Georgia Form 500 Schedule 1 Adjustments To Income

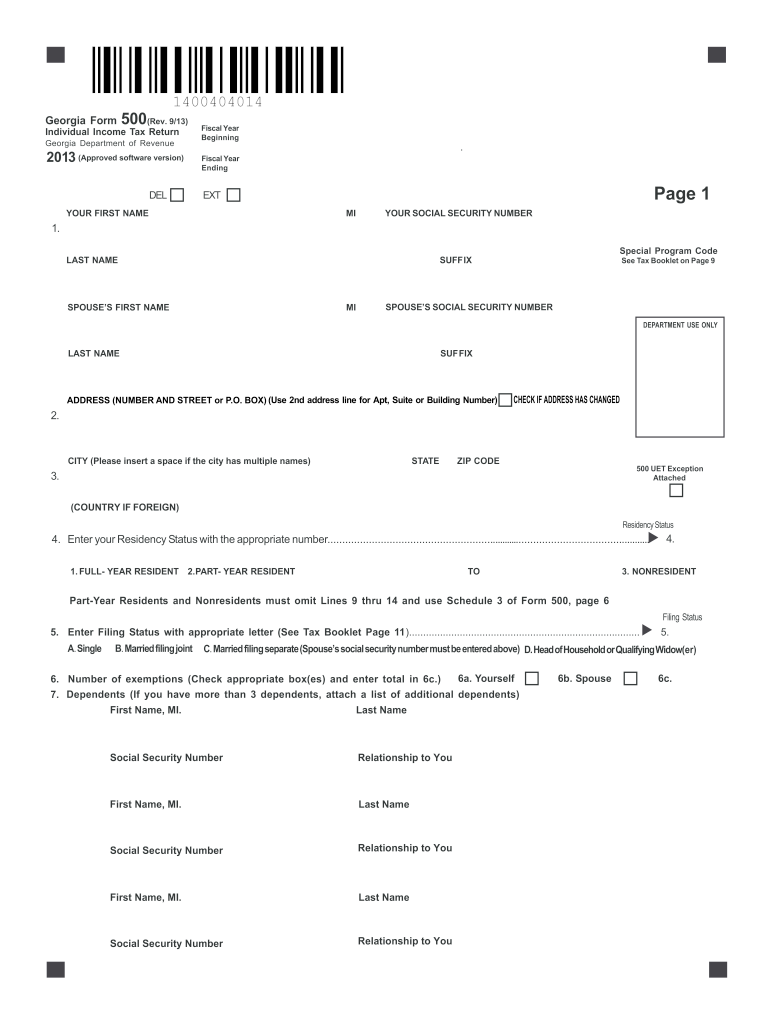

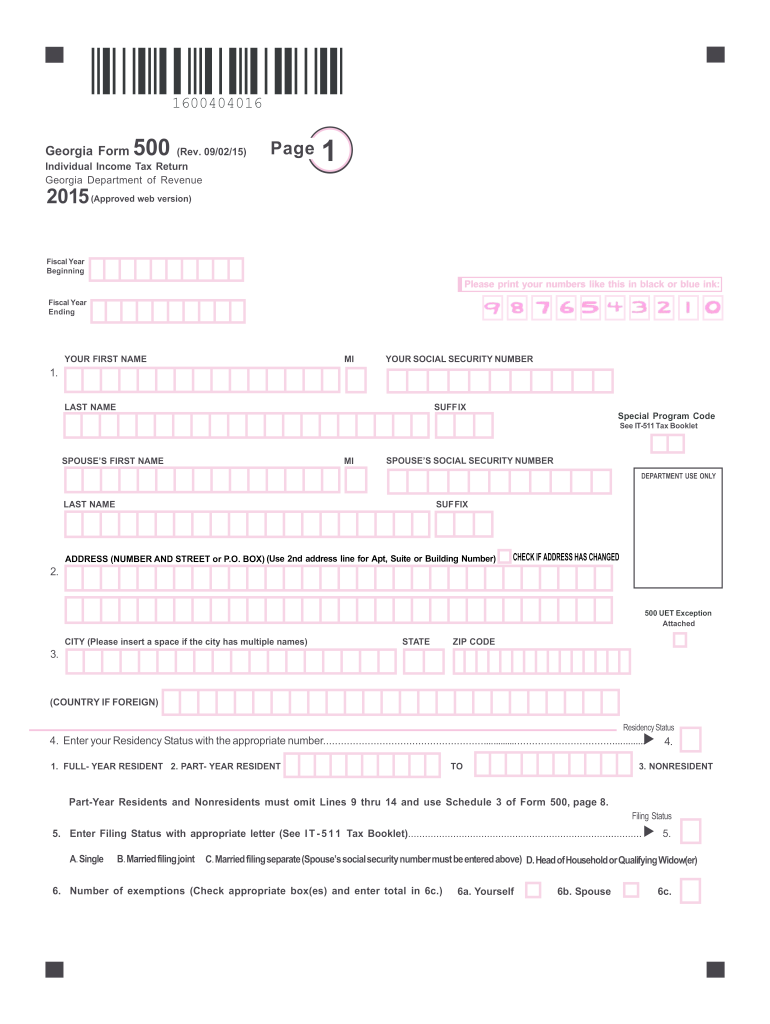

Georgia Form 500 Schedule 1 Adjustments To Income - Georgia adjusted gross income (net total of line 8 and line 9). Date of birth date of disability:. Web adjustment amount adjustment amount adjustment amount 12. Enter 2 if you and your spouse are 65 or older. Web forms in tax booklet: Web net of the motor fuels tax changes and local sales tax distribution adjustments, revenues for the three months ended september 30 were down 1.3. Web form 500 is the general income tax return form for all georgia residents. (do not use federal taxable income) if the amount on line 8 is $40,000 or more, or your. In the turbotax georgia state, it is using the new 10% and is deducting the additional 2.5%. Add lines 2 and 3; Try it for free now! Web schedule 1 adjustments to income based on georgia law 12. Form 500 requires you to list multiple forms of income, such as wages, interest, or alimony. “qrhoe credit adjustment” can be used for the. Date of birth date of disability:. Date of birth date of disability:. Print blank form > georgia department of revenue. Web georgia department of revenue save form. Add lines 2 and 3; Web forms in tax booklet: In the turbotax georgia state, it is using the new 10% and is deducting the additional 2.5%. Add lines 2 and 3; Web any unemployment income that was excluded on the taxpayer’s federal return should be added back on georgia form 500, schedule 1, line 5. Web georgia form500 page 1 (rev. Web enter 1 if you or your spouse. Georgia adjusted gross income (net total of line 8 and line 9). Web georgia form500 page 1 (rev. Web schedule 1 georgia form500 page 1 (rev. Other adjustments (specify) other5 (specify) 3. Georgia adjusted gross income (net total of line 8 and line 9). Web georgia form500 page 1 (rev. Georgia adjusted gross income (net total of line 8 and line 9). Web georgia department of revenue save form. “qrhoe credit adjustment” can be used for the. Web form 500 is the general income tax return form for all georgia residents. Form 500 requires you to list multiple forms of income, such as wages, interest, or alimony. Web any unemployment income that was excluded on the taxpayer’s federal return should be added back on georgia form 500, schedule 1, line 5. 08/02/21) schedule 1 adjustments to income 2021 (approved web2 version).00, ,.00, ,.00.00.00.00, ,.00, ,, ,, ,, ,.00.00, ,.00, ,,. For. Web my guess is that you have your georgia state income tax reported on your federal schedule a, so this amount is added back to income in georgia because it is. Georgia adjusted gross income (net total of line 8 and line 9). For other income statements complete line 4. Web it appears to me that turbotax federal is using. Web form 500 is the general income tax return form for all georgia residents. Georgia adjusted gross income (net total of line 8 and line 9). Web georgia department of revenue save form. Web schedule 1 georgia form500 page 1 (rev. Web my guess is that you have your georgia state income tax reported on your federal schedule a, so. 06/22/22) schedule 1 adjustments to income 2022 (approved web2 version).00, ,.00, ,, ,.00.00.00, ,.00, ,, ,.00.00.00.00.00,. Web form 500 is the general income tax return form for all georgia residents. Web it appears to me that turbotax federal is using last year's percentage of 7.5% instead of the new 10% to calculate the allowable deduction for medical expenses. Web schedule. “qrhoe credit adjustment” can be used for the. (do not use federal taxable income) if the amount on line 8 is $40,000 or more, or your. Enter 2 if you and your spouse are 65 or older. Georgia has adopted the ppp. Web georgia form500 page 1 (rev. 08/02/21) schedule 1 adjustments to income 2021 (approved web2 version).00, ,.00, ,.00.00.00.00, ,.00, ,, ,, ,, ,.00.00, ,.00, ,,. Try it for free now! Web my guess is that you have your georgia state income tax reported on your federal schedule a, so this amount is added back to income in georgia because it is. Web it appears to me that turbotax federal is using last year's percentage of 7.5% instead of the new 10% to calculate the allowable deduction for medical expenses. Web any unemployment income that was excluded on the taxpayer’s federal return should be added back on georgia form 500, schedule 1, line 5. Form 500 requires you to list multiple forms of income, such as wages, interest, or alimony. Web form 500 is the general income tax return form for all georgia residents. Web adjustment amount adjustment amount adjustment amount 12. Enter 2 if you and your spouse are 65 or older. For other income statements complete line 4. (do not use federal taxable income) if the amount on line 8 is $40,000 or more, or your. Web georgia form500 page 1 (rev. Georgia adjusted gross income (net total of line 8 and line 9). Other adjustments (specify) other5 (specify) 3. Web enter 1 if you or your spouse is 65 or older; Georgia adjusted gross income (net total of line 8 and line 9). Print blank form > georgia department of revenue. Web georgia department of revenue save form. “qrhoe credit adjustment” can be used for the. Web only enter income on which georgia tax was withheld.form 500 Fill out & sign online DocHub

State Tax Form 500ez Instructions bestyfiles

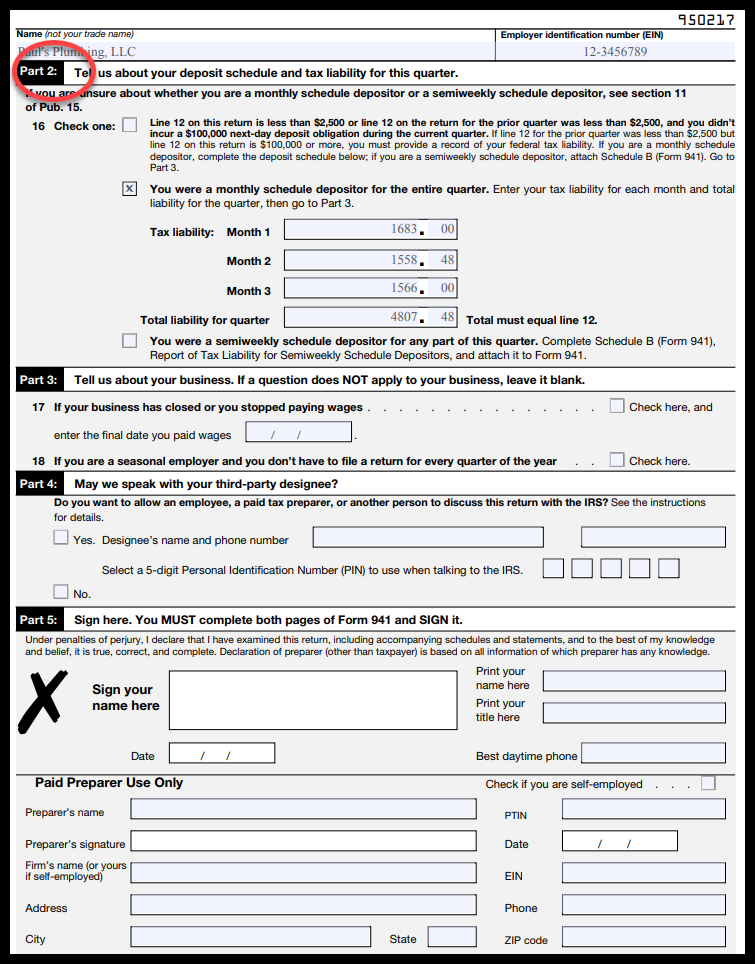

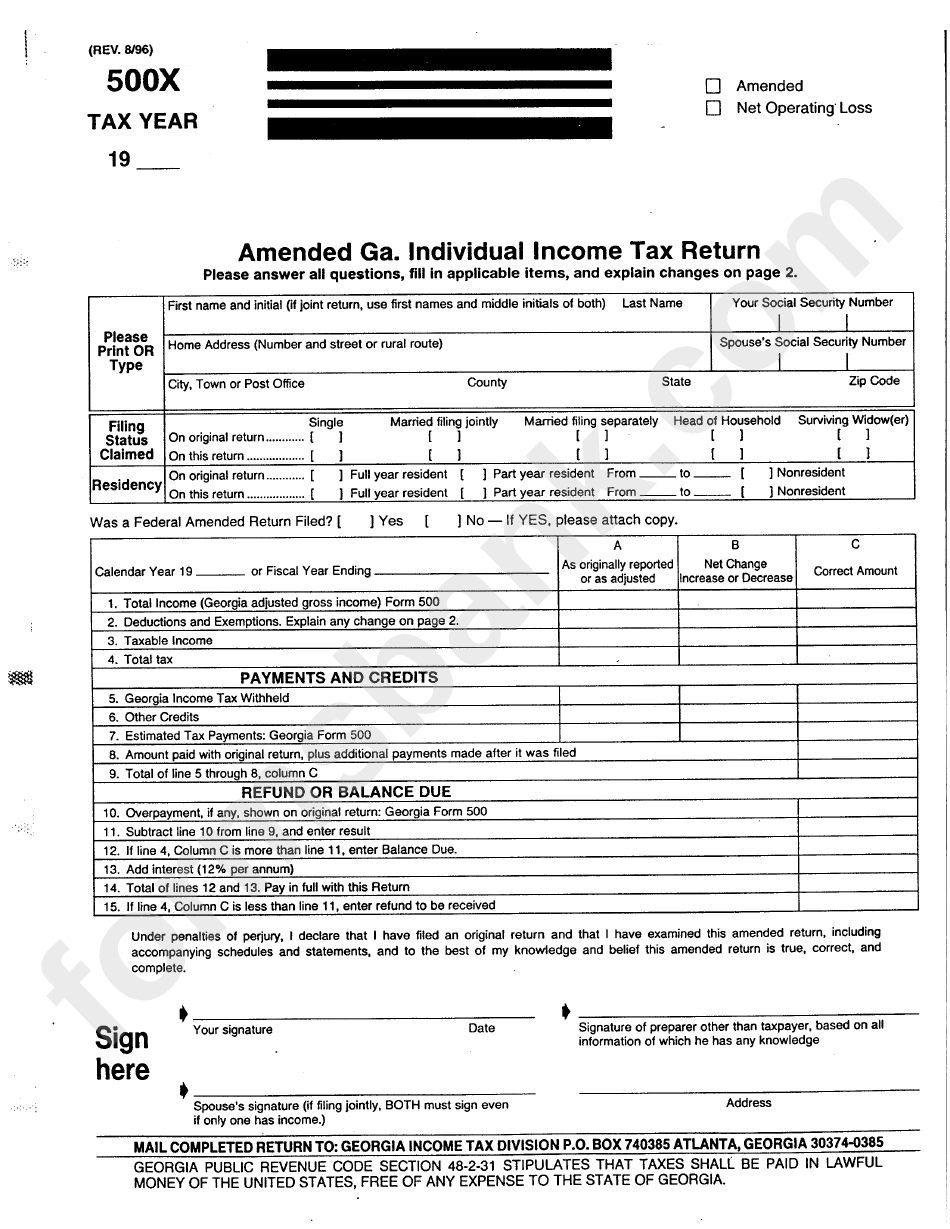

Fillable Form 500x Amended Ga.individual Tax Return printable

Schedule 1 1040 Form 2020 Instructions New Form

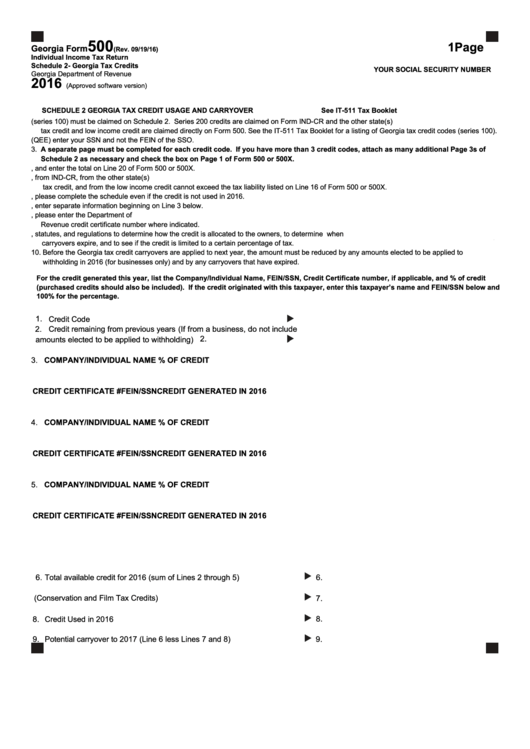

Form 500 (Rev. 09/19/16) Individual Tax Return printable

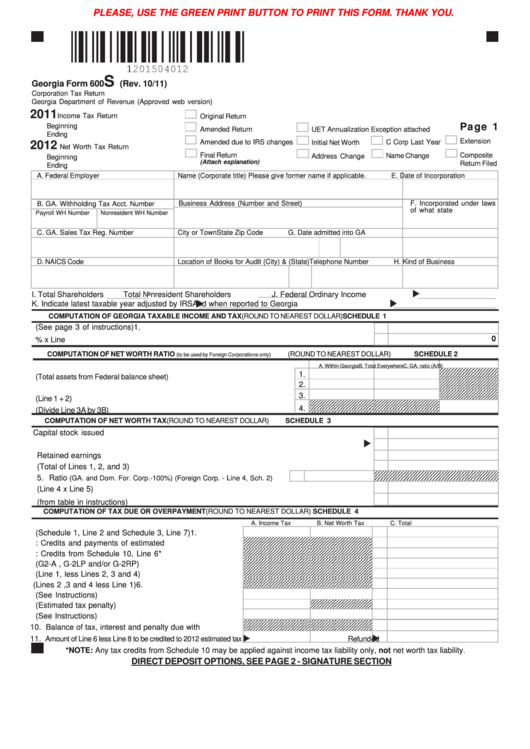

Printable Tax Forms Printable Forms Free Online

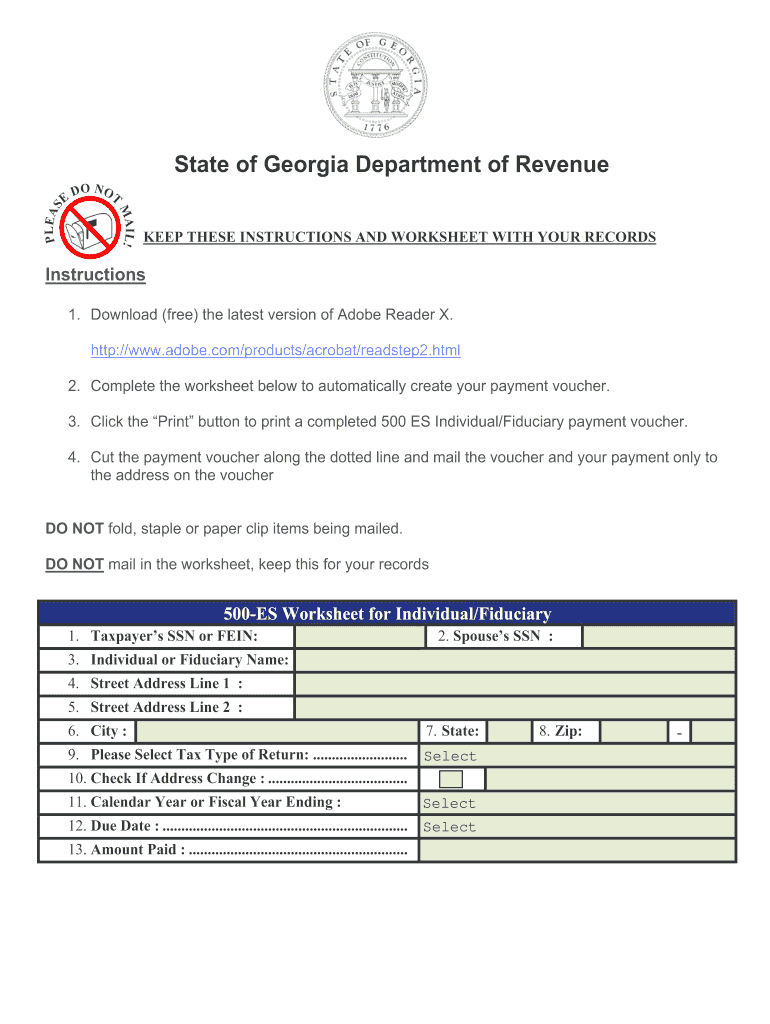

500 Es Form 2019 Fill and Sign Printable Template Online US

Ga form 500 Fill out & sign online DocHub

500 Tax Form Fill Out and Sign Printable PDF Template signNow

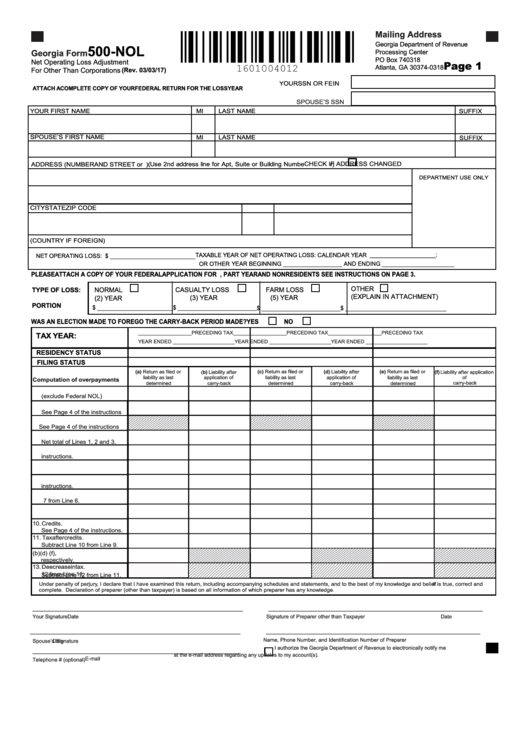

Fillable Form 500Nol Net Operating Loss Adjustment For Other

Related Post: