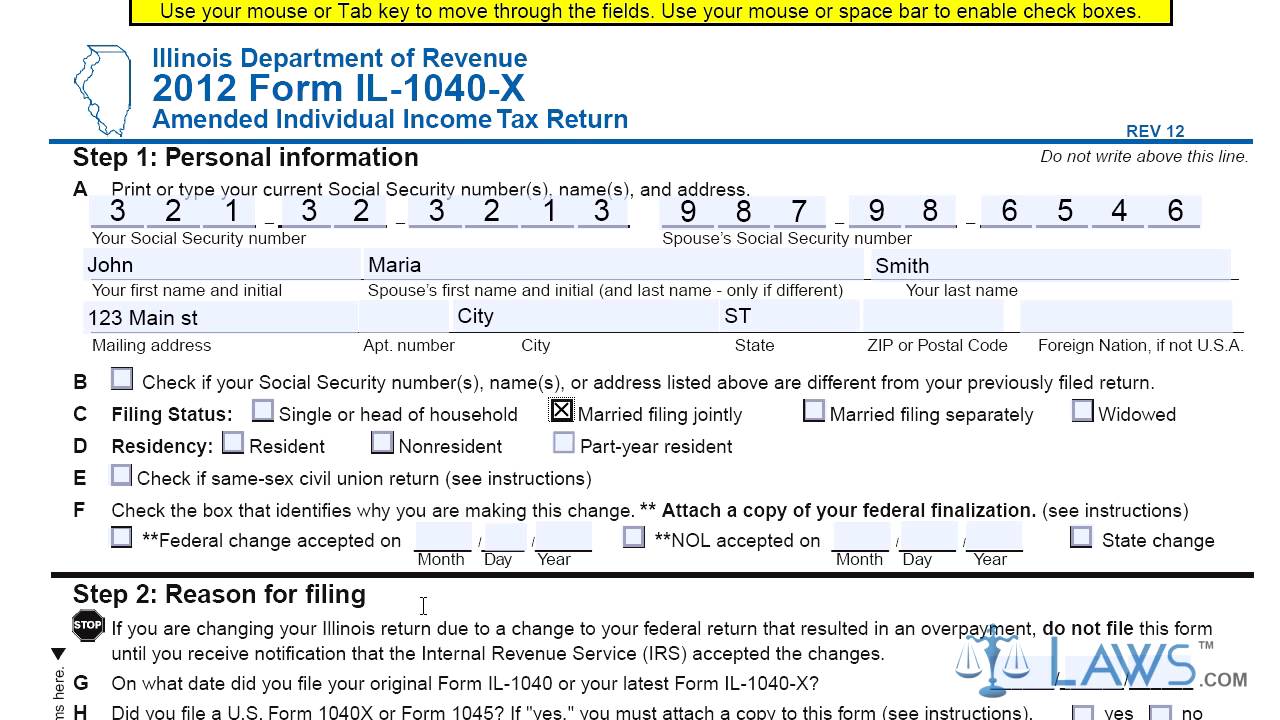

Form IL 1040 X Amended Individual Tax Return YouTube

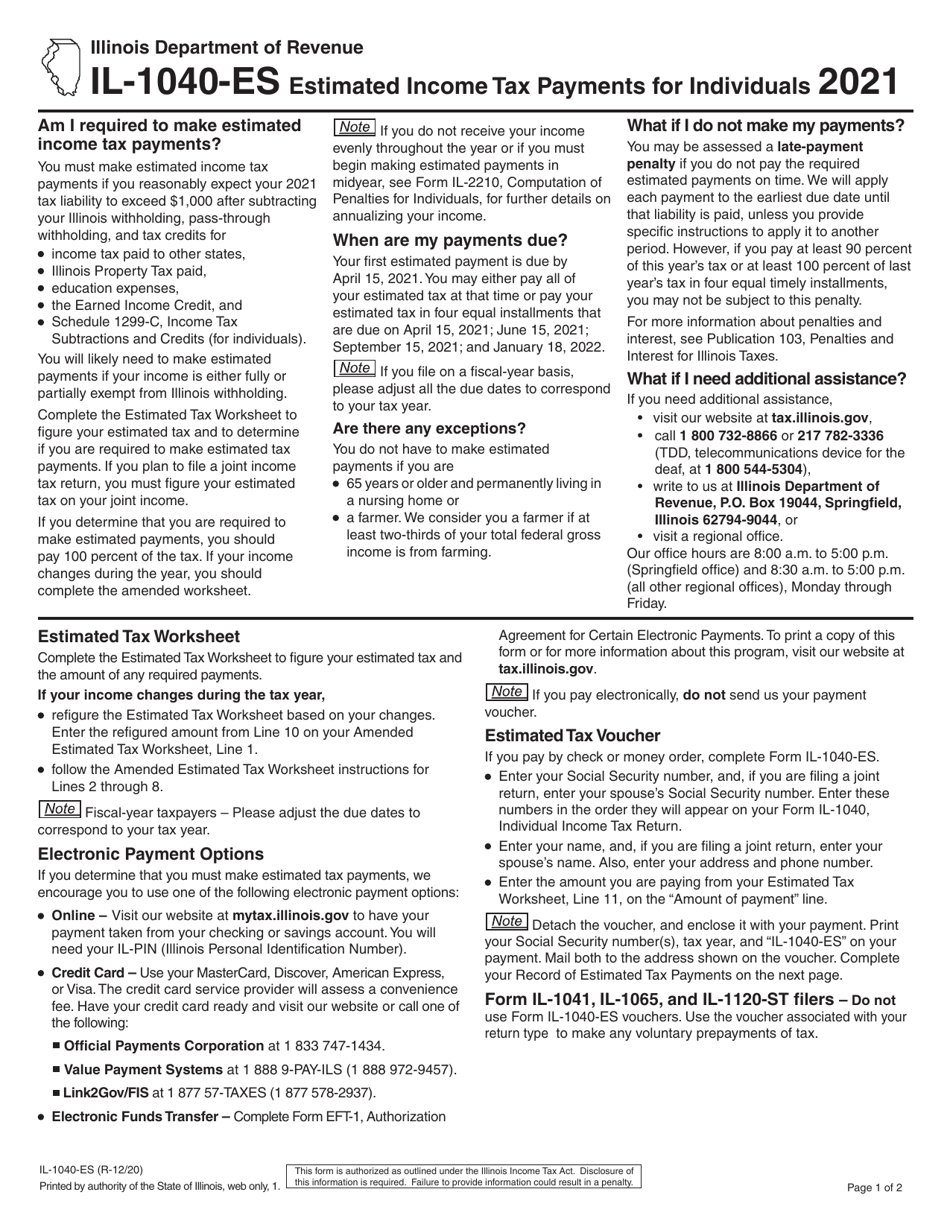

Form IL1040ES Download Fillable PDF or Fill Online Estimated

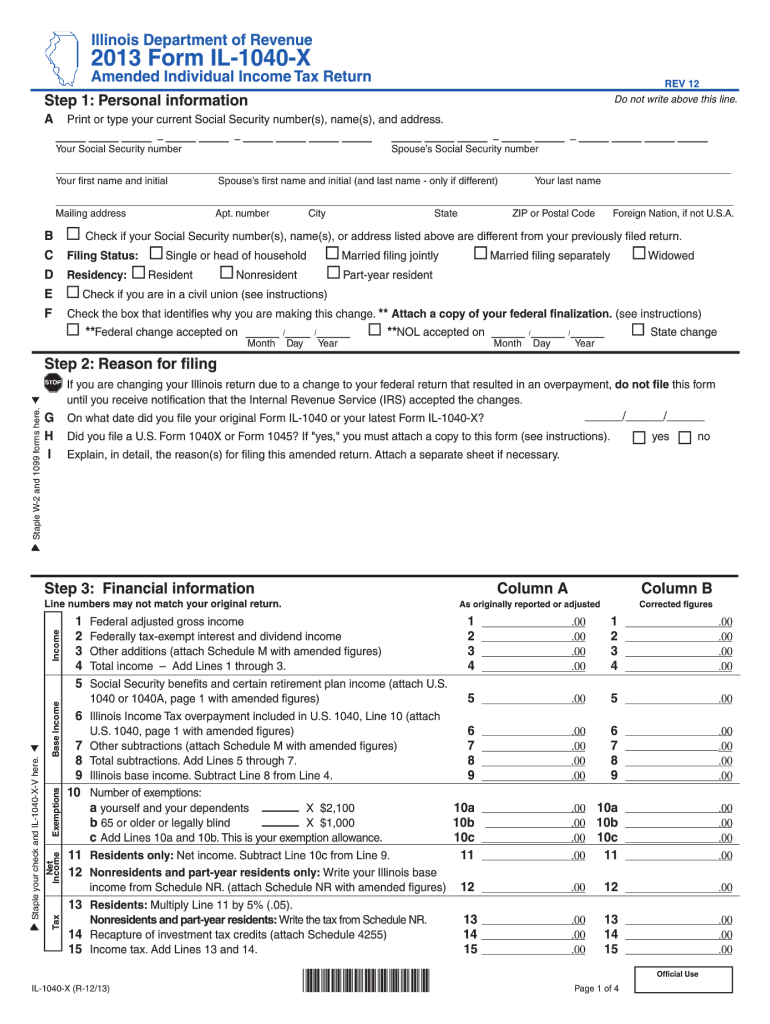

Form IL1040X 2019 Fill Out, Sign Online and Download Fillable PDF

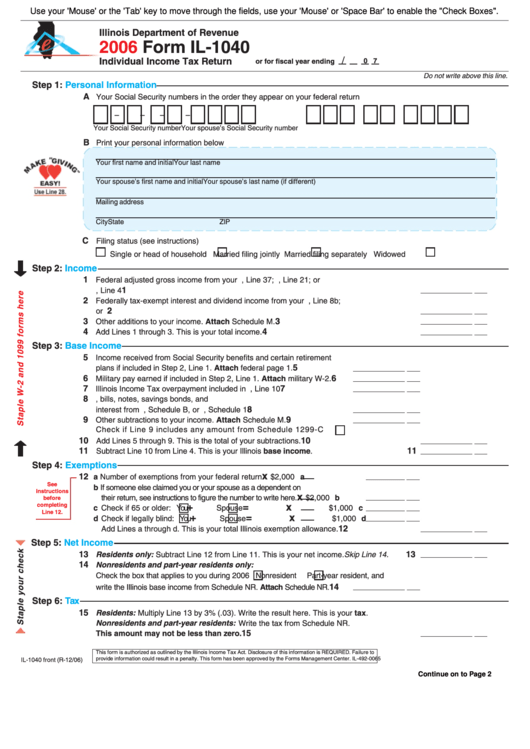

Fillable Form Il1040 Individual Tax Return 2006 printable

2012 Form IL DoR IL1040X Fill Online, Printable, Fillable, Blank

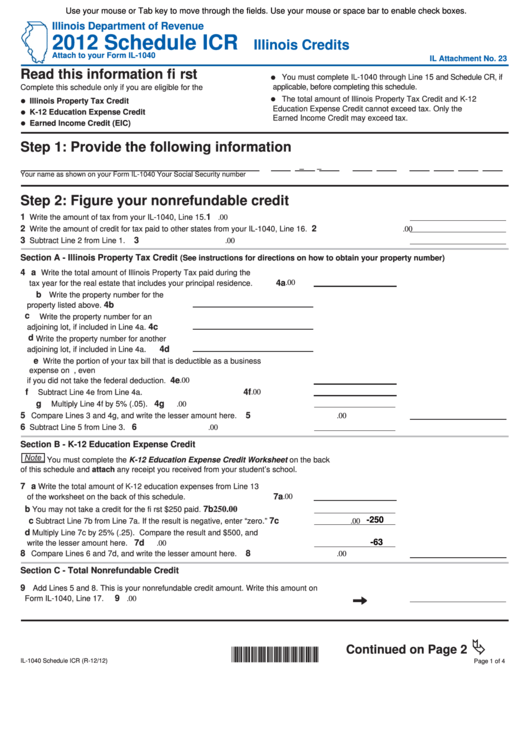

Fillable Schedule Icr Attach To Your Form Il1040 Illinois Credits

Related Post: